Good Afternoon, Happy Presidents day. I pray that as many of you as possible are enjoying a well deserved day off. I guess holiday pay will have to suffice for everyone else. That was it for a great deal of my career. So last week we made the move back into equities. It proved to be a controversial move as the market sold of on a hotter than expected CPI (Consumer Price Index) report the day that we moved in. I received the usual amount of negative comments as the S fund sold off in the neighborhood of three percent. Let me be perfectly clear and there’s only so many ways I can say this, we did not enter the market with any expectations for last Tuesday. It was irrelevant what the market did on the day of the trade. Of course, we would prefer that it would move higher the first day we enter into a new trade. Who wouldn’t want that, but had we entered the market expecting to make money on a specific day we would indeed be “timing” the market and that is not what we do. It’s absolutely not what we do! I understand that some folks make money that way, but I have never been able to successfully do it. Therefore, I do not do it. Our expectation for this trade or any trade that we make for that matter is to make money over the coming weeks or months. It is not to make money over the coming days. Again, that would be nice but it’s not what we do. So let me be clear. There’s only so many ways I can say this. Our goal in this or any other trade we make is to catch the next trend higher or avoid the next trend lower period! We are not day traders or market timers. If you prefer those styles then you are in the wrong place. Pass this website on and keep looking. You will be disappointed here. Also, if you don’t know the difference between market timing and trend following, then you need to learn. Know what works best for you and do it. Lets be clear on something else too. Selling is a tool to us. Conventional Wallstreet would have you believe that selling is a dirty word. You should buy and hold. They tell y0u that is the only way you can make money. Nobody, has the skill to get in and out of stocks effectively. Yeah, then why do most of them do it?? Do as I say not as I do I guess. They move the market higher and lower utilizing huge portfolios and high speed algorithms and wait for you to panic. The algorithms were not so much of a force until around 2008 or so. That is one of he reasons that we struggled recently after doing things the way we did them for so many years. I don’t really want to get off into that now other than to say that they even managed to trip us up as well when government stimulus was added to the equation. Once that stimulus started to be removed in earnest the algorithms got the best of us in 2022. In 2023 we fought them to a standstill and broke even, but in 2024 we’re finally starting to get the upper hand again. As I said more than once lately, we are even now still learning what our new momentum based indicators will do and just starting to scratch the surface of what they can do performance wise. A case and point would be our last move to the G Fund. Our indicators told us their would be a pullback and there in fact was, but it was shallow and the signal repainted quickly after which equities continue higher without us. We left money on the table after we got out too soon. Even at that we were able to hang onto the profit that we booked. So not all was bad, but here is the point I want to make. We learned from that trade. By studying our charts we noted movement in some of our indicators that will allow us to avoid this type of shallow pullback in the future. In other words had we known then what we know now we would have made a better decision based on that information and not made that move to the G Fund. They say hind site is 20/20 but in the case we gained foresight for the future. We used the old indicators from 1997 through 2022 and made a lot of money, but the market changed and forced us to change as well. During the 25 years of using the other system we got better and better at using it as time went along. Those you that were along for the ride will remember these adjustments. We always made money using that system. It’s just that we became more efficient at doing it as the years passed. I said all that to make this point. We will make money with this system in the same way and our utilization of it will improve in the same way. Now there is one final point that I want to make to tie this all up. We changed our method of analysis. Here me now and take a minute to let this sink in. WE DID NOT CHANGE OUR MARKET STRATEGY!!!! That had always been the same and that is to follow the trend. That is what made you all the money from 1997 through 2021 and that is what will make us money moving into the future. At least for us, it has been the superior style of investment and led to us outperforming the market by several hundred percent during that time. How may TSP Millionaires do we have in this group? Honestly, I lost count. Given God’s grace and the right market conditions I believe we can add many more. This system is the best I have personally ever seen. I thank God for again guiding our hand. I even thank Him for 2022. That’s right! If it wasn’t for 2022 we would have never been forced to get out of our comfort zone and develop this new system. Now let’s go run it….

