Good Evening, As most of you know I’m dealing with a death in the family. I also realize that there’s a lot of turmoil in the market that needs to be addressed so I’ll keep it short and sweet. The market continues to rise and fall on inflation news or more precisely speculation about how the Fed will react to inflation news. Inflation is hot and remains hotter than the Fed or investors expected it to be. The market continues to to struggle with pricing in the number of rate increases that the Fed will enact in the coming months. That will likely be the driving force for the volatility in the near future. This is a dynamic that has been with us for a while and will at some point resolve itself. As I said on Facebook, as inflation moderates so will the volatility affecting your thrift accounts. As long as earnings remain as good as they are now, the rally should remain intact when inflation eventually subsides. However, this at week there has been another problem and that is the Ukraine. Will Russia invade or will they not? The market sells off when the headlines support an invasion and rallies when hostilities subside. Today the market rallied as Russia announced the pullback of some of it’s troops from the Ukrainian border. Who knows about tomorrow when Putins involved. We’ll see. For now I’m in as long as I don’t get a sell signal for the C Fund. It’s simply day to day. One more piece of news that I need to mention is today’s announcement that the number of COVID cases are now 80% below their peak in January. That of course supports the economic recovery and as long as the recovery remains strong and corporate earnings stay good, we will be fine!

The days trading left us with the following results: Our TSP allotment posted a gain of +1.58%. For comparison, the Dow was up +1.22%, the Nasdaq +2.53%, and the S&P 500 +1.58%.

Dow jumps 400 points and snaps 3-day losing streak, Nasdaq pops 2.5%

The days action left us with the following signals: C-Hold, S-Hold, I-Hold, F-Sell. We are currently invested at 100/C. Our allocation is now -11.34% not including the days returns. Here are the latest posted returns:

| 02/14/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.7707 | 20.0766 | 66.5447 | 74.6763 | 37.6926 |

