Good Evening, The selling continued today with the S&P 500 moving into correction territory. No real surprises there. The negative action caused the chart for the C Fund break resistance at it’s 200EMA. In all likely hood we could be in for another leg down. That noted, we put in an interfund transfer to move our allocation to 100/G. which is where we should have been in the first place. I made the last interfund transfer in the beginning of February a day earlier than I should have. At the time my father was dying and I knew I wouldn’t be able to make the move the next day so I moved it one day earlier than I would have given normal circumstances. Had I waited until the next morning I would have watched my charts reverse and never moved the money to start with. That said, I am now moving back where I should have been in the first place. In my system there is only one best place to be and at least for now that is not in equities. If that changes meaning if and when my charts change I’ll make another move. There is very strong possibility that the market will rally if there is a s diplomatic solution to the Ukrainian conflict, but we must remember that while that situation is moving the market in the short term, it is inflation and the Fed response to that inflation that will move it in the long term. It is highly probable that we are looking at a quarter point increase in interest rates after each monthly Fed meeting for the rest of this year. If that’s the case, how will the market react to those increases? We just don’t know that for sure and neither does any one else. My advice is to run from anyone that says they do. We don’t claim to have a crystal ball here as some do, but we do think we can tell which way the wind might be blowing enough that we can mange our risk. The bottom line is that market volatility will continue until inflation moderates. So we will watch inflation and watch our charts!! I know some of this is a rehash of what we discussed on Facebook today but some of the members of our group do not have Facebook accounts. If by chance you do have a FB account simply didn’t know we’re on Facebook make sure you check out our page when you get a chance. There’s a lot of good stuff on there!

The days trading left us with the following results: our TSP allotment fell -1.01%. For comparison, the Dow dropped -1.42%, the Nasdaq -1.23%, and the S&P 500 -1.01%. The S Fund lost -1.52% and the I Fund was off -1.17%. Stocks traded well off their lows into the closing bell.

S&P 500 closes in correction territory, Dow drops 480 points as Russia-Ukraine conflict intensifies

The days action left us with the following signals: C-Sell, S-Sell. I-Sell, F-Hold. As of the close of business today we are invested at 100/G. Our allocation is now -12.36% for the year not including the days results. Here are the latest posted results:

| 02/18/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.7741 | 20.1377 | 65.7811 | 73.4718 | 37.8062 |

