Good morning, Our website remains down as I type this message. We hope to get it up in short order. We are currently researching a new web hosts and hope to have this problem remedied in the future. The market continues to trade in a wide range influenced by inflation, and everything related to inflation. The beginning of 2023 has been promising with all the major indices starting out the new year with gains. With the first two weeks of 2023 trading done, the three major indexes are up so far for the year. The Nasdaq Composite is leading the way, adding 5.9% as investors bought beaten-down technology stocks on rising hopes of an improving landscape for growth holdings. The S&P 500 and Dow followed, gaining 4.2% and 3.5%, respectively. Last week’s CPI report kept the party going showing the inflation had eased -0.01% for the month. While that was still an increase of approximately 6.5% over a year ago it showed that the current rate of inflation may be starting to moderate. Investors are looking at this metric thinking that it will influence the Fed to pivot from their current level of interest rate increases. The consensus among market players is that the Fed will reduce their rate of increase at their next meeting from 0.05% to 0.25%. There is even a small group of investors that believe the Fed might suspend their increases for now and take a little time to observe how their recent increases have affected the economy. While it has lessened somewhat there is still a fear among some investors that the Fed could increase rates too much and force the economy into a recession. So in essence, everything remains the same. The market continues to trade in a wide range with a higher than normal amount of volatility. We have discussed this volatility in many recent blogs so I won’t revisit it today other than to say that in seems to decrease incrementally as inflation comes down. The current rate of inflation has dropped from a high if close to 9% to the mid 6% range. So, the Fed rate increases appear to be having an effect. As we have said for well over a year now. The closer the rate of inflation gets to 2% the lower the volatility will be and the more normal the trading range will become. Investors also continue to keep a close eye on earnings reports. They are looking to make sure that corporations remain profitable in a rising interest rate environment. A decrease in earnings could be an indicator that the economy is slipping into a recession. On the flip side if earnings are too strong, they view it as a signal to the Fed that they need to increase rates higher and longer to control inflation. So quarterly reports must be Goldilocks warm, not to high or not too low. High enough to indicate that the economy is absorbing the interest rate increases without too many adverse effects yet low enough to let the Fed know that the economy is not running too hot. While the Fed watches other things such as employment and wage growth to determine their policy with respect to inflation these earnings reports play an important role in formation of that policy. As for as our thrift allocation goes, we continue to watch the value of the dollar which has recently been dropping. If the dollar continues to drop it will eventually have and adverse effect on the I Fund. The I fund has clearly been the strongest and most consistent of the TSP Funds as indicated by an SCTR of over 90%. While the S Fund has made some strong and quick gains in recent weeks, we feel that the downside risk is still too great for us to favor it as an investment given the current rate of volatility. That will change at some point as inflation and market volatility decrease. We will continue to watch both the S and the C funds and won’t hesitate to make a change to one or the other should their chart become the best.

The days trading left us with the following results: Our TSP allotment carried the day posting a gain of +0.31%. For comparison, the Dow fell -1.14%, the Nasdaq added +0.14%, and the S&P 500 dropped -0.20% and for those of you keeping score the S Fund posted a small gain of +0.12.

Dow closes almost 400 points lower and snaps 4-day win streak, pressured by Goldman shares

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 100/I. Our allocation is now +6.91% for the year not including the days results. Here are the latest posted results:

| 01/13/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.2595 | 18.7406 | 61.3899 | 65.8056 | 36.2888 |

