Good Evening,

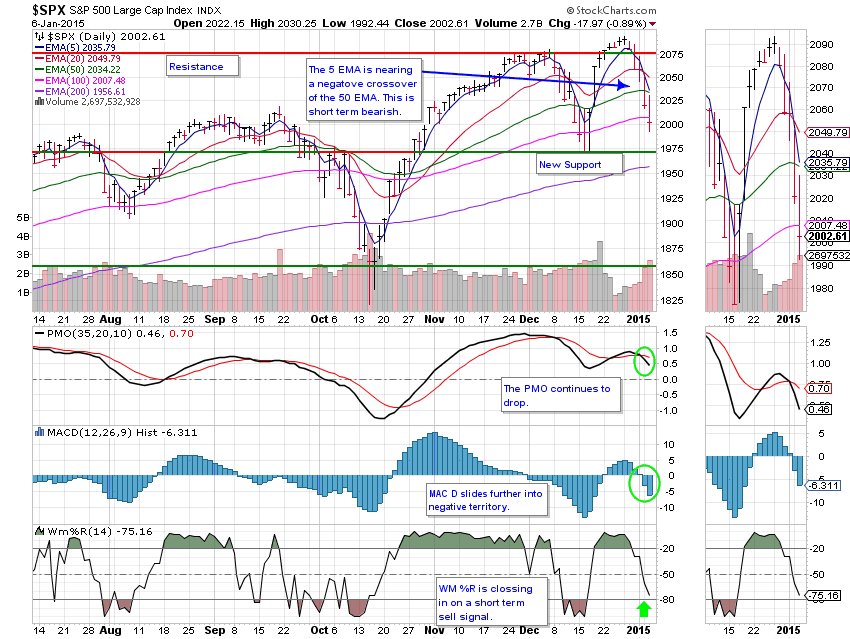

A key part of the recent pattern of bounces has been that there has been one or two failed bounces before the real thing occurs. This morning we started out in the green, but ended up in the red by lunch and never recovered. The major indices finishing with big losses. Not as big as yesterday, but still sizable. After several negative days for the Dow and S&P, the market is becoming oversold. In addition, with the S&P now down over 5% from its highs, we are starting to enter the territory where these computer generated V-Shaped bounces have occurred. I’m not saying that we will have one (a bounce) tomorrow, but I believe that it will be soon. If not, then Katie bar the door, this market has changed! Put is this way: I’m not vacating any positions just yet. Oil again may be the key. It closed below $48.00 per barrel today and seems to be starting to really have a negative effect on the market. Another thing to keep an eye on is the situation in Greece. If the anti-austerity party is elected, Greece may have to leave the EU and go back to their own currency. I can’t imagine that having a positive effect on world markets.

The day’s trading left us with the following results: TSP closed down -1.134% and AMP gave up another -0.716%. In comparison, the Dow was -0.76%, the S&P -0.89%, and the Nasdaq dropped another -1.29%.

Wall Street ends down fifth session; oil prices fall further

| 01/05/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6207 | 16.886 | 26.6655 | 35.6585 | 23.5838 |

| $ Change | 0.0026 | 0.0545 | -0.4944 | -0.5742 | -0.6335 |

| % Change day | +0.02% | +0.32% | -1.82% | -1.58% | -2.62% |

| % Change week | +0.02% | +0.32% | -1.82% | -1.58% | -2.62% |

| % Change month | +0.03% | +0.50% | -1.84% | -1.76% | -2.62% |

| % Change year | +0.03% | +0.50% | -1.84% | -1.76% | -2.62% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.3891 | 22.6682 | 24.4818 | 25.9813 | 14.6995 |

| $ Change | -0.0636 | -0.2290 | -0.3204 | -0.3911 | -0.2540 |

| % Change day | -0.36% | -1.00% | -1.29% | -1.48% | -1.70% |

| % Change week | -0.36% | -1.00% | -1.29% | -1.48% | -1.70% |

| % Change month | -0.35% | -1.01% | -1.31% | -1.51% | -1.73% |

| % Change year | -0.35% | -1.01% | -1.31% | -1.51% | -1.73% |