Good Evening,

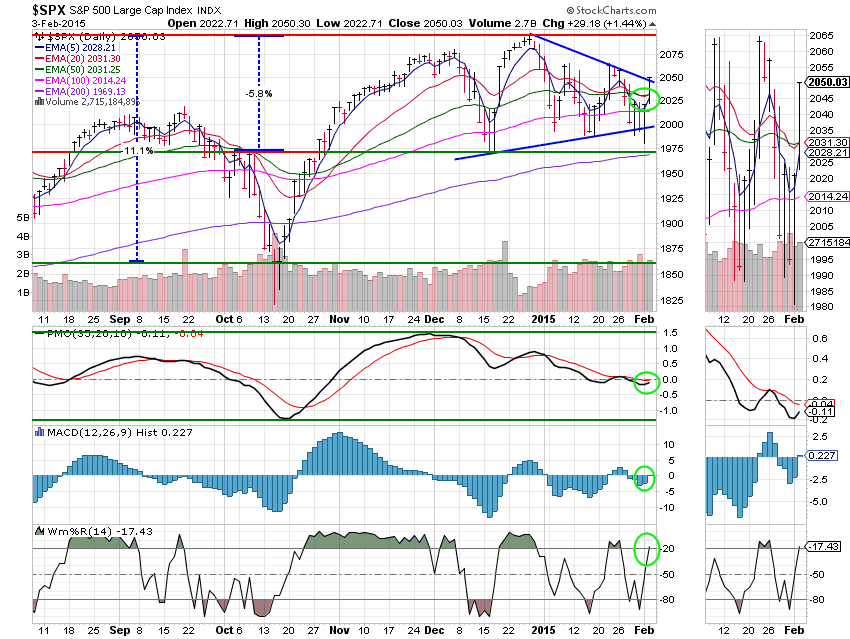

This is a very difficult market to trade right now. I had hoped it would be less difficult than last year but it is not. The momentum swings are not only very big, but very random. It is extremely easy to get caught on the wrong side of the trading if you aren’t cautious. I don’t care if we’re making money or losing money, we need to understand the dynamics of what is going on in order to have control over the market beast.

I am going to continue with my theme of what I believe the problem is with the current market. What fundamental change has occurred that makes this market different from the markets that did not behave in this matter? And equally as important, is the change here to stay? My conclusion is that high speed computer trading (or algorithm trading) has changed the market landscape. It became increasingly noticeable after 2009 and has now become even more pronounced. Yesterday and this morning are good examples.

As the market broke key support levels, there was a big reversal in the indices obviously driven by the computer programs. It is exactly the sort of manipulation that we see from computer trading. The break in support triggers sell stops and causes the bears to press, which is normal. However, that is the ideal time for the computers to jump in and create a bounce that catches traders leaning the wrong way. Am I saying what you think I’m saying? Yes I am. It is intentional manipulation of the markets by the machines and most notably those that program them. As far as I’m concerned, this type of trading should be banned because it will ultimately lead to disaster. A lot of folks are dealing with it by buying and holding, but there will be a day when this market will drop so fast that they will be powerless to do anything about it.

It makes me think of the old TV series Lost in Space with the Robot proclaiming ‘Danger Will Robinson, Danger’. If the SEC does not deal with this issue, that painful day will surely come… For now, our job is to learn how to work around this manipulation. We have had a little success using longer manipulators, but will more than likely feel yet a little more pain when we are forced to take defensive measures. The best answer I can give for that problem is that we’re working on it! All that said, I have no doubt that God will guide us through this market just as He did during the Dot Com bubble and the Great Recession. All we have have to do is trust Him!

The day’s action was volatile again, but left us with some nice gains. Our TSP allotment added +0.645% while AMP tacked on +0.583%. For comparison, the Dow gained +1.76%, the Nasdaq +1.09% and the S&P +1.44%. TSP and AMP are currently invested more conservatively to protect against the downside given all the volatility. God willing, we will keep more of what we make.

Wall Street posts second day of strong gains, led by energy

| 02/02/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6446 | 17.1642 | 26.6945 | 35.9384 | 24.6227 |

| $ Change | 0.0017 | 0.0053 | 0.3425 | 0.3130 | 0.1150 |

| % Change day | +0.01% | +0.03% | +1.30% | +0.88% | +0.47% |

| % Change week | +0.01% | +0.03% | +1.30% | +0.88% | +0.47% |

| % Change month | +0.01% | +0.03% | +1.30% | +0.88% | +0.47% |

| % Change year | +0.19% | +2.16% | -1.73% | -0.99% | +1.67% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.4736 | 22.8804 | 24.7579 | 26.3025 | 14.9039 |

| $ Change | 0.0373 | 0.1144 | 0.1583 | 0.1928 | 0.1221 |

| % Change day | +0.21% | +0.50% | +0.64% | +0.74% | +0.83% |

| % Change week | +0.21% | +0.50% | +0.64% | +0.74% | +0.83% |

| % Change month | +0.21% | +0.50% | +0.64% | +0.74% | +0.83% |

| % Change year | +0.13% | -0.08% | -0.19% | -0.29% | -0.37% |