| $ Change | 0.0008 | 0.0371 | -0.4651 | -0.9421 | -0.1229 |

| % Change day | +0.00% | +0.18% | -0.70% | -1.27% | -0.32% |

| % Change week | +0.04% | -0.23% | -1.52% | -2.11% | -0.45% |

| % Change month | +0.09% | -1.53% | -3.58% | -2.09% | -0.20% |

| % Change year | +0.22% | -3.59% | -8.57% | -11.95% | -4.15% |

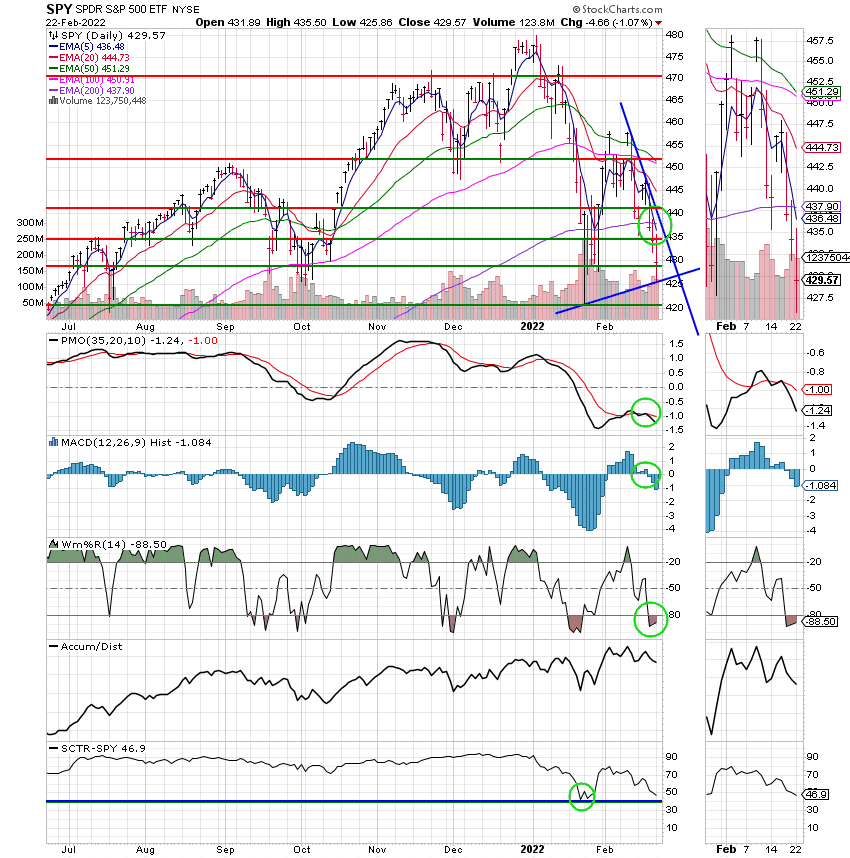

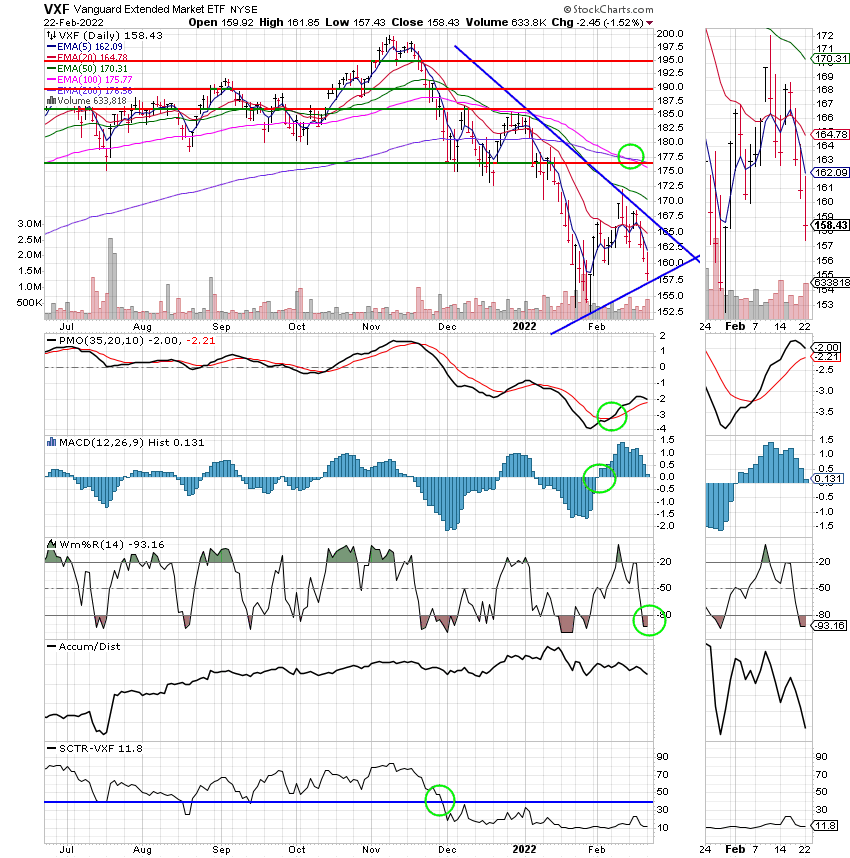

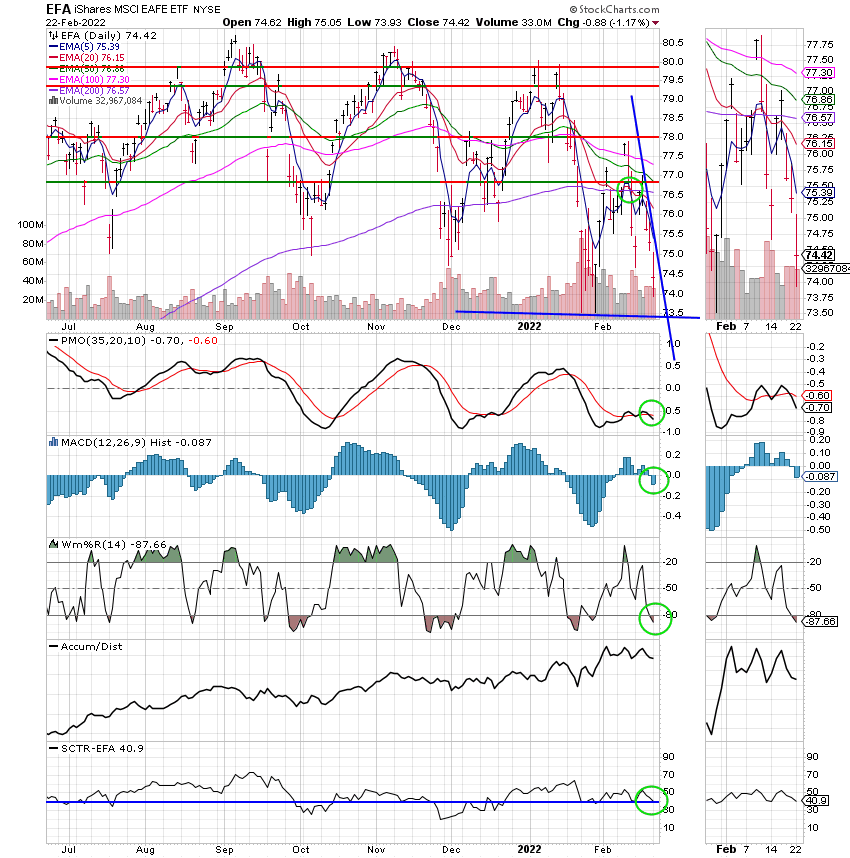

