Good Evening,

I know that we ended up making money today and that is good, but I have to say that this market has an artificial feel to me. It feels a lot like the machines are running it up and down. Unless you are a day trader and don’t have a time frame that is shorter than a day, it is extremely hard to make money. I know I’m not the only one that feels this way. The message boards are full of similar complaints. There’s bound to be something that will shake these machines up at some point. A nice long down trend? I still think the SEC should limit the use of this type of trading. It’s simply not healthy. It’s effect on the markets has been very pronounced since 2009 and a lot of market players are growing tired of it.

We got our “Greece is saved” rally today. It seems that the EU and Greece discussed retiring the Greek Debt and issuing something called growth-linked bonds. I’m not really sure what those are, but I’m sure we’ll all be thinking about them in our sleep before this is over. It’s just a proposal at this time so I guess we could have another “Greece is lost” sell-off if it is not approved. I know as a trader I would like to have a “Greece is gone” celebration…

Anyway, the market responded with an extremely strong late afternoon rally, rescuing the major indices from no man’s land. The action left our TSP allotment with a nice gain of +1.125%. AMP also finished in the green at +0.2289%. However, it did end the day at the back of the pack. For comparison, the Dow gained +1.14%, the Nasdaq +0.89%, and the S&P +1.30%. Some sectors, such as Health Care and Retail, lagged on the day so we’ll probably see some more upside tomorrow as they get in on the celebration of the proposed Greek solution.

Wall St. rallies late on Greek deal hopes; energy gains

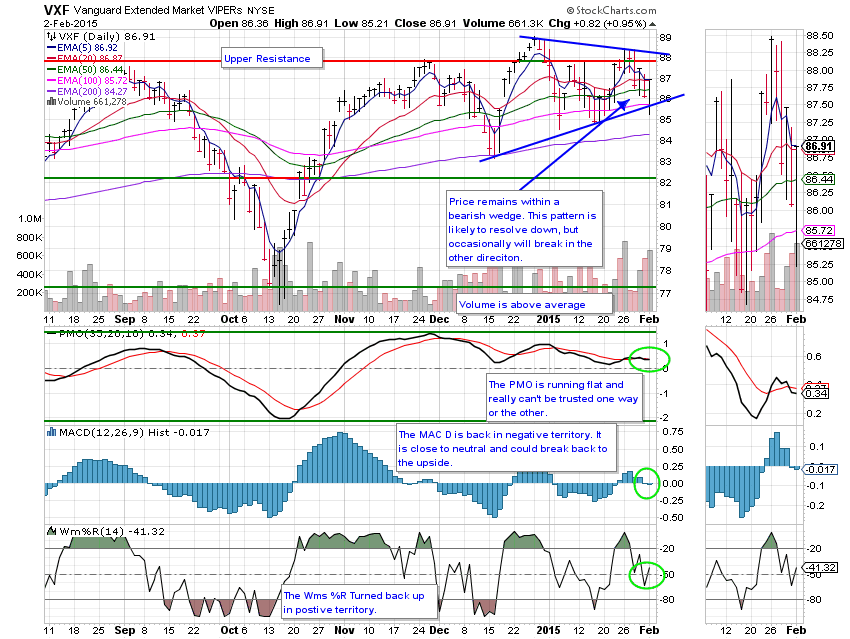

The day’s action left us with the following signals: C-Sell, S-Neutral, I-Neutral, F-Buy. As of the close of business today, we will be invested at 50/F, 50/S. Our allocation is now -2.16% on the year not including the day’s results. Here are the latest posted results:

| 01/30/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6429 | 17.1589 | 26.352 | 35.6254 | 24.5077 |

| $ Change | 0.0017 | 0.0591 | -0.3467 | -0.5482 | -0.1285 |

| % Change day | +0.01% | +0.35% | -1.30% | -1.52% | -0.52% |

| % Change week | +0.05% | +0.62% | -2.75% | -1.63% | +0.27% |

| % Change month | +0.18% | +2.13% | -2.99% | -1.85% | +1.19% |

| % Change year | +0.18% | +2.13% | -2.99% | -1.85% | +1.19% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.4363 | 22.766 | 24.5996 | 26.1097 | 14.7818 |

| $ Change | -0.0349 | -0.1231 | -0.1755 | -0.2188 | -0.1402 |

| % Change day | -0.20% | -0.54% | -0.71% | -0.83% | -0.94% |

| % Change week | -0.30% | -0.79% | -1.04% | -1.21% | -1.36% |

| % Change month | -0.08% | -0.58% | -0.83% | -1.02% | -1.18% |

| % Change year | -0.08% | -0.58% | -0.83% | -1.02% | -1.18% |

“We’ve had many unloved rallies in the last couple years but the one today was particularly frustrating for many market players. Many folks have been more cautious lately as the high level of volatility has taken a toll. It was looking like another day of choppiness but we suddenly ramped up into the close and left many folks on the sidelines scratching their heads.

Normally there is some cause and effect relationship in the market with news of some sort driving the action. We did have a good bounce in oil and there was some talk about saving Greece once again but the action had the stench of computer driven action. There were two sharp sell-offs and two sharp spikes intraday and it looked designed to exploit the emotions of traders.

Technically the strong close does help to redeem the indices but the action in individual stocks and the wild swings don’t instill a high level of confidence. The market simply didn’t have the feel of ‘natural’ buyers but that doesn’t mean we can’t continue to rally.

I can’t recall the last time I’ve seen so many frustrated traders with the indices gaining well over 1%. Trust is low and the level of bearishness is high which is going to make the contrarian bulls optimistic.

Right now this is simply a very difficult market to trade. It doesn’t much matter that the indices are up to such a great degree when the intraday action is so chaotic.”

I agree fully. All I can say about today is that we lived to fight another day. May God continue to bless our trades!