Good Evening,

We got our follow through today and we’re back in business. At least for now. The market will be different this year than last with the new dynamic of oil. We have talked a lot about oil, but let me elaborate a little more. Oil is on the way down (I can hear you all now, “No joke Scott”). I don’t believe it’s done yet. It’s simple supply and demand. There’s too much of it out there. The OPEC Cartel can’t control the price anymore. My heart is breaking for them! So the talk on the street is that they are trying to run the US shale producers out of business.

Well…..that’s half the story, but it is not their primary objective. What is? Iran and Russia. Why? Because they are supporting Bassur Assad and the Syrian government in its war with Syrian Rebels who are looking to overthrow the government. While I’m sure all of you have heard about that conflict, there is a dynamic that you may not be aware of… The rebels are Sunni Muslims and the government is Shiite. The most prominent members of OPEC are Sunni led by the most influential member Saudi Arabia. Sunni’s and Shiites basically hate each other since they have a disagreement on who the actual successor of their prophet Muhammad is. Saudi Arabia is using oil as a weapon against Russia and Iran, not necessarily in that order. They once used oil as a weapon against us in the late 70’s. You probably heard of the Arab oil embargo. That was also religiously fueled, but I am not going to chase that rabbit at this time. After the embargo, they artificially inflated prices and pocketed all the profits for years. Until now. As a result of the shale oil fields, Canada and the US are now energy independent. Guess what OPEC? You ain’t running nuthin no more!

So now you have all this talk about how crashing oil prices are going to destroy the economy. Yes, there may be some jobs lost in the oil and oil-related industries. However, I must be missing something here (Sarcasm). The average household in the US is now getting approximately $ 1,100.00 refund and guess what? Our government isn’t the one paying for it. It’s OPEC! It’s just a little different this time than it was back in ’78. While Saudi Arabia is playing their games, they are hurting their own economy. Despite extensive efforts to to broaden their economy to areas other than oil, they have failed. Oil is currently 90% of their GDP. As a result, they had close to an 83.5 billion dollar deficit last year. Couple that with the fact that they share their oil revenues with the population and you have to wonder just how long they can afford to do this before it destabilizes their economy and possibly even their government. It says here that at some point they will be forced to cut production, but in the meantime oil will continue to drop. My target is in the 35 – 42 dollar per barrel range. That brings us to the meat of the subject. How does all this effect us? Each time oil falls, the market will sell off pretty much like it did the last several sessions. This will occur until oil reaches the bottom. Each pullback will create a new opportunity. Outside of TSP, we must look for ways to exploit the lower oil prices such as transportation, retail, food and entertainment stocks. Within TSP, we must be careful not to jump out of the market too quickly, as the market will almost certainly head back up when the price of oil stabilizes. Another thing worth mentioning is that oil stocks are starting to reach bargain basement prices. It will definitely be worth nibbling on a few of them when the bottom is near because they will explode like powder kegs when oil finally does turn up. Our job now is to monitor the charts to make sure that the aforementioned volatility doesn’t get out of hand. The days rally left us with good results in both allocations. TSP posted another strong gain of +1.618% and AMP was back in the green at +1.026%. AMP is not as volatile as being invested in a total equity based fund. It loses less and makes a little less.

Wall St. jumps for second day, helped by economic optimism

|

TSP Share Prices

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

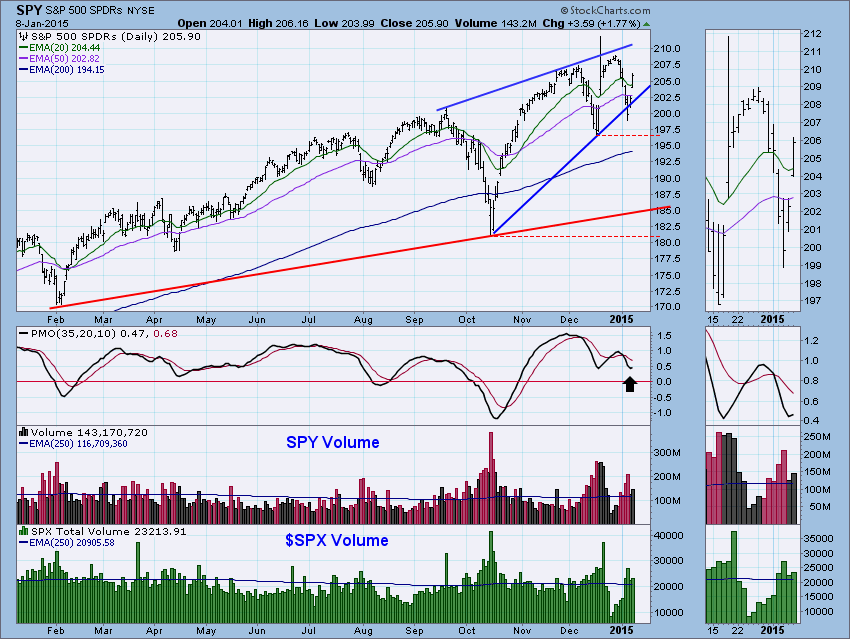

“After price broke down through support, it seemed logical that price would at least test December lows before bouncing, but that wasn’t the case. This two day rally has managed to turn the PMO up at about the same area it turned up after last months correction.”

“Conclusion: It’s been two days of a wild rally, it’s time for digestion and our ultra-short-term indicators seem to agree. However, after that, our indicators suggest the rally will continue.”