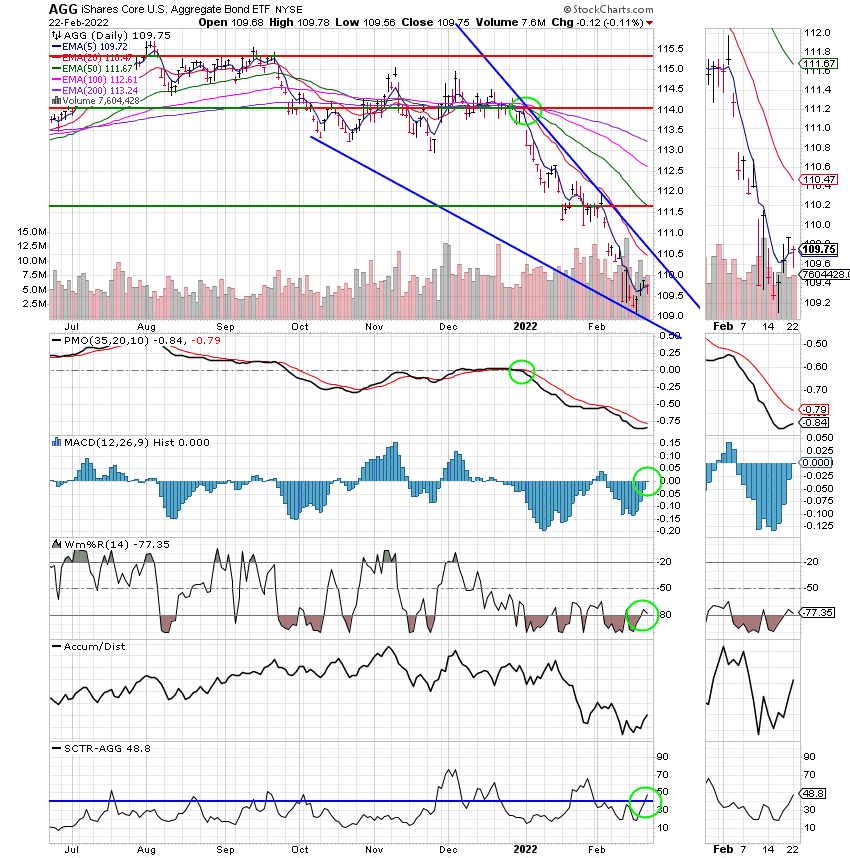

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

It’s a rough one but it’s early in the year. We’ll watch our charts and see it there’s anything we can take advantage of and yes we’ll keep praying! That’s all for tonight. Have a nice evening and may God continue to bless your trades.

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future. If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.