Good Morning, Just when you thought it was safe to go back into the water……. Here comes China again. Yesterdays sell off was fast and furious. A Chinese start up released a a free AI APP called DeepSeek and the market did what it loves to do, it panicked. DeepSeek was said to have out performed Open AI’s Chat GPT in several tests and the company announced that it only spent six million in it’s development. So the market did what it does best and sold first and asked questions later. The first impression left by DeepSeek was that it was better and cheaper than anything we had developed at a much greater expense. China is ahead in the AI race!! The sky is falling! Nvidia, the worlds largest company by market cap sold off to the tune of 17%. It was the largest drop in market cap for a US company in the history of the market. Overreaction? Yes I think so. I’m placing my bets on Nvidia and the other US tech companies. They certainly didn’t get where they are at by laying down. First of all, while DeepSeek outperformed what we have now, how can we really believe that it only cost six million?? When did we start trusting anything tied to the CCP anyway? Second, I remember when I was a kid and the Russians put the first space capsule in orbit around the earth. What happened? We woke up and the next thing that happened was we put a man on the moon. Like I said, my money was and is on US tech. Especially with the stargate program (AI) announced a couple weeks ago. Ya’ll can invest in China all you want. I’m keeping my money right here in the good old USA!! The second major market maker this week is the Fed meeting that starts today and ends tomorrow at 2:00 PM EST with Jerome Powell’s press conference. Bets are that the Fed will keep rates steady this time. The market will probably not be thrilled, but I’m not expecting that there will be a major selloff or any thing like that. We will see. Finally, we have continued earnings reports with Starbucks reporting Tuesday after the bell. A slate of Magnificent Seven companies will report in the coming days, with Meta Platforms, Microsoft, Tesla and Apple due later this week. Most of these reports should be favorable and provide at least a few tailwinds for the market. After all, in the end it is all about earnings. Never forget that. With all that taken into consideration, the overall market trend is moving higher. So we will continue to remain invested at 100/S. The S Fund still has the best chart. With that in mind we will keep our money on the best horse. That is what we do!

The days trading has so far left us with the following results: our TSP allotment is up +0.57%. For comparison, the Dow is adding +0.31%, the Nasdaq +0.49%, and the S&P 500 +0.43%. It will take the market a day or two to recover from yesterdays selloff.

