Good Evening,

The market is living up to my forecast of being volatile. We started the morning with several poor earnings reports, sales of durable goods dropping last month, and renewed concern over the strengthening dollar. Combined, this news pressured the market lower today. There was one bit of good news in the afternoon and that allowed the market to close somewhat off its lows for the day. That good news was the consumer confidence report. Consumer confidence reached its highest level since 2007.

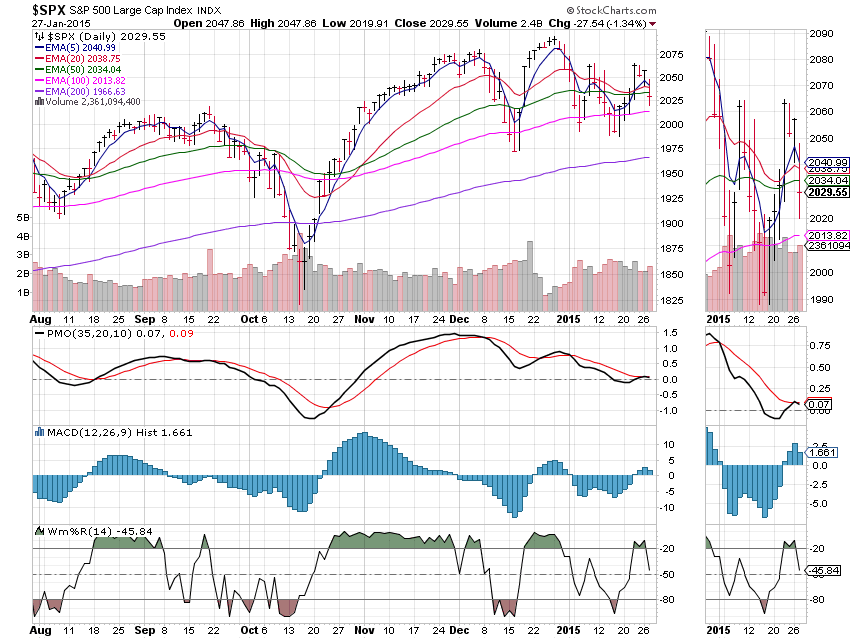

Nevertheless, there was a lot of doom and gloom starting to float around out there. I’m not discounting the fact that some of the news (such as poor earnings reports) could take the market down, but it is obvious that the market players are panicking as their beloved v-shaped bounce has been undermined. No panic here, we’ve seen this a time or two since we started our group. We’ll watch the charts and if they say sell, we’ll sell, just like we’ve always done. But right now, the trend is still up.

Two things that might lift tomorrow’s market: Apple just reported the best quarter in corporate history and the FED statement will be released. There are many people saying that the FED would be crazy to raise interest rates in 2015. Anything in tomorrow’s statement that gives a hint along those lines will please the market very much. Those two things combined, could give the market a nice pop, so don’t be surprised if we head back up. I’m on record saying that there’s going to be a lot of smoke, but just a little fire in 2015.

The day’s selling left us with the following results: Our TSP allotment fell back -0.93% and AMP was off -0.3466%. For comparison, The Dow lost -1.65%, the Nasdaq -1.89%, and the S&P 500 -1.34%. While both of our allocations fell back, they did out perform all the major indices. Give God all the praise!

Wall Street falls 1 percent on earnings; Apple rallies late

| 01/26/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6386 | 17.0437 | 27.167 | 36.6099 | 24.6364 |

| $ Change | 0.0025 | -0.0092 | 0.0702 | 0.3929 | 0.1935 |

| % Change day | +0.02% | -0.05% | +0.26% | +1.08% | +0.79% |

| % Change week | +0.02% | -0.05% | +0.26% | +1.08% | +0.79% |

| % Change month | +0.15% | +1.44% | +0.01% | +0.86% | +1.73% |

| % Change year | +0.15% | +1.44% | +0.01% | +0.86% | +1.73% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.5077 | 23.0137 | 24.9518 | 26.5475 | 15.0612 |

| $ Change | 0.0197 | 0.0653 | 0.0930 | 0.1167 | 0.0756 |

| % Change day | +0.11% | +0.28% | +0.37% | +0.44% | +0.50% |

| % Change week | +0.11% | +0.28% | +0.37% | +0.44% | +0.50% |

| % Change month | +0.33% | +0.50% | +0.59% | +0.64% | +0.69% |

| % Change year | +0.33% | +0.50% | +0.59% | +0.64% | +0.69% |