Good Evening, Renewed concern about global growth drove stocks down again today. The market rebounded late in the session to finish off the lows of the day, but all in all it was still an ugly day.

The days selling left us with the following results. Our TSP allotment maintained it’s ground in the G Fund. For comparison, the Dow lost -1.10%, the Nasdaq -1.82%, and the S&P 500 -1.42%. It was another good day to be in the G Fund.

Growth worries, rate hike uncertainty pull Wall Street down

The days action left us with the following signals: C-Neutral, S-Sell, I-Neutral, F-Buy. We are currently invested at 100/G. Our allocation is now +0.22% on the year not including the days results. Here are the latest posted results:

| 02/05/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9477 | 17.241 | 25.4024 | 30.8387 | 22.167 |

| $ Change | 0.0007 | 0.0077 | -0.4765 | -0.9365 | -0.2496 |

| % Change day | +0.00% | +0.04% | -1.84% | -2.95% | -1.11% |

| % Change week | +0.03% | +0.20% | -3.03% | -4.11% | -2.52% |

| % Change month | +0.03% | +0.20% | -3.03% | -4.11% | -2.52% |

| % Change year | +0.22% | +1.69% | -7.84% | -12.48% | -8.00% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.5097 | 22.2969 | 23.6973 | 24.8754 | 13.926 |

