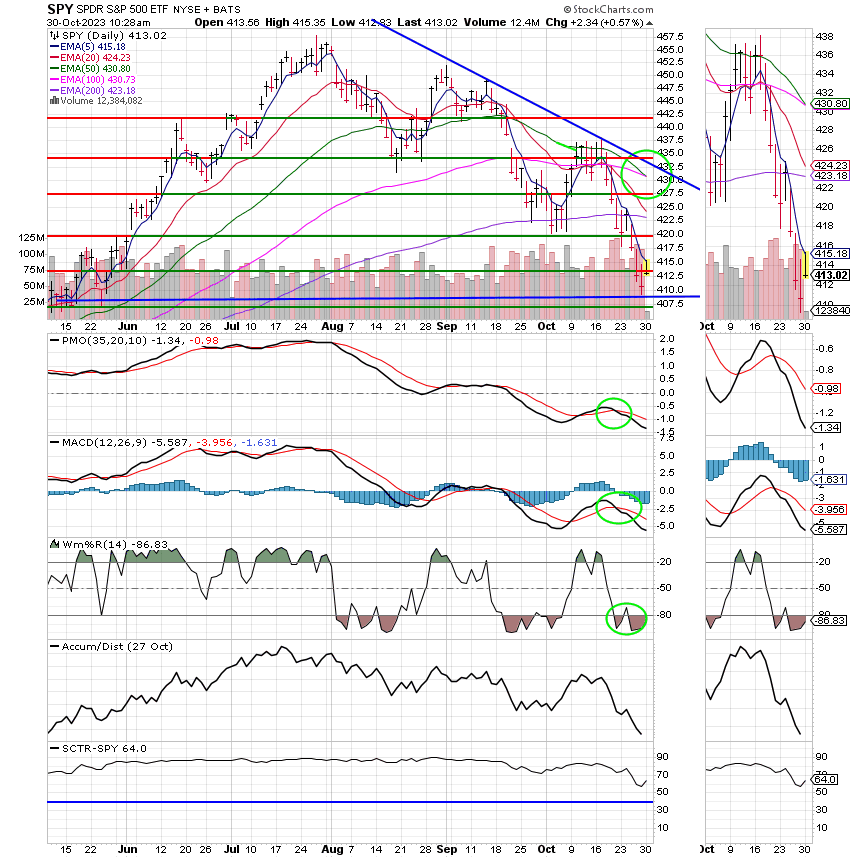

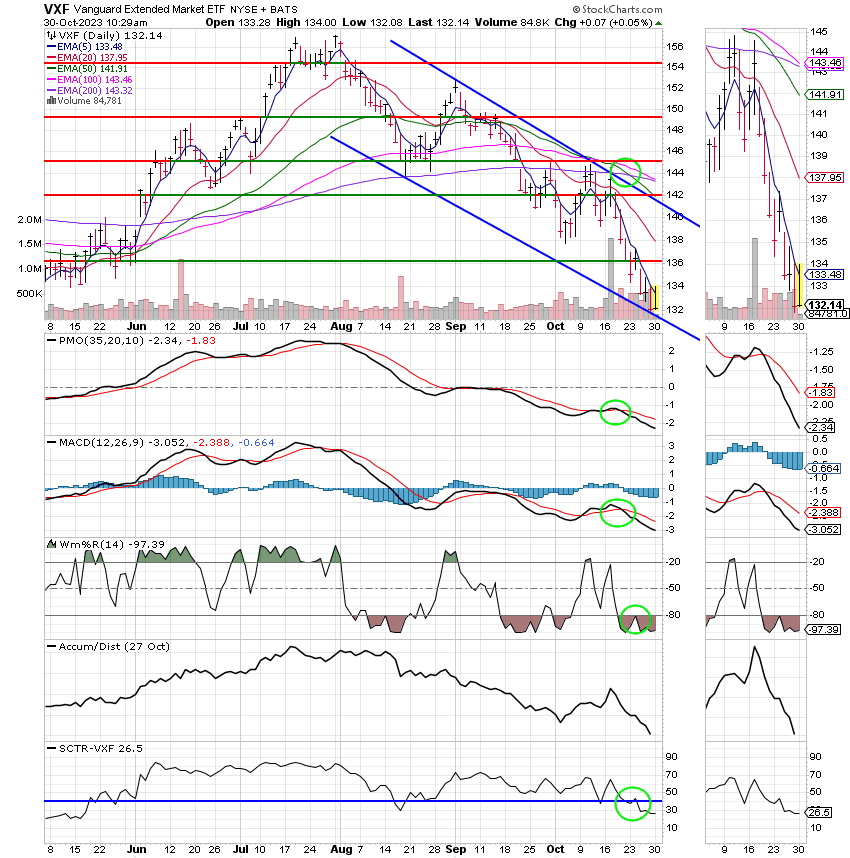

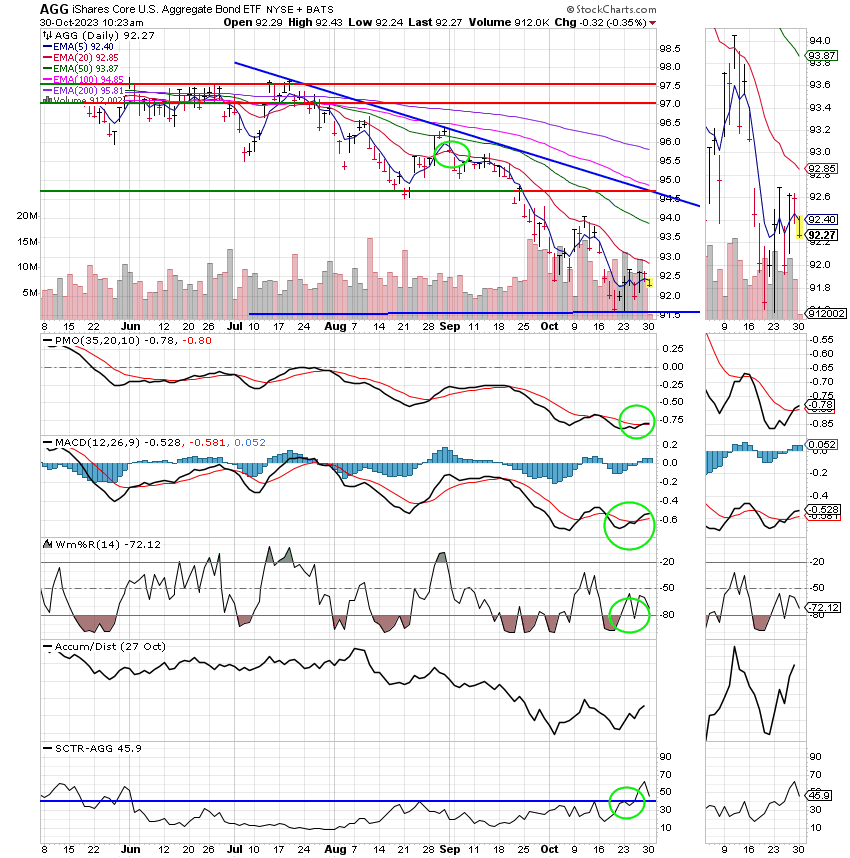

Good Morning, Well we’re almost done with the month of October. With one more trading day to go it’s almost certain that the major indices will all end the month in the red which will make it three consecutive months in red. That hasn’t happened since the pandemic. As you know we have been patiently waiting for a fall uptrend which to this date has not arrived. Why did we wait when that’s usually not what we do? In one word, volatility. Overall it has remained at a high level making the runs both higher and lower extremely quick. Given the oversold nature of this market and the fact that seasonality is shifting in favor an uptrend, we decided to hold for the next uptrend. It is still our opinion that sitting on the sidelines could cause us to miss out on the initial stages of the that uptrend. We also based that decision on the fact that there was at the time solid support at 420 SPY. In retrospect we were wrong about the support as it failed to hold and is now sitting at 413.38. Nevertheless, we are now committed to holding until the next uptrend. While we are having a moderate bounce at the time of this writing, I do not think anything significant will happen until Wednesday afternoon when the Fed concludes it’s November meeting. It is widely thought that the Fed will hold rates steady. How will the market react if they do? These days you just never know. I would normally say that the reaction would be favorable. but then again what has gone the way we though it would for the past two years? Trying to predict this market is worse than a waste of time. It is best to focus on reacting to what it does which is exactly what our strategy is and will be. The best thing to do is to watch events like the Fed meeting knowing that they are inflection points for the market and drill down on your charts when they take place. Trying to plan for anything else has been an act of pure futility for the past two years. All that said there are some fundamental things to consider as we watch our charts. The first is the extremely oversold nature of