Good Day, There are only so many new things that you can write about this market. The media comes up with every little nuance that affects the market and writes story after story about how the market is affected. All the issues they report on seem different on the surface but ultimately lead back to one main issue that has, is , and will continue to shape the market which of course is inflation. In the last week you’ve had the full gamut of news leading to buying and selling of stocks. It all started with a stronger than expected employment report a week ago this last Friday. The market interpreted that as bad news due to that fact that it could influence the Fed to further increase interest rates in their battle with inflation. I personally think that both the Fed and the market are paying too much attention to the employment numbers. There are other facets of this economy that have been frequently overlooked and tell us that inflation has peaked. Yes strong employment numbers lead to strong consumers that can spend money and keep inflation numbers stubbornly high, but I prefer to look at the glass as half full rather than half empty. For instance, I see the strong employment as a good thing in that the overall economy is holding up well as the Fed increases rates. As time goes on and inflation wanes it is entirely possible that that we could avoid a recession or as economists like to say have a soft landing. The individual consumer makes up about 80% of the overall economy and if he remains healthy the economy remains healthy or at least healthy enough to avoid a recession. Consider this, the Feds increased rates are indeed having the desired effect of slowing the economy down. One has only to look as far as the quarterly corporate earnings reports to see this. This earnings season so far had had only 69% of corporations reporting exceed their projected numbers as compared to a five year average of over 78%. The economy is definitely slowing. When the Fed increases rates it takes time for it to move though the economy. That is the reason that the Fed reduced the amount of their rate increase to a quarter point at the last meeting. They are being a little more cautious and waiting to see the effects of their previous rate increases before moving on with new ones. While they have not been perfect and initially underestimated the post pandemic inflation making them late to the game. They have now been able to slow down, take a breath and become more data dependent than they were early on. That is the reason that this scenario simply has to play out. The Fed will continue to evaluated the data they have coming in and compare it with the current state of the economy and the the rate of inflation to determine whether they increase, decrease or hold rates steady each time they meet. The market will continue to react to each economic report in an attempt to project what they Fed will do they next time they meet. This dance will go on until the Fed achieves their target rate of inflation which as we have often repeated is two percent. As news continues to roll in the buying and selling will continue to cause the volatility that we have become accustomed to in the past year. So, what will ultimately trigger the new bull market we have all been waiting for? That would be nirvana for the market when the Fed finally starts to decrease rates. I don’t know when that will come. Of course the sooner the better, but in the end it really doesn’t matter. The process of a data dependent Fed bringing the rate of inflation down to their two percent target will just have to be completed and that will happen when it happens. So why worry about it??? The most important thing to consider is to be well positioned for the next rally when it starts. This rally will likely sneak up on all of us as it will be disguised by the volatility created by the markets reaction of each news release. That means that those who are well positioned will see their account balances effected by this ongoing volatility. That said, enduring this roller coaster will be a necessary evil to being in place to take advantage of the oncoming rally. It should be noted that the only way to know whether or not you should buy, hold, or sell will be to look at the long term trend on your charts. The only reasons to sell at this point would be if that long term trend is broken or if the fund your invested in starts to steadily underperform the other Thrift funds. For now we feel that the opportunity to make the best return moving forward is to remain invested in the S Fund. We are basing this on the recent overall strength of mid cap and small cap stocks that make up the S Fund. Also, never forget to keep praying for God to guide our hand. We can have all the good data in the world and still make the wrong investment decisions. We need Him to guide us in this as well as in all things we do……

There is no trading today due to Presidents Day. However, here are the results from Friday. Our TSP allotment fell back -0.43%. For comparison, the Dow lost gained +0.39%, the Nasdaq lost -0.58%, and the S&P 500 gave up -0.28%.