| $ Change | 0.0025 | -0.1081 | -0.2523 | -0.3754 | -0.2860 |

| % Change day | +0.01% | -0.54% | -0.38% | -0.50% | -0.75% |

| % Change week | +0.01% | -0.54% | -0.38% | -0.50% | -0.75% |

| % Change month | +0.07% | -1.83% | -2.46% | -0.48% | -0.50% |

| % Change year | +0.20% | -3.88% | -7.51% | -10.50% | -4.43% |

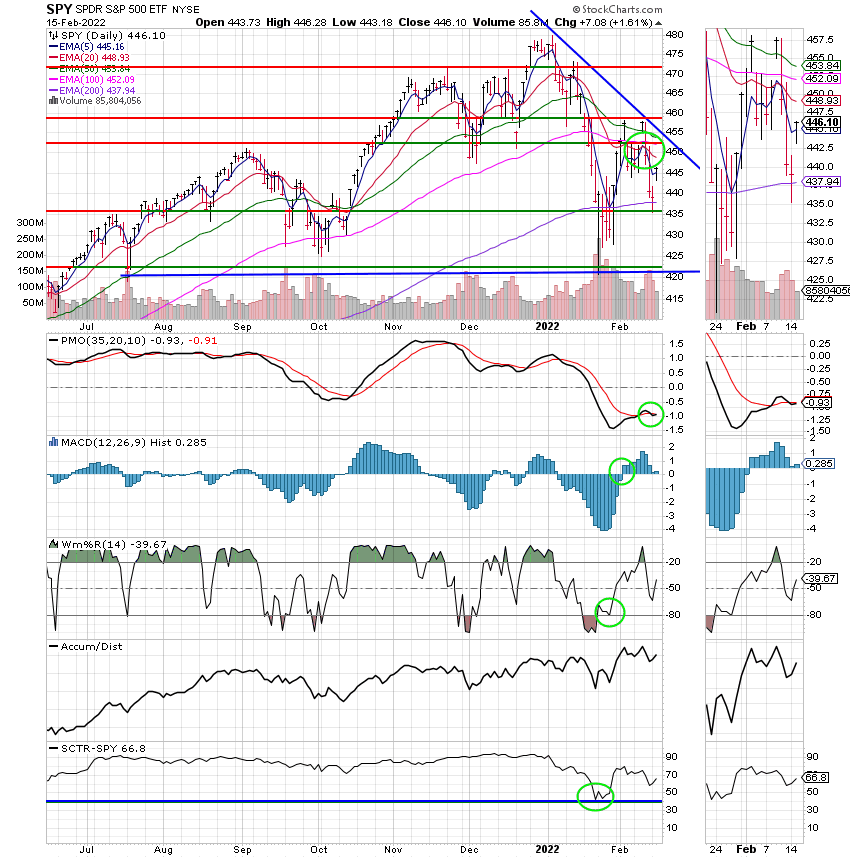

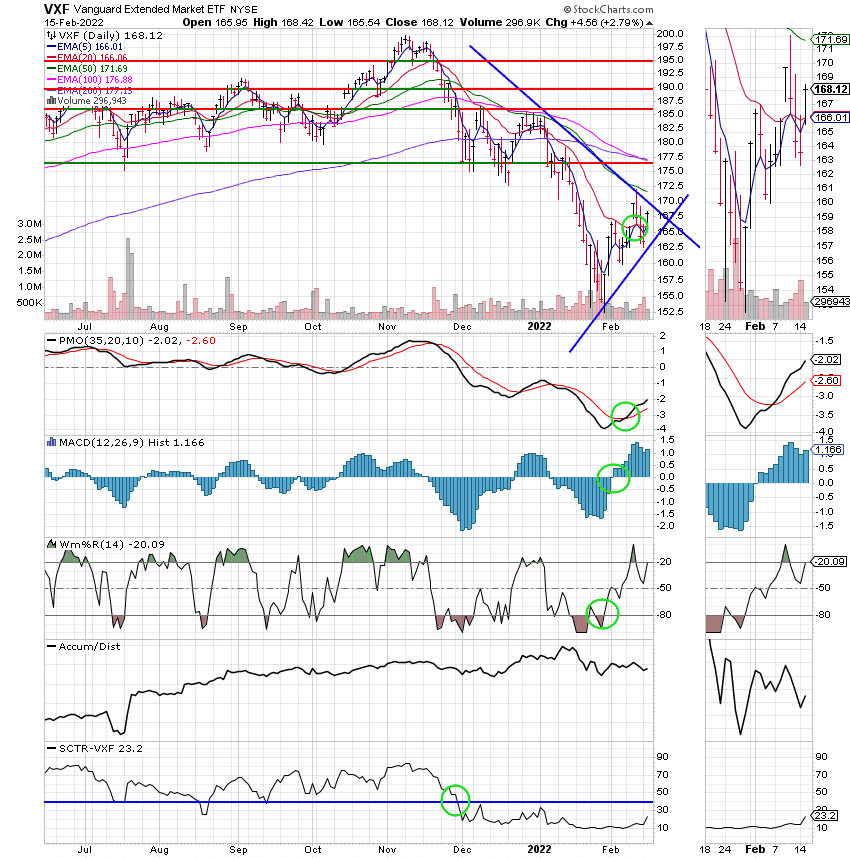

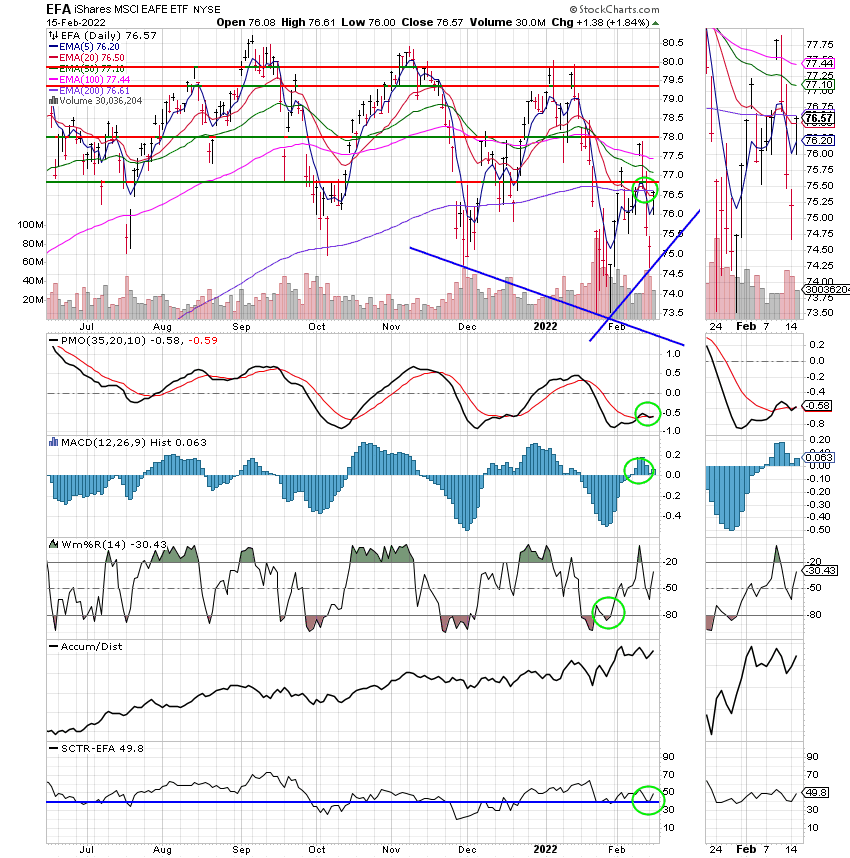

