Good Evening,

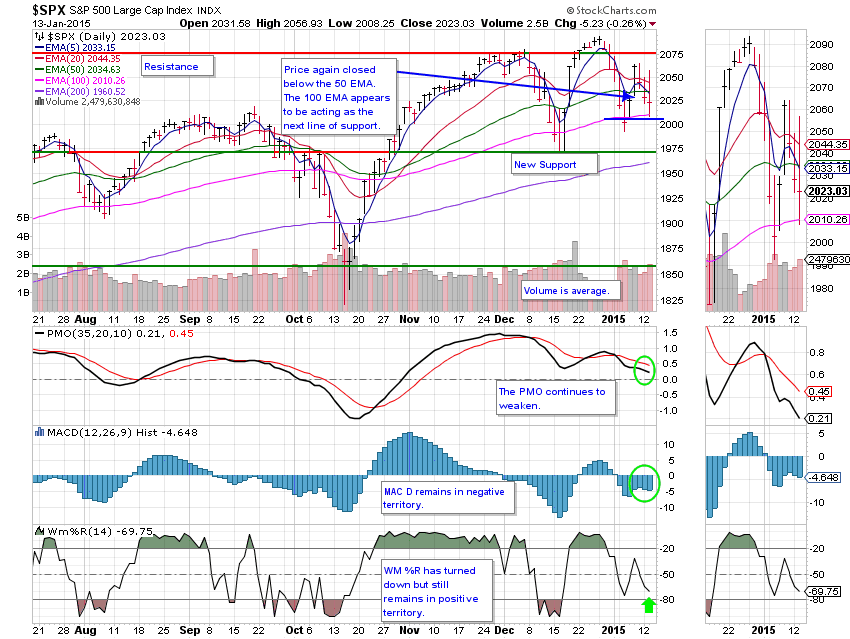

Oil went down……and the market went up? What gives?? I think the market just decided to ignore oil for most of the day or perhaps it is starting the embrace the benefits of cheap oil. I have written about the benefits of cheap oil and have gone on the record as saying that I think the benefits of cheap oil far out weigh it’s negative effects. How much all that is priced into the market I’m not sure. Although, I’m pretty sure that the benefits aren’t fully priced in. Another factor that many folks are overlooking in today’s market is the beginning of earnings reports. Most specifically the first report made by Alcoa Aluminum (AA), their report released this morning showed great earnings and strong guidance which prompted Bloomberg to write that the report “spurred speculation that the economy is picking up”. I think they hit the nail on the head and that was largely responsible for today’s upswing. Problem with that was the market seems to be a tad more volatile in 2015 and decided to let everyone know about it with a wicked intraday reversal that wiped out all the mornings gains and put the major indices in a big hole. After somewhat of a late after noon recovery, the big three managed for the most part to close flat. The wild swing left our TSP allotment at -0.0422% and AMP was again the king of the day with a gain of +0.1899%. For comparison the Dow slipped back -0.15%, the S&P -0.26%, and the Nasdaq -0.07%. I was thrilled with our gain in AMP on a negative day!

Wall St. ends down in volatile session; materials a drag

The day’s action left us with the following signals: C-Neutral, S-Neutral, I-Sell, F-Buy. We are currently invested at 34/C, 66/S. Our allocation is now -1.36% on the year not including today’s results. Here are the latest posted results:

| 01/12/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6267 | 16.9844 | 26.7763 | 35.7452 | 23.8282 |

| $ Change | 0.0026 | 0.0420 | -0.2181 | -0.1891 | 0.0657 |

| % Change day | +0.02% | +0.25% | -0.81% | -0.53% | +0.28% |

| % Change week | +0.02% | +0.25% | -0.81% | -0.53% | +0.28% |

| % Change month | +0.07% | +1.09% | -1.43% | -1.52% | -1.61% |

| % Change year | +0.07% | +1.09% | -1.43% | -1.52% | -1.61% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.4207 | 22.748 | 24.5862 | 26.103 | 14.7755 |

| $ Change | -0.0122 | -0.0454 | -0.0658 | -0.0826 | -0.0523 |

| % Change day | -0.07% | -0.20% | -0.27% | -0.32% | -0.35% |

| % Change week | -0.07% | -0.20% | -0.27% | -0.32% | -0.35% |

| % Change month | -0.17% | -0.66% | -0.89% | -1.05% | -1.22% |

| % Change year | -0.17% | -0.66% | -0.89% | -1.05% | -1.22% |