Good Morning, I pray that most of you are enjoying a well deserved day off on this holiday shortened week and that those of you who are not will at least enjoy some extra holiday pay. During my career I was most often one of the latter. Last Thursday the CPI came in a little hot and spurred some negative action in stocks. However, that report was negated to a certain degree by Fridays PPI which came in lighter than expected. Many investors decided that the hot CPI was a one off and would not effect the Fed. This type of action has always puzzled me to a certain degree. Why do they put so much time into the futile effort of trying to predict the future of the market? The Fed is and will remain data driven. That has always been the case. These folks make investing in the market way more difficult than it needs to be. Of course, you know our policy is to react to what we see on our charts. Right now the market is all about earnings. The first earnings with the big banks came in mixed on Friday. That really didn’t effect the market all that much as market players were looking for signs that the economy is cooling off. In their eyes it remains a case of the economy being not too hot and not too cold. That brings us closer to a soft landing for the economy. In other words inflation coming under control without a recession. Which brings me to the point. What will spur the next major rally? The next major rally will brought on by a reduction in the rate of inflation to two percent without a recession. All you need to know is two percent and no recession. I will also add that the beginning of that uptrend will start when the Fed begins cutting interest rates. That is a clear signal that inflation is under control and that the worst is behind us. The closer that the rate of inflation gets to two percent the stronger the rally will become. So what could cause the market to take a detour from this obvious course? What I call a landmines. They are always out there. They are catastrophic or world altering events such as the expansion of the war in the middle east for example. Issues like that are always out there and they are the main reason that it’s futile to attempt to predict the future of the market.

