Good Evening,

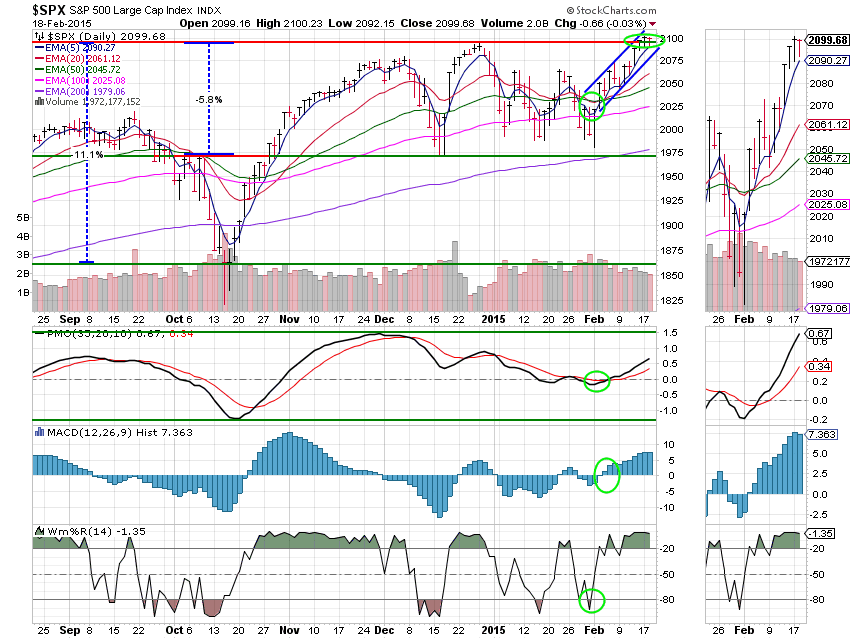

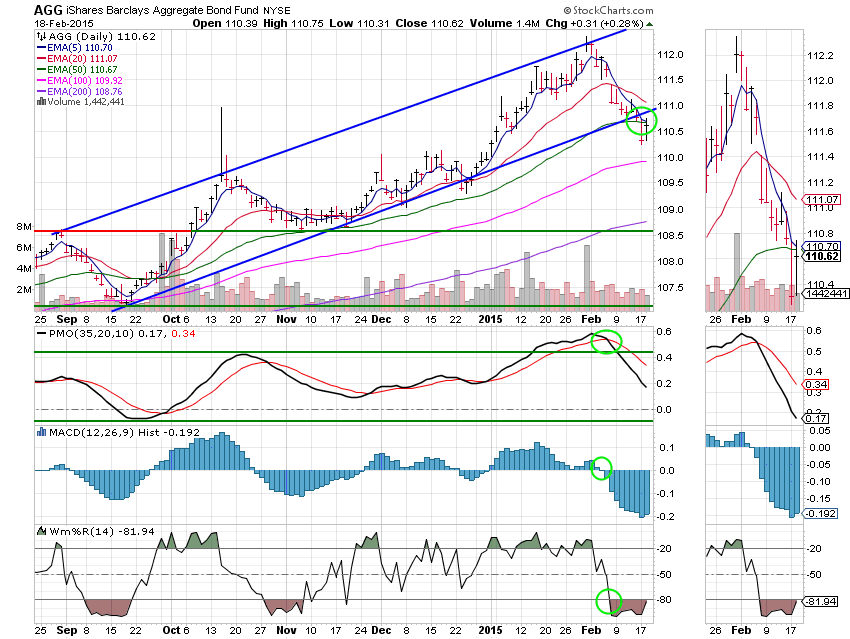

The EU gave Greece a two week extension to work things out. The FED minutes from their last meeting released today were more dovish that most thought they would be. The market didn’t exactly celebrate, but it did come back from the lows of the day to close flat to slightly off. Also worth noting, bonds rallied on the news that an interest rate increase was unlikely in the near future. If you want to know the details you can read the Reuters report below. I’m more concerned with the what than the why.

The day’s action left us with the following results. Our TSP allotment ended up +0.304% and AMP was a model of consistency with its 6th straight gain adding +0.2508%. For comparison, the Dow was off -0.10%, the Nasdaq added +0.14%, the S&P slid back -0.03%, AT&T was -0.63%, Alaska Air Group was +2.57%, Facebook was +1.47% and Apple added another +0.69%. It was a flat day for the market, but a decent day for us! The Lord blessed us with another good day. Give Him the all the praise!!!

