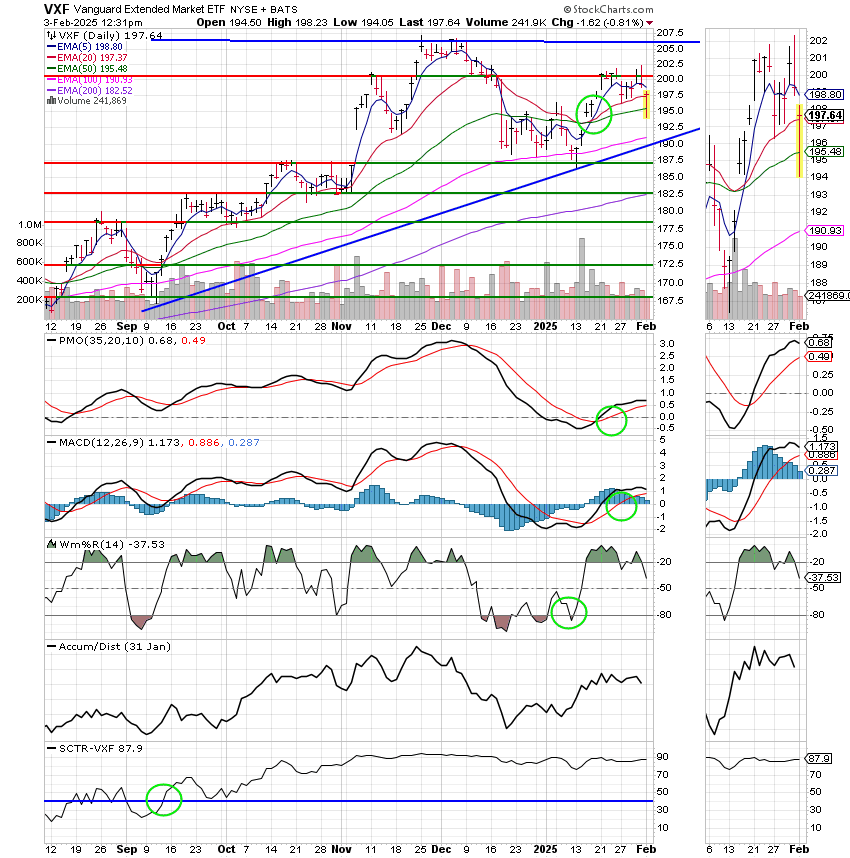

Good Morning, Or….at least what’s left of it! I hit the ground running and still have not stopped. We all knew that this morning would be difficult with the tariffs that were applied to Canada and Mexico. Our intent was to wait and watch our charts as we had been through this before in 2016 but we didn’t have to wait long. Our chart for the S Fund immediately plunged deep into the red and generated a very quick sell signal. We decided to honor the sell signal since we are sitting on a moderate profit for the year. Well…it was no longer than we got everything for a move t0 the G Fund completed in the computer than the charts started reversing in the opposite direction and I mean 180 degrees in the opposite direction! While we thought this would always be the end result, we believed that it would take time to work through the process. It looked like we had enough time to short the market and make a little money. No sir, not with President Trump. Never a dull moment! The next thing we knew the Mexican government was sending troops to the Border to deal with the Fentanyl/ Illegal Immigrant situation and stocks were heading back up. So I spent all morning reacting to a situation that totally reversed. Here, I am at 11:30 AM and I have accomplished absolutely nothing…. unless it was protecting my p0rtfolios from a potential sell off. Oh well, nothing ventured nothing gained…….or eh in this case…..nothing lost……at least not yet. So now we wait and watch some more. Lets go back to the beginning of this mess and start the day over.

