Good Evening,

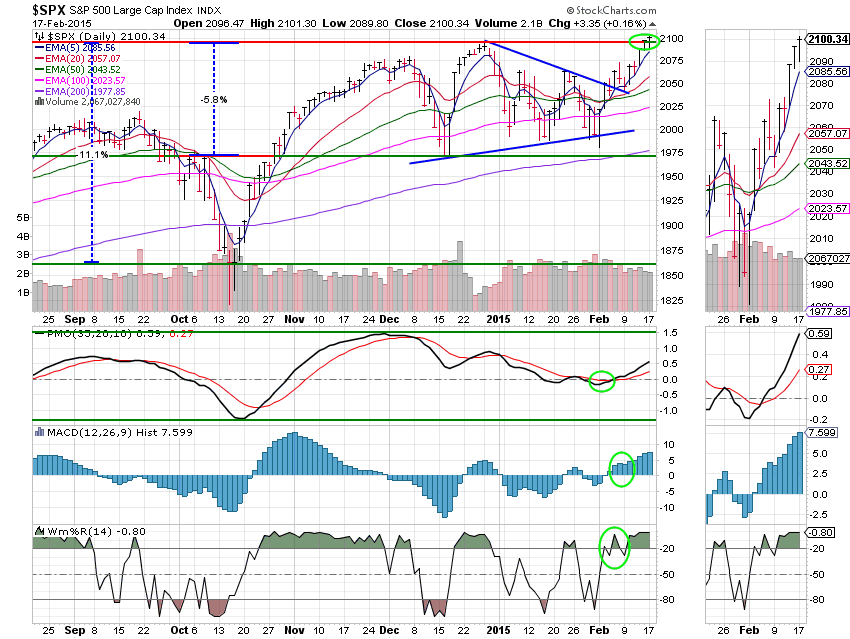

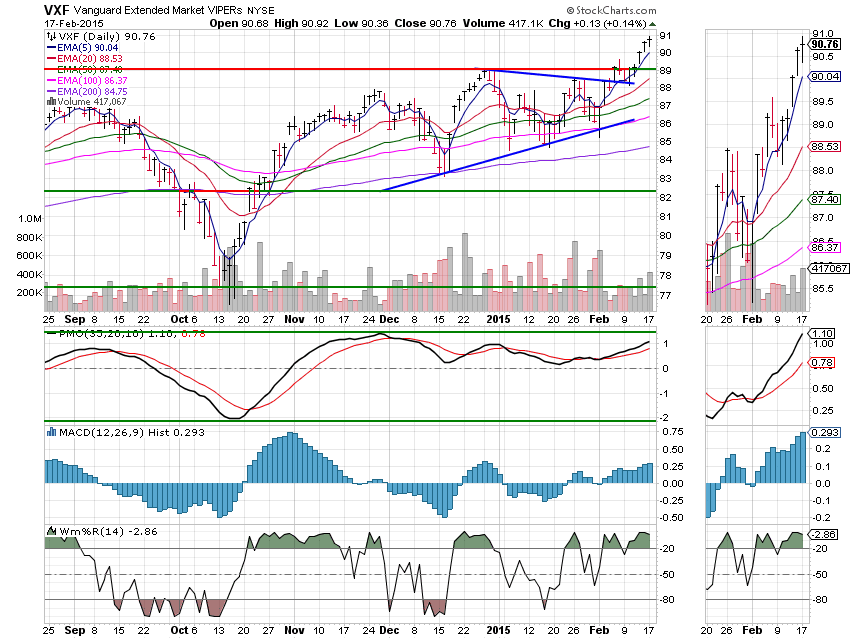

Russia’s trying to run out the clock on the Ukraine and there is no deal between Greece and the European Union. The market ignored these obvious sell the news situations and hung around in flat territory for the whole session. Although, each of the major indices did close small gains. The S&P 500 even eked out another record high at 2100.34. The day’s trading left us with the following results. Our TSP allotment gained +0.176% and AMP added +0.078%. For comparison the Dow was up +0.16%, the Nasdaq +0.11%, the S&P 500 +0.16%, Alaska Air Group -0.53%, AT&T +0.14%, Facebook -0.18%, and Apple made another solid gain of +0.59%. With the exception of a few stocks like Apple everything was pretty flat.