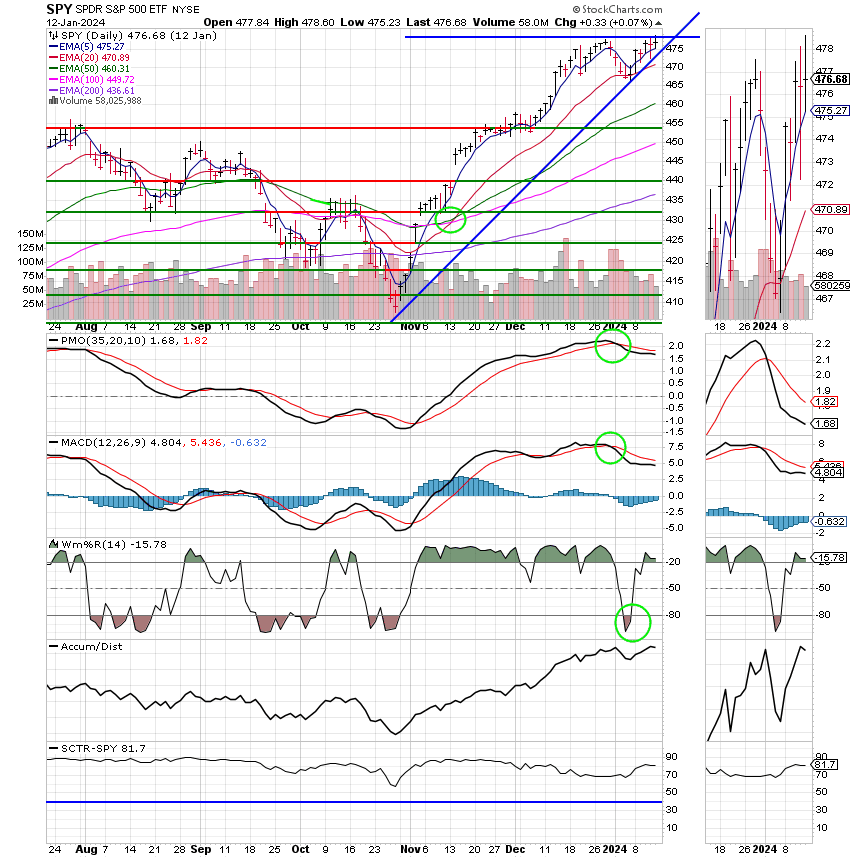

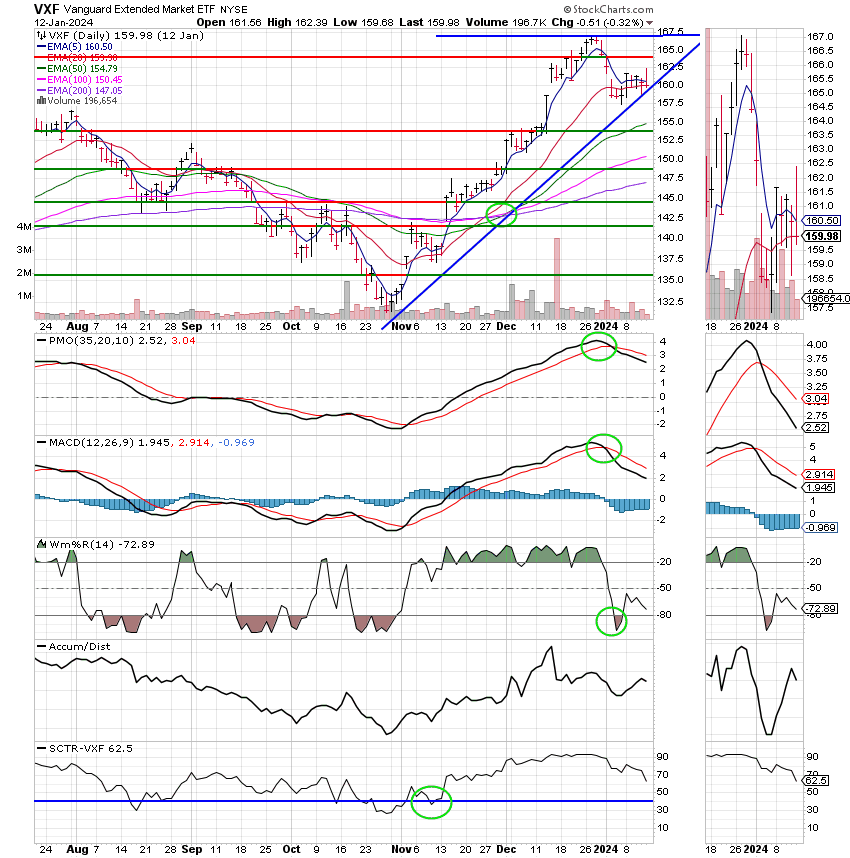

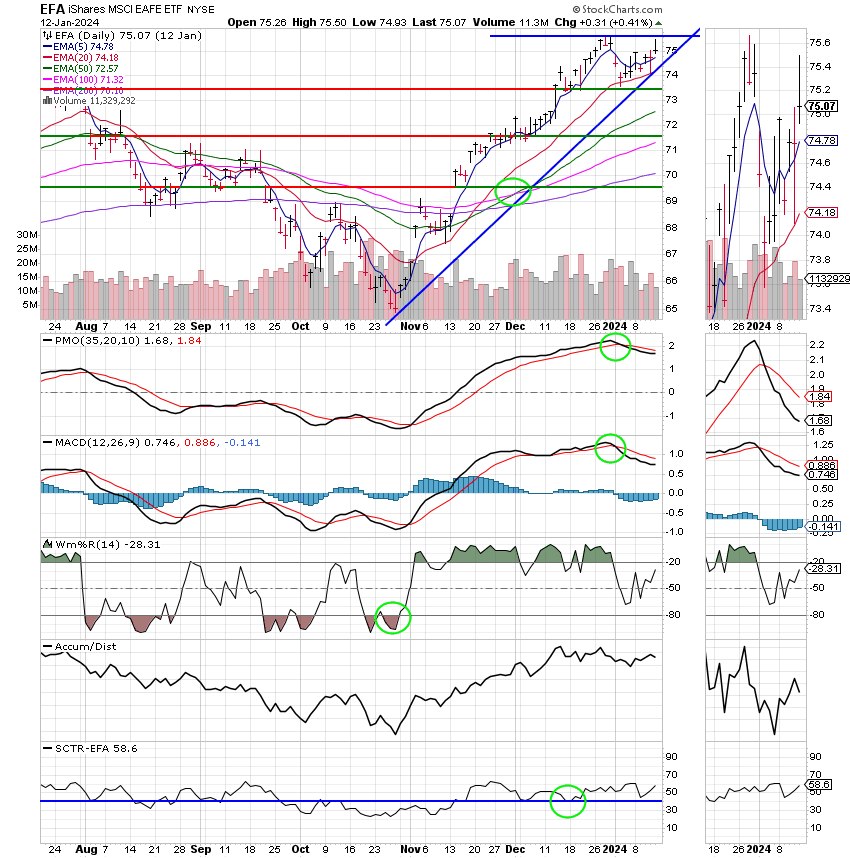

As of last week we entered equities again at 100/C after we received a new buy signal in the C Fund. There were many folks that thought we should have invested in the S Fund or at least gone 50/C and 50/S. I used to do mixes in stocks such as that. That way I was always at least partially in the right place, but I got to thinking. While I was partly in the correct place, I was also always in the second best or wrong place as well. It was not my goal to be in the second best place. My goal was to be in the best place. I understand that many of the so called experts say this can’t be done, but it would remind them that we have done it more often than not throughout the years. It takes skill to read the charts and know which one is truly the strongest. It also takes skill to know when it is time to leave a successful investment and move to another whose chart is trending stronger. Most often we will not make that move quickly as equities may be extended and in need of a pullback. When that is the case it is best to wait for the next cycle rather than change in mid stream. Again, it is important to be able to analyze the strength of the chart through technical analysis. That is the reason that we check our charts daily even when things are going well. We are looking for two things. A change in the overall trend or a change in the strength of the chart. In other words anything that would necessitate a change in our allocation. Also, one important thing to note. As you all know in TSP we are only allowed two trades a month. That is the reason that we never make trades based on our emotions. Also, we never base a new allocation on a change that we think may happen. For instance, even thought we anticipate the S Fund being the best fund later as interest rates drop, we did not base our current allocation on that. We take what is best here and now and that is the C Fund. That is what the additional trades are for. We can always go from 100/C to 100/S. Okay, but what if I use my second trade up???? What then Scott?? I’m out of trades? Well….yes and no. I