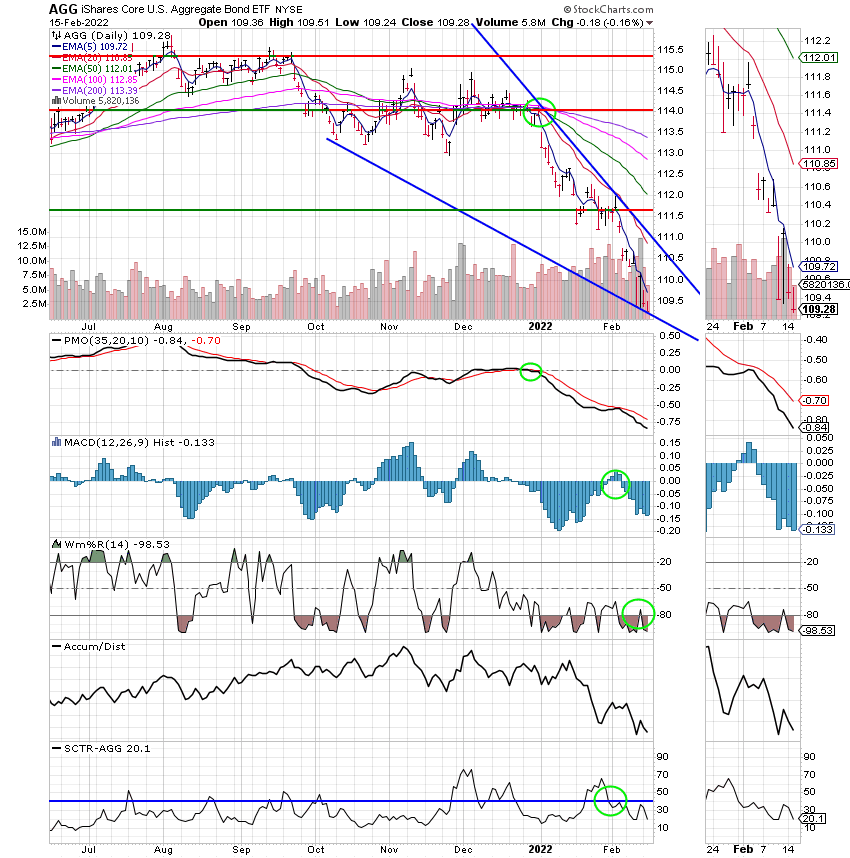

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Now is the time to keep praying for our group. We’ve been in tough markets before and God has always brought us through. Never forget. He inhabits the praises of the faithful. That said, I’m excited to see what He’s going to do for us next! That’s all for tonight. Have a nice evening and may God continue to bless your trades,

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.