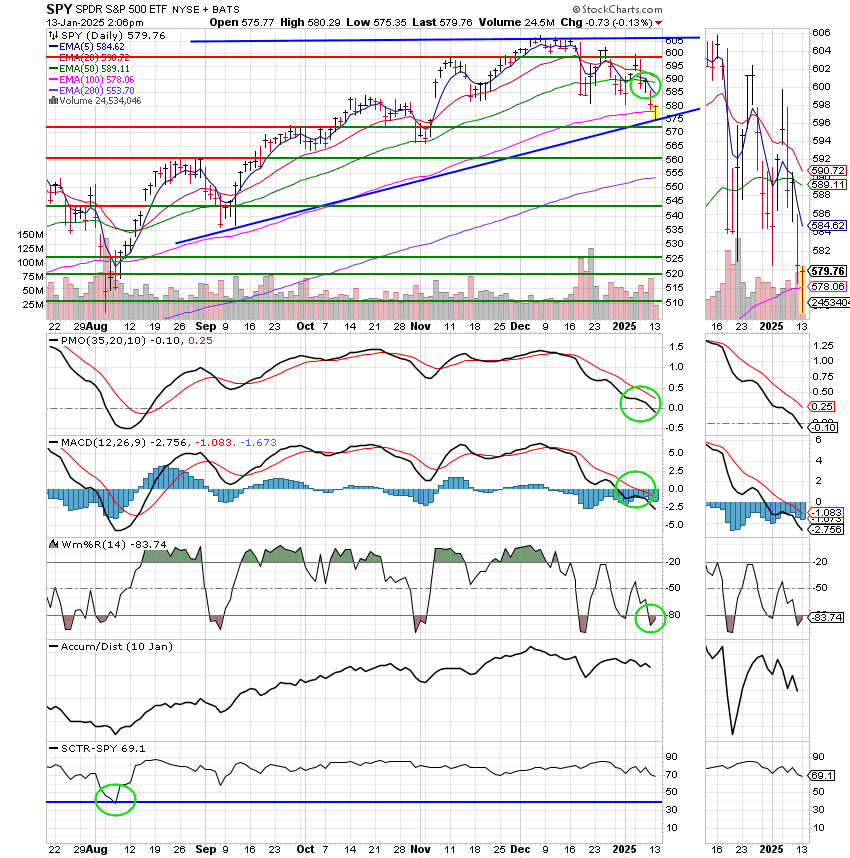

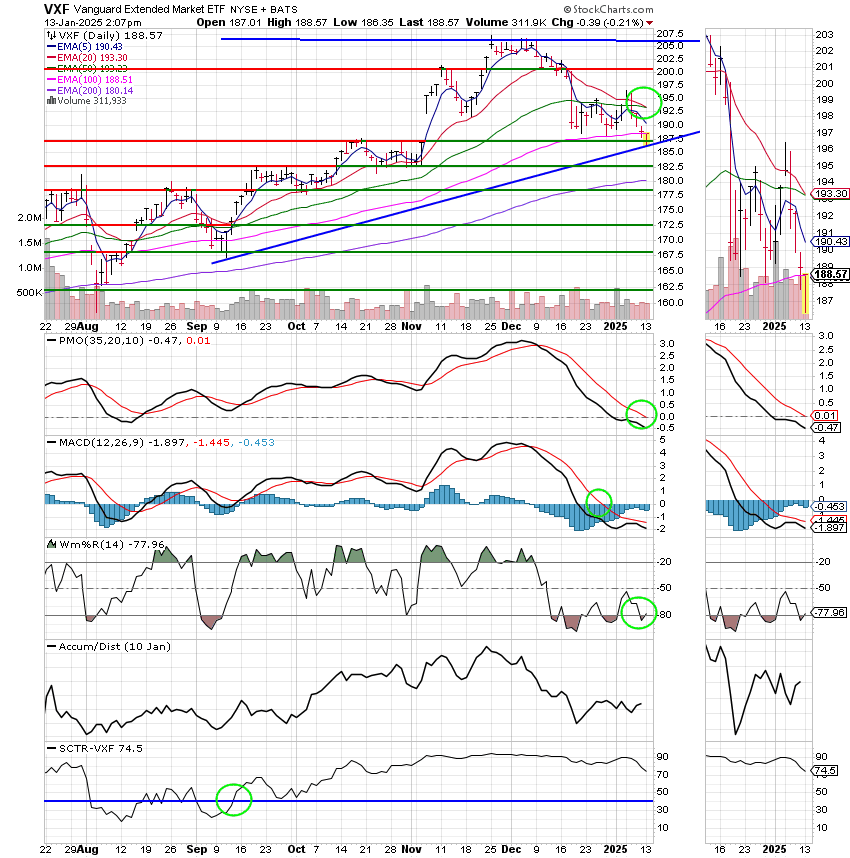

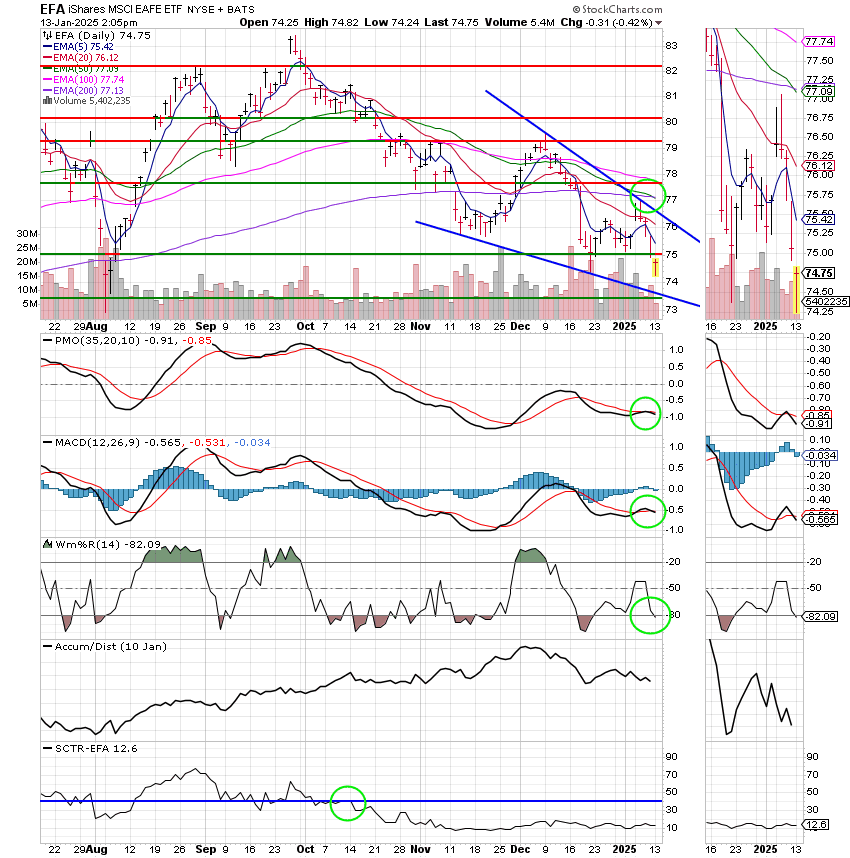

Good Afternoon, This is a complicated market. Someone on Facebook asked me where my line in the sand is for the S Fund. That’s a loaded question and very applicable to our current situation. So I will rehash it here. My line in the sand so to speak was crossed on December 24. I have been watching support at 189. It appears that it may be breached today. We knew that the market would likely trend lower over the short term if we held on December 24th. Although, there was always the chance that a Santa Rally could materialize during the last week of the year, we anticipated that their would probably be some selling. While we weren’t counting on it, a Santa Rally is always a possibility in late December. If you don’t believe me just look at the records. So why did we hold? We held and are still holding for fundamental reasons. There are two events that we believe will spur the next leg higher. 4th Quarter earnings reports will begin this week. We think the start of the fourth-quarter earnings season will stabilize markets. Banks including Citigroup, Goldman Sachs and JPMorgan Chase report on Wednesday, while Morgan Stanley and Bank of America will post results on Thursday. By all indications they should be good. We believe they will bring the market back to reality. 2nd we have the presidential inauguration on January 20th. We believe both the euphoria and the business friendly policies of the incoming administration will provide additional tailwinds for stocks. Given those conditions and the fact the a long term uptrend is still in place on our charts, we chose to remain in position to take full advantage of the next move higher. The bottom line is this. Sometimes you have to endure a root canal before the tooth will get better. That definitely applies here. I hate holding and to me it is like a root canal. Nonetheless, the decision to hold or sell was made back on December 24th. Deviating from that plan now could prove to be costly. I say buy the dip!