this market. Let’s face it. We’re more than due for some type of bounce. Second, there’s the anticipation that the Fed will end their rate hiking campaign. We’ll know on Wednesday afternoon at 2 PM ET. Also, along those lines you have somewhat dovish central bank conditions around the world (BOJ, EU, BOE, etc.). Then finally you have economic developments moving in the right direction (cooler EU, the CPI, USJOLTS, US jobs etc.). These things give us the feeling that we are about to get over the hump. Then again, there are other issues such as the wars in Ukraine, and the middle east. Just how positive can things get with world war three just around the corner…… Seriously, I’ve got to turn to my faith on that one….. the Bible tells us that there will be wars and rumors of wars….not to worry but to look up for our redemption draws near. Such is the nature of this world. We must do the best we can until our Lord and Savoir Jesus Christ returns. Will He catch us sleeping? Will He find faith on the earth when that time comes? I’m pretty sure we won’t be thinking about our earthly investments…… Just food for thought. Keep praying for all these things. He is a good Father and He will provide for our needs.

The days trading is producing the following results: Our TSP allotment is currently trading in the green at +0.73%. For comparison, the Dow is up +1.10%, the Nasdaq +0.86%, and the S&P 500 is +0.73%. Praise God for a day in the green!

Stocks bounce as S&P 500 tries to climb out of correction territory: Live updates

Recent action has left us with the following signals: C-Sell, S-Sell, I-Sell, F-Hold. We are currently invested at 100/C. Our allocation, is now -10.01% for the year. It is -3.90% for the month. Here are the latest posted results:

| 10/27/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.8114 | 17.7871 | 63.9912 | 61.7108 | 34.6764 |

| $ Change | 0.0023 | 0.0034 | -0.3073 | -0.6625 | -0.1319 |

| % Change day | +0.01% | +0.02% | -0.48% | -1.06% | -0.38% |

| % Change week | +0.09% | +0.67% | -2.52% | -3.03% | -1.09% |

| % Change month | +0.35% | -1.28% | -3.90% | -7.85% | -4.46% |

| % Change year | +3.34% | -2.31% | +8.64% | +0.29% | +2.16% |