Good Evening, We find ourselves off to a good start in 2022 with two relatively decent days for the market so far. The Dow is up today but the Dow is only 30 stocks and is not truly representative of the market as a whole. The S&P 500 which was up yesterday and is flat today is a little better gauge for what is going on but is far from perfect. When taken as a whole the major indices failed to reflect the true nature of the market in 2021 and if the first two trading days of 2022 are any indication that could be the case again this year. Right now treasury yields are crushing a lot of small cap and tech stocks. While the Russell 2000 (IWM) did put up a buy signal it seems little weak and nothing to bet the farm on. Small caps stocks should be purchased selectively and with at least a small dose of caution at this time. This market remains bifurcated due to the higher treasury yields. A case in point is that the C Fund closed flat at -0.04% while the S Fund ended the day well in the red at -0.81%. That is actually the closest they traded all day with S Fund actually being off more than -1.20% at one point. I expect the treasury yields to continue to put pressure on the small and midcaps that make up the S Fund. On another note, conditions like this favor a stronger dollar which in turn favors the I fund as US goods become more expensive and inversely foreign goods become cheaper. With this in mind I’m watching the I Fund as it could come into to play for us in 2022. It has begun to pick up recently and would probably be even stronger if not for the supply chain issues. Once the world economy starts humming the I Fund probably will too!

The days trading left us with the following results: Our TSP allocation was flat at -0.06%. For comparison, the Dow was up +0.59%, the Nasdaq fell -1.33%, and the S&P 500 was close to even at -0.06%. The I Fund which I mentioned above had a great day closing up +0.57%. The best of our TSP funds today…..

Dow rises to new record, but Nasdaq falls nearly 2% as higher rates divide the market

The days action left us with the following signals: C-Buy, S-Hold, I-Buy, F-Sell. We are currently invested at 100/C. Our allocation is now +0.64% for the year not including the days results. By the way, for those of you that don’t already know we closed the books on 2021 with a gain of +14.64%. A little off our average which is closer to 18.00% but if I were given the opportunity I’d take it every year! As usual I thank God for His guidance of our group to yet another successful year. Give Him all the praise and all the glory for He is worthy!! Here are the latest posted results:

| 01/03/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.7386 | 20.7363 | 72.4061 | 83.8284 | 39.3497 |

