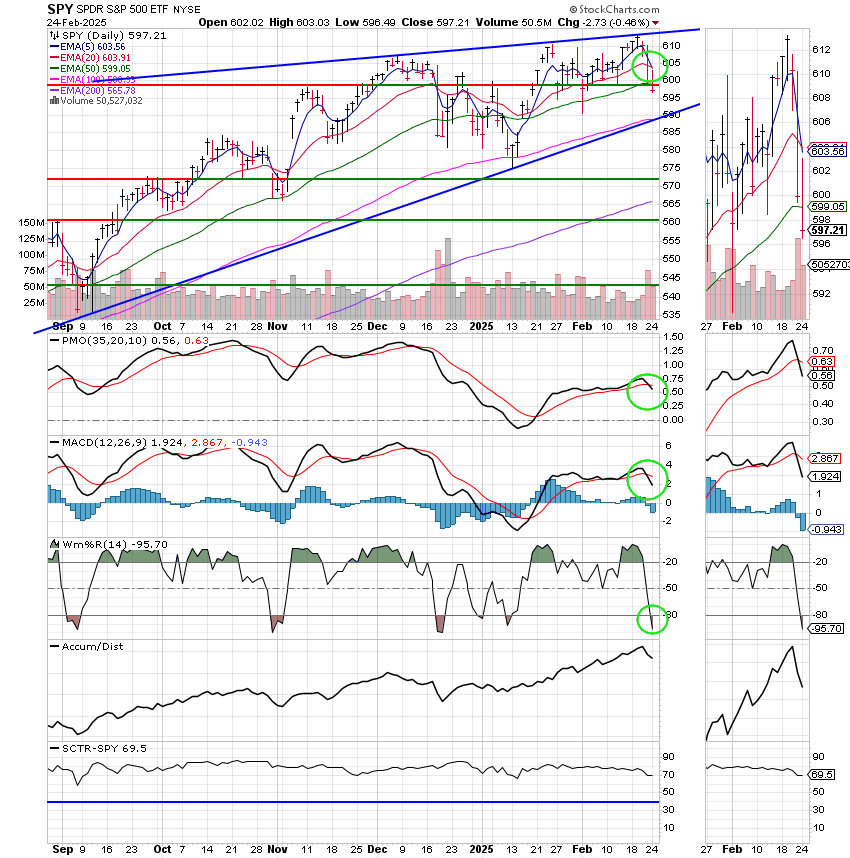

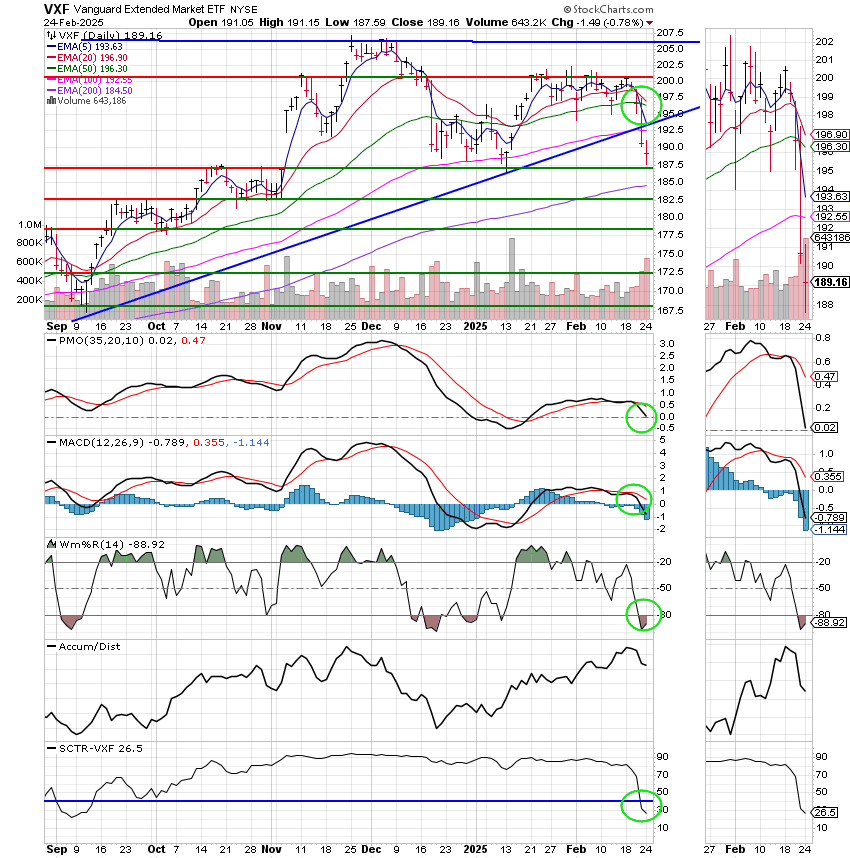

Good Evening, It was another negative day for the market following a huge sell off Friday. Stocks sold off on Friday after February data raised concern over the state of the U.S. economy. Purchasing managers’ index numbers showed the U.S. services sector contracted for the month, while the widely followed University of Michigan’s consumer sentiment index came in weaker than expected All this selling is starting to make the charts look like a correction but we need more data before we can declare that. We’ll just have to see but Id say that it’s time to raise your level of caution. We have. One thing for sure is that the S Fund generated a sell signal late Thursday afternoon. While it certainly would have been nice to sell and avoid Fridays dip we could not do so due to TSP trade restrictions. If they are only going to allow only two trades a month the least they could do is allow them to occur in real time instead of having the current 12:00 o’clock deadline for trade to be effective the next day. They put too many restrictions on you. That is the reason so many folks roll their money out of Thrift as soon as they can. Moving on…. the rest of the week will mostly be driven by earnings with bellwether stocks Lowes and Home Depot reporting on Wednesday with Tech Titan Nvidia reporting later after the bell. However, one important report Friday should not be overlooked. The CPE or Consumer Price Expenditure Index will be release at 8:30 AM. It is the Feds Favorite gauge of inflation and is always a market mover. All that noted, it is my personal opinion that the Fed has pretty well made their mind up not to change rates for the next few meetings. So I really don’t think this report will effect the Fed rate decision at the next meeting. As a result of the weakness in the chart for the S Fund we put in an interfund transfer to 100% G Fund that took effect at the close of business Friday. So far it’s been a good move with both the S and C Funds declining today. We will see how it goes. Again, the charts are looking somewhat weak and it appears that we could experience some more selling. So we will watch from the safety of the G Fund until things get a little clearer. Keep watching your charts and keep praying!

The days trading left us with the following results. Our TSP allocation was steady in the G Fund. For comparison, the Dow posted a slight gain of +0.09% which was really good today, the Nasdaq fell -1.21%, , and the S&P 500 was -0.49%.