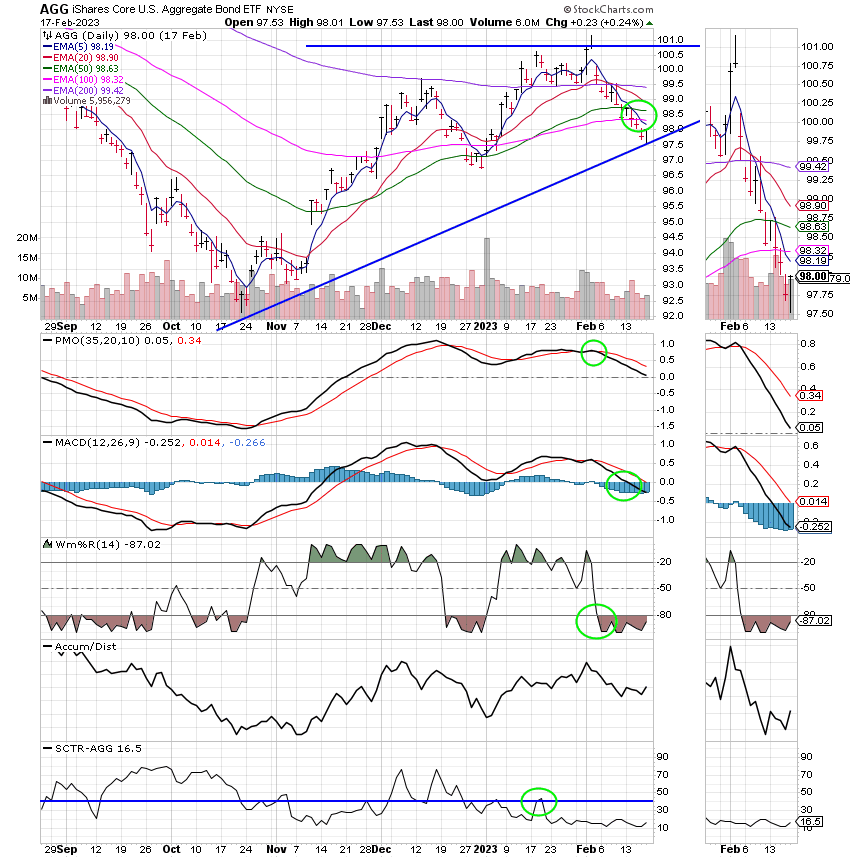

The most recent action has left us with the following signals: C-Hold, S-Hold, I-Hold, F-Sell. Our allotment is now +6.41% for the year. Here are the latest posted results:

| 02/17/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.3228 | 18.4325 | 62.7279 | 68.8575 | 36.5235 |

| $ Change | 0.0017 | 0.0393 | -0.1627 | -0.3076 | 0.0278 |

| % Change day | +0.01% | +0.21% | -0.26% | -0.44% | +0.08% |

| % Change week | +0.07% | -0.47% | -0.20% | +1.55% | +0.38% |

| % Change month | +0.17% | -1.95% | +0.20% | +0.98% | -0.76% |

| % Change year | +0.51% | +1.24% | +6.49% | +11.91% | +7.61% |

| The Lifecycle (L) Funds | |||||

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 23.3684 | 11.7959 | 40.9522 | 12.2004 | 45.8283 |

| $ Change | -0.0049 | -0.0052 | -0.0338 | -0.0111 | -0.0464 |

| % Change day | -0.02% | -0.04% | -0.08% | -0.09% | -0.10% |

| % Change week | +0.08% | +0.10% | +0.14% | +0.15% | +0.16% |

| % Change month | +0.01% | -0.02% | -0.07% | -0.09% | -0.11% |

| % Change year | +2.27% | +3.26% | +4.80% | +5.23% | +5.66% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 12.4629 | 27.1368 | 13.1949 | 13.1935 | 13.1919 |