| $ Change | 0.0021 | -0.1504 | 0.4591 | 0.3874 | -0.0919 |

| % Change day | +0.01% | -0.72% | +0.64% | +0.46% | -0.23% |

| % Change week | +0.01% | -0.72% | +0.64% | +0.46% | -0.23% |

| % Change month | +0.01% | -0.72% | +0.64% | +0.46% | -0.23% |

| % Change year | +0.01% | -0.72% | +0.64% | +0.46% | -0.23% |

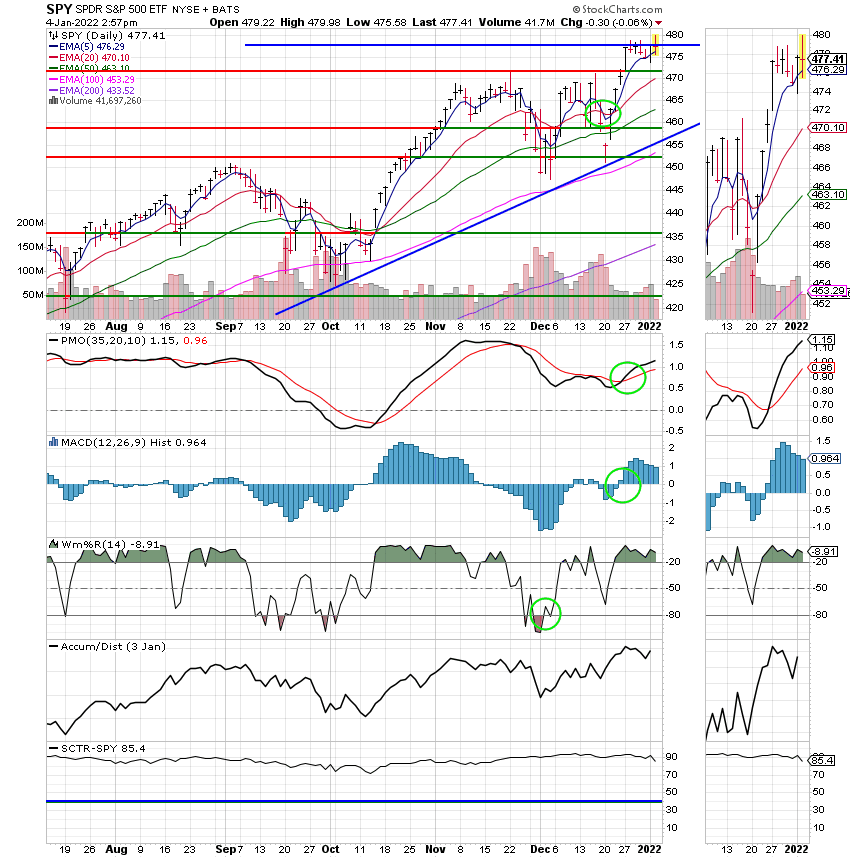

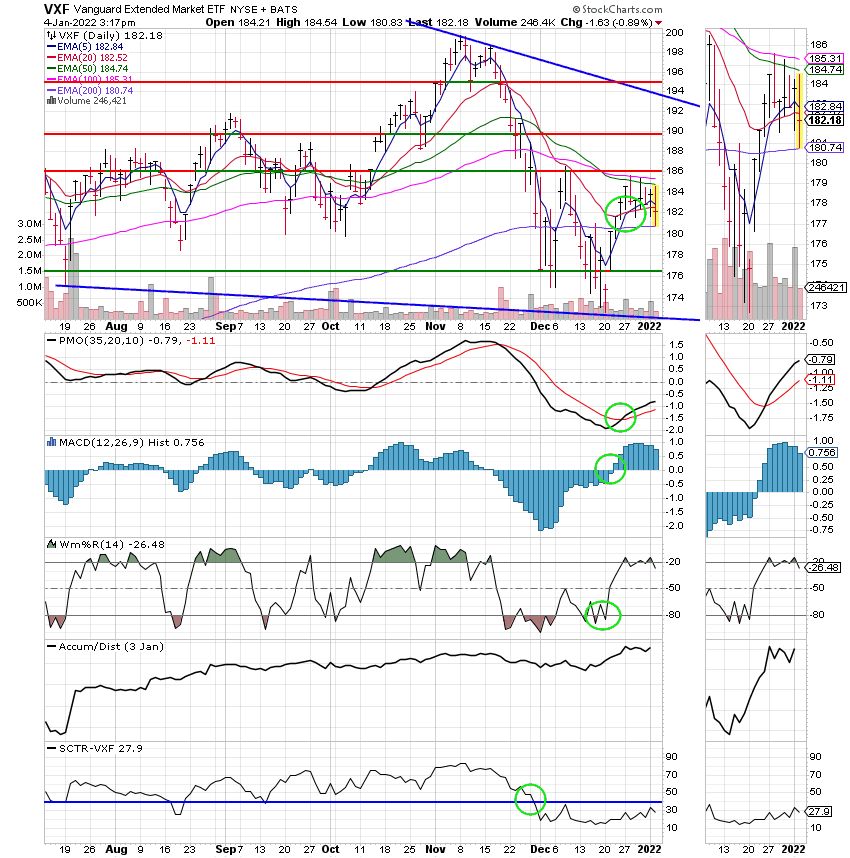

