Good Evening,

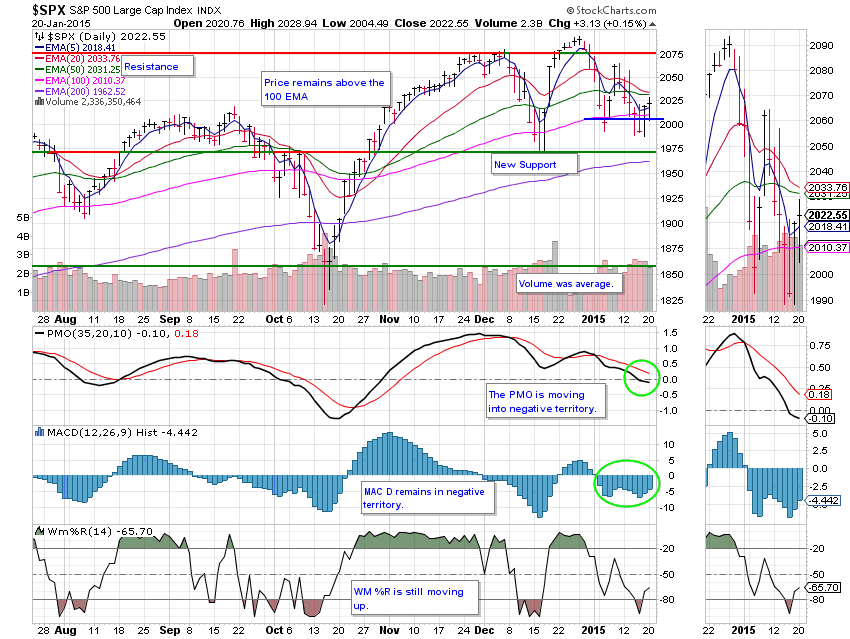

The market wasn’t terrible today, but it wasn’t really what you could call good either. There were a few earnings reports and a home builders report that had some effect, but for the most part the market is marking time ahead of the European Central Bank meeting announcement on Thursday.

I have mentioned this meeting in several newsletters. The time is here and the ECB has the spotlight and the market’s attention. I feel like some of the anticipated Quantitative Easing is already priced into the market. The downside is tremendous if the ECB fails to please the market which they have a history of doing. The ECB isn’t exactly like the FED. It’s made up of several nations, not just one. If you think the gridlock in congress here has been bad then think of trying to get the politicians in several nations to agree. They have literally put this off until they have no choice but to enact some new QE. The market is fully anticipating new European QE for this reason and that’s what makes this a dangerous situation. The market never ever reacts well when it fails to get something that it thinks it’s going to get. Nevertheless, the ECB virtually has no choice in the matter. For that reason, I fully expect them to buy some more bonds as well. So why did I mention the ECB’s track record in the first place? You must be prepared to react to whatever you see on your charts. You must have a plan for what you will do in a given situation and you must monitor your charts with greater vigilance when there is the potential for the current situation to change. The answer to the question is simple, this situation qualifies as one that could significantly alter the current direction of the market…..

The action today left us with the following results: TSP -0.054% , AMP +0.486%. For comparison the Dow ended at +0.02%, the Nasdaq +0.44%, and the S&P 500 +0.15%. AMP ruled the day again! The way it’s invested it’s just tough to beat when there’s a negative bias.

Wall Street ends little changed as hope for ECB move increases

| 01/16/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6301 | 17.0265 | 26.6644 | 35.6341 | 24.1593 |

| $ Change | 0.0009 | -0.0439 | 0.3533 | 0.5302 | 0.1825 |

| % Change day | +0.01% | -0.26% | +1.34% | +1.51% | +0.76% |

| % Change week | +0.04% | +0.50% | -1.22% | -0.84% | +1.67% |

| % Change month | +0.09% | +1.34% | -1.84% | -1.82% | -0.24% |

| % Change year | +0.09% | +1.34% | -1.84% | -1.82% | -0.24% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.4283 | 22.77 | 24.6126 | 26.1304 | 14.795 |

| $ Change | 0.0403 | 0.1342 | 0.1887 | 0.2332 | 0.1492 |

| % Change day | +0.23% | +0.59% | +0.77% | +0.90% | +1.02% |

| % Change week | -0.03% | -0.10% | -0.16% | -0.21% | -0.22% |

| % Change month | -0.13% | -0.56% | -0.78% | -0.94% | -1.09% |

| % Change year | -0.13% | -0.56% | -0.78% | -0.94% | -1.09% |