Good Morning, Markets cycle. That is just a fact. They always have and they always will. It is possible to make money in all cycles albeit less during the down trends. Our group fell with all the others at the beginning of the current bear cycle. As we have mentioned many times, our group along with everyone else had to adjust to conditions that had never occurred before when the Fed unwound it’s fiscal stimulus. It took us about six months to figure that one out so the current bear market cycle has been our worst to date. Why mention it yet again? So you will have the confidence to face future cycles and know that if you manage them well you can still make money and at the very least break even or come close to breaking even which was always our case prior to 2022. All that said, we now find ourselves in a late stage bear cycle. The thing that you must understand about these cycles is that they very in duration. They can last months or up to a year or more. As I have often mentioned, the recovery in 2000 took close to five years. I do not think that will be the case this time, but I am mentioning it to illustrate the point that these cycles very in length. Another example was the last bull cycle which was one of the longest if not the longest in the history of the market (probably because of the government stimulus). What I am saying is that late stage does not mean over. The are a variety of factors that determine that. Those are the things that we talk about every week. Those are the factors that shape the market such as inflation, interest rates, geopolitical developments, earnings seasons, natural disasters, advances in technology (the crypto market comes to mind) and the list goes on and on. The great majority of these things we have little or no control over. So why worry about what we can’t control? We need to turn that over to God and focus on what we can control. There is an old saying. “You don’t make your environment. Your environment makes you.” I think that is only partially true. A lot of folks seem to just submit to what they feel they can’t control. They say that is their fate. I will also add that many of to people are buy and holders that accept only what the market gives them. I say baloney!! It’s not your environment that determines who you are and what you do. No! It’s how you react to your environment!!! What does this have to do with being in a late bear market cycle?? Everything!! You can’t control the time line, but knowing where you are located on it is precious. This is the information that our charts give us. They tell us where we are. They cannot predict future events as many folks think they can, but they clearly tell us where we are here and now. So barring any big changes that is how we make our plans. We also make plans on which way we will go in the event that things do not go as we envisioned. Those are our contingency plans. Think of those as having to take a detour around a bridge that is out if you will. Then think of your charts as a road map. When we come to a bridge that is out we look at our map (charts) and determine what detour we will make to get around it to arrive in at the same destination which is profitability. Knowing such things about how you will approach unforeseen obstacles is the difference between failure and success and that is often a fine line. Again, that is why we had difficulty during the first six months of 2022. There was no roadmap!! We were explorers in a strange land and had to make our own charts which we did. That’s called experience!! Now we have it. So with that in mind what is a good definition for experience?? Having made mistakes!! Why do you think employers demand experience when they are looking for new job candidates?? Getting back on track, we currently find ourselves in a late stage bear market. Our charts tell us that the market likely bottomed in October. So any downside moving forward should be limited (please note that I said should be as we can’t predict future events). I prefer to refer to this stage as the accumulation stage. It is the stage where on the street we start buying up beaten down stocks that are down not because they are bad stocks but because the market as a whole sold off. We know these stocks will recover as the market recovers from the selloff. We are buying them low and selling them high. This is how we make our money. It is all about being positioned as early in the market recovery as we can without taking unnecessary risks. So we accumulate good stocks and wait for the recovery to come knowing that we bought them at a discounted rate and that we will make money when the market recovers. We don’t concern ourselves with selloffs beyond this point. We don’t sell every time the market moves lower because we know that we have purchased our stocks at a discounted rate and will eventually make money when the new bull market cycle begins. As this process takes place we check our charts (road maps) to determine where we are. We know that support was established back in October so we don’t concern our selves very much with selloffs because we know exactly where we are at. Our only concern will be if the support established in October fails to hold. At that time and only at that time will we study are charts and determine if we need to sell and protect our precious capital. Any selling prior to seeing this support breached would be panic selling and as I have said many times and will repeat again now, PANIC IS NOT A STRATEGY!!! Now how do we do this in Thrift?? Exactly the same way only we substitute Funds for stocks. I will add that we determine which Funds are best by selecting the best charts. Folks, it’s not rocket science. It just takes a little discipline and organization. It’s like the Georgia Bull Dogs last night. They had a plan and stuck to it and as a result won the NCAA championship for a second season. In closing, I will also add that we have the ultimate safety net in our heavenly Father who guides our hand in all things if we simply trust in Him. So…..How can we fail??????

Trading today is generating the following results: Our TSP allotment is currently trading flat at +0.01%. For comparison, the Dow is up +00.9%, the Nasdaq +0.24%, and the S&P 500 +00.7%. We’ve had a good run the past few sessions so I thank God for that!