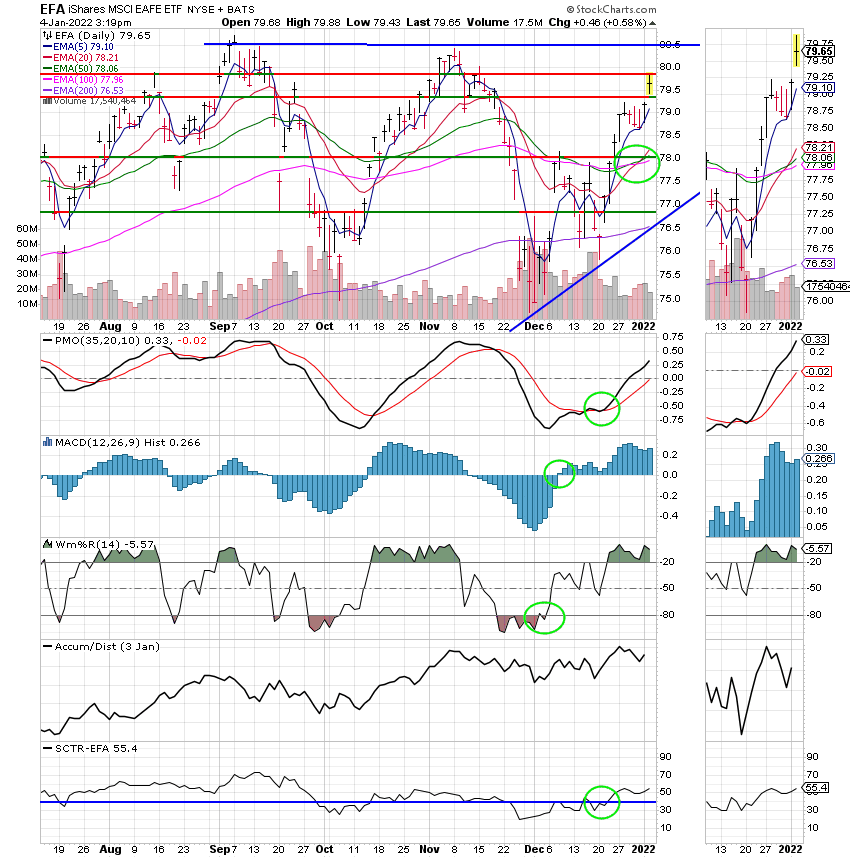

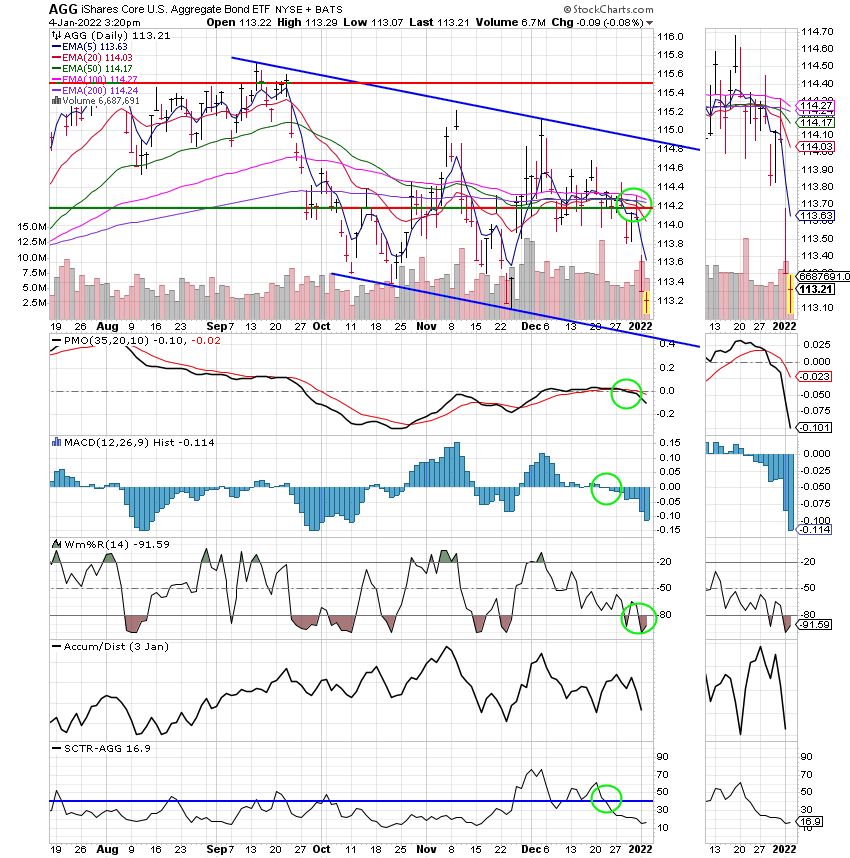

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

So far we’re in the green. I pray that we can stay there all year but I know there are going to to some serious bumps along the way. So buckle up, it’s going to be another wild one!! That’s all for tonight. Have a nice evening and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.