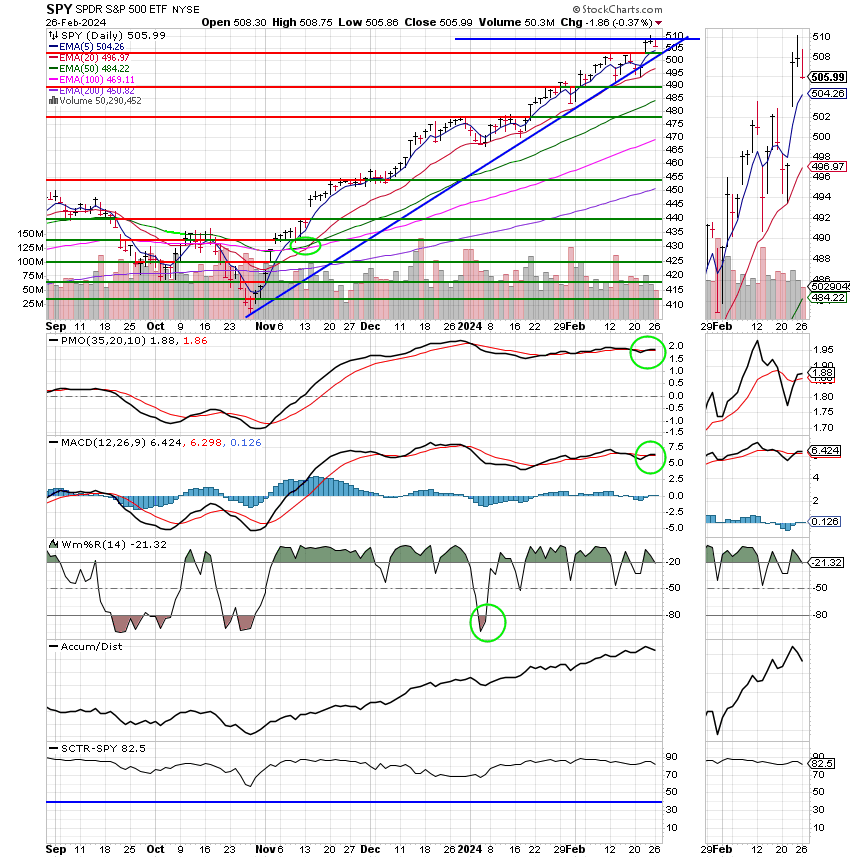

Good Evening, I’ll keep it simple and get straight to the point. There are two things that are influencing this market the most at this time and they are not new. The first is economic rep0rts and their effect on Federal Reserve Board rate decisions. The last of these rep0rts came in a little hot with the CPI and PPI presenting headwinds for the current rally. The second are this quarters earnings reports which continue to show surprising strength putting strong support under stocks. When it comes to earnings reports one area that continues to drive stock prices higher is AI (Artificial Intelligence). Reports from semiconductor companies that produce chips and components for AI have been stellar and are the biggest reason that this market continues to disregard high treasury yields and interest rates to move higher. Last weeks blowout report from Nvidia (NVDA) single handedly saved the major indices from having a losing week! A lot of market pundits argue that AI is a bubble like Dot.com was a bubble in 2000. Folks the Dot.com bubble was indeed all hype, but let me be perfectly clear, AI is not and will move us higher! There were many that thought this market would take a rest at the beginning of the month including us. Well we were all wrong and AI was the main reason for it. Again, this is not just hype. AI will change the way industry operates and that will have a profound effect on stock and stock prices. Before this is done it will touch every worker in the world. It will change the way we all work. JPMorgan Chase CEO Jamie Dimon told CNBC’s Leslie Picker that artificial intelligence is more than just a fad and will become part of the daily reality for many workers going forward. “This is not hype. This is real. When we had the internet bubble the first time around, … that was hype. This is not hype. It’s real,” Dimon said. So…am I a supporter of AI ???? Spiritually speaking, I have concerns about where this is ultimately going but as for as the here and now and the effect AI has having on the market, it’s all good. Later this week on Thursday we have the Feds Favorite inflation report the CPE (Consumer Expenditures Price Index). If it comes in hot like the CPI and PPI did last week then the battle between good earnings reports and persistent inflation will continue. That is where all the give and take in the current market comes from. So buckle up! More volatility is on the way.

