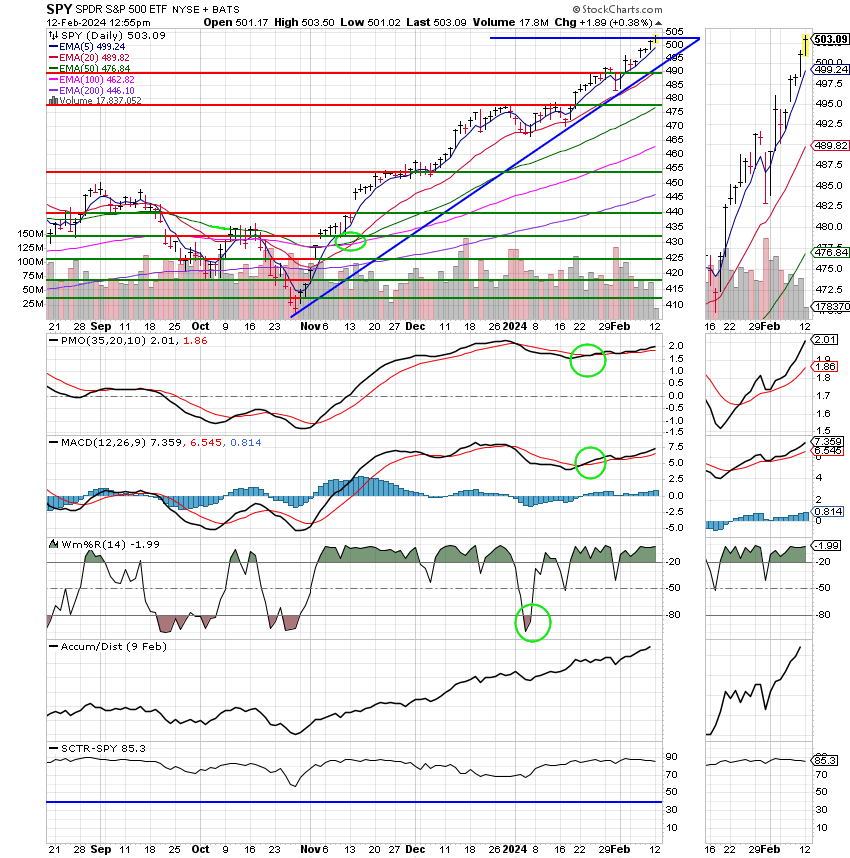

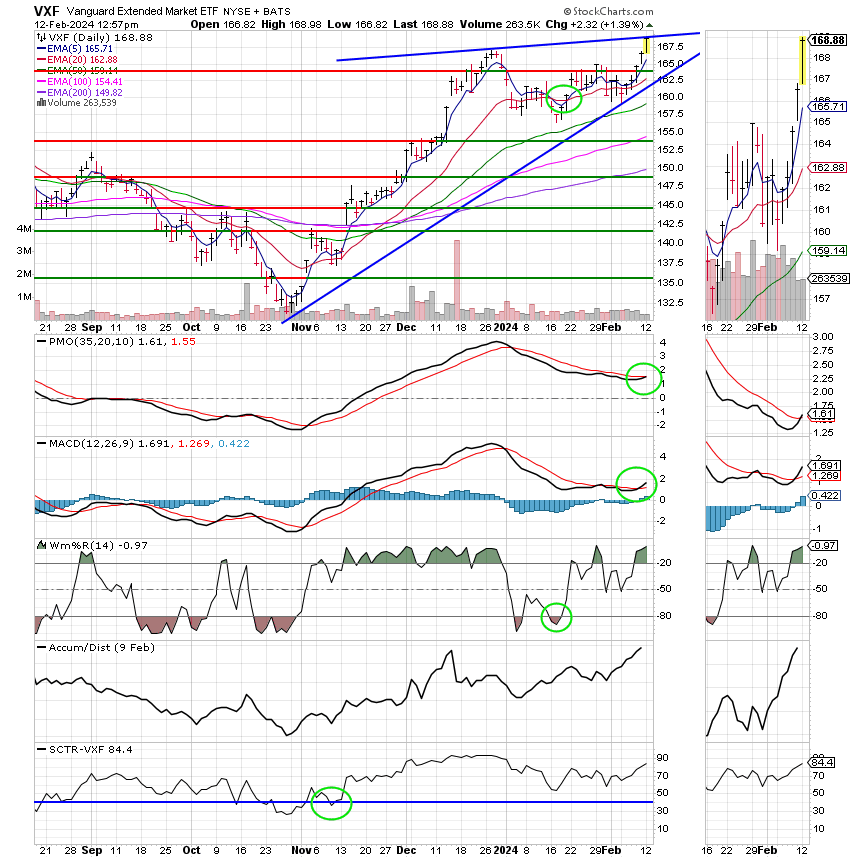

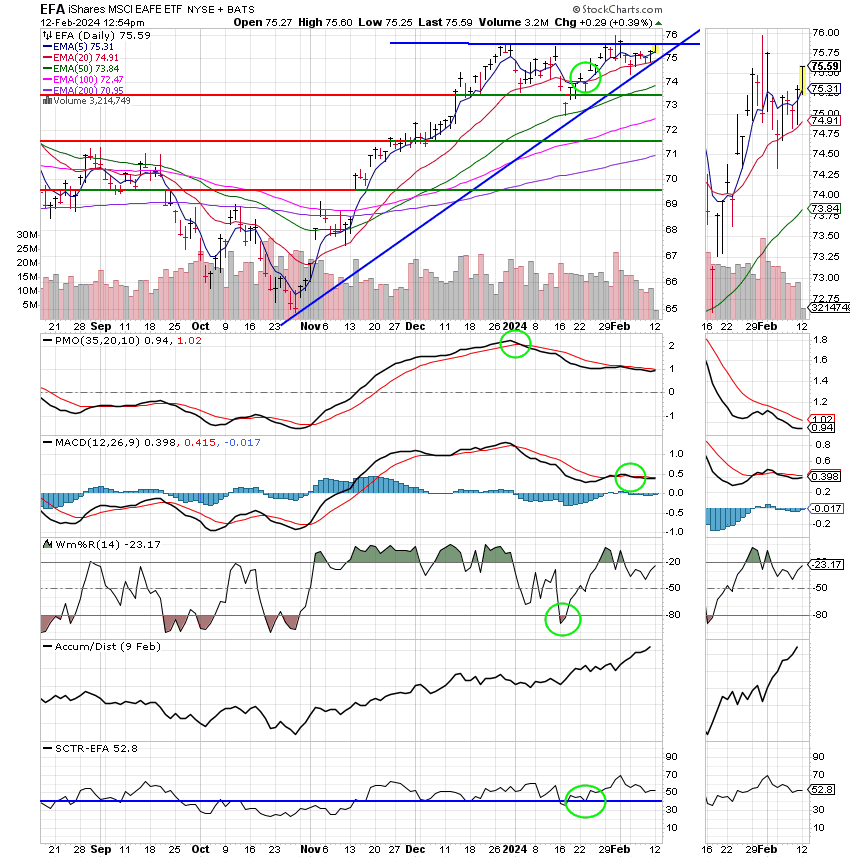

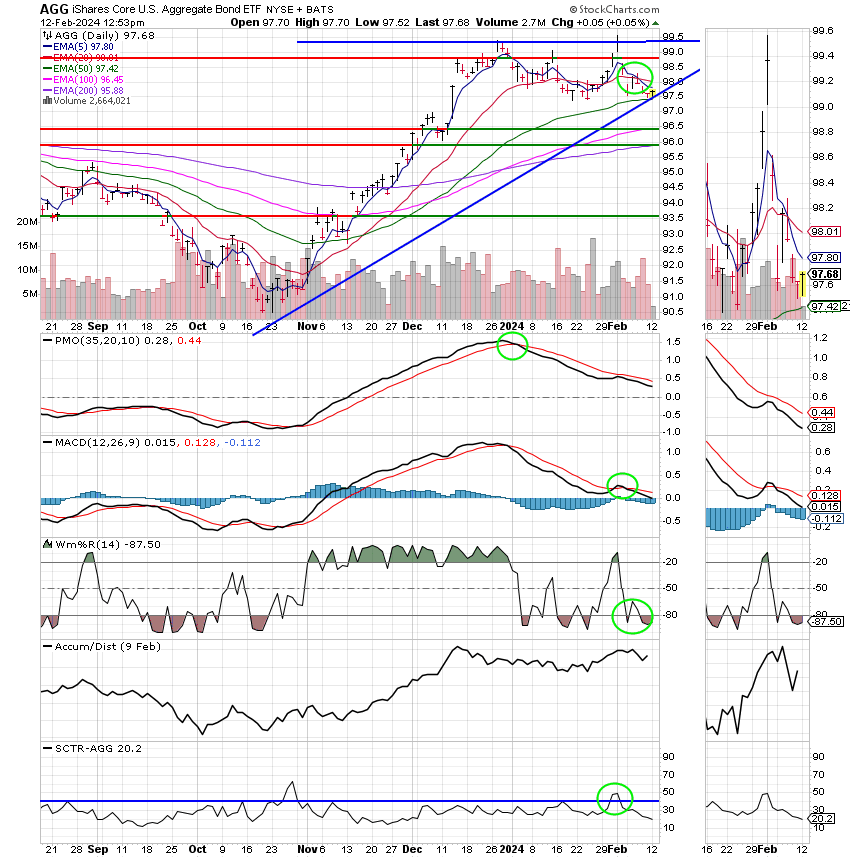

Good Day, This morning we found the market pretty well unchanged. However, it has decided to continue to move higher after a nice rally last week. Although, our indicators showed a high probability of a pullback it never really occurred as economic report after ec0nomic report continue to show a strong economy. So what gives here Scott? I thought the strong reports indicated that inflation will remain sticky and the Fed might possibly have to increase rates or at the very least delay any cuts for the foreseeable future?? Folks, that narrative has changed! The market has decided based on the past few Fed meetings that #1 The Fed will begin to decrease interest rates in the spring of early summer, most likely in May or June. #2 The Fed has in fact engineered the soft landing for the economy and a recession is now off the table. To sum it all up, economic conditions are now goldilocks warm. Investors will look forward to additional economic indicators this week that I believe will further support the current rally. They will be watching out for the latest level on the consumer price index — or CPI, a key inflationary gauge — set to be released on Tuesday morning. More key economic data is expected on Thursday and Friday, including January’s reading on retail sales, production, imports and exports, housing starts and the producer