Good Evening, The market reluctantly allowed an oversold bounce to occur today after nearly giving up it’s gains early when oil dropped below $30.00 per barrel. I’m afraid that until market players accept the fact that oil is going to trade below $30.00 and the markets in China are going to be volatile they will continue to freak out each time one or the other takes place. I’ve said this before and I’ll say it again, nobody ever made any money by panicking. At least right now, the US economy while not setting things on fire is at least on solid ground and that’s all I’m concerned about. I also am wondering about the other 93% of the market that benefits either directly or indirectly from low oil……..

At the end of the day Wall Street left us with the following results. Our TSP allotment was steady in the G Fund. For comparison, the Dow gained +0.72%, the Nasdaq +1.03%, and the S&P 500 +0.78%.

Energy, biotech help lift Wall St. to second day of gains

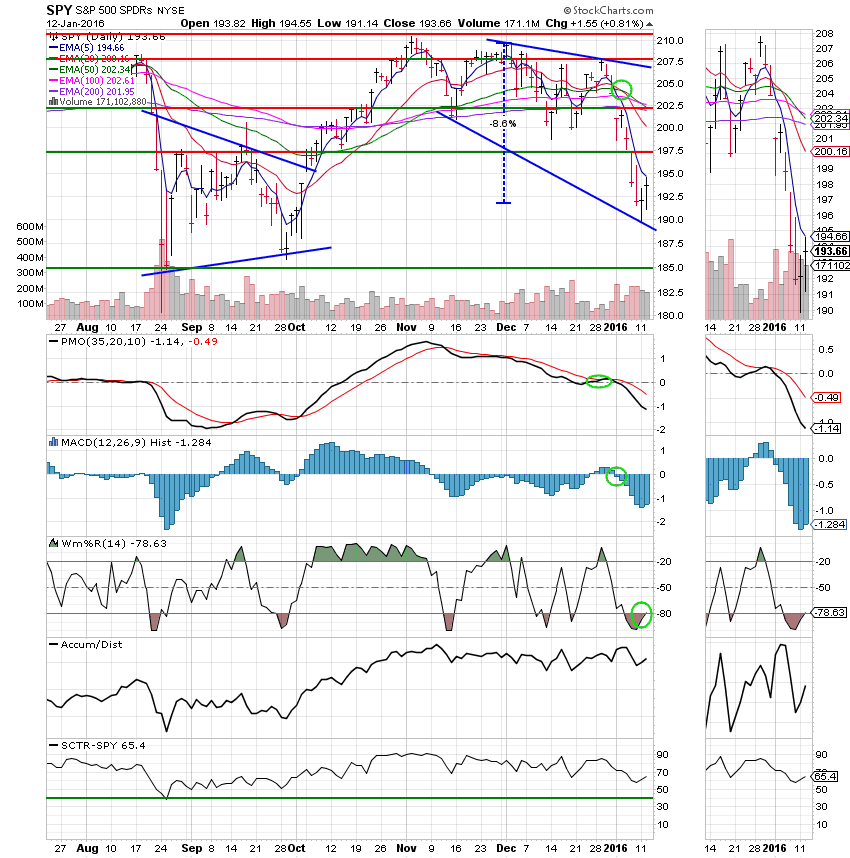

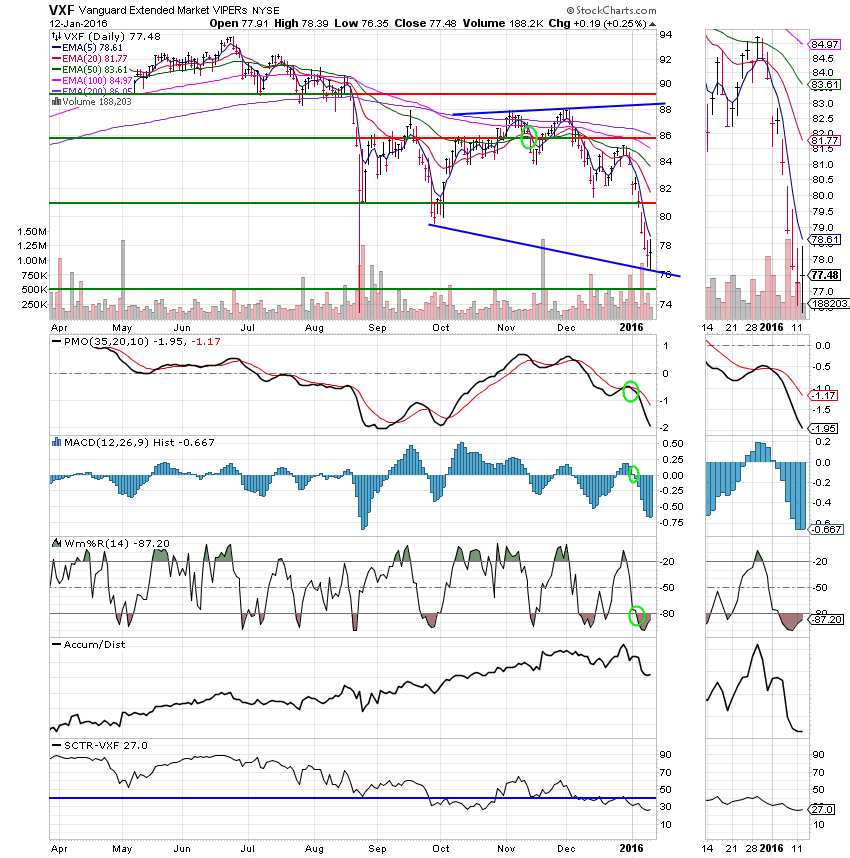

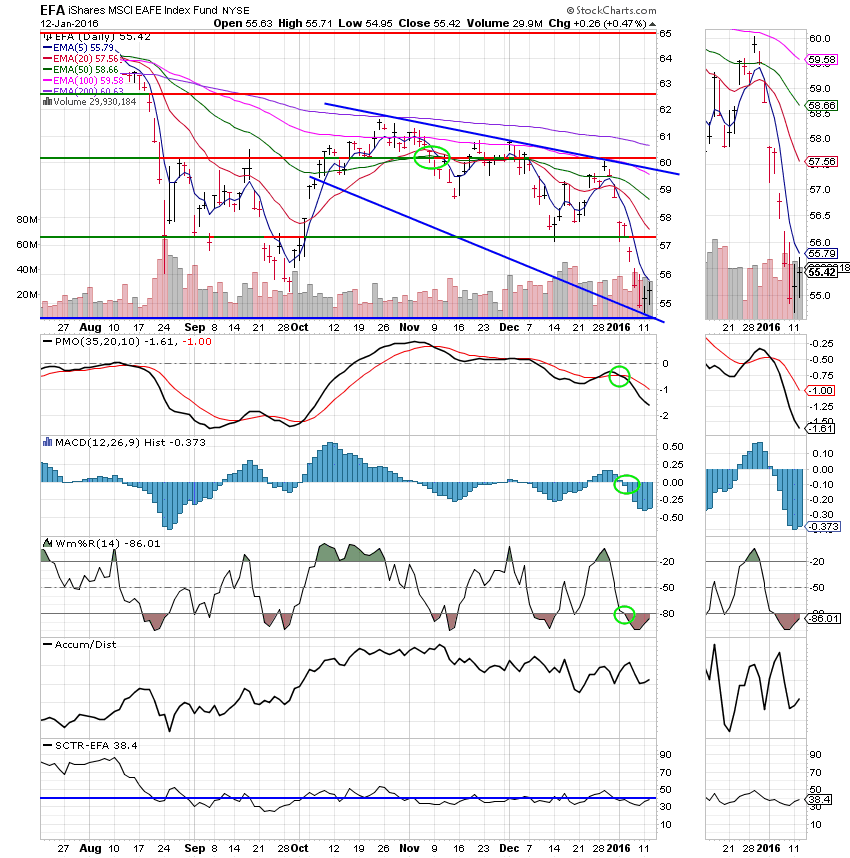

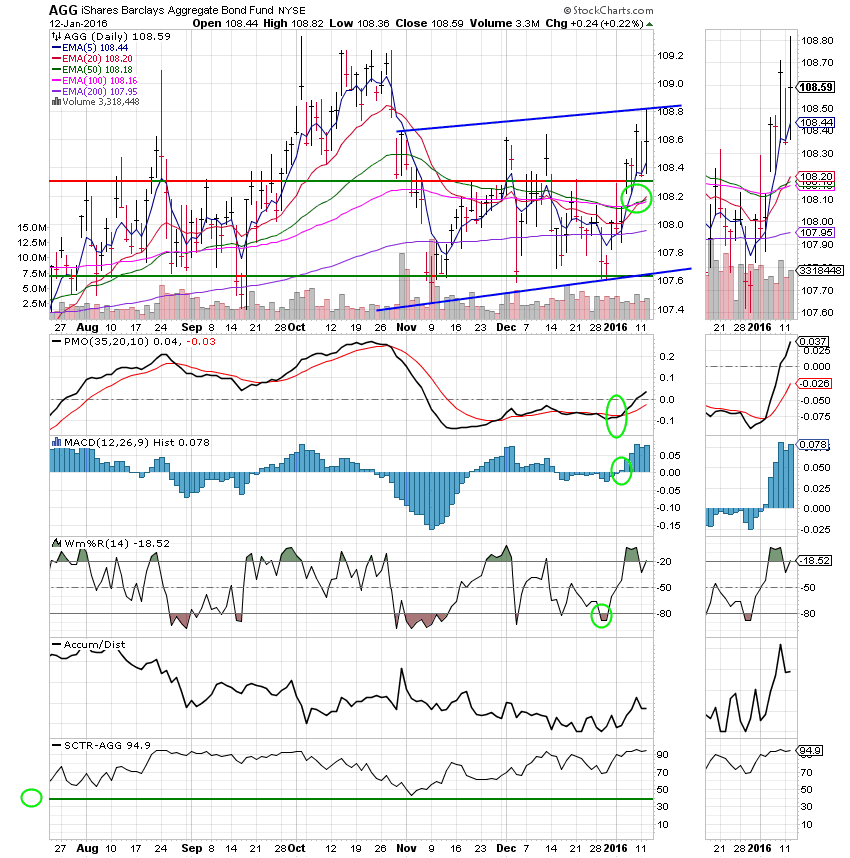

The days action left us with the following signals: C-Sell, S-Sell, I-Sell, F-Buy. We are currently invested at 100/G. Our allocation is now +0.07% on the year not including the days results. Here are the latest posted results:

| 01/11/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9254 | 17.0491 | 25.9571 | 32.5205 | 22.6278 |

| $ Change | 0.0028 | -0.0172 | 0.0223 | -0.1896 | 0.0710 |

| % Change day | +0.02% | -0.10% | +0.09% | -0.58% | +0.31% |

| % Change week | +0.02% | -0.10% | +0.09% | -0.58% | +0.31% |

| % Change month | +0.07% | +0.56% | -5.82% | -7.71% | -6.09% |

| % Change year | +0.07% | +0.56% | -5.82% | -7.71% | -6.09% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.5673 | 22.5381 | 24.0716 | 25.3467 | 14.2362 |

| $ Change | 0.0035 | 0.0067 | 0.0078 | 0.0079 | 0.0045 |

| % Change day | +0.02% | +0.03% | +0.03% | +0.03% | +0.03% |

| % Change week | +0.02% | +0.03% | +0.03% | +0.03% | +0.03% |

| % Change month | -1.16% | -2.89% | -3.96% | -4.61% | -5.26% |

| % Change year | -1.16% | -2.89% | -3.96% | -4.61% | -5.26% |