S&P 500 closes lower Monday as market’s comeback attempt fizzles: Live updates

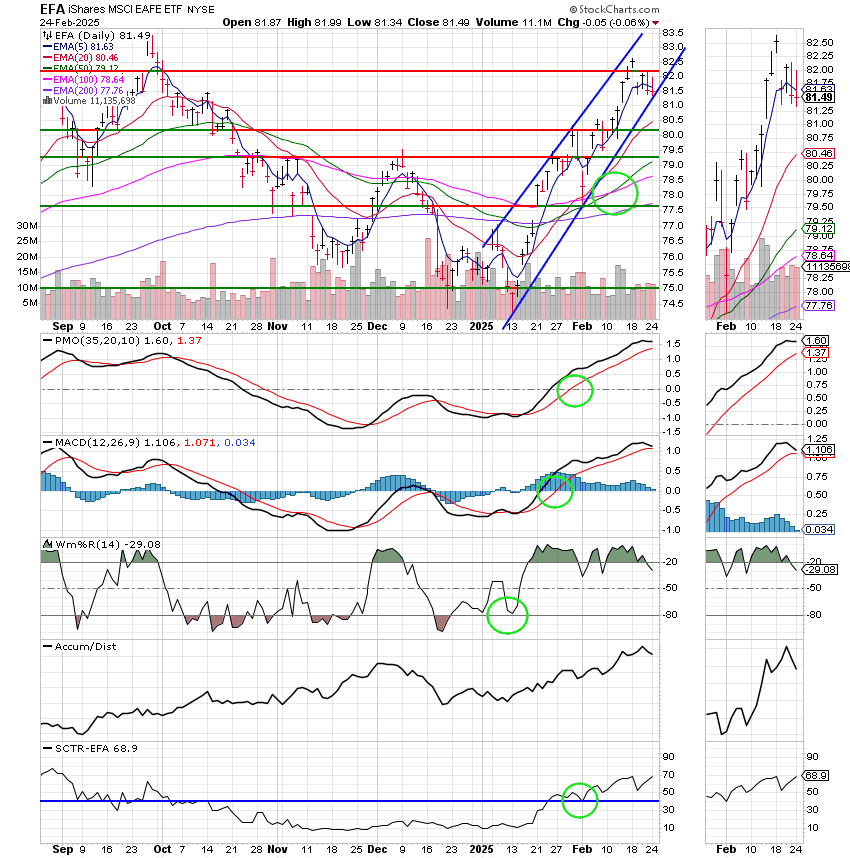

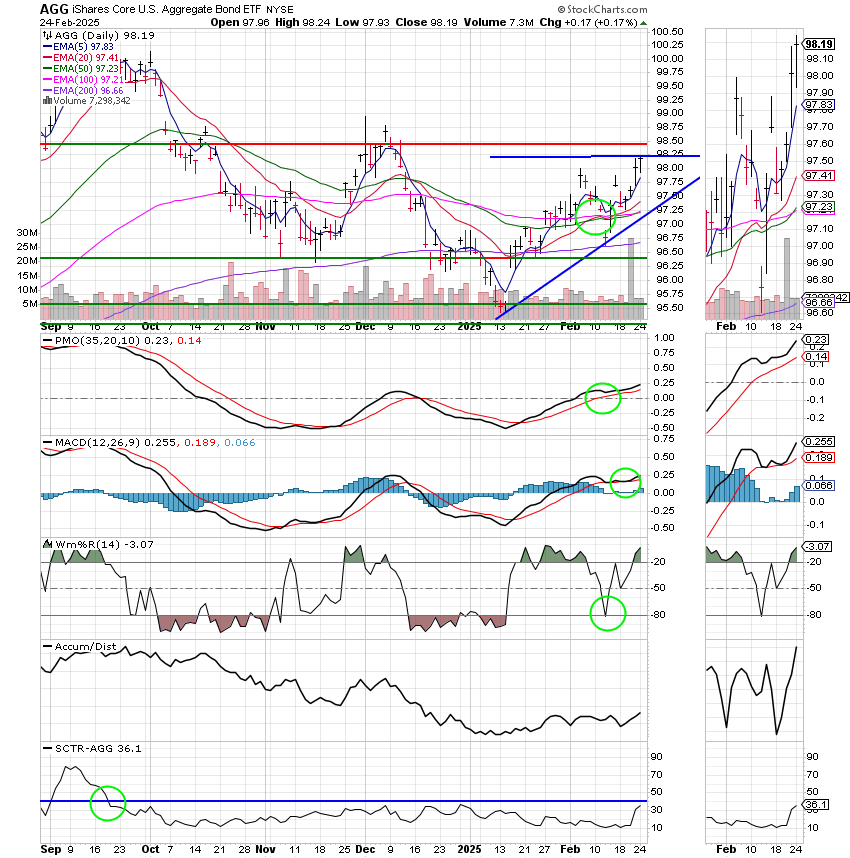

The latest action left us with the following signals: C-Sell, S-Sell, I-Buy, F-Buy. We are currently invested at 100/G. Our allocation is now +0.34% on the year. Here are the latest posted returns.

| 02/21/25 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.8784 | 19.7619 | 95.1758 | 90.4564 | 44.2773 |

| $ Change | 0.0024 | 0.0863 | -1.6490 | -2.8550 | -0.3264 |

| % Change day | +0.01% | +0.44% | -1.70% | -3.06% | -0.73% |

| % Change week | +0.09% | +0.35% | -1.63% | -4.51% | -0.44% |

| % Change month | +0.27% | +0.94% | -0.35% | -4.43% | +1.93% |

| % Change year | +0.66% | +1.46% | +2.42% | +0.34% | +5.68% |