Good Evening, The market was enjoying another oversold bounce this morning. However, the price of oil dropped in the afternoon and the gains did as well. The S&P and Dow both finished the day only slightly in the green.

The days trading left us with the following results: Our TSP allotment was steady in the G Fund. For comparison, the Dow added +0.17%, the Nasdaq dropped -0.26%, and the S&P 500 was flat at +0.05%.

The days action left us with the following signals: C-Sell, S-Sell, I-Sell, F-Buy. We are currently invested at 100/G. Our allocation is now +0.09% on the year not including the days results. Here are the latest posted results:

| 01/18/16 |

|

|

|

Prior Prices |

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

14.9291 |

17.1256 |

25.3777 |

31.4042 |

21.9039 |

| $ Change |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

| % Change day |

+0.00% |

+0.00% |

+0.00% |

+0.00% |

+0.00% |

| % Change week |

+0.00% |

+0.00% |

+0.00% |

+0.00% |

+0.00% |

| % Change month |

+0.09% |

+1.01% |

-7.93% |

-10.87% |

-9.09% |

| % Change year |

+0.09% |

+1.01% |

-7.93% |

-10.87% |

-9.09% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

17.4795 |

22.2578 |

23.6578 |

24.838 |

13.9093 |

| $ Change |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

0.0000 |

| % Change day |

+0.00% |

+0.00% |

+0.00% |

+0.00% |

+0.00% |

| % Change week |

+0.00% |

+0.00% |

+0.00% |

+0.00% |

+0.00% |

| % Change month |

-1.65% |

-4.10% |

-5.61% |

-6.52% |

-7.43% |

| % Change year |

-1.65% |

-4.10% |

-5.61% |

-6.52% |

-7.43% |

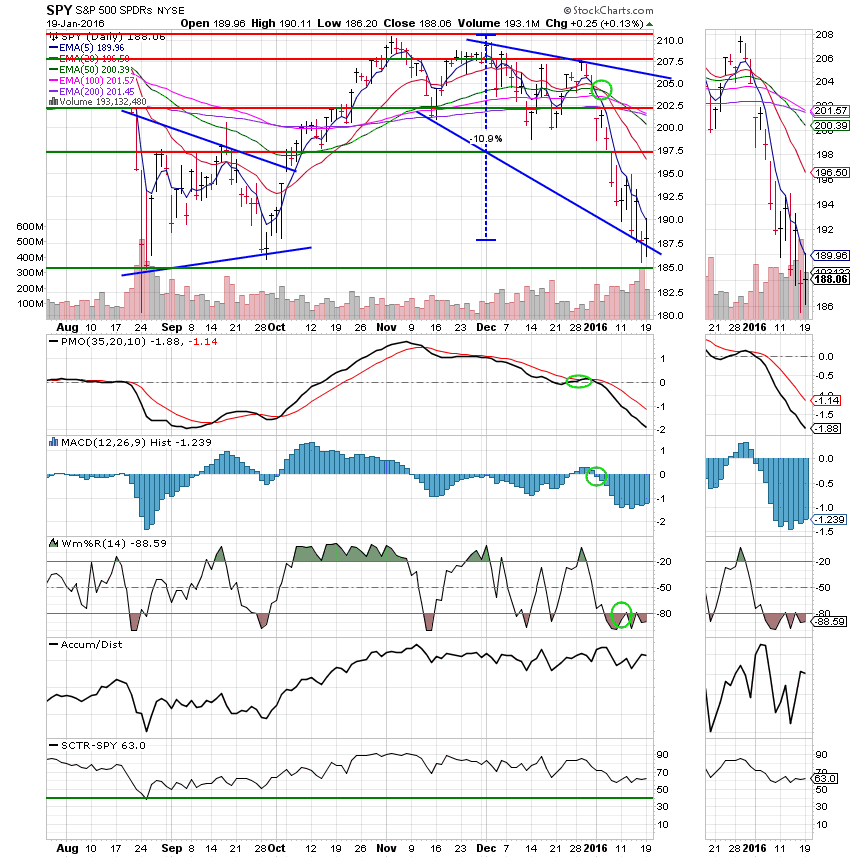

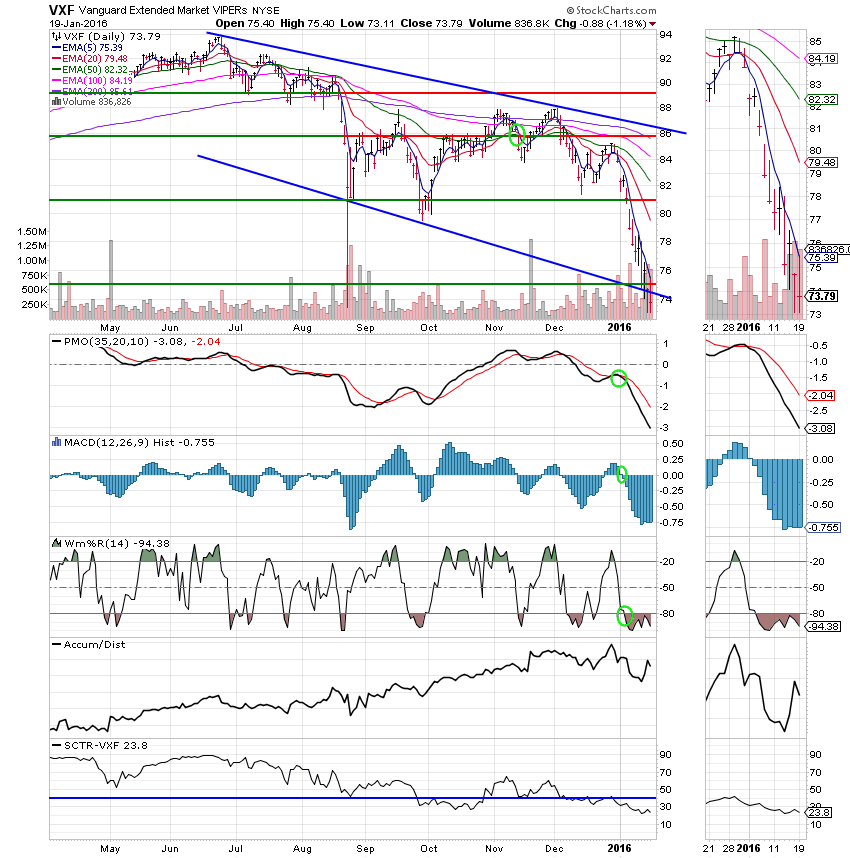

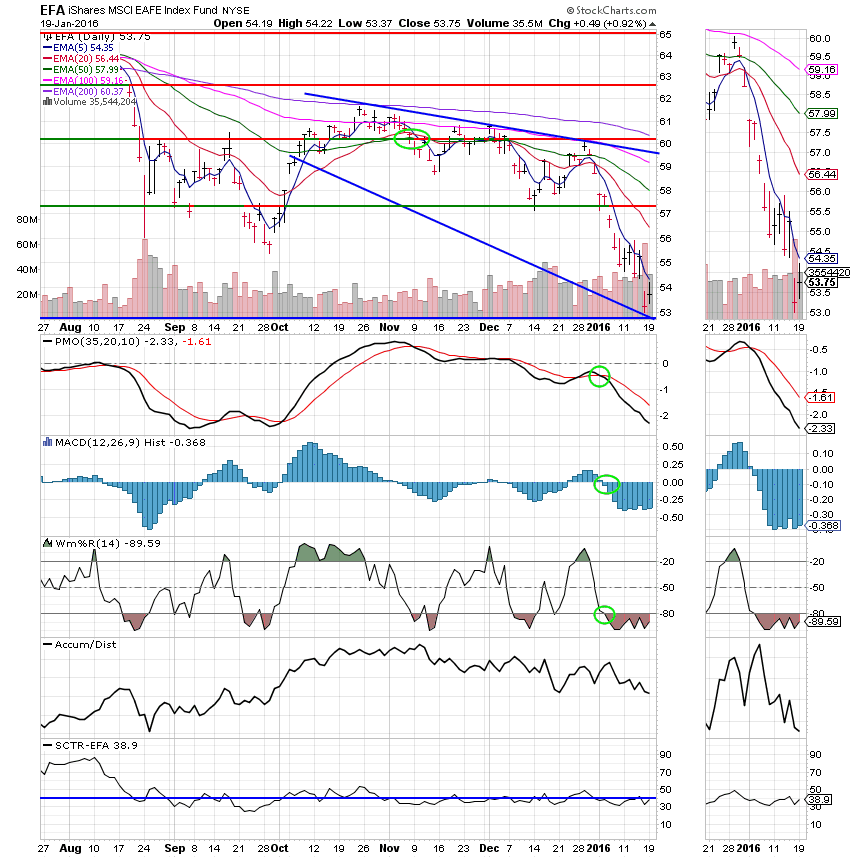

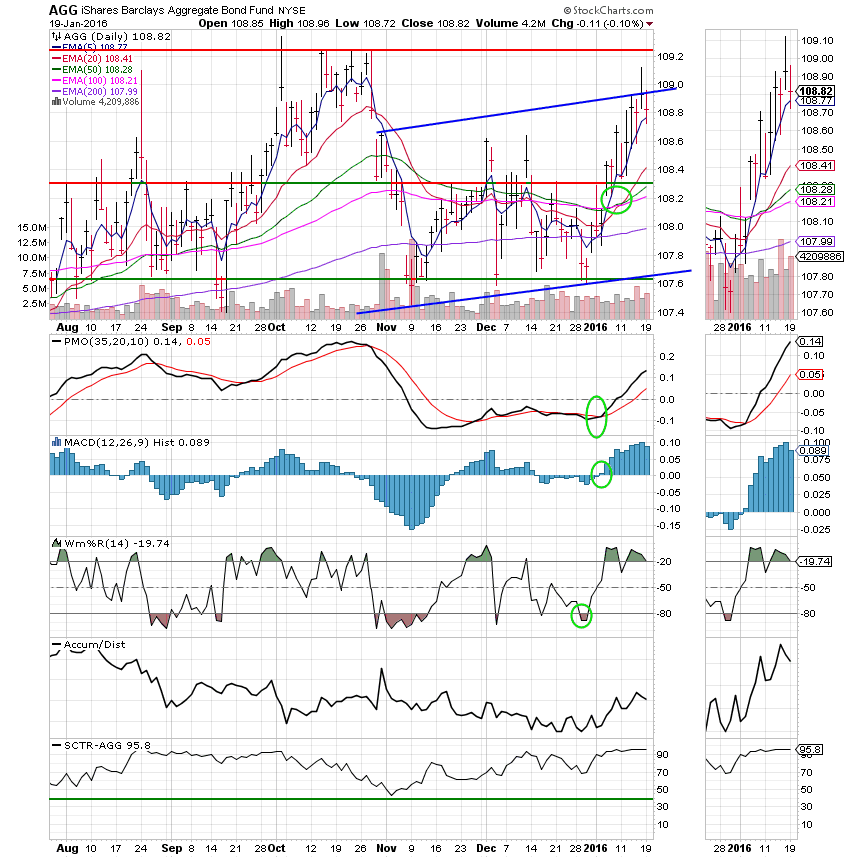

Lets take a look at the charts: (All signals annotated with Green Circles) If you click on the charts they will become larger!

C Fund:

S Fund:

I Fund:

F Fund:

I haven’t been taking the time to explain each chart blow by blow every night. It becomes too redundant and the time is better spent doing research. I will continue to explain the charts in detail when a meaningful change occurs. Also, I would be amiss not to say the many of you have been with me long enough that you can read the charts as well as I can. For now the main chart we watch which is the S&P 500 (C Fund) is in a freefall. It will take several good days, not just one, to repair all the technical damage that has been done to the point that we can confidently buy again. In simple terms that are easy to understand. We are in a bear market until the charts tell us otherwise. Thus, bear market rules apply. Every rally must be treated as no more than a countertrend bounce that will not last and is not to be trusted! That’s all for tonight. Have a nice evening and may God continue to bless your trades!

God bless, Scott

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.