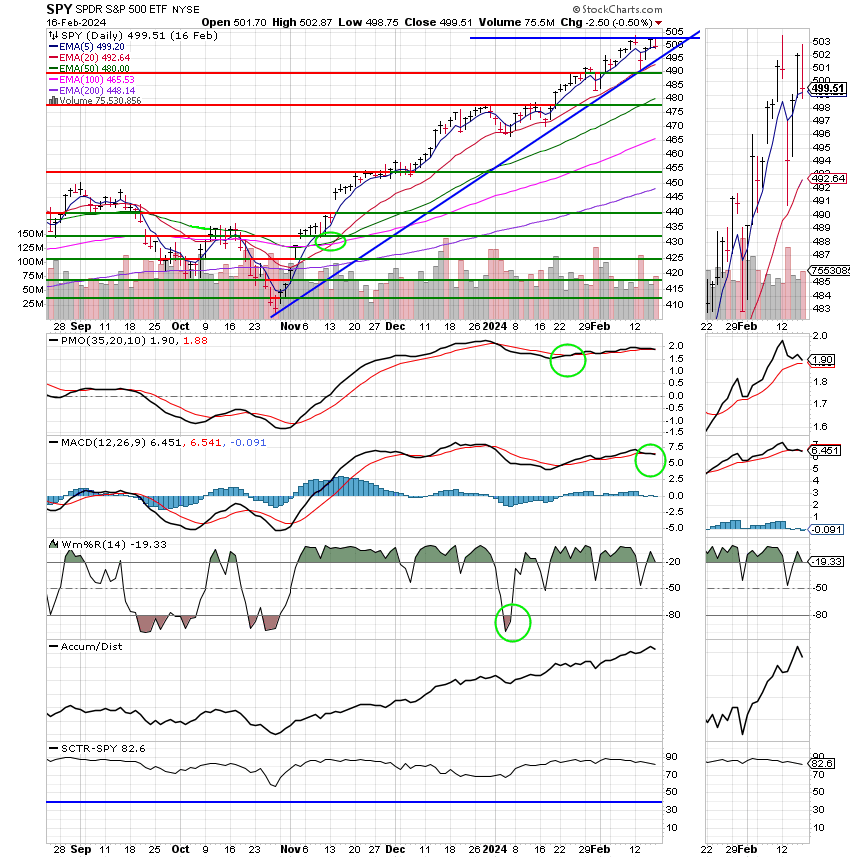

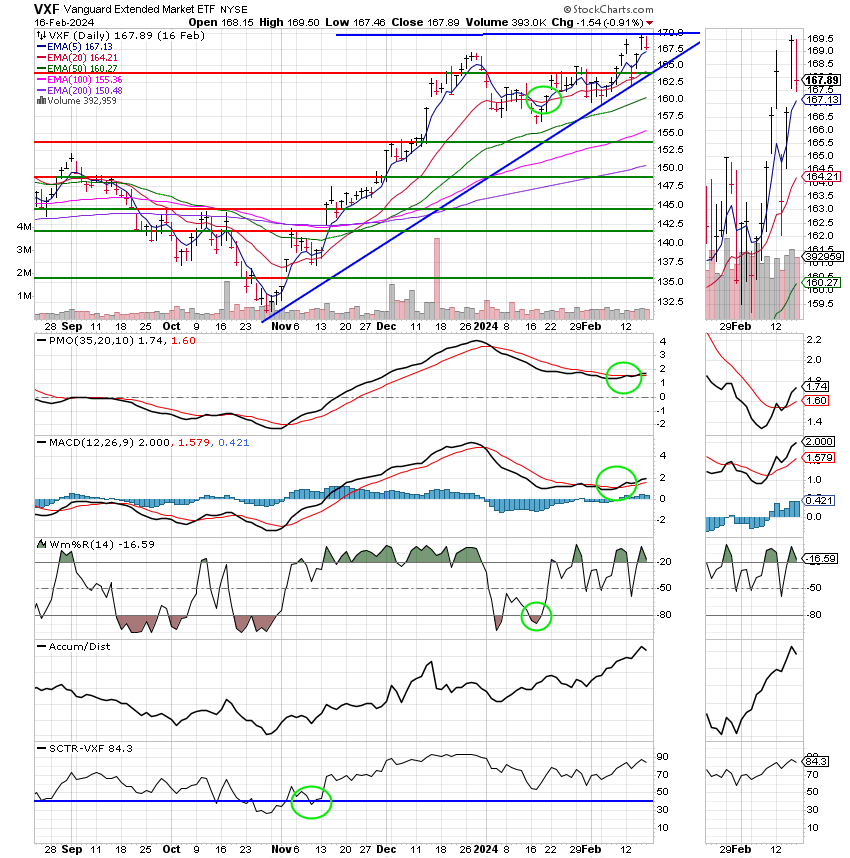

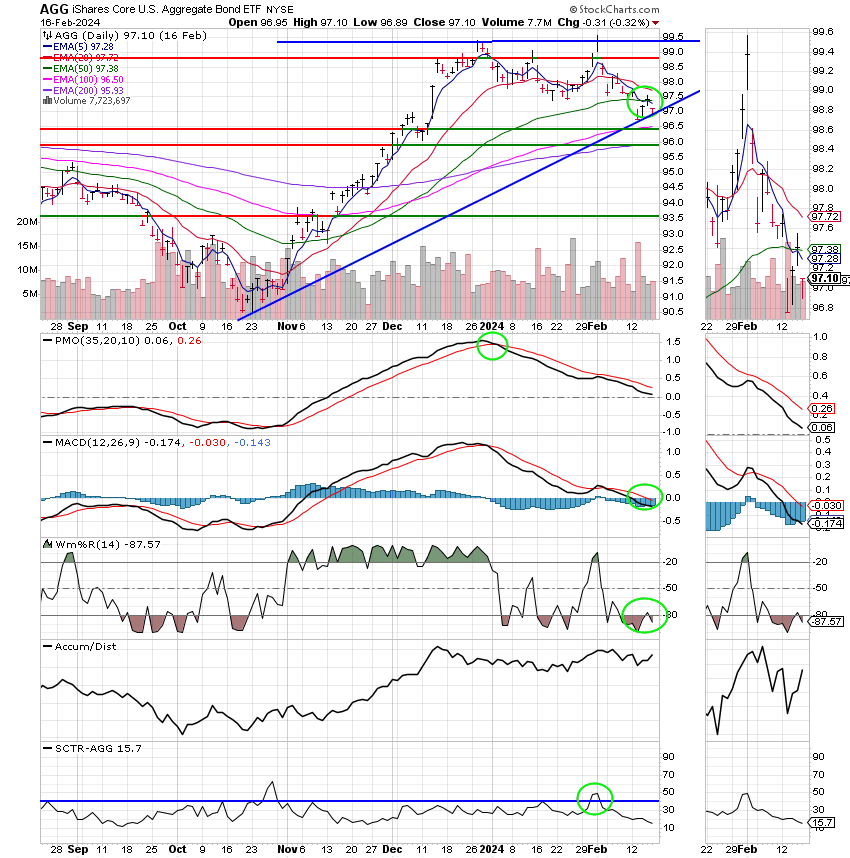

Moving forward now, we will continue to watch the corporate earnings and economic reports. The key focus will be on how soon and how much the Federal Reserve will cut rates. You should all brace for more volatility. I don’t know how many ways to say this but the market will not simply move straight up as it has the past dozen years prior to the pandemic. There will be more volatility in the coming years than there was then and even more than that right now as the market focuses on rate cuts until the rate of inflation finally stabilizes at or near two percent. Given the effectiveness of our new system we hope to remain invested for the shallow pullbacks and sell only for the deep ones. So Scott what are you calling deep? Glad you asked. More than 5%. Preferably in the 7-10%n range. Those are the ones we will attempt to sit out. The others, those less than 5% we will attempt to ride out. That is the plan. That is what we would like to do. For now we will continue to stay invested at 100/S in a effort to take advantage of a falling interest rate environment. We believe the overall uptrend will remain in tact through the remainder of 2024,

