Good Evening,

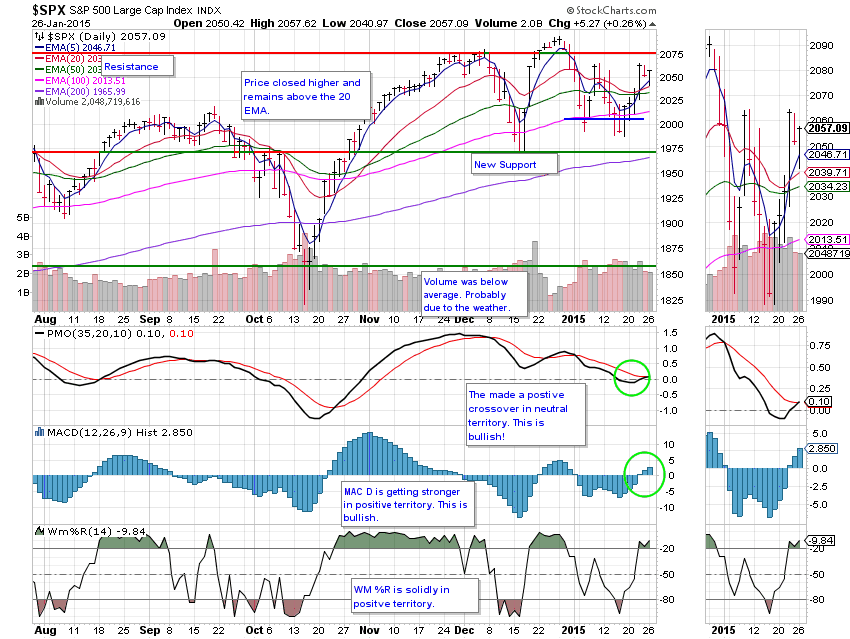

The profit taking ended in the afternoon and the market drifted up into the close for a small gain. Safe havens such as precious metals and bonds were off on the day. This hints that some money may be flowing out of those areas and back into stocks. It appears that the Greek elections are now priced into the market. That coupled with an end to the profit taking after Thursday’s big run may allow the rally to resume. A lot of traders were heading home with all the bad weather up and down the east coast, reducing the volume, giving the market somewhat of a holiday feel. I know many of them are hoping the market will close with the bad weather in New York. The last time that happened was in 1969. The weather service did say that this is a storm of historic proportions…

Our allocations both came out on the plus side today. TSP really had a nice day, out-performing at +0.7682 % while AMP rose +0.021%. For comparison the Dow was up +0.03%, the Nasdaq +0.29%, and the S&P added +0.26%.

Wall Street rises after Greek elections; energy climbs

| 01/23/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6361 | 17.0529 | 27.0968 | 36.217 | 24.4429 |

| $ Change | 0.0009 | 0.0572 | -0.1496 | -0.0611 | -0.0250 |

| % Change day | +0.01% | +0.34% | -0.55% | -0.17% | -0.10% |

| % Change week | +0.04% | +0.16% | +1.62% | +1.64% | +1.17% |

| % Change month | +0.13% | +1.50% | -0.25% | -0.22% | +0.93% |

| % Change year | +0.13% | +1.50% | -0.25% | -0.22% | +0.93% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.488 | 22.9484 | 24.8588 | 26.4308 | 14.9856 |

| $ Change | -0.0092 | -0.0369 | -0.0519 | -0.0635 | -0.0412 |

| % Change day | -0.05% | -0.16% | -0.21% | -0.24% | -0.27% |

| % Change week | +0.34% | +0.78% | +1.00% | +1.15% | +1.29% |

| % Change month | +0.21% | +0.22% | +0.21% | +0.20% | +0.18% |

| % Change year | +0.21% | +0.22% | +0.21% | +0.20% | +0.18% |