Good Day, This juncture in a market downturn is always the most difficult. You have a bunch of serial bottom callers that are constantly saying the bottom is in. The thing about that is that they only have to be right once. It doesn’t matter that they were wrong ten times before…. There were some real heroes such as the ones that called the great market crash in 1987 or the Dot com bubble that burst in 2000. They got it right once and were the media darlings, but did they ever get it right again? Did they have crystal ball accuracy again? No, you never heard of any of them again! You’ve often hear that disclaimer at the end of advertisements for various investments that says “Past performance does guarantee future results”. Well let me tell you there’s a reason they say that!!! The bottom line is this. When your dealing with your precious retirement money your goal is or should be to keep as much as you can, to reduce risk. If you do this efficiently then your average balance will take care of itself. After all what do you care about? Having the most money at the end to the week or having the most money you can have at the end of your career? You can invest for one or the other but it is virtually impossible to do both. No matter how hard you try you will never eliminate 100% of the risk in the market. Thus, your realistic goal is to reduce risk as much as you can. So here’s what you must consider with regard to the current market. The closer you try to get to the exact bottom the greater the risk you incur! It is also true that you will get a greater reward if you get it right. Obviously you can make more money if you pick the exact bottom! Good luck with that. You pick it one out of ten times and see if you make more money than a more prudent investor. The end result of that is that when you miss the bottom you lose more money. The law of averages is not with you! Sure you can buy and hold. After all, it has worked great the past ten years. You’ll definitely be there for the bottom of every decline. That is all well and good….er that is when you have government stimulus. Try it without stimulus and get caught in a lengthy market decline and see how that works for you! You will spend the rest of your career trying to get back what you could have had. But Scott, that never happens. Well in most of your careers it hasn’t but I am old and groaty….I’ve seen it happen on multiple occasions. The worst and most recent one (as I have noted many times) was when the dot com bubble burst in 2000. The market fell and TSP folks that bought and held an average of 34% of their accounts. Wanna know how long it took them to make that money back?? It was March of 2005. Almost five years! Five long years!! So, many of them worked an extra five years in order to get back what they needed to retire. What did they get? The same thing they could have had if they had just sold with the rest of us in December of 1999. Up until then they had scoffed at their co workers that played it safe. Not that time. Those folks who played it safe retired when they wanted to and the ones that didn’t retire added to their accounts and ultimately retired with an additional five years worth of gains that the others did not get. They say time is money and money is time…. All that said, I am not satisfied that there is a solid bottom just yet. My charts tell me that it is possible that we could see another leg down in this market. If I had to put a percentage on that I would say there is a 30-40% chance that we will see new lows. Yes, that means that there is a greater chance that we could move higher from here and when we do move higher we will have a clearer picture of things than we do right now. I just don’t like the odds today. Please remember that bottoming is a process. I do strongly believe that we will retest the lows once again before we move higher and how that plays out all depends on the remaining stimulus. As you know stimulus is being reduced but it is not gone just yet. So the question is can the remaining stimulus fuel yet another V Shaped recovery? I’m not sure there is anyone out there who can answer that, but if there is still enough money then we will move higher. However, as money becomes tighter you will not see the V shaped recoveries that you have seen the past 10 years. The market will struggle to recover where it has not in the recent past and recoveries from selloffs will take much longer. I can tell you that for sure. What I cannot tell you is when the stimulus will be reduced enough that such a scenario will take place. Thus, I am playing it safe for now. I am forgoing potential gains to protect my capital from a possible lengthy loss. In other words, I am choosing to forgo some gains in order to avoid the risk of a big loss of time. I can make the money back up a lot easier than I can get back the time. Those of you that want to get back into stocks now will probably be fine but as for my money…. I choose to wait and watch a little while longer.

Currently, our TSP allotment is steady in the G Fund. For comparison the Dow is flat at 0.00%, the Nasdaq is up +0.09%, and the S&P 500 is +0.02%. We will see where they go from here.

Stocks are little changed to start February after S&P 500’s worst month since March 2020