| $ Change | -0.0615 | -0.1880 | -0.2761 | -0.3389 | -0.2170 |

| % Change day | -0.35% | -0.84% | -1.15% | -1.34% | -1.53% |

| % Change week | -0.58% | -1.41% | -1.95% | -2.27% | -2.59% |

| % Change month | -0.58% | -1.41% | -1.95% | -2.27% | -2.59% |

| % Change year | -1.48% | -3.93% | -5.45% | -6.38% | -7.32% |

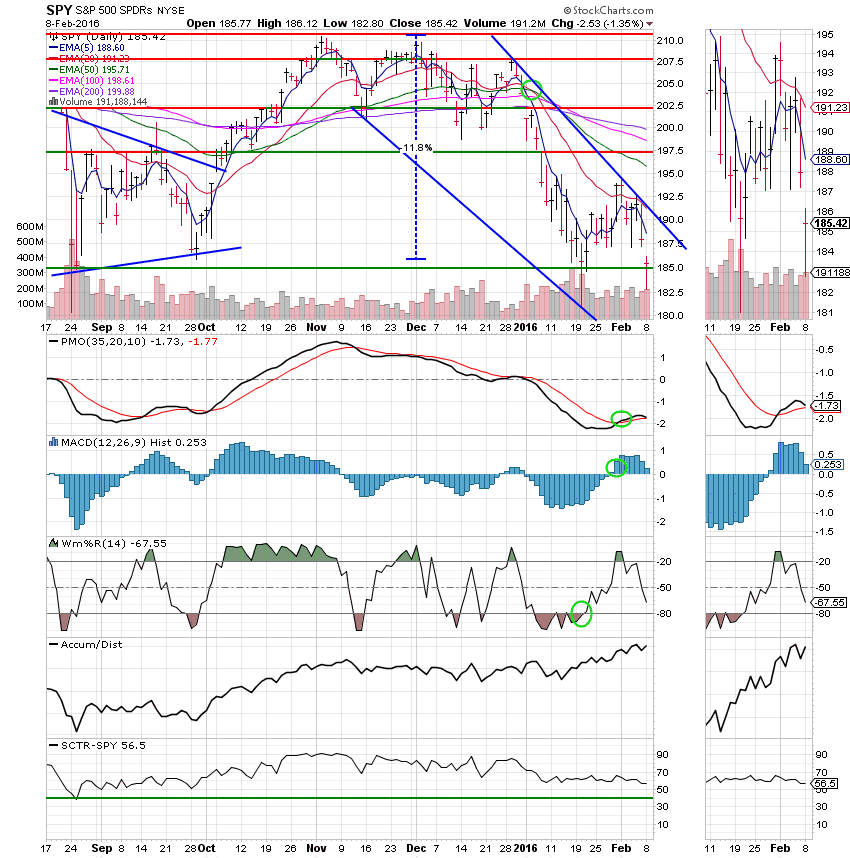

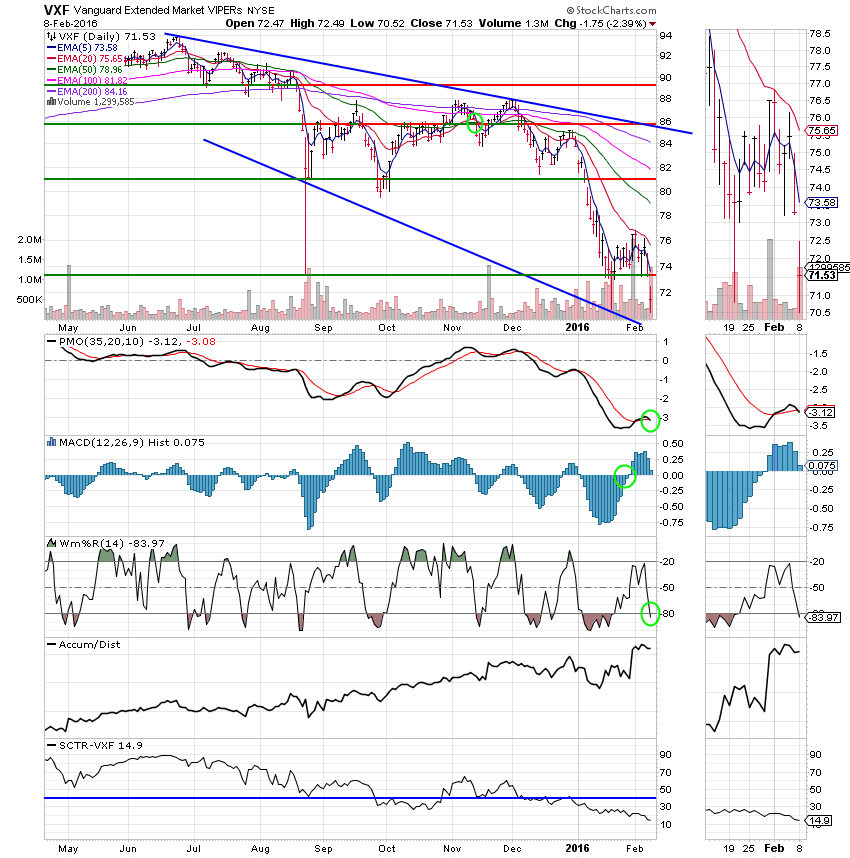

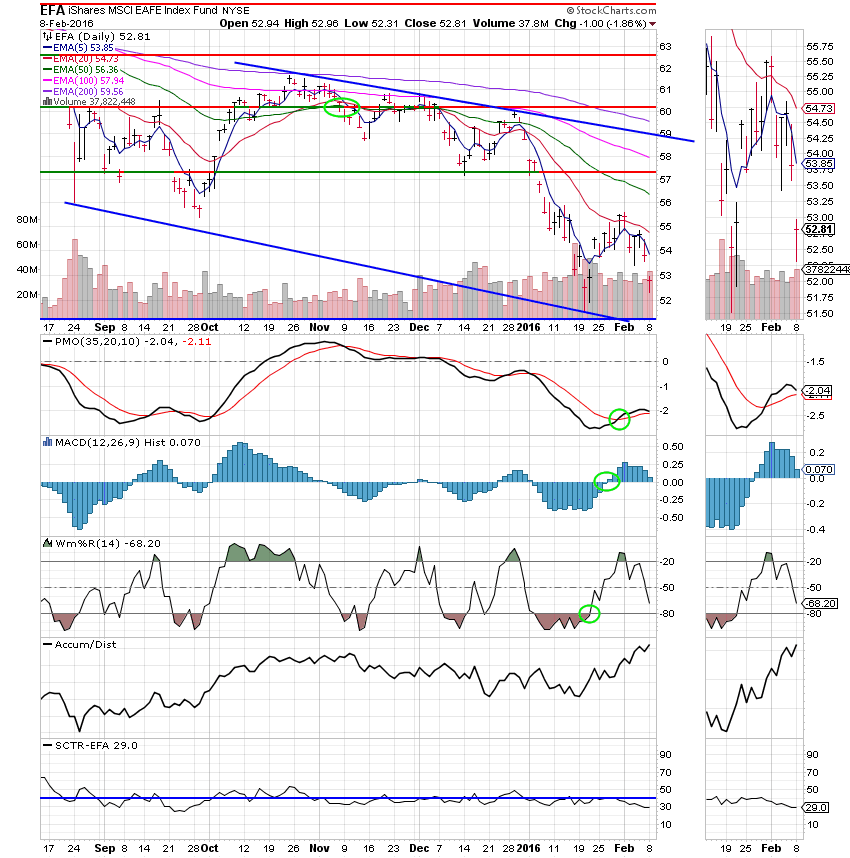

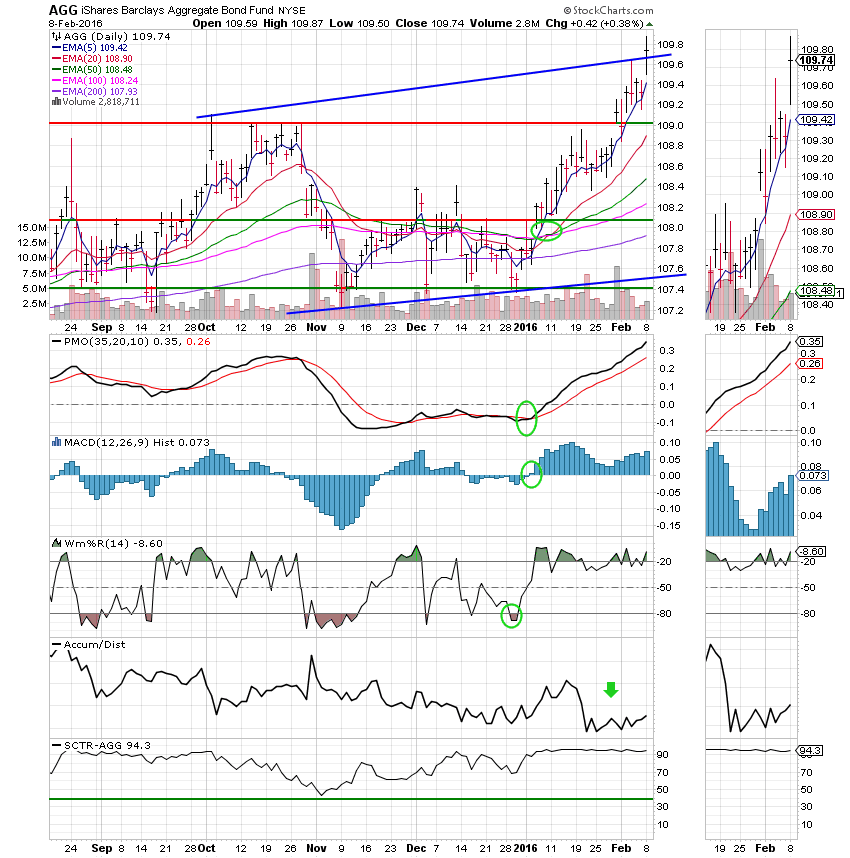

Lets take a look at the charts: (All signals annotated with Green Circles) If you click on the charts they will become larger!

C Fund: Price tested support again at 185. I really thought it was going to close under it. If this support breaks, the next support is 145 or 1450 for the SPX. I don’t know for sure, but I believe that this support will break. This is a bear market and I don’t think it’s finished going down. Any rally should to be treated as a countertrend bounce and a bull trap!

S Fund: The S Fund generated a sell signal today as the PMO and WMS%R moved into negative configurations. Small and Mid Caps got hammered yet again!

I Fund:

F Fund: The F Fund keeps moving along. In the absence of interest rate increases this is the place to be. One could even argue that the chart is predicting that there will be no rate increases for the foreseeable future.

The Trend is down and we must respect it. I don’t know when this market will bottom. But I do believe this. When timing the market is the objective, it is better to be late than early and my charts tell me it is still early.