Good Evening,

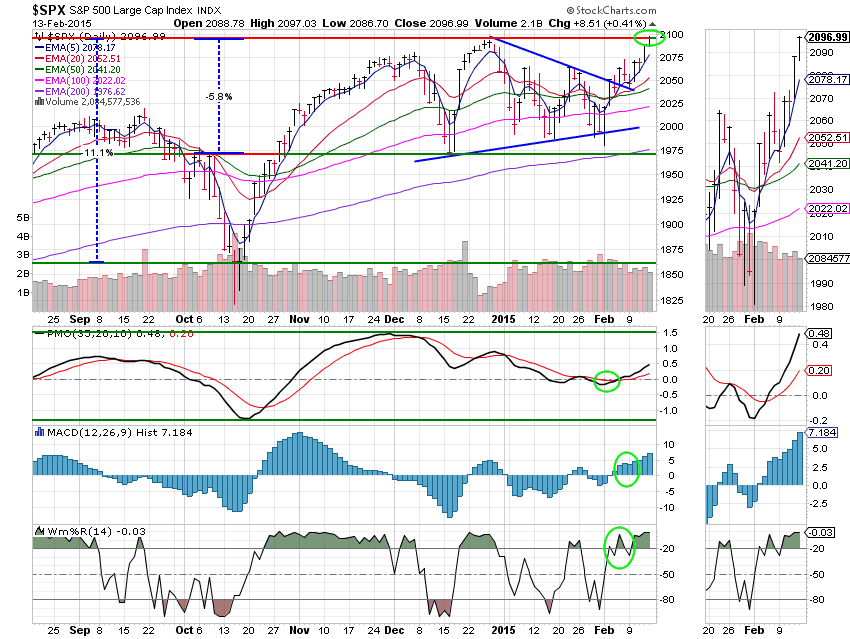

Friday the 13th was just another lucky day for us. Traders seemed reluctant to load up ahead of the long weekend (the market will be closed Monday for President’s Day), but decided to do so in the afternoon, powering the indices to their highs for the day. The S&P 500 set a new record which was in line with our analysis. It’s good when we are right! The market appears to be pricing in an agreement on Greek debt. However, there may be more room to run as many market players were willing to hold positions over the long weekend. Simply put, they are betting that the market will move up Tuesday morning and they don’t want to be left behind. That bodes well for us…..

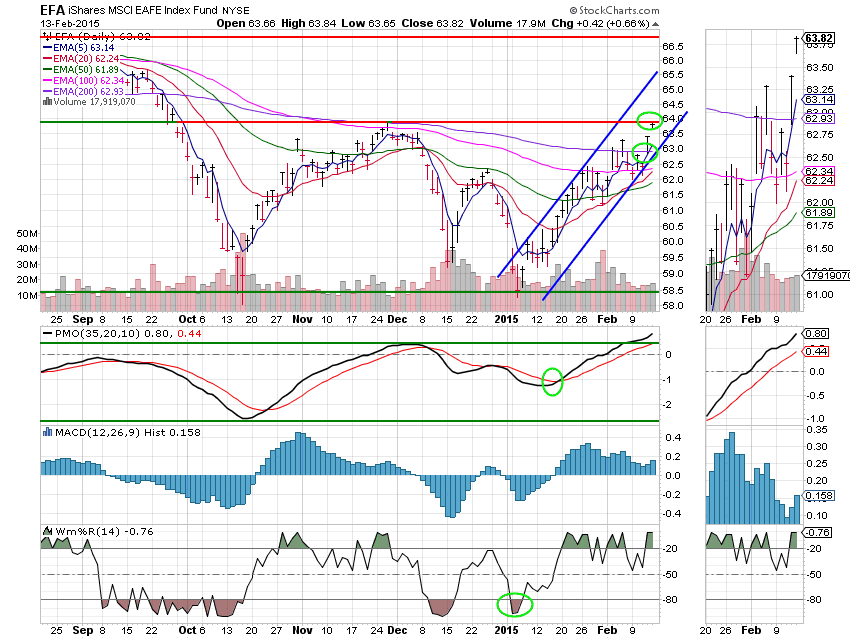

The day’s action gave us the following results. Both TSP and AMP posted solid gains again today with AMP posting its fourth gain in a row! Our TSP allotment added +0.589% and AMP gained +0.334%. For comparison the Dow was up +0.26%, The Nasdaq +0.75%, the S&P +0.41%, AT&T +0.14%, Alaska Air Group -0.30%, Facebook -0.64%, and Apple added another +0.49%. I think both our allocations fared well today. God be praised!

S&P closes at record, Nasdaq hits 15-year high

| 02/12/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.651 | 16.9681 | 27.6285 | 37.2625 | 25.0703 |

| $ Change | 0.0006 | 0.0116 | 0.2704 | 0.4049 | 0.3458 |

| % Change day | +0.00% | +0.07% | +0.99% | +1.10% | +1.40% |

| % Change week | +0.03% | -0.11% | +1.67% | +1.25% | +0.63% |

| % Change month | +0.06% | -1.11% | +4.84% | +4.60% | +2.30% |

| % Change year | +0.24% | +0.99% | +1.70% | +2.66% | +3.52% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.5752 | 23.2209 | 25.2369 | 26.8951 | 15.2845 |

| $ Change | 0.0400 | 0.1335 | 0.1863 | 0.2280 | 0.1470 |

| % Change day | +0.23% | +0.58% | +0.74% | +0.85% | +0.97% |

| % Change week | +0.28% | +0.66% | +0.85% | +0.97% | +1.09% |

| % Change month | +0.80% | +2.00% | +2.59% | +3.01% | +3.40% |

| % Change year | +0.71% | +1.41% | +1.74% | +1.96% | +2.18% |