Fridays action left us with the following results. Our TSP allotment give up -0.91%. For comparison, the Dow was off -0.53%, the Nasdaq -0.82%, and the S&P 500 -0.50%.

Dow slides more than 100 points Friday, major averages end 5-week winning run: Live updates

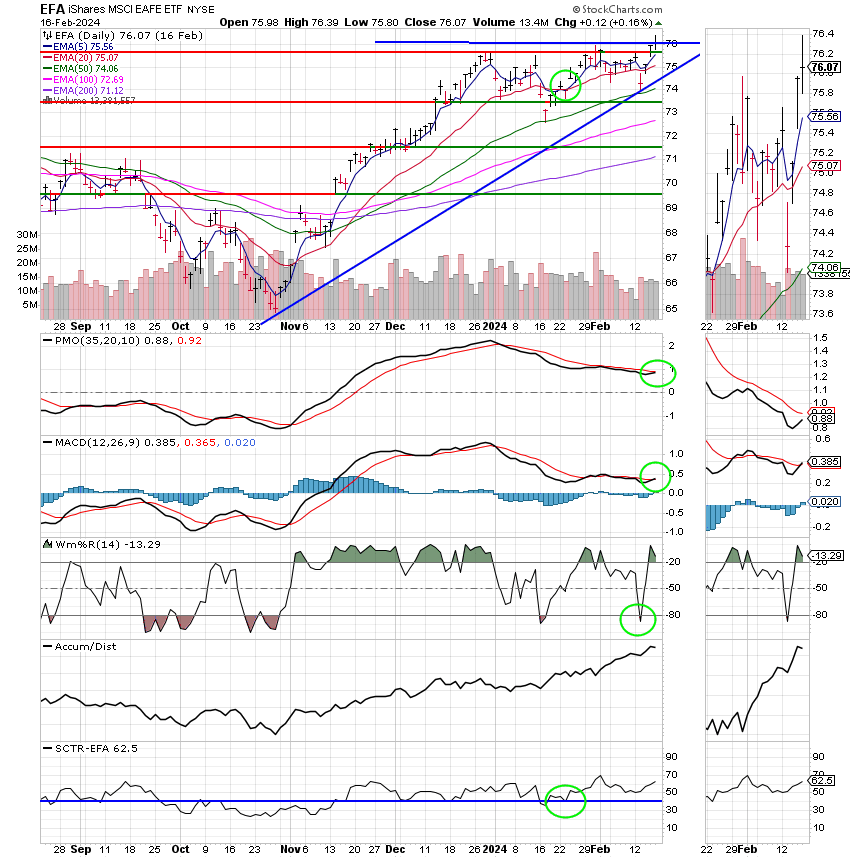

Recent action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Hold. We are currently invested at 100/S. Our TSP allocation is now +2.28% on the year. Here are the latest posted returns.

| 02/16/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.0575 | 18.854 | 78.1899 | 78.7308 | 40.6046 |

| $ Change | 0.0021 | -0.0595 | -0.3653 | -0.7225 | 0.1625 |

| % Change day | +0.01% | -0.31% | -0.47% | -0.91% | +0.40% |

| % Change week | +0.08% | -0.55% | -0.35% | +0.79% | +1.14% |

| % Change month | +0.18% | -1.73% | +3.41% | +4.64% | +1.28% |

| % Change year | +0.53% | -1.92% | +5.14% | +2.12% | +1.05% |