Good Evening, At least it’s good for us…… I could write a couple of paragraphs and sound very intelligent on today’s action. By the matter of fact, that is what I use to do because it gave me credibility. I don’t do that so much anymore as I have come to realize that it is results that give credibility. That is the reason that I always include a link to the main news article that I read below. That way I can stick to the main thing that most of you are interested in which of course is approaching retirement in a secure manner. With that said, I’ll get right to the subject. China shut their market down again and devalued the yuan last night and everyone else panicked this morning. The result was another deep and painful sell off today. The first thing you need to know is that nobody ever makes any money by panicking. The second thing you have to know regardless of what the experts may say is that you need to keep your powder dry while the market is going down. No one can say how far the market is going to go down. All we can say is that it is going down now! There will be plenty of opportunity to buy when things turn back up after a deep selloff and right now this is starting to qualify as deep! It is no time to be a hero!!!!

The days selling left us with the following results: Our TSP allotment was secure in the G Fund. For comparison, the Dow lost whopping -2.32%, the Nasdaq was even worse at -3.03%, and the S&P 500 dropped -2.37%. Thank God we were in the G Fund! Give Him all the praise!!

Dow off to worst January start ever as China fears grow

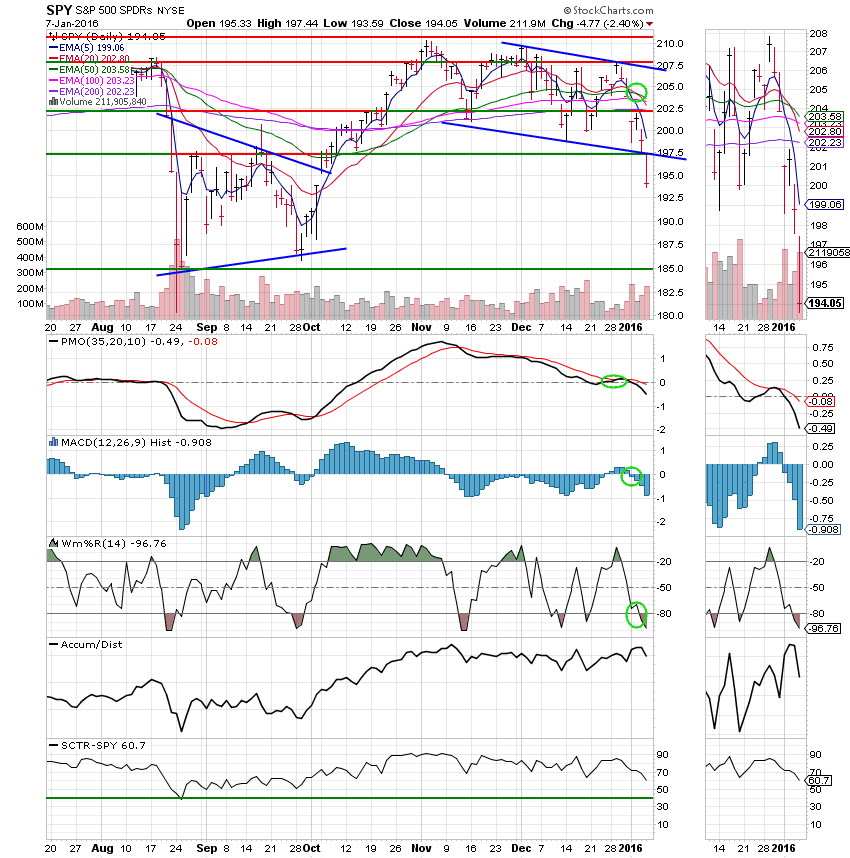

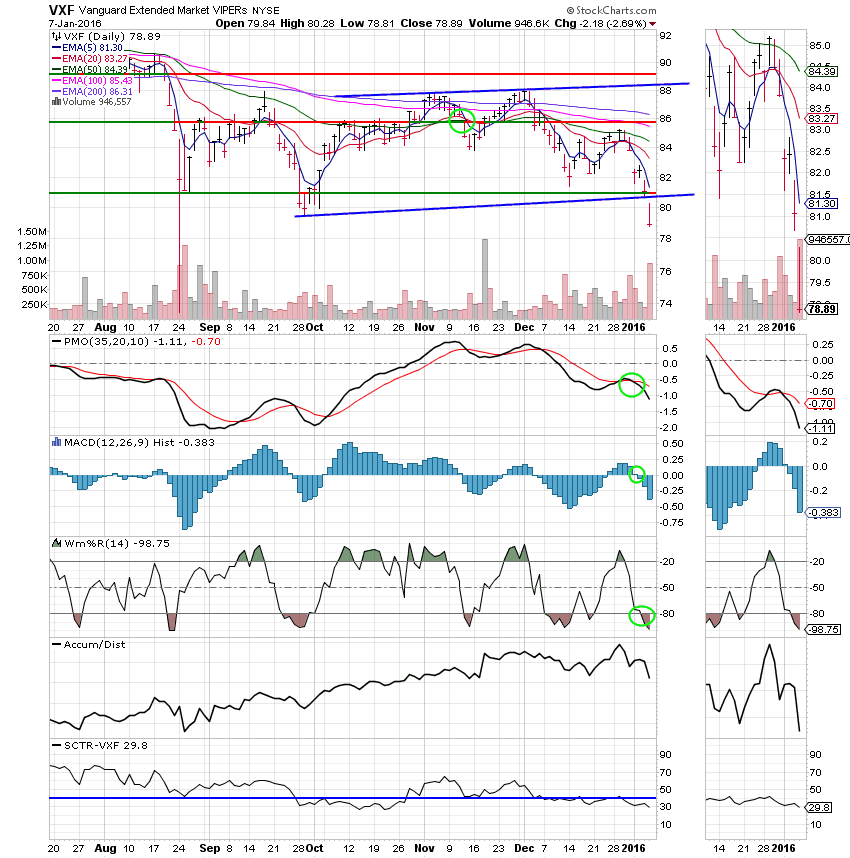

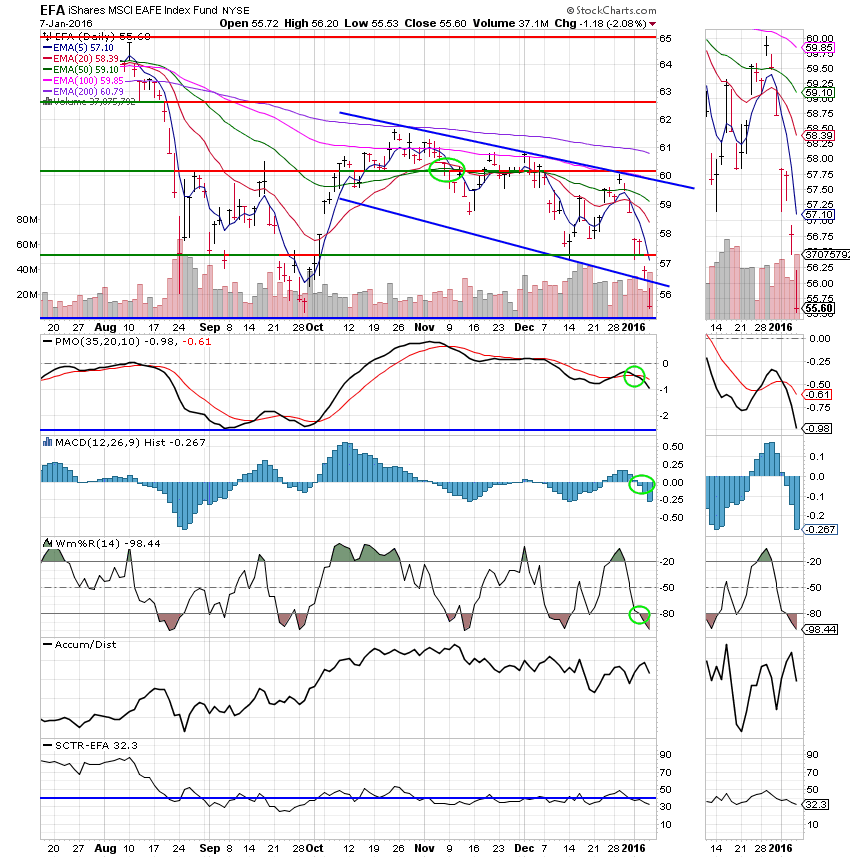

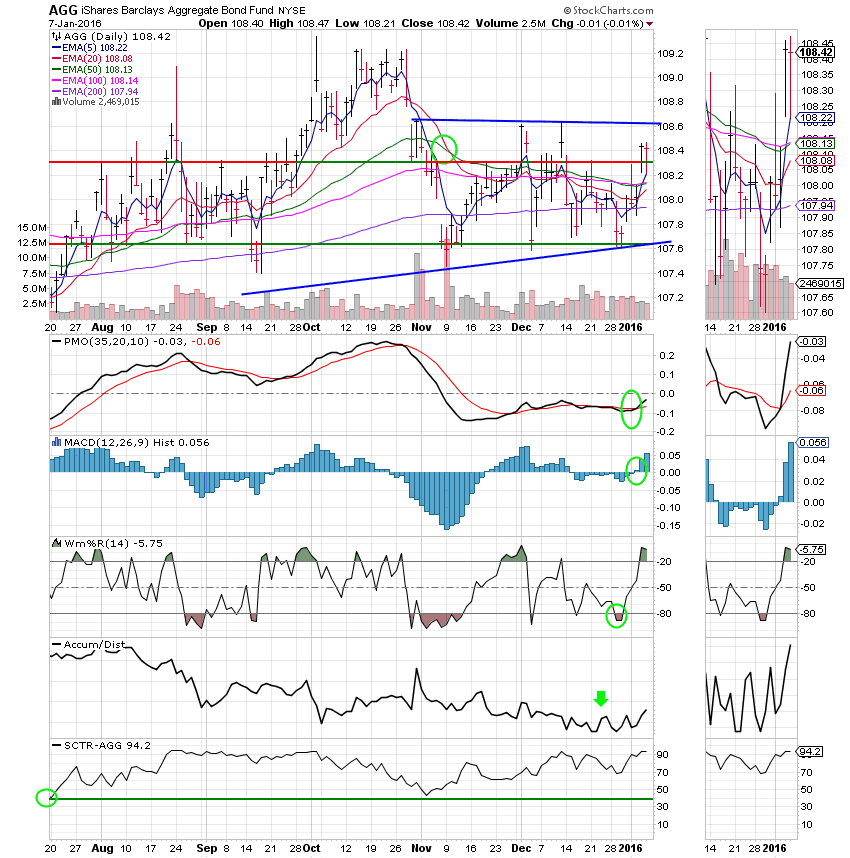

The days action left us with the following signals: C-Sell, S-Sell, I-Sell, and F-Neutral. Our allotment is now +0.04% on the year not including the days results. Here are the latest posted results:

| 01/06/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9208 | 17.0348 | 26.8551 | 34.1067 | 23.3206 |

| $ Change | 0.0009 | 0.0604 | -0.3469 | -0.5403 | -0.2370 |

| % Change day | +0.01% | +0.36% | -1.28% | -1.56% | -1.01% |

| % Change week | +0.04% | +0.47% | -2.57% | -3.20% | -3.21% |

| % Change month | +0.04% | +0.47% | -2.57% | -3.20% | -3.21% |

| % Change year | +0.04% | +0.47% | -2.57% | -3.20% | -3.21% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6823 | 22.9007 | 24.6099 | 26.0109 | 14.6634 |

| $ Change | -0.0392 | -0.1289 | -0.1923 | -0.2378 | -0.1541 |

| % Change day | -0.22% | -0.56% | -0.78% | -0.91% | -1.04% |

| % Change week | -0.51% | -1.33% | -1.81% | -2.11% | -2.42% |

| % Change month | -0.51% | -1.33% | -1.81% | -2.11% | -2.42% |

| % Change year | -0.51% | -1.33% | -1.81% | -2.11% | -2.42% |