always considered it like having three trades or more per month. You are out of trades in that you cannot moved to the F, C, S, or I funds. However, you have an unlimited amount of moves to the G Fund. This might sound ridiculous but you can move money from the say the C Fund one percent at a time if you so choose. So your never stuck. What you want to avoid is wasting a move to move a small percentage of money from one equity based fund to another. Then when you really need to move money to a fund that is performing well you are truly stuck. The same goes for a bad market day. If you waste your second move to put your entire allocation in the G Fund just because the market is having a bad day you are indeed as you say stuck! That is the reason that if for no other reason you use charts. You must base your moves on concrete trend where you are seeing higher highs and higher lows or lower highs and lower lows. With the TSP restriction of only two moves per month it is imperative that you do this. That would not be the case if we had an unlimited amount of moves, but we do not and in order to be successful we must manage our moves carefully. That is one of the reason that many folks buy and hold. They don’t have the skill to do this. We do and with God’s help we will!

Friday’s trading left us with the following results: Our TSP allocation poste a slight gain of +0.08%. For comparison, the Dow dropped -0.31%, the Nasdaq added +0.02%, and the S&P 500 was +0.08%.

Dow closes more than 100 points lower Friday, ekes out a weekly gain: Live updates

Recent action has left us with the following signals: C-Buy, S-Sell, I-Buy, F-Buy. Our current allocation is 100/C. Our allocation is now -0.25% for the year and +0,25% for the month. Here are the latest posted results:

| 01/12/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.9872 | 19.1833 | 74.618 | 75.0515 | 40.0185 |

| $ Change | 0.0020 | 0.0408 | 0.0617 | -0.2057 | 0.2201 |

| % Change day | +0.01% | +0.21% | +0.08% | -0.27% | +0.55% |

| % Change week | +0.08% | +0.91% | +1.87% | +0.85% | +1.08% |

| % Change month | +0.13% | -0.20% | +0.34% | -2.65% | -0.41% |

| % Change year | +0.13% | -0.20% | +0.34% | -2.65% | -0.41% |