Good Evening,

Forget oil for now! Nobody even noticed when it dropped back today. No Sir, we’re on a mission. We have to go save Greece…..again. Market players loaded up today in anticipation of an agreement between the European Commission (EC) and Greece on Greek Debt tomorrow that could stabilize things in Europe. In a way you can’t blame them; prior to the prominence of the V-Shaped recovery, the “Greece is saved” rallies were the surest ways to make a buck. When you think about it, the whole concept is crazy, but then again who in recent history could say the market has been sane. After all, as I mentioned the other day, the Greek GDP is only about the same size as Proctor and Gamble. If P&G went broke, do you really think that the whole world market would crash?

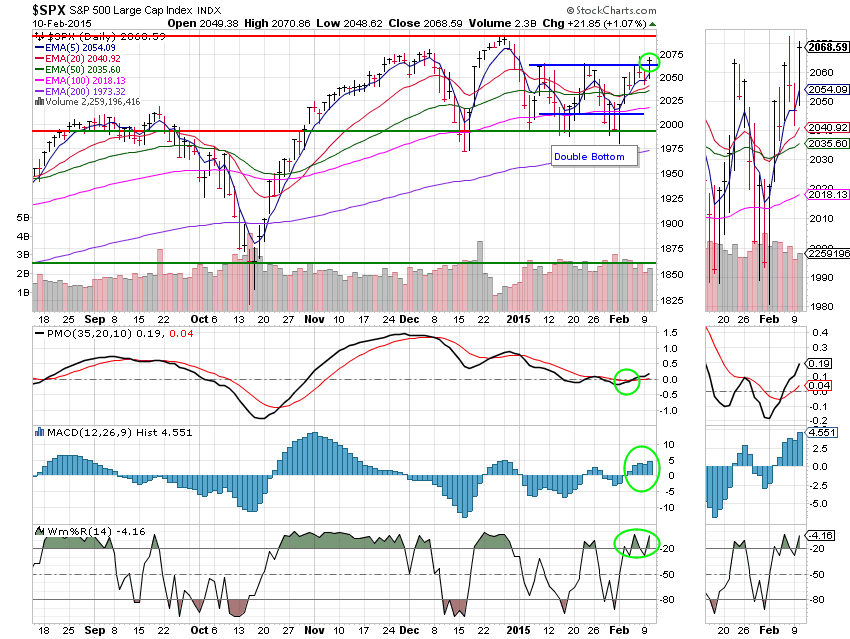

At any rate, the thing that concerns me most at this time, the thing that most threatens the next rally, is the market being disappointed in the outcome of the meeting between Greece and the EC tomorrow. I wonder just how sure of a thing that a positive outcome to this meeting really is? After all, the new Greek government hasn’t exactly shown a lot of interest in pleasing the EC. So one has to ask, how serious are they about making a deal in the first place? Up to now, it’s been their way or the highway. It says here that if the market isn’t satisfied with the outcome of this meeting that you’d better run and hide because it’s going to get ugly. On the flip side, if it is satisfied, the rally will be on. A positive outcome to this meeting could well be the catalyst for a nice run into the spring. All that said, we were able to move up into the close on today’s positive action. So far, so good I guess…

The day’s action left us with the following results. Our TSP allotment gained +0.893% and AMP added +0.79%. For comparison the Dow gained +0.79%, the Nasdaq, +1.30%, the S&P 1.07%, AT&T +0.61%, and Alaska Air Group added +2.93%. That should give you a good idea how our allotments are performing.

Wall St. rises on Greek deal hopes; Apple hits record

The day’s action left us with the following signals: C-Buy, S-Buy, I-Neutral, F-Neutral. We are currently invested at 30/C, 40/S, 30/I. Our allotment is now -0.89% on the year, not including today’s results. Here are the latest posted results:

| 02/09/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6491 | 16.9843 | 27.0591 | 36.581 | 24.8245 |

| $ Change | 0.0020 | -0.0021 | -0.1144 | -0.2223 | -0.0885 |

| % Change day | +0.01% | -0.01% | -0.42% | -0.60% | -0.36% |

| % Change week | +0.01% | -0.01% | -0.42% | -0.60% | -0.36% |

| % Change month | +0.04% | -1.02% | +2.68% | +2.68% | +1.29% |

| % Change year | +0.22% | +1.09% | -0.39% | +0.78% | +2.50% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.5122 | 23.0191 | 24.9544 | 26.5476 | 15.063 |

| $ Change | -0.0135 | -0.0491 | -0.0706 | -0.0883 | -0.0567 |

| % Change day | -0.08% | -0.21% | -0.28% | -0.33% | -0.38% |

| % Change week | -0.08% | -0.21% | -0.28% | -0.33% | -0.38% |

| % Change month | +0.44% | +1.11% | +1.44% | +1.68% | +1.90% |

| % Change year | +0.35% | +0.53% | +0.60% | +0.64% | +0.70% |