Good Evening,

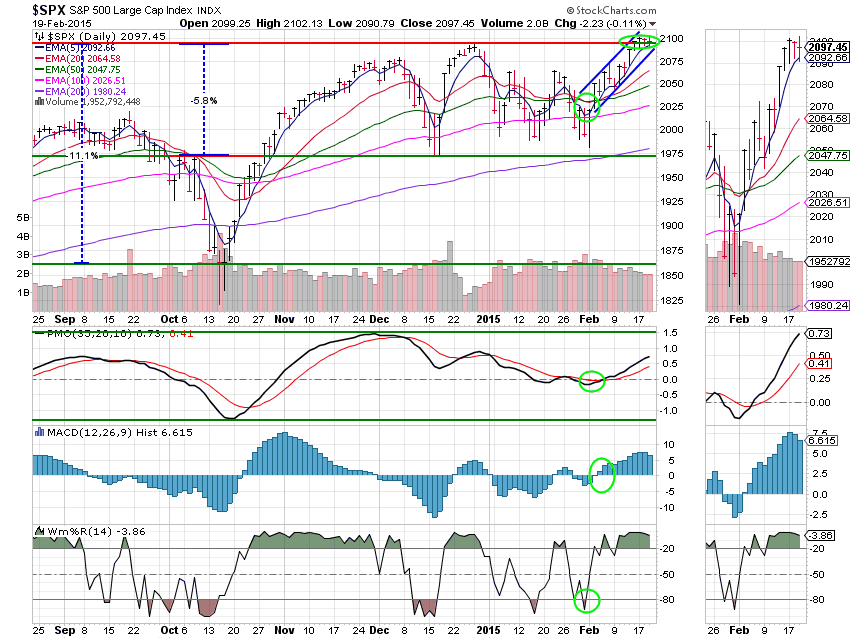

The market was flat with a slightly negative bias as it waited another day for a decision/agreement on the Greek debt issue. It is my expectation that the market won’t make any big moves one way or the other until this situation is resolved. This market continues to feel different than it did in the past and that baffles many traders, who (even after the five years that have passed since the mortgage crisis) are still looking for it to trade like it used to. They don’t want to accept the fact that there is a fundamental shift in the way that this market runs. If you use the rules that you used prior to 2008 you will never be in line with this market. I know that first hand, as I tried to do so last year and under-performed as a result. It was the worst performance that our allocation ever logged. Adapting to this new market is the biggest challenge that exists and it will continue to be so for the foreseeable future. Better get used to it.