Wall St. ends nearly flat; Fed minutes support

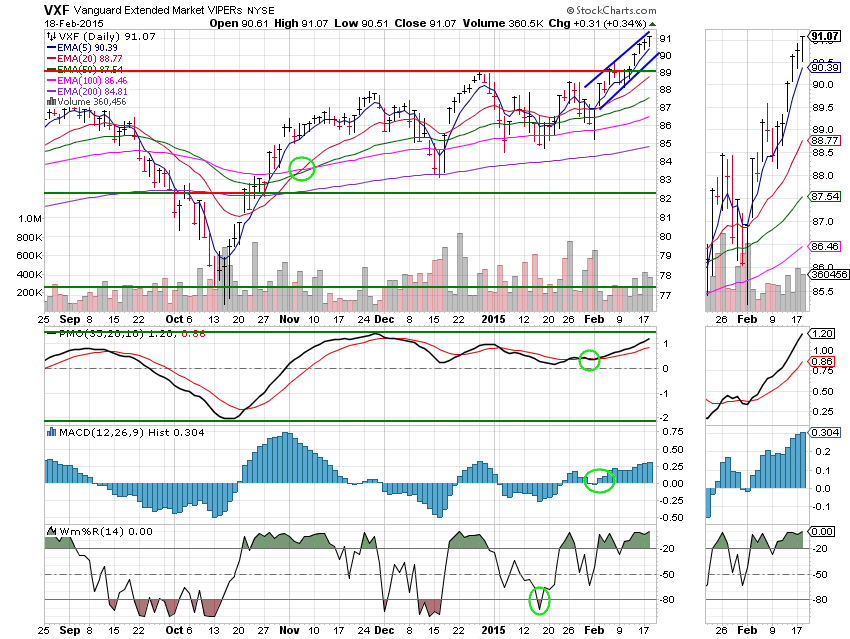

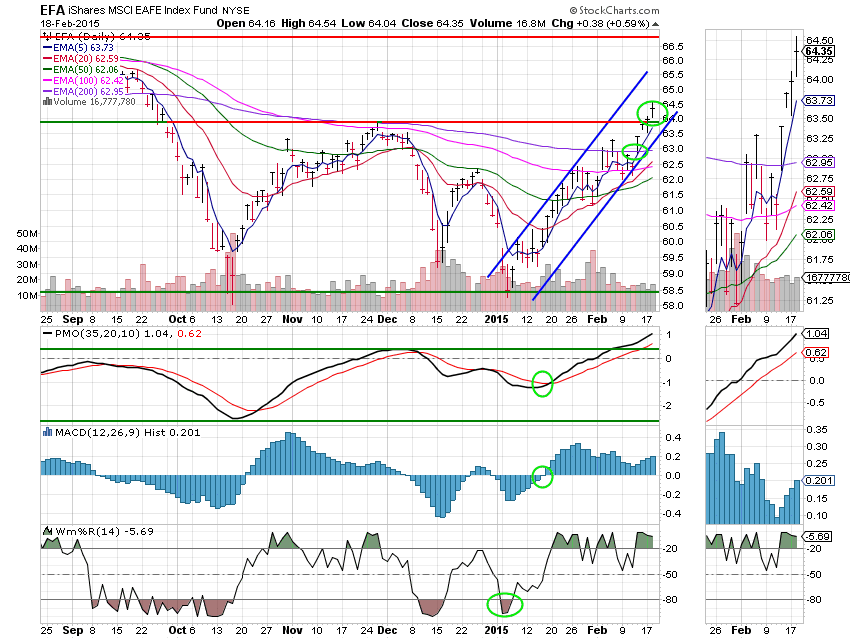

The day’s action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Neutral. We are currently invested at 30/C, 40/S, 30/I. Our allocation is now +1.58% on the year not including today’s gains. Here are the latest posted results:

| 02/17/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6543 | 16.861 | 27.792 | 37.5496 | 25.3334 |

| $ Change | 0.0027 | -0.0848 | 0.0486 | 0.0414 | 0.0334 |

| % Change day | +0.02% | -0.50% | +0.18% | +0.11% | +0.13% |

| % Change week | +0.02% | -0.50% | +0.18% | +0.11% | +0.13% |

| % Change month | +0.08% | -1.74% | +5.46% | +5.40% | +3.37% |

| % Change year | +0.26% | +0.35% | +2.31% | +3.45% | +4.60% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.5974 | 23.305 | 25.3552 | 27.0409 | 15.3809 |

| $ Change | 0.0025 | 0.0136 | 0.0191 | 0.0237 | 0.0166 |

| % Change day | +0.01% | +0.06% | +0.08% | +0.09% | +0.11% |

| % Change week | +0.01% | +0.06% | +0.08% | +0.09% | +0.11% |

| % Change month | +0.92% | +2.37% | +3.07% | +3.57% | +4.05% |

| % Change year | +0.84% | +1.77% | +2.21% | +2.51% | +2.82% |