| $ Change | -0.0136 | -0.0323 | -0.0217 | -0.0217 | -0.0216 |

| % Change day | -0.11% | -0.12% | -0.16% | -0.16% | -0.16% |

| % Change week | +0.17% | +0.18% | +0.25% | +0.25% | +0.25% |

| % Change month | -0.13% | -0.14% | -0.02% | -0.02% | -0.03% |

| % Change year | +6.03% | +6.40% | +7.60% | +7.60% | +7.60% |

Get TSP Fund Returns For Any Date or Between Any 2 Dates

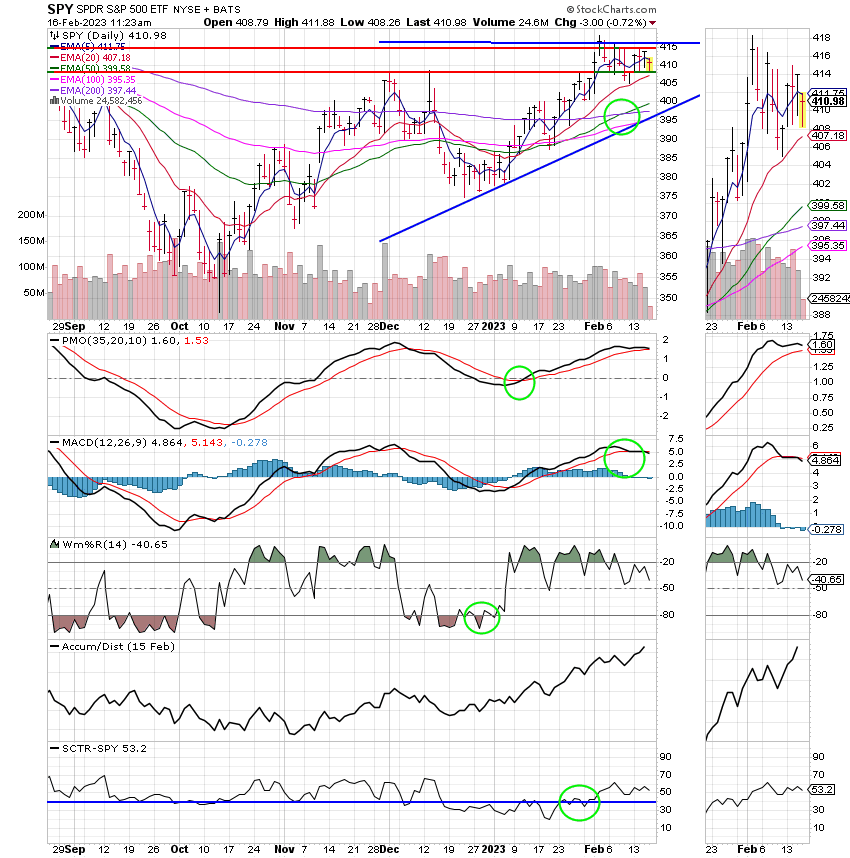

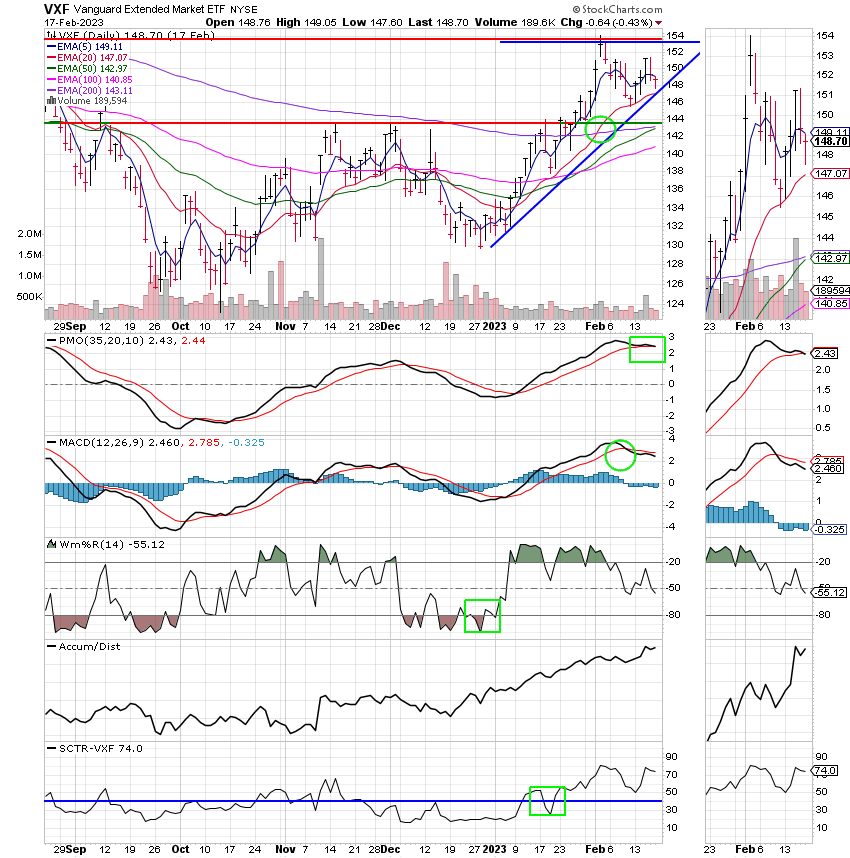

