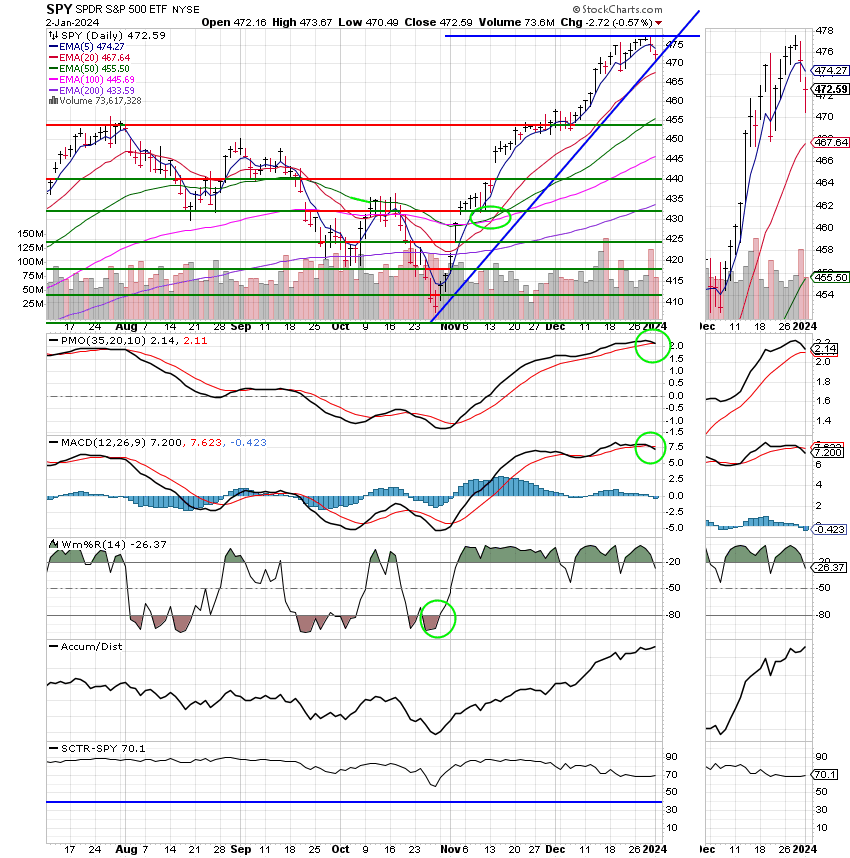

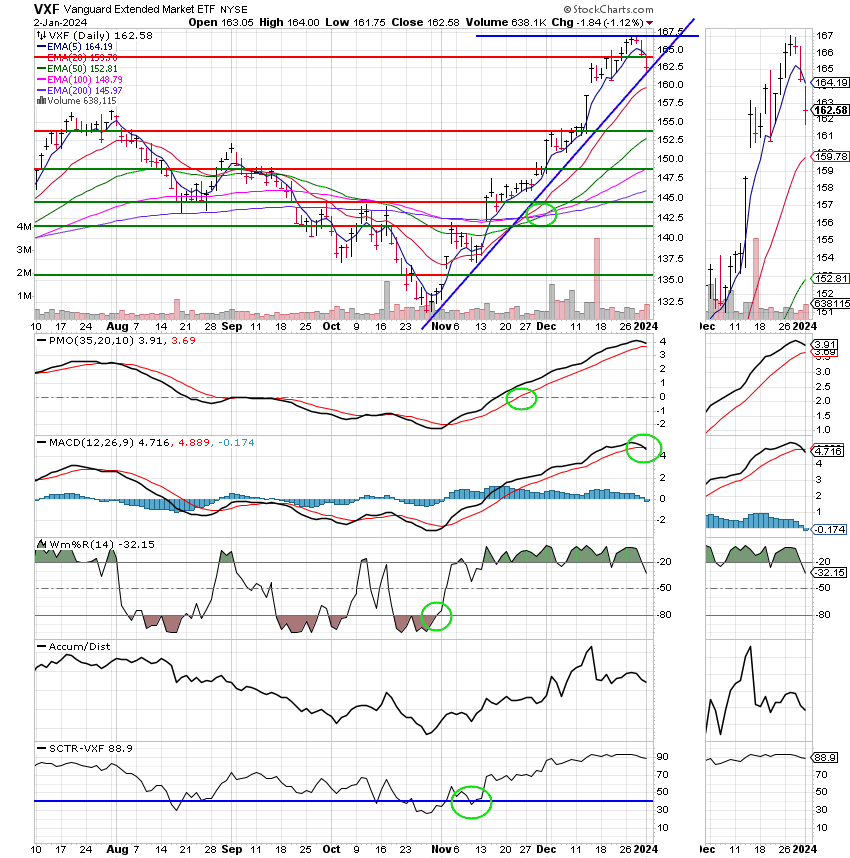

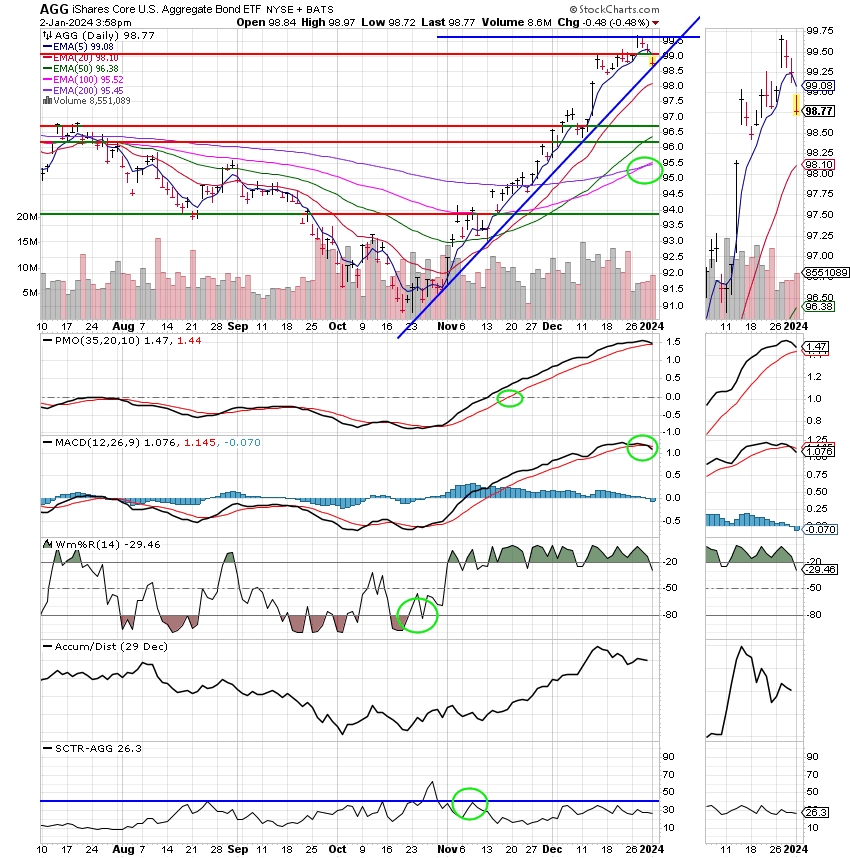

Good Evening, Yes, I’ve been slow with the blogs. I normally do a little better during the holidays, but this year has been a little busier than in the past. I went to visit my 91 year old mother and spent Christmas with my Grandkids. The latter led me to the conclusion that being Santa Clause can be as difficult as investing…..So I’m doing the best that I can! I did check the charts daily and would have certainly put out an alert had a change been needed. Don’t forget, I have money invested too! So lets see where we are now. The market moved higher through Christmas as the relief rally that started about nine weeks ago spurred by a resilient economy, a lower rate of inflation, and a Federal Reserve that is signaling that their policy of rate increases is over. By the matter of fact, Jerome Powell even hinted at rate decreases later this year. Well now it’s 2024. This is where euphoria meets reality. This market has moved up quickly. It is overdue at the very least for some consolidation and probably more like a correction. The market has been hot and needs to cool off. It never moves up forever. As I have said a lot lately, corrections whether they are deep or shallow are a healthy part of normal market. I know many of you folks that started trading in the last ten years don’t agree with that, but I will tell you right here and now that your wrong. The stimulus money that made the market go up during that period is gone. This is the old/new normal. So deal with it. The market will reset on a regular basis. You can with stay in it and lose time and money or you can get out and try to buy into the next uptrend. Those are your choices. Plain and simple! Quit frankly, we expected the reset to occur in December. So we got out a a little too early this time. We left some money on the table. Prayerfully, we’ll do better next time. That said we booked a nice profit and added just a little to it with bonds during December. No one ever got shot for taking a profit. The market dropped today. The C, S and I funds were off pretty bad and so was the F fund but not near as bad as the others. Bonds will always outperform stocks when stocks are trending lower. That is the main reason we are invested at 100/F in the first place. Is this the beginning of the correction we have been waiting for? I’m not ready to to declare that just yet, but it