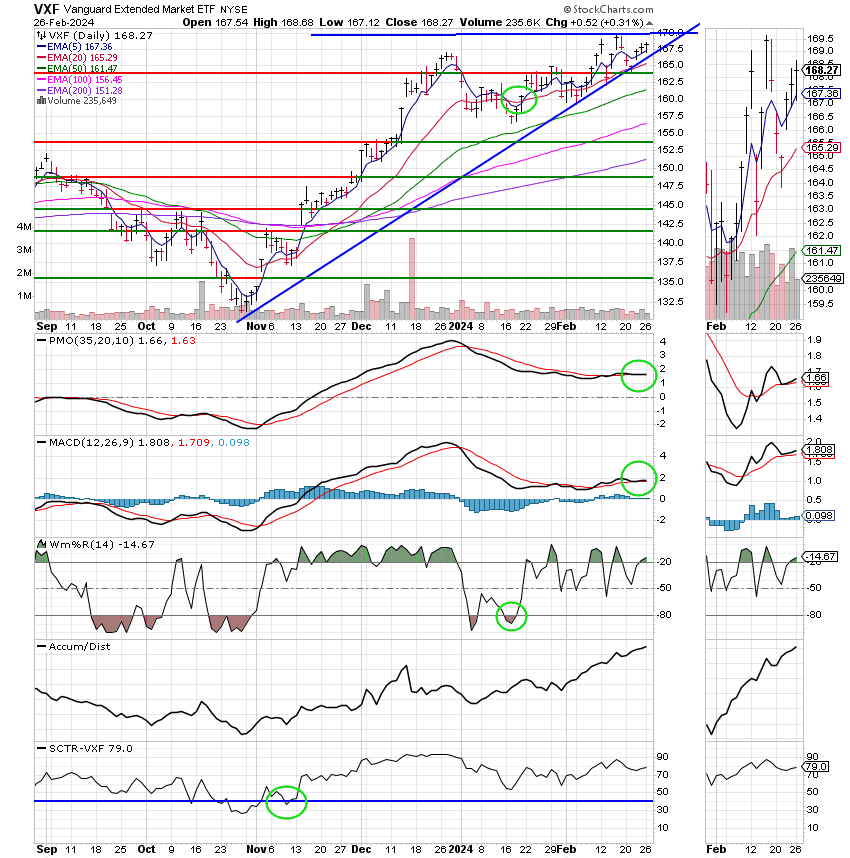

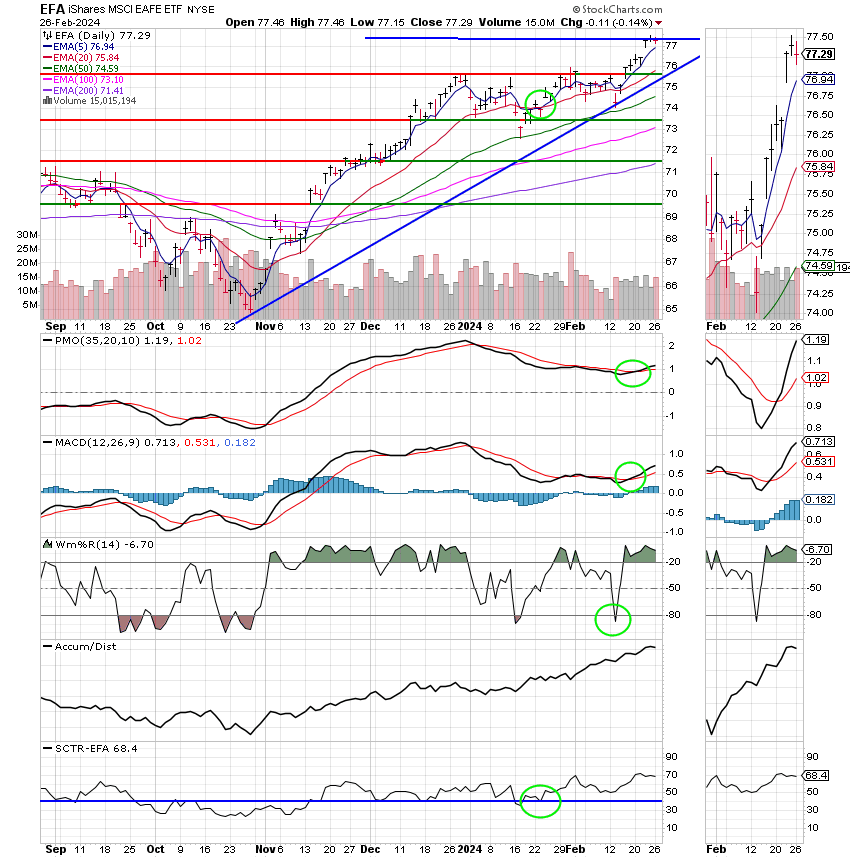

The days trading left us with the following results: Our TSP allotment posted a gain of +0.31%. For comparison, the Dow dropped -0.15%, The Nasdaq -0.13%, and the S&P 500 -0.38%. Praise God for a good day in the S Fund!

The S&P 500 closes lower on Monday, retreating from record, as rally pauses: Live updates

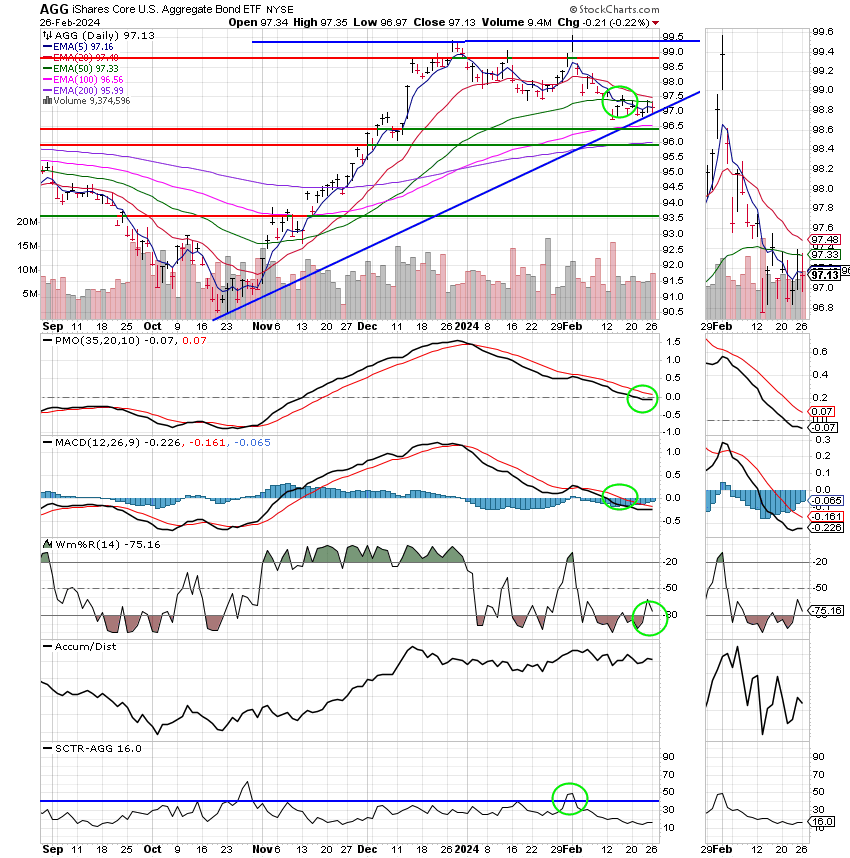

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Sell. We are currently invested at 100/S. Our allocation is now +2.43% on the year. Here are the latest posted results:

| 02/23/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.0718 | 18.9007 | 79.5017 | 78.6023 | 41.3088 |

| $ Change | 0.0020 | 0.0728 | 0.0295 | 0.1970 | 0.0836 |

| % Change day | +0.01% | +0.39% | +0.04% | +0.25% | +0.20% |

| % Change week | +0.08% | +0.25% | +1.68% | -0.16% | +1.73% |

| % Change month | +0.26% | -1.49% | +5.14% | +4.47% | +3.04% |

| % Change year | +0.61% | -1.67% | +6.91% | +1.95% | +2.81% |