Stocks rise slightly as investors look to next inflation report, earnings season

Recent results have left us with the following signals: C-Hold, S-Hold, I buy, F-Buy. We are currently invested at 100/I. Our allocation is currently +4.07% for the year not including the days results. Here are the latest posted results:

| 01/09/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.252 | 18.6338 | 59.7362 | 62.8115 | 35.3242 |

| $ Change | 0.0057 | 0.0575 | -0.0356 | 0.2961 | 0.2801 |

| % Change day | +0.03% | +0.31% | -0.06% | +0.47% | +0.80% |

| % Change week | +0.03% | +0.31% | -0.06% | +0.47% | +0.80% |

| % Change month | +0.10% | +2.34% | +1.41% | +2.08% | +4.07% |

| % Change year | +0.10% | +2.34% | +1.41% | +2.08% | +4.07% |

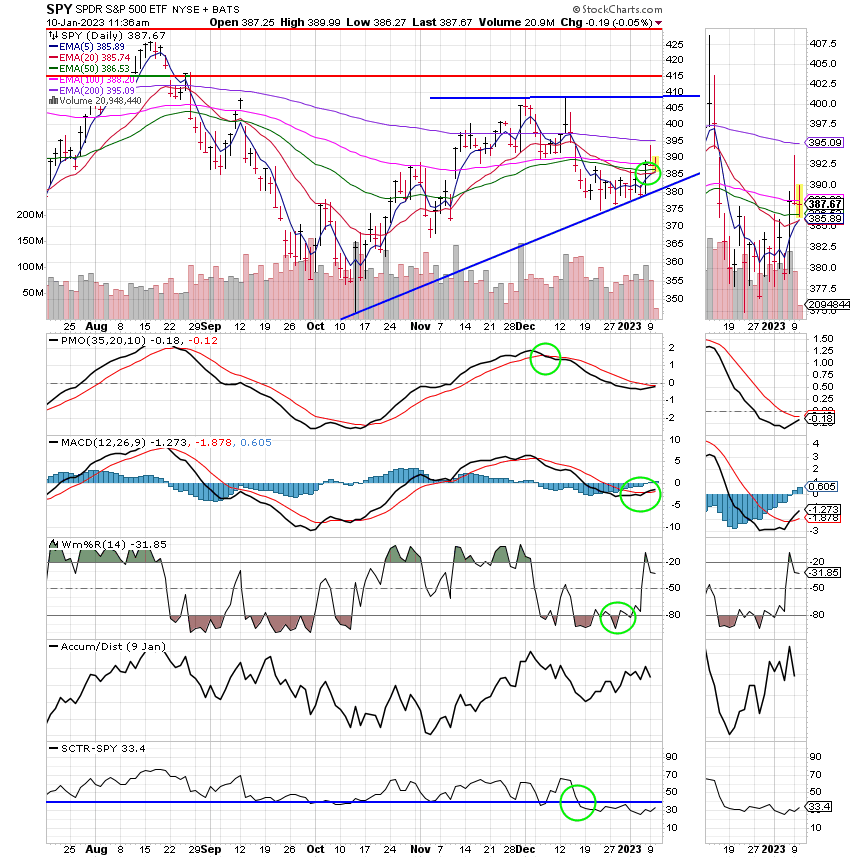

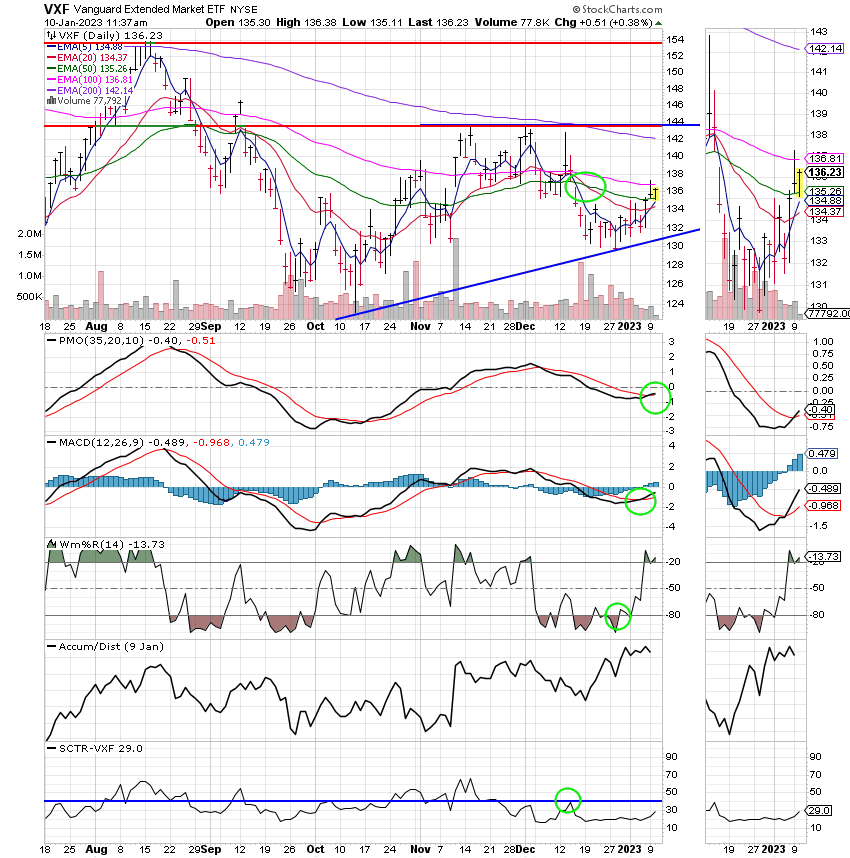

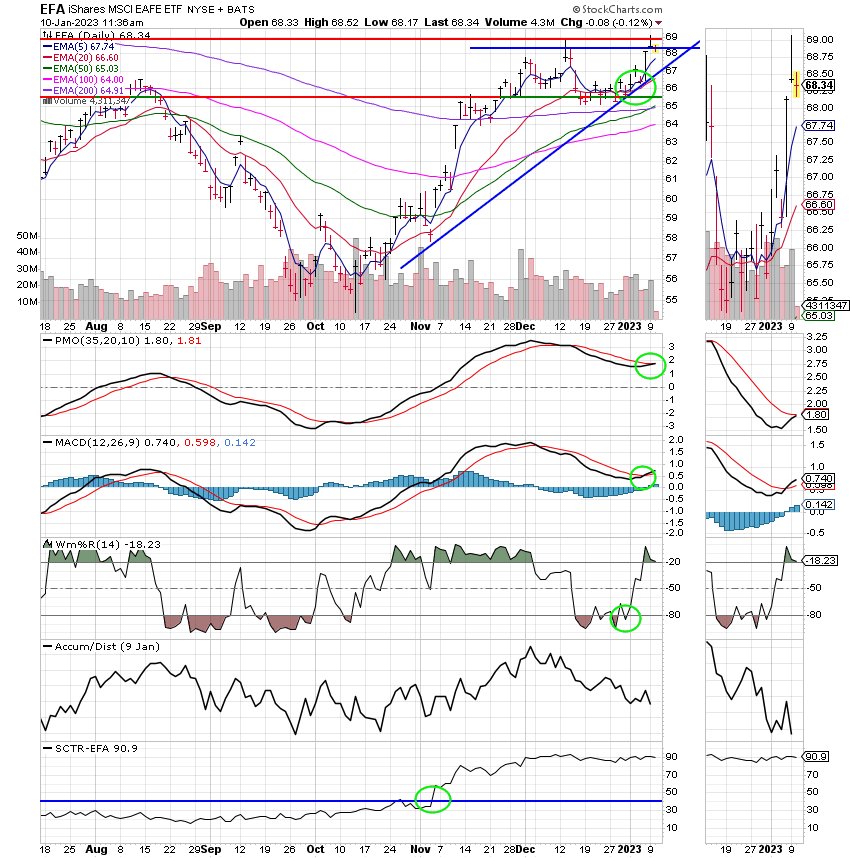

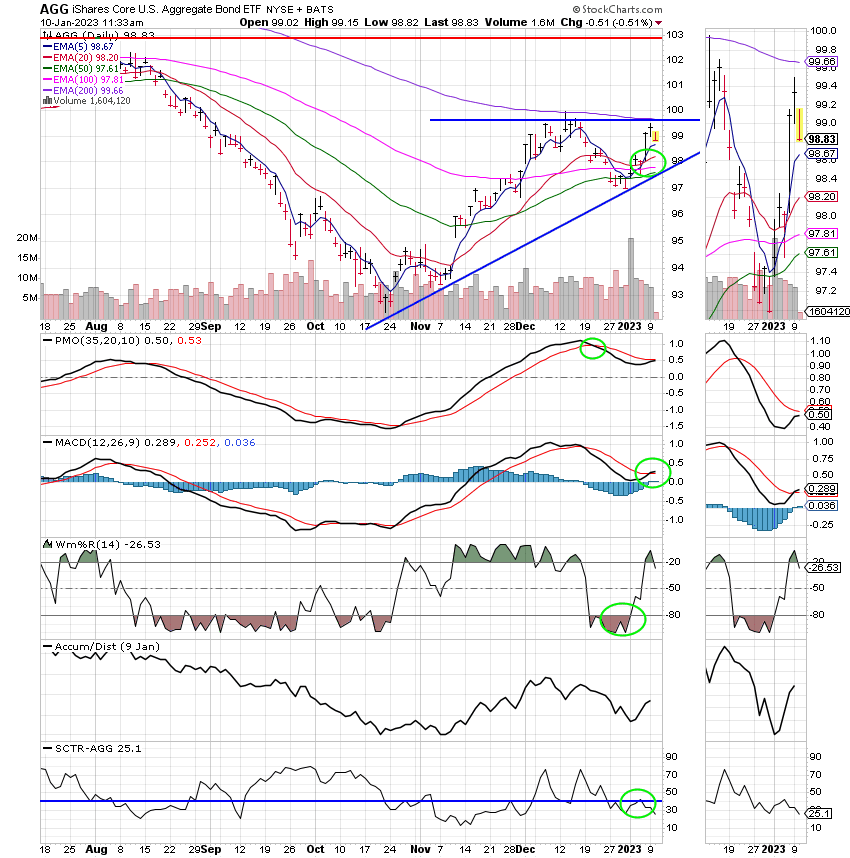

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Our task at this point it to maintain our position if possible until a sustained recovery comes. That’s all for today. Have a nice afternoon and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.