sure could be. Nonetheless, there is one thing I know for sure. The longer the market moves higher, the more extended it gets. I like to think of it as winding a watch. That is if any of you can remember watches that have to be wound. The longer you wind the watch the tighter the spring gets until finally either the pressure is released or it breaks. My charts tell me that’s where we’re at. So I’m staying invested at 100/F until something gives. While bonds moved lower today. I do not think that there will be a lot of downward pressure applied to the price of bonds. As you know, bond prices and bond yields move in opposite directions. Today bond yields moved higher causing bond prices to move lower. Bond yields and interest rates are joined at the hip. When one goes up, so does the other. I just don’t see interest rates moving substantially higher at this time with the Fed signaling rate decreases later this year. So bond yields should move sideways if not lower going forward. Given those dynamics I feel that bonds are a safe place to be for the time being. So our allocation will remain at 100/F for now. Bond charts are also a little extended at this time, but not nearly as much as stocks. That noted, should bond prices continue to move lower for some unforeseen reason we will not hesitate to move to the G Fund. Our main strategy is to wait until we get a fresh buy signals from our equity charts and get back on the gravy train.

The days trading left us with the following results. Our TSP allotment fell back -0.47%. For comparison, the Dow posted a slight gain of +0.07%, the Nasdaq fell -1.63%, and the S&P 500 dropped -0.57%. All the major indices were off well over 1% but regained a lot of ground in the final hour of trading.

S&P 500 closes lower to begin 2024, Nasdaq notches worst day since October: Live updates

The days action left us with the following signals: C-Hold, S-Hold, I-Hold, F-Hold. We are currently invested at 100/F. Our allocation is now -0.47% for the year and for the month. Here are the latest posted results:

| 12/29/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.963 | 19.2226 | 74.3644 | 77.0955 | 40.1816 |

| $ Change | 0.0067 | -0.0186 | -0.2069 | -0.9541 | 0.0150 |

| % Change day | +0.04% | -0.10% | -0.28% | -1.22% | +0.04% |

| % Change week | +0.11% | +0.33% | +0.34% | -0.06% | +0.96% |

| % Change month | +0.39% | +3.72% | +4.54% | +10.45% | +5.39% |

| % Change year | +4.22% | +5.58% | +26.25% | +25.30% | +18.38% |