Good Evening,

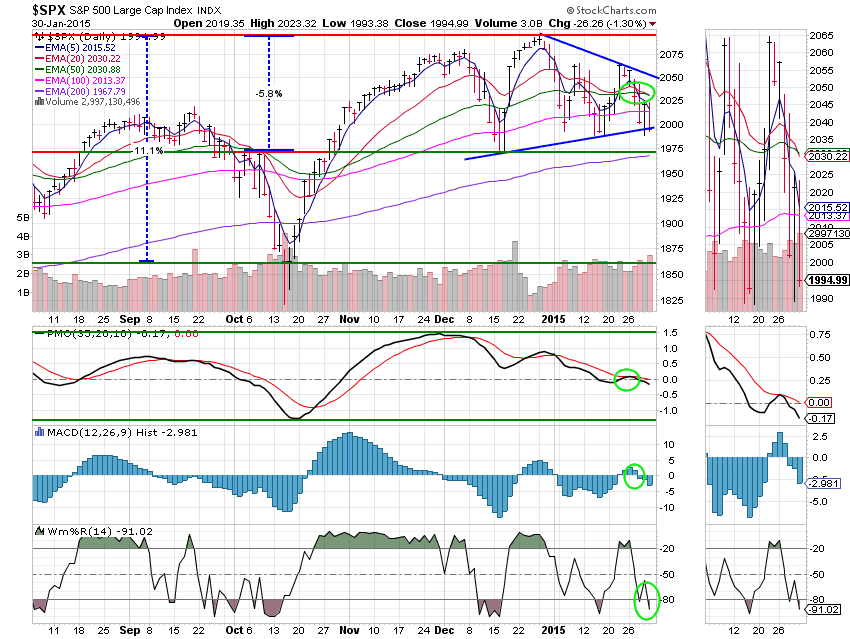

I know that this market is frustrating to each one of you. The market continues to oscillate between established support and resistance. It’s up one day and down the next. One week it has a negative bias, the next it is positive. The increased volatility signals a market that really doesn’t know which way to go. As we deal with it, we continue to wait for it to resolve one way or the other. To commit all your resources to offense or defense leads to success one day and extreme pain the next. To take a middle of the road approach leaves you treading water. I prefer the middle of the road approach as it recently has led to a better average than selling out one way or the other. The AMP allocation is invested more in that manner.

The bottom line is that nobody is going to be able to hold on to any gains until the market breaks one way or the other. Personally, I don’t really care which way that is. There are options available to us each way. The current problem is that nothing really works well in both directions, up or down. We need a market that knows where it’s going to generate and hold on to some gains. Until then, we remain in no man’s land…

Today, the new Greek finance minister said the new government would not work with European Union in regard to their monetary assistance. Simply put, they are done with austerity measures. That was the only excuse the market needed and the selling was on. The market did swing up briefly on an 8% spike in oil before it resumed its plummet. It was funny in that it was the v-shaped bounce perma-bulls that were panicking to the exit! We will not panic here. We will survey the damage, check out the charts and decide what we are going to do about it. In the mean time, we’ll wonder out loud if they are going to save Greece again on Monday… That would sure be nice!

The action left us with some gaping holes in the hull of the ship. TSP was off -1.445% and AMP didn’t fare much better at -1.365%. There was really no where to hide but bonds and they are a ticking time bomb. For comparison, the Dow lost -1.45%, the Nasdaq -1.03%, and the S&P -1.30%. Like I said, there was nowhere to hide.

Wall St. closes down for January, Shake Shack rallies in debut

| 01/29/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6412 | 17.0998 | 26.6987 | 36.1736 | 24.6362 |

| $ Change | 0.0009 | -0.0216 | 0.2546 | 0.3214 | 0.1239 |

| % Change day | +0.01% | -0.13% | +0.96% | +0.90% | +0.51% |

| % Change week | +0.03% | +0.28% | -1.47% | -0.12% | +0.79% |

| % Change month | +0.17% | +1.77% | -1.72% | -0.34% | +1.73% |

| % Change year | +0.17% | +1.77% | -1.72% | -0.34% | +1.73% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.4712 | 22.8891 | 24.7751 | 26.3285 | 14.922 |

| $ Change | 0.0284 | 0.0927 | 0.1299 | 0.1599 | 0.1021 |

| % Change day | +0.16% | +0.41% | +0.53% | +0.61% | +0.69% |

| % Change week | -0.10% | -0.26% | -0.34% | -0.39% | -0.42% |

| % Change month | +0.12% | -0.04% | -0.13% | -0.19% | -0.24% |

| % Change year | +0.12% | -0.04% | -0.13% | -0.19% | -0.24% |