Good Morning, We’re now into the first month of the new trading year. Our system is working well. As most of you know, we went to a new set of indicators in the middle of 2023 in order to adapt to the post pandemic/ Quantitative tightening market. I would also add to that, that to a much greater degree it was in response to the market makers post pandemic trading algorithms. Folks there was a reason that we underperformed for the majority of 2022 and 2023. So we got our new indicators in place in late June to early July of last year, but we didn’t fully get the new system in place until late October. Since that time our returns have been much better and much more like our pre-pandemic returns. I will admit though that we got out a little early in December and left some money on the table. That was not the fault of the indicators. They told me exactly what the market was going to do. I just pulled the trigger a little early. Given what we had been through the past two years, I will chalk that up to being overly cautious. I wanted everyone to come out of 2023 with their contributions in tact. We achieved that goal. As you may painfully remember there was a time in early 2023 when we were down more than 11 percent. This took place in a rising market. However much of the second quarter and all of the third quarter saw the market decline. So there was no opportunity to make our money back. We did hold our own during that period, but holding our own was not good enough. It left us in the hole and our critics raked us over the coals the whole time. Of course they all failed to mention how far they still were behind us over the past ten years. That’s all behind us now and it just made us work harder to out perform the market again as we had always done before. The fourth quarter of 2023 saw us learning more about our indicators. We were able to make up our deficit and could have actually added to that had I not gotten out of the market 2-3 weeks too early. I learned even more about our indicators during that time and will continue to learn about them moving forward. After all we ran the last set of indicators we used for nearly 25 years. I wasn’t nearly as good with them in the beginning as I was near the end of that period. This will be no different. This set of indicators still has a lot of untapped potential moving forward. So again, here we are in the first month of 2024. I would ask where are those critics now? Most of them are behind us at the moment and the rest are doing no better than we are at the moment. Of course that can all change. I am well aware of that. My only point in bringing it up for the umpteenth time is to emphasize how important it is to look at the big picture. Everyone stumbles, every system has times when they are effective and times when they are not. Just because someone had a good week, month, or quarter in the market does not make them the greatest trader of all times. Even Warren Buffett makes some bad trades. The important thing when you stumble is to learn from it as we did. I am excited moving into the future. God has been gracious to guide us into a new future for our group. I give Him all the praise!!

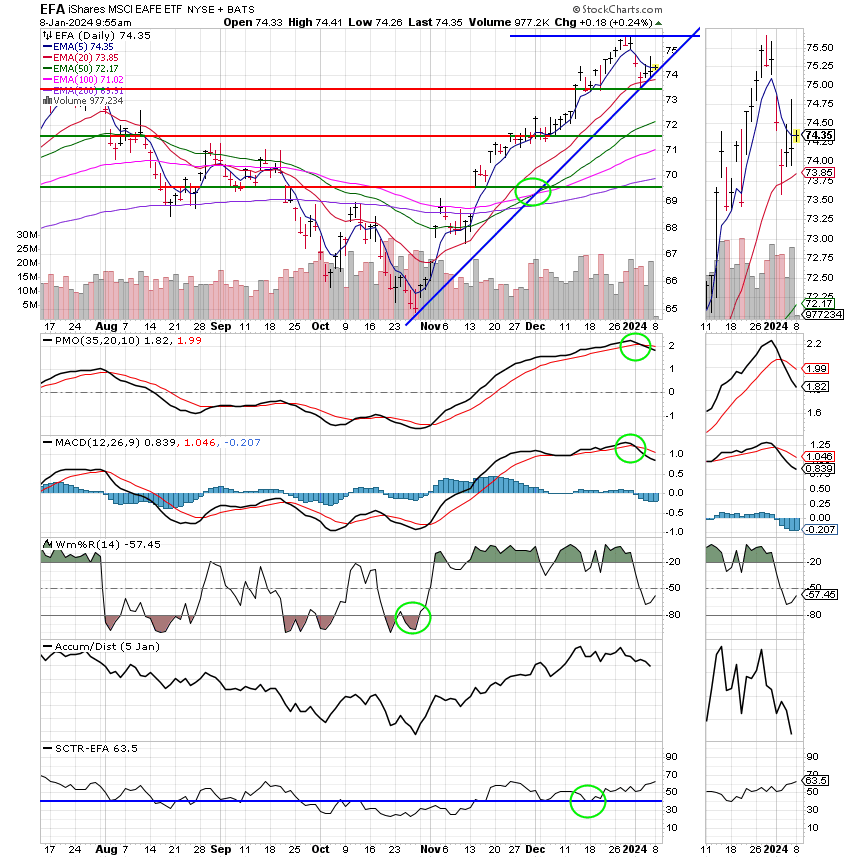

As we move into 2024 we find the market consolidating it’s gains from the fourth quarter of 2023. We find it to be extended and overbought. The overall trend remains higher, but the the market remains overbought and in need of some additional consolidation or correction. Our indicators tell us that this will likely be a shallow dip and that the market will for the most part move sideways. The thing to understand here is that the risk is higher during this period. We don’t know for sure when the selling will end. So even though we think the market will for the most part move sideways during this consolidation period, we won’t take any chances. That is the reason we remain in the G Fund. While the G Fund is basically our equivalent of cash it is indeed earning a little more these days as bond yields are moving higher. I can remember in the lates eighties and early nineties when it was earning over 6%. There were many folks at that time that were more than happy to leave their money there all the time. It was not until the G fund returns dipped below 3% before many of them moved some of their capital into equities. My main point in all this is that it’s not like your no longer moving ahead when your in the G fund. It’s just that y0ur moving at a slower safer pace. Never ever forget. It’s not what you make that’s important. It’s what you keep! Right now our task is to watch our charts for the next opportunity to make money in equities. This requires a little time and effort but this is where we make our money. It’s not important to be the first investor back into the market when the next leg up begins. What is important is to be in equities for the majority of the move higher and to do it consistently time after time. Rinse and repeat and do it again. That’s how we make the best returns over a 20 year period!!!! Looking forward into this week we have three market moving events all toward the end of the week. They will determine where we go next. The first is the CPI or consumer price index on Thursday followed by the PPI or producer price index which is released on Friday. Both reports are are watched closely by the Fed as a gauge of inflation. Also on Friday the major banks will issue their quarterly reports to begin earnings season. Of course investors follow the reports closely to gauge the strength of the economy. By the end of Friday we should know where this market is heading over the short term.

Today’s trading is generating the following results. Our TSP allotment remains steady in the G Fund. For comparison, the Dow is down -0.22%, the Nasdaq is higher at +1.16% and the S&P 500 is in the green by +0.53%. All three of our TSP equity based funds are well in the green at the time of this writing.

S&P 500 and Nasdaq rise thanks to tech boost, Boeing weighs on Dow: Live updates

Recent action has left us with the following signals. C-Hold, S-Hold, I-Hold, F-Hold. We are currently invested at 100/G. Our allocation is now -0.33% for the year and for the month not including the days returns. Here are the latest posted results:

| 01/05/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.9733 | 19.0097 | 73.247 | 74.4226 | 39.5921 |

| $ Change | 0.0019 | -0.0446 | 0.1336 | 0.0747 | 0.0266 |

| % Change day | +0.01% | -0.23% | +0.18% | +0.10% | +0.07% |

| % Change week | +0.06% | -1.11% | -1.50% | -3.47% | -1.47% |

| % Change month | +0.06% | -1.11% | -1.50% | -3.47% | -1.47% |

| % Change year | +0.06% | -1.11% | -1.50% | -3.47% | -1.47% |