Good Evening,

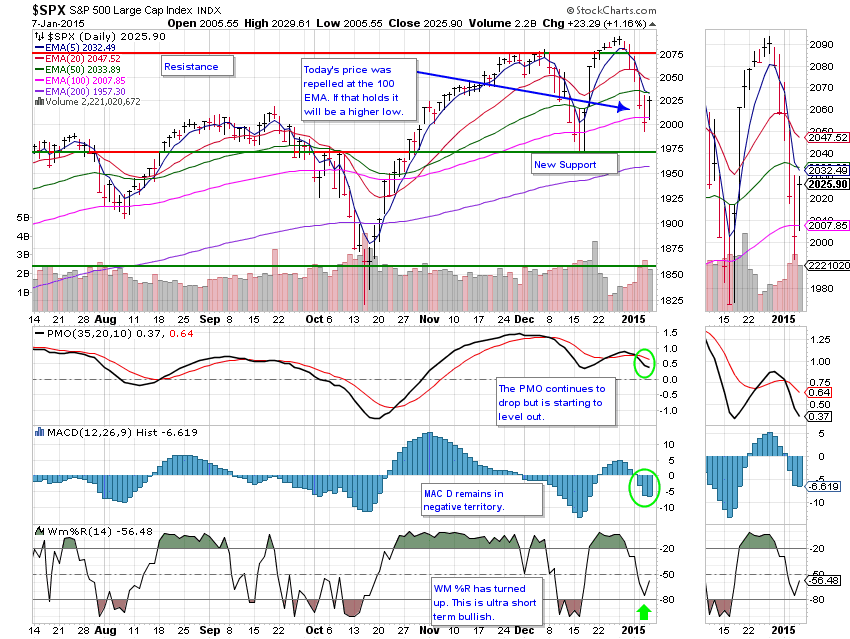

With God’s help, our analysis was once again correct. We got our bounce today and the bleeding was stopped. Now we’ll see if we can get some follow through tomorrow. Remember, the recent pattern has been for one or two failed bounces to occur before we head back up. Yesterday’s fade into the afternoon definitely qualifies as one and while we did get a bounce that lasted all day today, we won’t be out of the woods until we get some meaningful follow through tomorrow. There is still a chance for today’s bounce to fail… The action was good to our TSP allotment which posted a solid gain of +1.226%. AMP, which is invested differently, broke even at +0.00515%. Not to worry, though… It is invested differently and will have its day. For comparison, the Dow added +1.23%, the Nasdaq +1.26%, and the S&P 500 +1.16%.

Wall Street ends up more than 1 percent, boosted by jobs data

| 01/06/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6215 | 16.9396 | 26.4285 | 35.2122 | 23.4383 |

| $ Change | 0.0008 | 0.0536 | -0.2370 | -0.4463 | -0.1455 |

| % Change day | +0.01% | +0.32% | -0.89% | -1.25% | -0.62% |

| % Change week | +0.02% | +0.64% | -2.69% | -2.82% | -3.22% |

| % Change month | +0.03% | +0.82% | -2.71% | -2.99% | -3.22% |

| % Change year | +0.03% | +0.82% | -2.71% | -2.99% | -3.22% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.3633 | 22.574 | 24.347 | 25.8126 | 14.5906 |

| $ Change | -0.0258 | -0.0942 | -0.1348 | -0.1687 | -0.1089 |

| % Change day | -0.15% | -0.42% | -0.55% | -0.65% | -0.74% |

| % Change week | -0.51% | -1.41% | -1.84% | -2.12% | -2.43% |

| % Change month | -0.50% | -1.42% | -1.85% | -2.15% | -2.46% |

| % Change year | -0.50% | -1.42% | -1.85% | -2.15% | -2.46% |