S&P 500 ends at record high on Greece hopes, as bonds drop

| 02/16/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6516 | 16.9458 | 27.7434 | 37.5082 | 25.3 |

| $ Change | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| % Change day | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change week | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change month | +0.06% | -1.24% | +5.28% | +5.28% | +3.23% |

| % Change year | +0.24% | +0.86% | +2.13% | +3.34% | +4.47% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.5949 | 23.2914 | 25.3361 | 27.0172 | 15.3643 |

| $ Change | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| % Change day | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change week | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change month | +0.91% | +2.31% | +2.99% | +3.48% | +3.94% |

| % Change year | +0.83% | +1.71% | +2.14% | +2.42% | +2.71% |

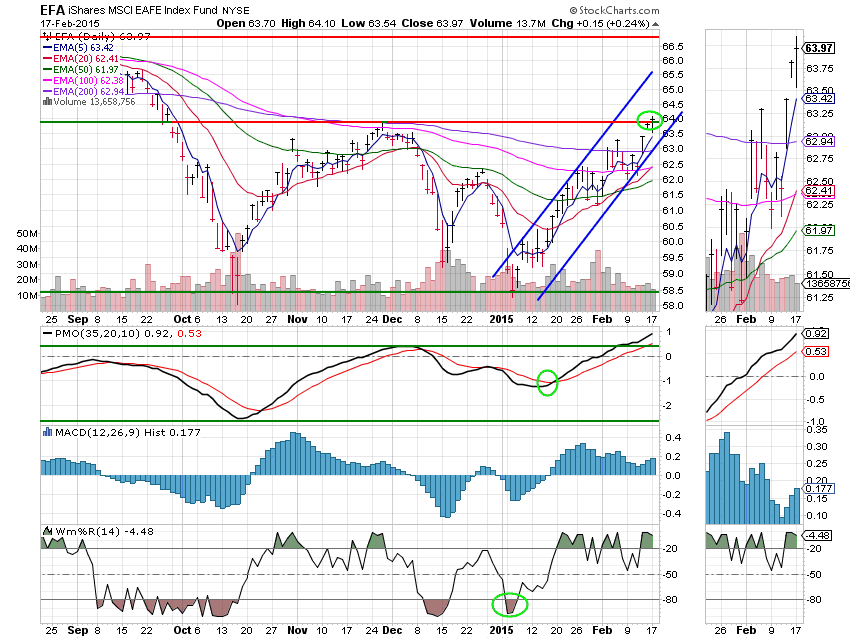

I Fund: This Fund broke upper resistance at 63.90 today which is bullish. Note the ascending channel.

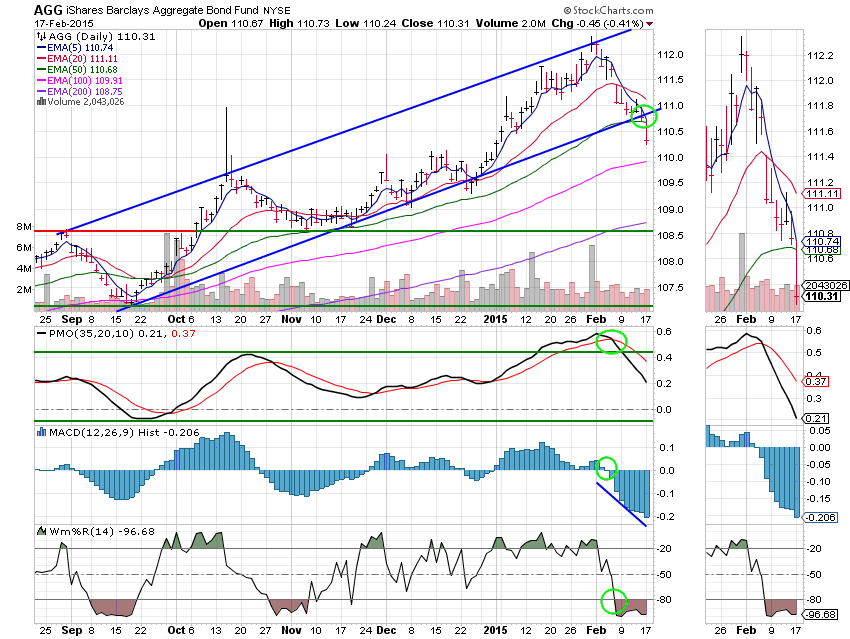

Although they remain somewhat extended, as they have been for the past 14 months or so, the charts for our equity based funds are looking like the can move higher. Also supporting this observation is the fact that bond prices are dropping. In our bond fund (the F Fund), price dropped out of its established ascending channel today. The AGG has been in that channel for a long time. This tells me two things. #1 Money is flowing out of of bonds and #2 This price drop will likely continue. If you couple this with the fact that we are entering one of the best seasonal periods of the year, it makes a strong case for higher equity prices over the next 6 weeks. With God’s help, we appear to be positioned well for the current market. Our task remains to monitor the charts for any change in the trend. That’s all for tonight. Have a great evening and may God continue to bless your trades!