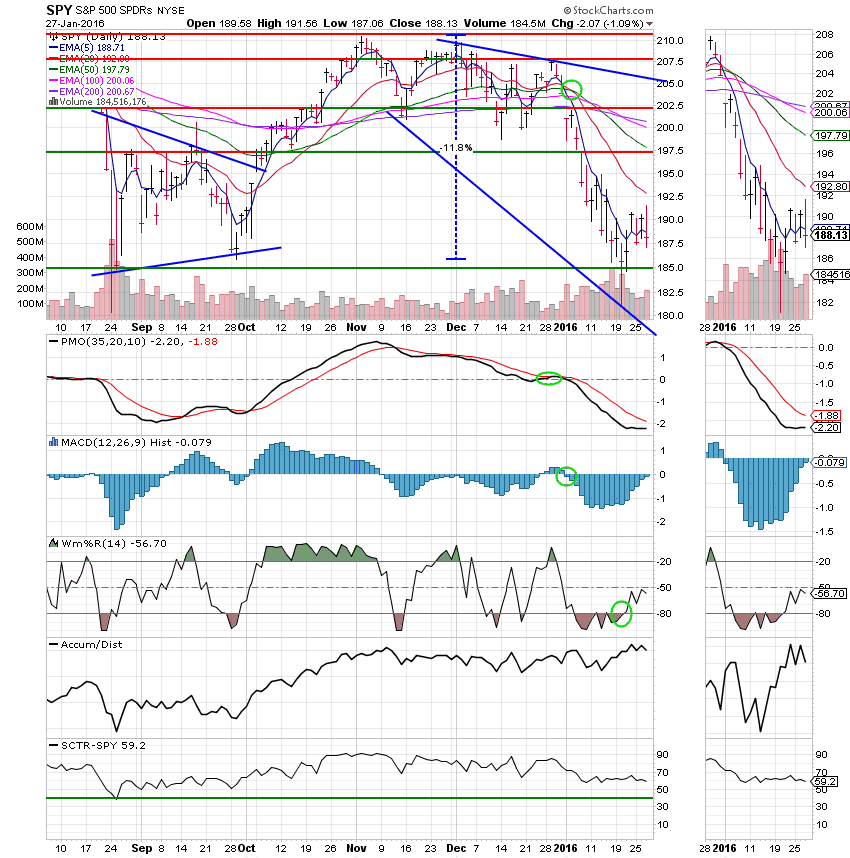

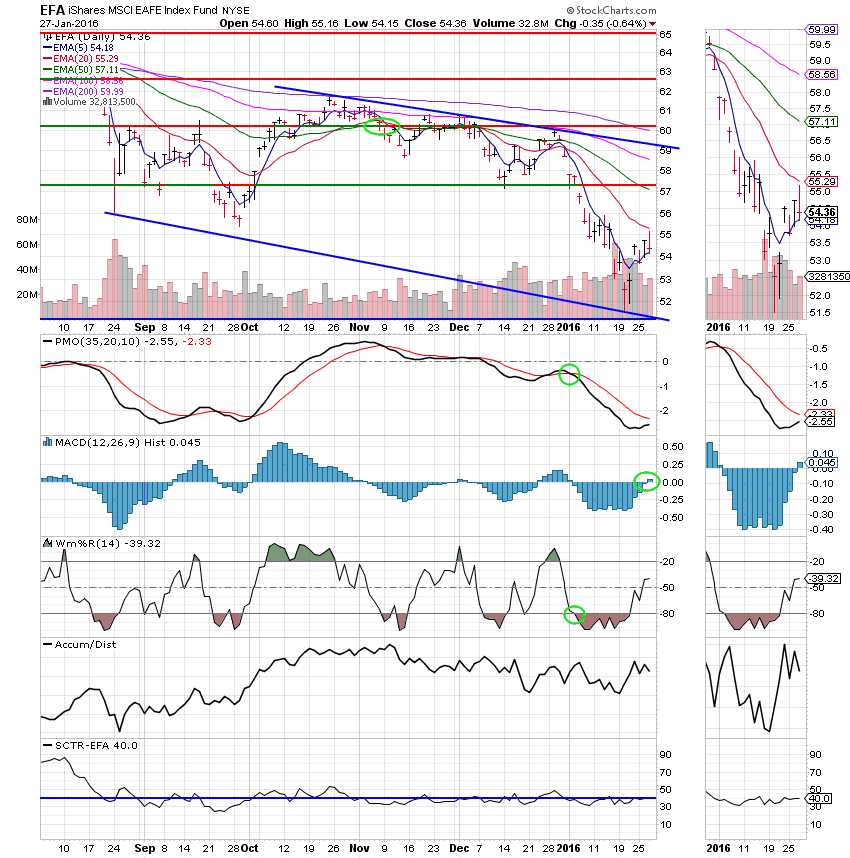

Good Evening, Recently, it’s all been about China and Oil. Again, that was the case this morning as oil and the market both went up. But, then the Fed made their announcement and the market totally reversed course resulting in triple digit losses in all the major indices. They left interest rates alone and made their statement more dovish. However, the market didn’t think the statement was dovish enough. While the Fed indicated that the timing of future rate increases would be data dependent, that simply wasn’t enough to satisfy Mr. Market. The market wanted the Fed to say exactly what they were going to do and when they were going to do it. That simply just wasn’t going to happen. The Fed would be painting themselves in a corner if they did that. They would be basing their decision on future conditions that are unknown to them at this time. It was a no win situation. They did the only the they could do. The important thing to know about all this is that the charts never indicated that the current uptick was anything more than an oversold bounce in a larger downtrend.

The days yoyo action left us with the following results: Our TSP allotment was steady in the G Fund while the Dow lost -1.38%, the Nasdaq -2.18%, and the S&P 500 -1.09%.

Wall Street sinks after Fed fails to impress

The days action left us with the following signals: C-Sell, S-Sell, I-Sell, F-Buy. We are currently invested at 100/G. Our allocation is now +0.16% on the year not including the days results. Here are the latest posted results:

| 01/26/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9392 | 17.1418 | 25.6976 | 31.7201 | 22.3768 |

| $ Change | 0.0009 | 0.0202 | 0.3586 | 0.6405 | 0.3596 |

| % Change day | +0.01% | +0.12% | +1.42% | +2.06% | +1.63% |

| % Change week | +0.02% | +0.20% | -0.17% | -0.10% | +0.91% |

| % Change month | +0.16% | +1.10% | -6.77% | -9.98% | -7.13% |

| % Change year | +0.16% | +1.10% | -6.77% | -9.98% | -7.13% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.5412 | 22.4215 | 23.8894 | 25.1169 | 14.0848 |

| $ Change | 0.0563 | 0.1656 | 0.2410 | 0.2943 | 0.1873 |

| % Change day | +0.32% | +0.74% | +1.02% | +1.19% | +1.35% |

| % Change week | +0.06% | +0.09% | +0.12% | +0.13% | +0.15% |

| % Change month | -1.31% | -3.39% | -4.68% | -5.47% | -6.27% |

| % Change year | -1.31% | -3.39% | -4.68% | -5.47% | -6.27% |