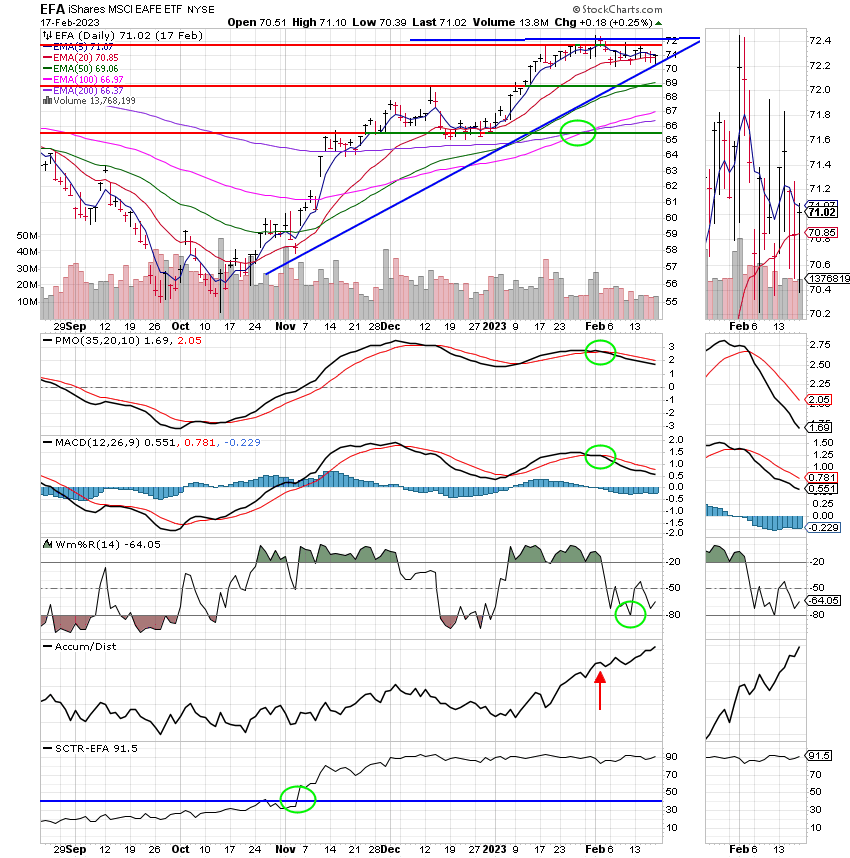

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

There’s not much we can add here. Job one remains to monitor our charts to make sure that the overall trend remains in tact and that the S Fund continues to perform at a satisfactory level. That’s all for this week. Have a great day and may God continue to bless your trades.

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.