price index, or PPI. If these reports meet expectations they will add further support to price of stocks. Will the market move straight up as it has in recent years? Absolutely not! Those days are gone. While the major indices have the room to move higher they will probably stall at some point until there is greater clarity on future rate cuts. As this takes place and inflation drops to acceptable levels the current rally will gain steam and eventually turn into strong bull. Which brings me to todays interfund transfer. As I said our indicators showed the high probability of a pullback in recent weeks. That pullback did not occur and those signals have since repainted. We knew that was a possibility but decided nevertheless to play it safe. So we booked a profit and protected our gains. During that time we left some money on the table. That folks, was the premium for an insurance policy that fortunately we did not need. The way I see it, we booked profit and nobody ever got shot for doing that. We are in the green so far in 2024 and we intend to stay there. There will be many opportunities to make money and the important thing to bear in mind is that heretofore we have kept what we made. Never Forget “It’s not how much you make that’s important. It’s what you keep!!!” Given the above economic conditions and the fact that our charts are again showing solid buy signals we have decided to reenter the market knowing full well that there will be some volatility moving forward. It is our intention to hold through it as long as our charts remain reasonably strong and support it. Considering what should be a falling rate environment as we move forward, we have decided to invest in our small/midcap fund which is the S Fund. Small and mid caps always benefit from falling rates and that’s our reason for investing in the S Fund. All that noted we have put in an interfund transfer and will be invested at 100/S as of the close of business today. May God graciously bless our trade!

Todays market has so far generated to following results: Our TSP allotment is steady in the G Fund. Remember, we are in the G Fund until the close of business today. For comparison, the Dow is higher at +0.54%, the Nasdaq +0.51%, and the S&P 500 is +0.41%.

S&P 500 hits fresh record high to start the week, Nvidia rises: Live updates

Recent action has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Sell. As of the close of business today we will be invested at 100/S. Our allotment is currently +2.44% for the year not including the days results. Here are the latest posted results:

| 02/09/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.0432 | 18.9575 | 78.4641 | 78.1166 | 40.1487 |

| $ Change | 0.0021 | -0.0158 | 0.4552 | 0.8897 | 0.0703 |

| % Change day | +0.01% | -0.08% | +0.58% | +1.15% | +0.18% |

| % Change week | +0.08% | -0.82% | +1.40% | +2.41% | +0.26% |

| % Change month | +0.10% | -1.19% | +3.77% | +3.83% | +0.14% |

| % Change year | +0.45% | -1.38% | +5.51% | +1.32% | -0.08% |