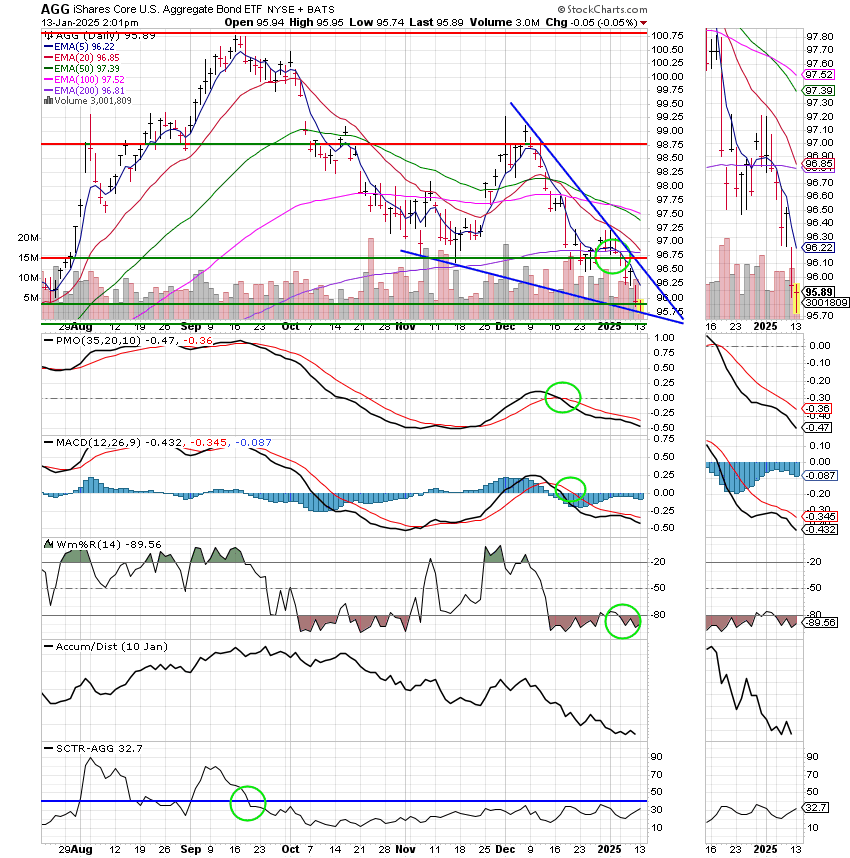

Moving on, this is a busy week. Not only do we have earnings season starting on Wednesday, but we also have the CPI (Consumer Price Index) which is one of the reports that the Fed looks at closely when forming their monetary policy. Then following the CPI, we have the PPI on Thursday. The Producer Price Index is the measure of the prices that businesses have to pay. It is occasionally referred to as a measure of wholesale prices. Personally, barring a huge surprise, I don’t think either of these reports will change the Feds outlook on inflation at this time. It is a bit sticky as a result of a strong economy and the Fed has no choice but to slow down it’s pace of interest rate decreases. So don’t expect one until at least March. How will the market handle this? It’ll get over it. Much better than it would handle a recession to be sure!!! Folks unless something drastic happens, the long term trend is still moving higher. Will the market move lower right now? Maybe, we might even have a full blown correction. Yes we are caught holding… sometimes when you are committed to a strategy it is best not to change it in midstream. To sell now would possibly lock in a loss. If you sell you risk that one earnings report or policy announcement might reignite the rally. Will the valuation of stocks ever catch up to this market? Yes it probably will sometime next year, but not now. Right now we need to remain positioned for the next move higher in this bull market and if that means enduring a root canal then tell the dentist to drill away! 100% S for now!!

The days trading so far has left us with the following results: Our TSP allotment is off -0.27%. Which is not as I thought it might be. Perhaps market players are anticipating the upcoming earnings reports. It they are smart they will. For comparison, the Dow is actually gaining +0.62%, the Nasdaq is sliding -0.83%, and the S&P 500 is dropping a modest -0.18%. Okay, the day is not the disaster that I thought it might be. Praise God for that!

S&P 500 slides as key tech stocks get hit, Nasdaq drops more than 1%: Live updates

The most recent action has left us with the following signals: C-Sell, S-Sell, I-Sell, F-Sell. We are currently invested at 100/S. Our allocation is now -0.53% for the year not including the days results. Here are the latest posted results:

| 01/10/25 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.7777 | 19.2814 | 92.1063 | 89.6769 | 41.6296 |

| $ Change | 0.0048 | -0.1095 | -1.4230 | -1.5324 | -0.6761 |

| % Change day | +0.03% | -0.56% | -1.52% | -1.68% | -1.60% |

| % Change week | +0.09% | -0.86% | -1.91% | -2.55% | -1.14% |

| % Change month | +0.13% | -1.01% | -0.88% | -0.53% | -0.64% |

| % Change year | +0.13% | -1.01% | -0.88% | -0.53% | -0.64% |