Stocks are little changed as Nvidia looks to rebound from AI rout: Live updates

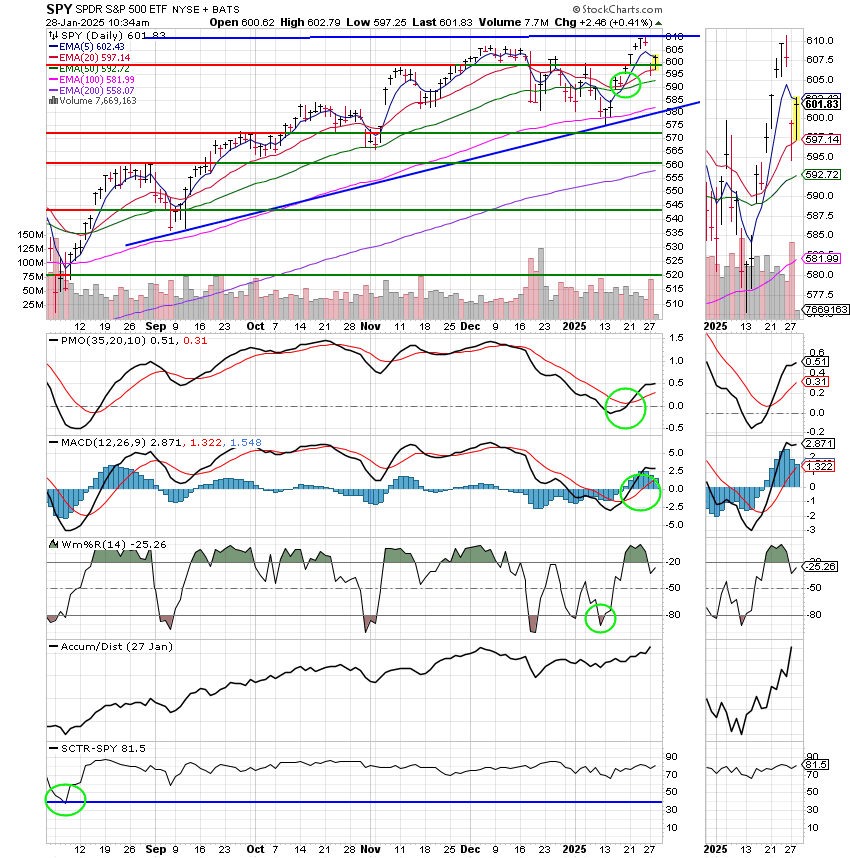

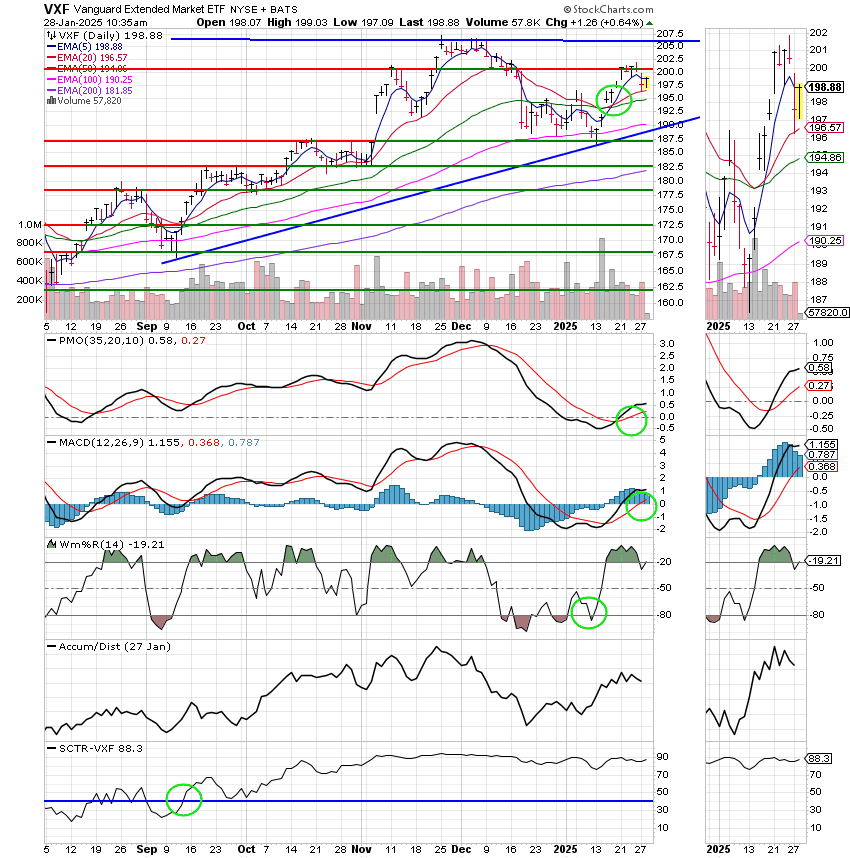

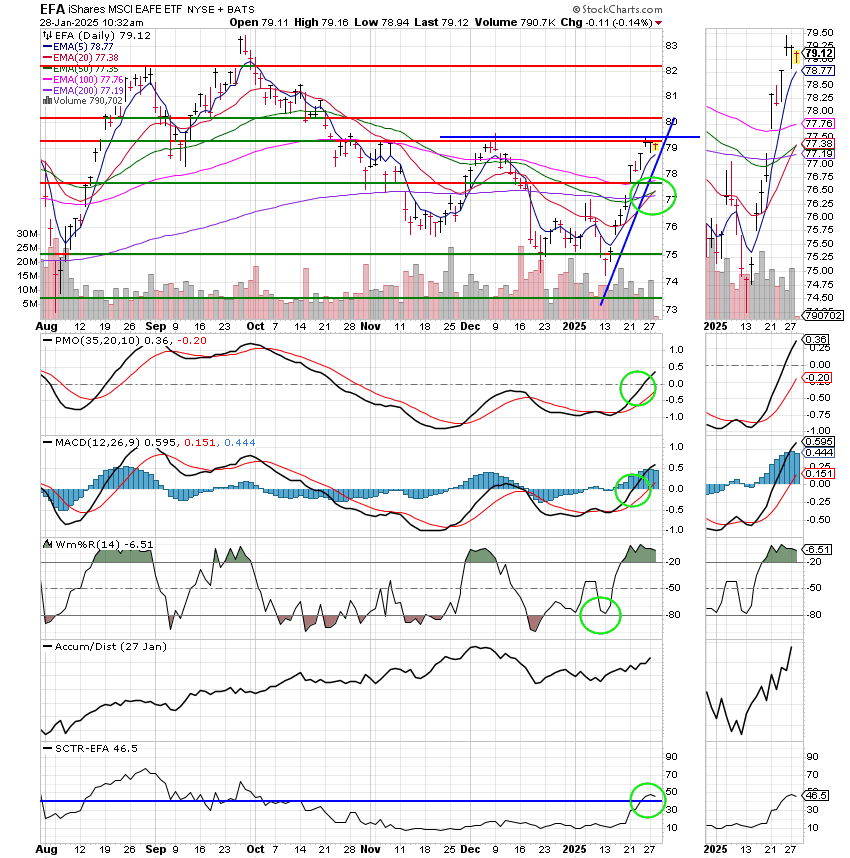

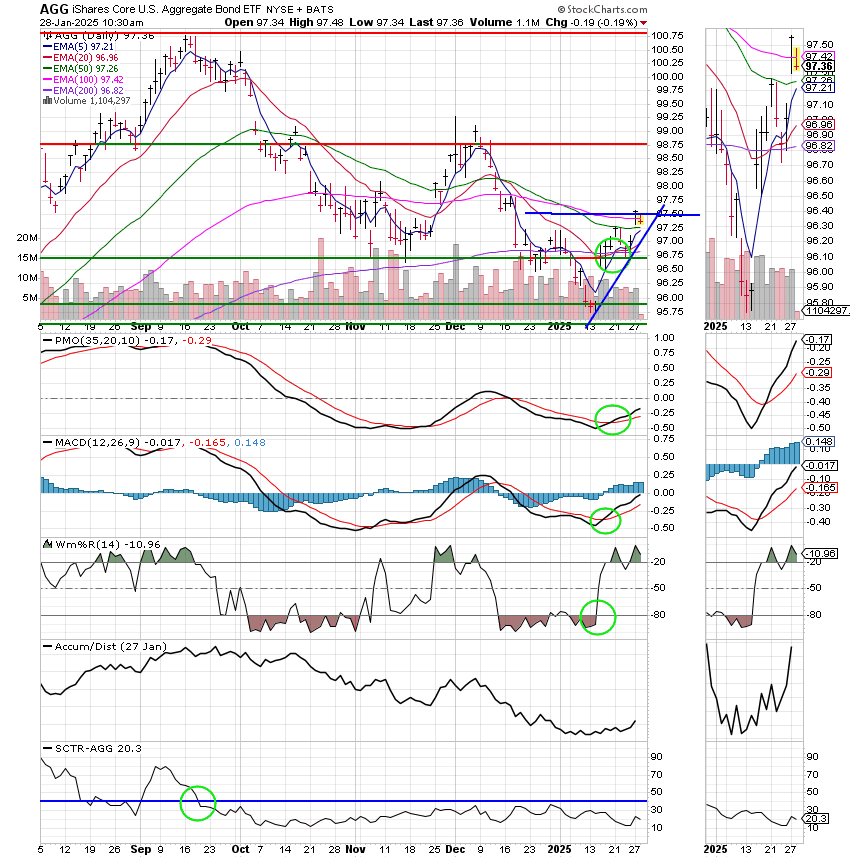

Recent action has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 100/S. Our allocation is now +3.99% not including the days results. Here are the latest posted results:

| 01/27/25 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.8185 | 19.5978 | 95.0611 | 93.7506 | 43.1891 |

| $ Change | 0.0072 | 0.1031 | -1.4058 | -1.5139 | -0.3319 |

| % Change day | +0.04% | +0.53% | -1.46% | -1.59% | -0.76% |

| % Change week | +0.04% | +0.53% | -1.46% | -1.59% | -0.76% |

| % Change month | +0.34% | +0.61% | +2.29% | +3.99% | +3.09% |

| % Change year | +0.34% | +0.61% | +2.30% | +3.99% | +3.09% |