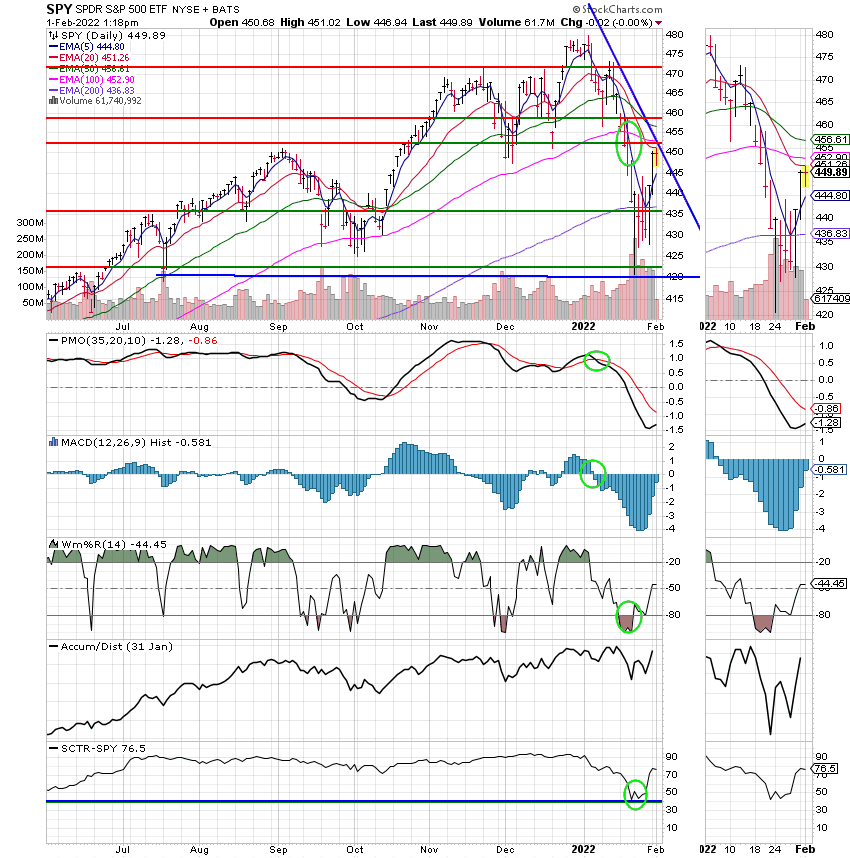

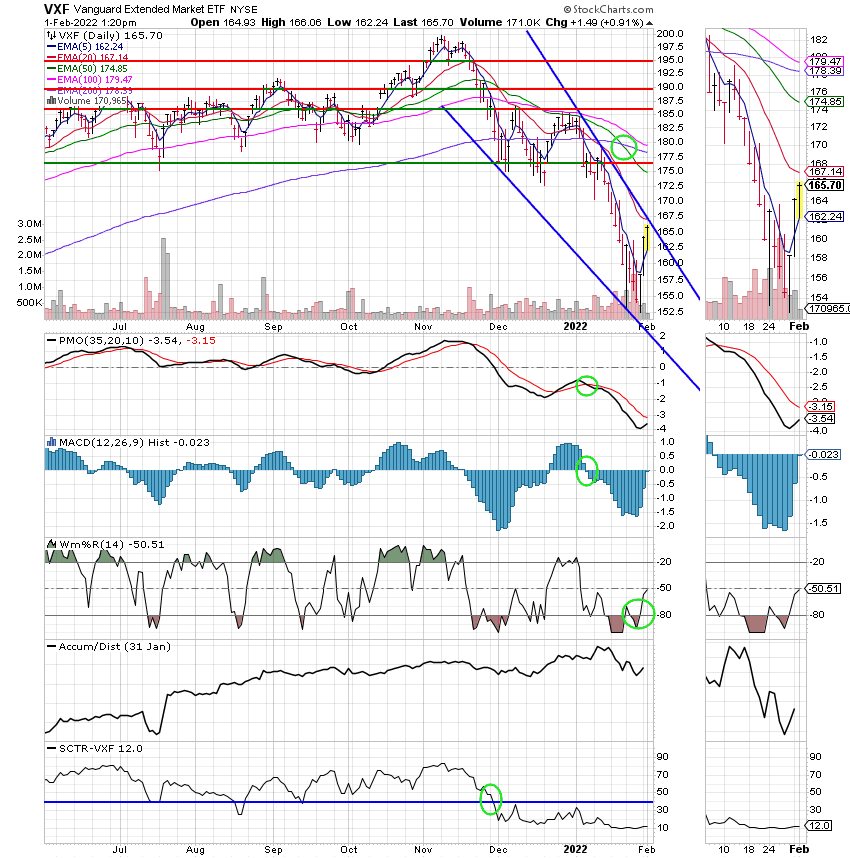

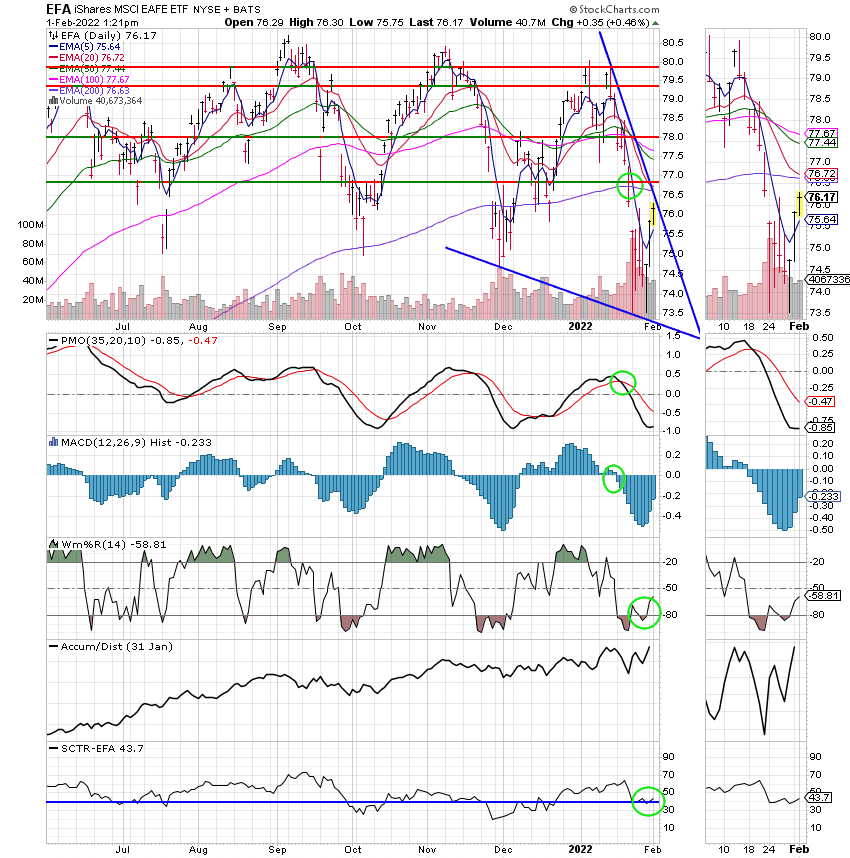

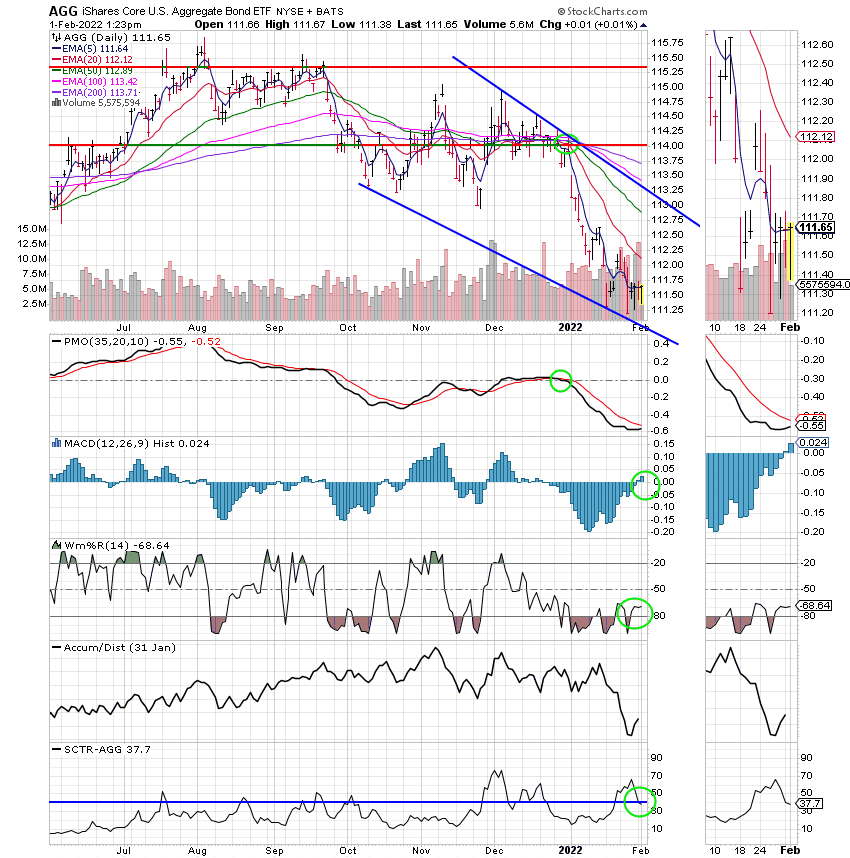

Our charts are generating the following signals: C-Sell, S-Sell, I-Sell, F-Hold. We are currently invested at 100/G. Our allocation is now -7.62% for the year. Here are the latest posted results:

| 01/31/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.759 | 20.4504 | 68.2231 | 75.0386 | 37.8808 |

| $ Change | 0.0022 | -0.0065 | 1.2657 | 2.7196 | 0.6864 |

| % Change day | +0.01% | -0.03% | +1.89% | +3.76% | +1.85% |

| % Change week | +0.01% | -0.03% | +1.89% | +3.76% | +1.85% |

| % Change month | +0.13% | -2.09% | -5.18% | -10.07% | -3.96% |

| % Change year | +0.13% | -2.09% | -5.18% | -10.07% | -3.96% |

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Keep praying! That’s all for today. Have nice day and may God continue to bless your trades.

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.