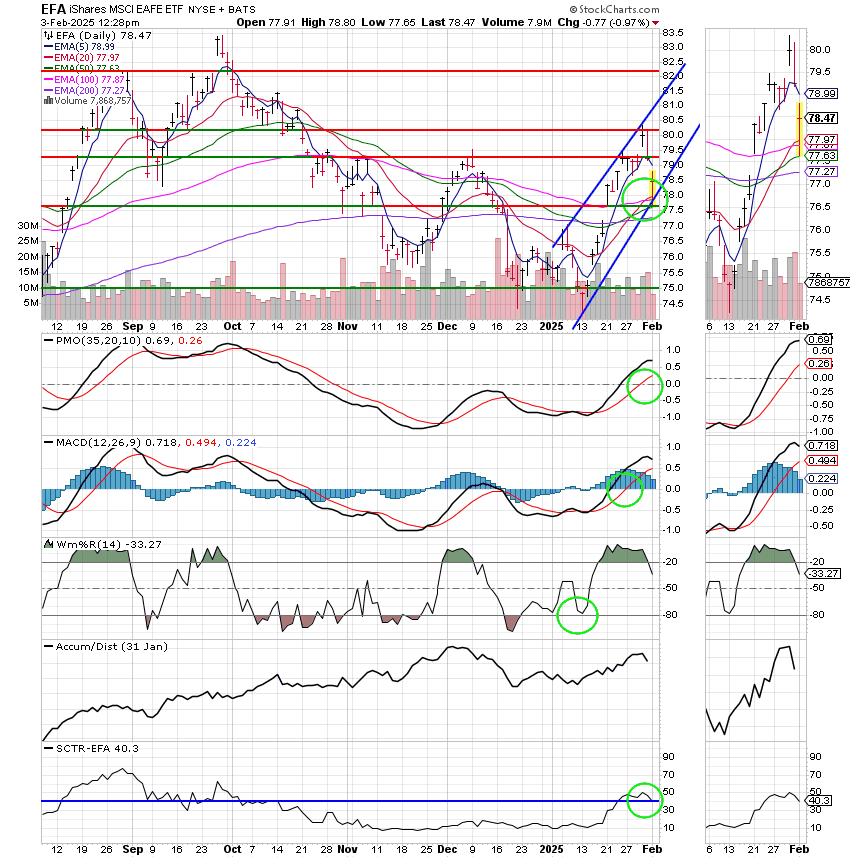

I had a lot of folks that contacted me over the weekend and asked me what my response to the tariffs would be and I told them to wait and watch. As I said above, we never thought we would see a sell signal so quickly, but our stance then and now is that we went though this before in 2016 and ended up making some decent money. So we we’ll wait and watch. We know from past experience with President Trump that he is trying to achieve something with his Tariffs. In this case it is to stem the tide of illegal immigrants and Fentanyl that are flowing into this country. He contended that China, Mexico, and Canada aren’t doing enough about this problem. So he slapped tariffs on them primarily but not entirely for that reason. So it should be noted that the administration also feels there are certain trade improprieties that exist with the countries and have decided to deal with those issues at the same time. So todays volatility is cause and effect. Expect more of it! Next Trump will turn his attention to Europe and what he considers to be unfair trade practices there as well. So it is extremely likely we will play this game of chicken all over again in a day or two. If that is indeed the case, we will watch the charts and react to what we see again. There are a couple of facts to note when looking closely at this situation. First and foremost is that the US economy is the largest market in the world. Those countries need us more than we need them. Sure they are all talking tough right now, but believe me when I tell you they will do whatever it takes to gain access to and sell their goods on our market. Our market, our rules! If they don’t like it, they can sell their goods in Europe and China. Eventually, this will all play out and when it does it will be just like it was in 2016. Good for American industry and good for the US stock market. Unfortunately we will have to ride a roller coaster to get there. We have a bunch of corporate earnings reports coming the rest of this week that should support the market while we work through is tariff thing. More than 120 companies in the S&P 500 are set to report their results, including tech names Alphabet, Amazon and Palantir, as well as consumer giants, including Walt Disney and Mondelez. Also later in the week we have the January nonfarm payrolls report which will be out on Friday. Economists are expecting that 175,000 jobs were added last month. We will see. One thing is for sure, there will be no rest for the weary in 2025. So keep praying and watch your charts closely.

The days trading so far has left us with the following results. Our TSP allotment is trading off it’s lows for the day at -0.98%.For comparison, the Dow is off only -0.28%, the Nasdaq -1.28%, and the S&P 500 -0.65%. All are trading well off their lows for the day.

Stocks cut losses after Trump pauses tariffs on Mexico, Dow down just 100 points: Live updates

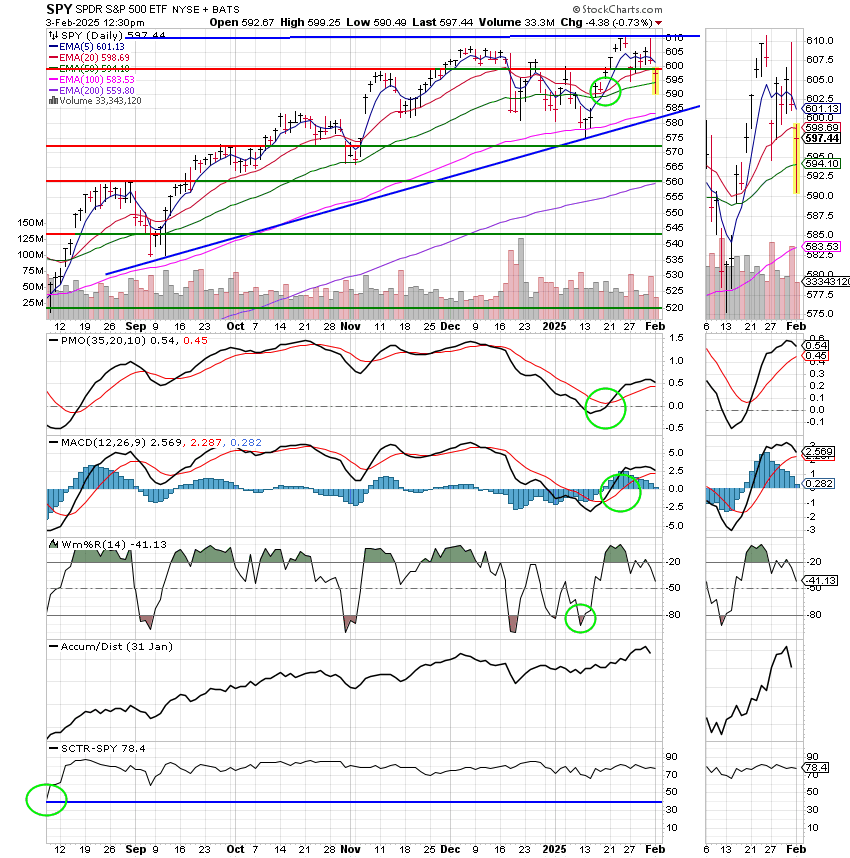

The most recent action has generated the following signals: C-Hold, S-Hold, I-Hold, F-Buy. We are currently invested at 100/S. Our allocation is now +4.99% on the year not including the days results. Here are the latest posted results:

| 01/31/25 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.828 | 19.5785 | 95.5121 | 94.652 | 43.438 |

| $ Change | 0.0024 | -0.0313 | -0.4792 | -0.6352 | -0.2974 |

| % Change day | +0.01% | -0.16% | -0.50% | -0.67% | -0.68% |

| % Change week | +0.09% | +0.43% | -0.99% | -0.64% | -0.19% |

| % Change month | +0.39% | +0.51% | +2.78% | +4.99% | +3.68% |

| % Change year | +0.39% | +0.51% | +2.78% | +4.99% | +3.68% |