Good Evening,

Oil was down, bad news out of Greece, the S&P 500 closed down. That’s really all there is to it. We can talk about the world news, but these two issues are what is and has been driving the market. Two that are working are: #1 Consumer discretionary stocks are doing well with the dip in oil and #2 Home building stocks are feeding off of low interest rates. Nothing we can really do about that in TSP, but in AMP…

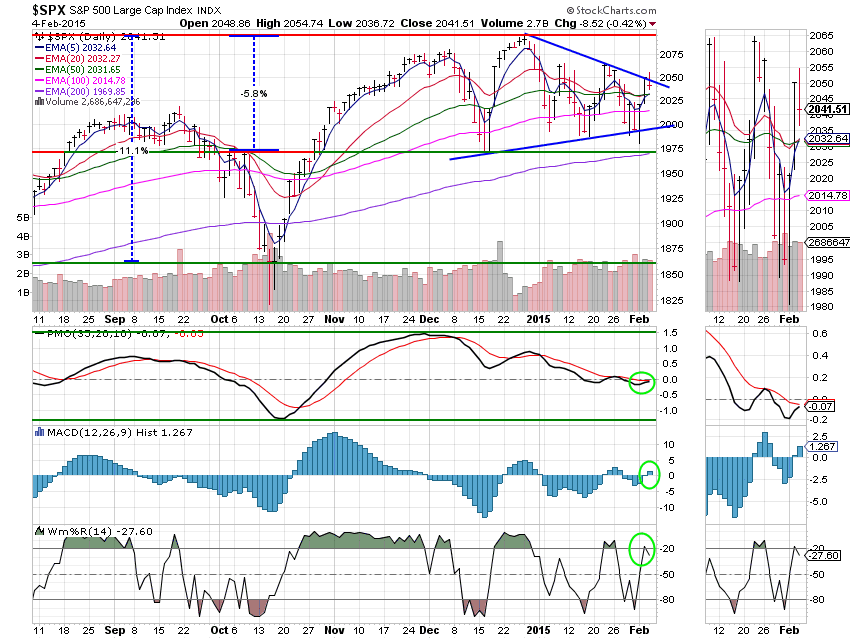

The day’s mixed action left us with the following results: Our TSP allotment slipped back -0.11% while AMP was king of the day at +0.12%. For comparison, the Dow added +0.04%, the Nasdaq lost -0.23% and the S&P dropped -0.42%. Our TSP and AMP allotments fared well against the big three. Oh, by the way my target for oil is still in the $35.00 to $42.00 per barrel range. I believe that oil will not bottom until the fourth quarter (Oct- Dec) of 2015.

Wall St. ends lower with oil prices, renewed Greece worries

| 02/03/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6452 | 17.0902 | 27.0804 | 36.558 | 25.0511 |

| $ Change | 0.0006 | -0.0740 | 0.3859 | 0.6196 | 0.4284 |

| % Change day | +0.00% | -0.43% | +1.45% | +1.72% | +1.74% |

| % Change week | +0.02% | -0.40% | +2.76% | +2.62% | +2.22% |

| % Change month | +0.02% | -0.40% | +2.76% | +2.62% | +2.22% |

| % Change year | +0.20% | +1.72% | -0.31% | +0.72% | +3.44% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.5246 | 23.0597 | 25.0096 | 26.6121 | 15.1042 |

| $ Change | 0.0510 | 0.1793 | 0.2517 | 0.3096 | 0.2003 |

| % Change day | +0.29% | +0.78% | +1.02% | +1.18% | +1.34% |

| % Change week | +0.51% | +1.29% | +1.67% | +1.92% | +2.18% |

| % Change month | +0.51% | +1.29% | +1.67% | +1.92% | +2.18% |

| % Change year | +0.42% | +0.70% | +0.82% | +0.88% | +0.97% |

Remember what I said about the I Fund? Look at that change per year. However, it would be fair to say that nice gain may be hard to hold with all the turmoil in the Euro Zone. That said, the I fund has been beat down the most and thus has the most room to run if the conditions become favorable. It bares watching.