| $ Change | 0.0019 | -0.0623 | 0.2465 | 0.3962 | 0.2212 |

| % Change day | +0.01% | -0.33% | +0.40% | +0.61% | +0.61% |

| % Change week | +0.08% | +0.88% | +2.71% | +5.26% | +3.55% |

| % Change month | +0.14% | +2.93% | +4.22% | +6.95% | +6.91% |

| % Change year | +0.14% | +2.93% | +4.22% | +6.95% | +6.91% |

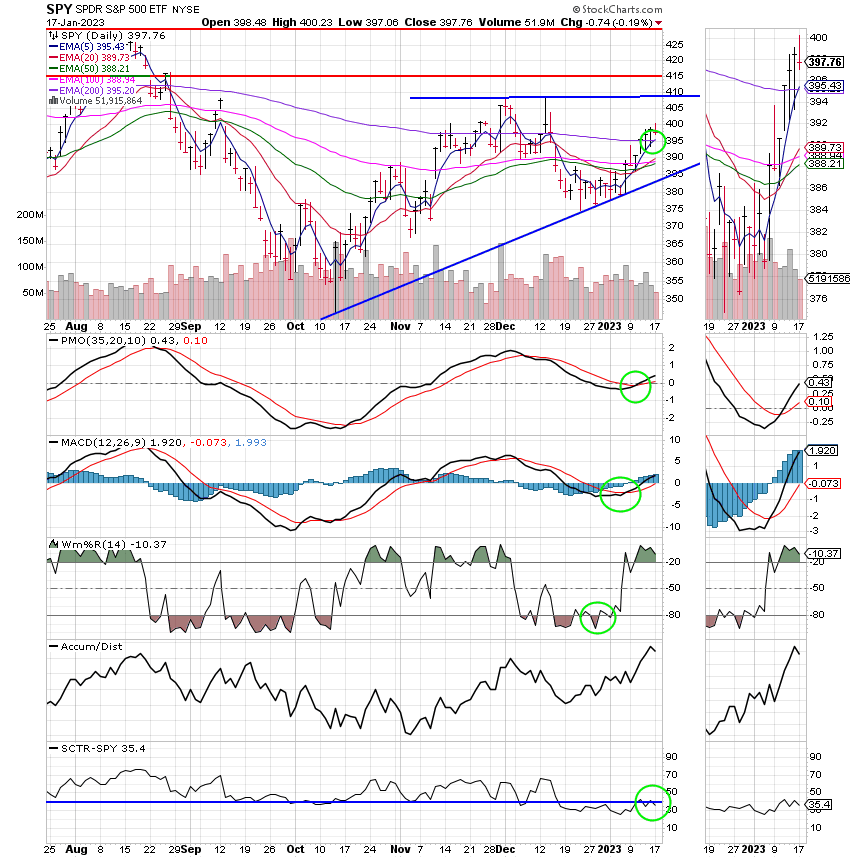

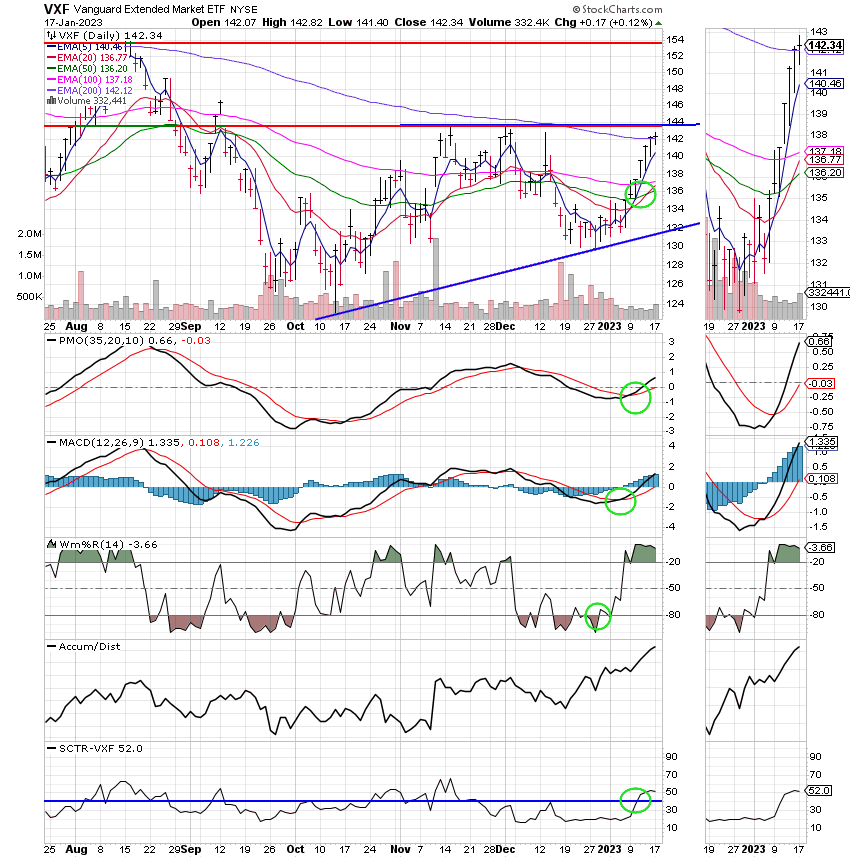

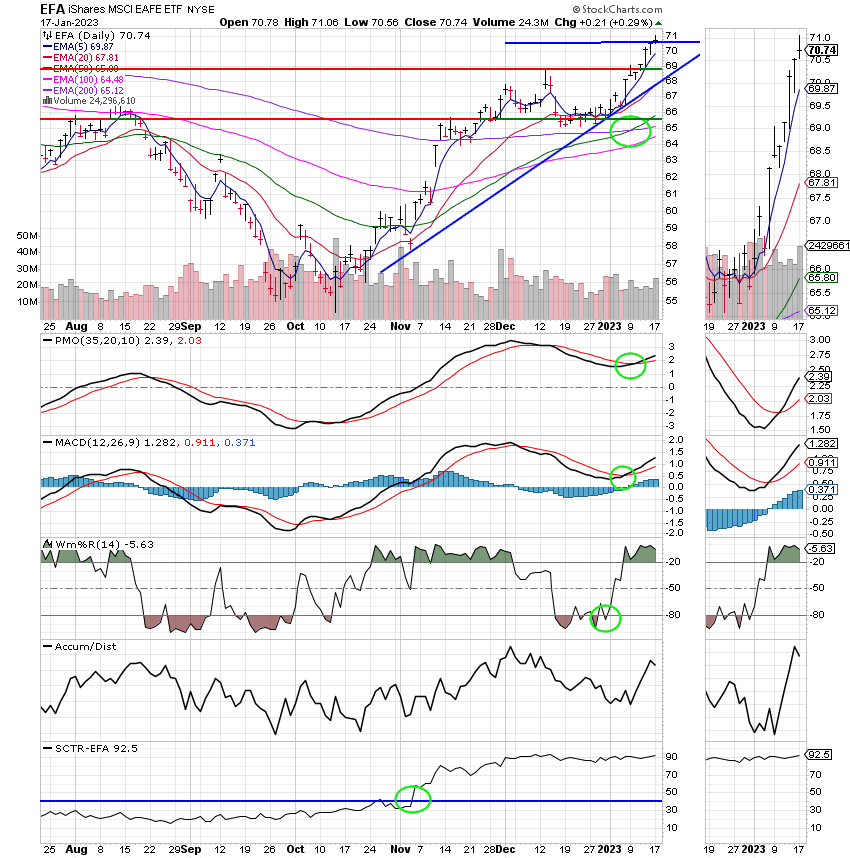

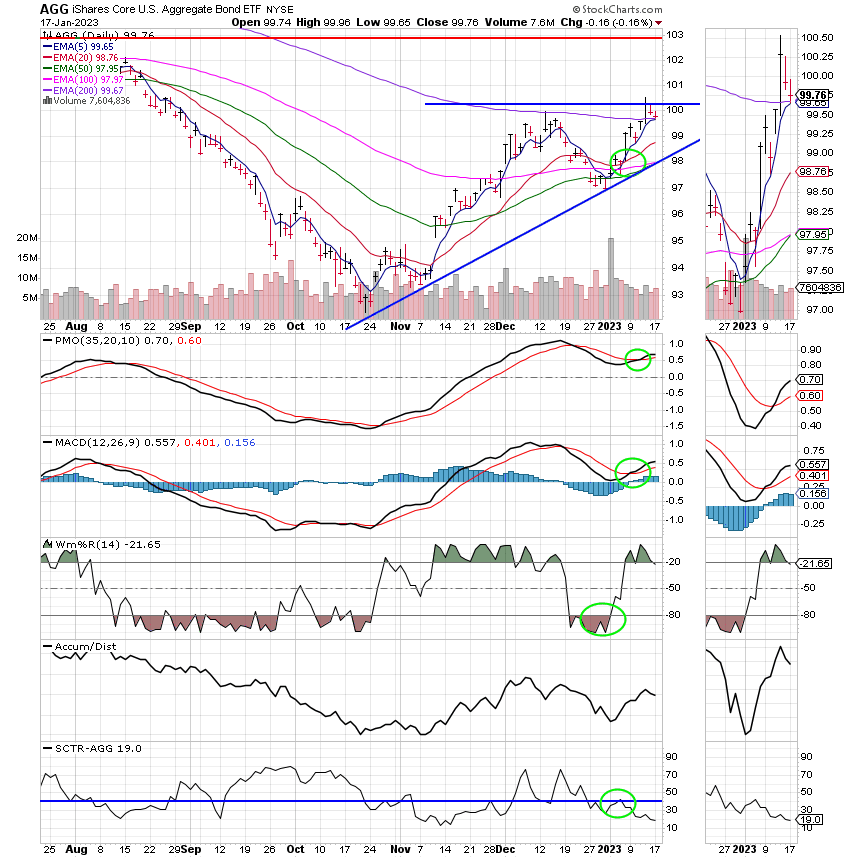

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Most of my charts and indicators say we’re moving higher. That’s all good, but don’t forget that we still need to watch our charts and we still need to pray. The volatility is not over! We must continue to thank God for guiding our hand and petition Him that He will continue to do so. That’s all for today. Have a nice evening and may God continue to bless your trades.

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.