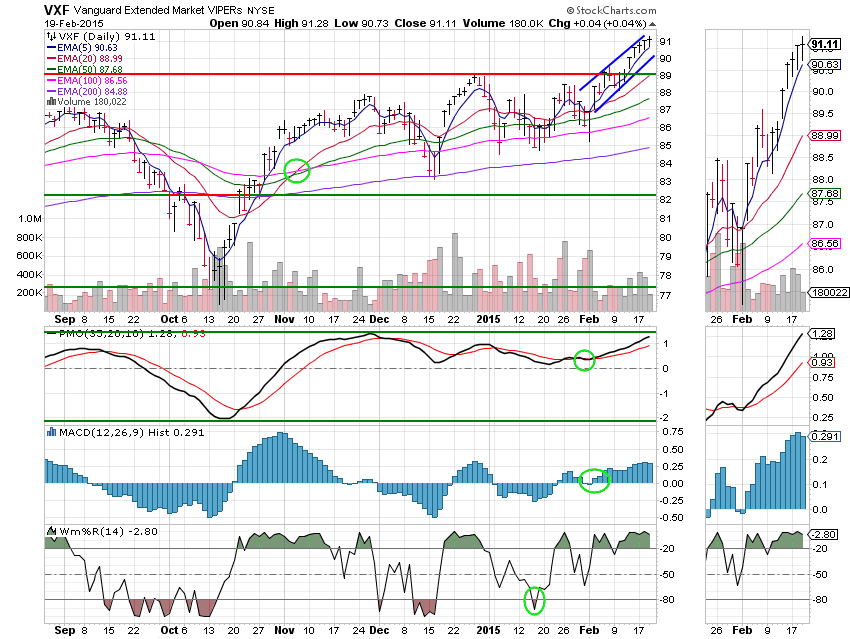

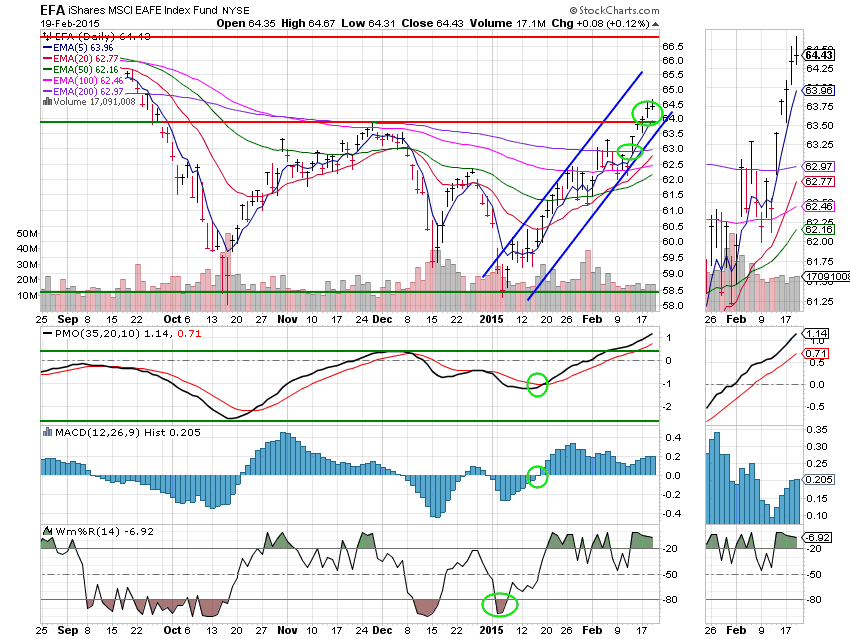

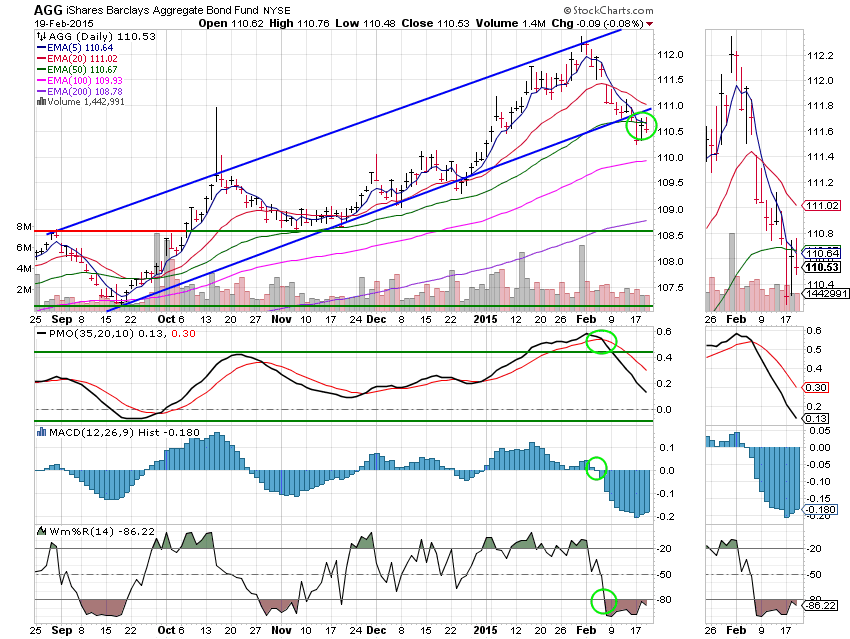

The day’s trading left us with the following results: Our TSP allotment made a slight gain of +0.019%, and AMP continued to roll with its seventh consecutive gain at +0.1916%. For comparison, the Dow dropped -0.24%, The Nasdaq added +0.37%, the S&P slipped -0.11%. AT&T was -1.16%, Alaska Air Group -1.39%, Facebook was +3.53%, and Apple slipped -0.21%. With God’s help, our allocations did well again today!

Dow, S&P 500 slip with energy, Wal-Mart; Nasdaq gains

| 02/18/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6549 | 16.9227 | 27.7847 | 37.6842 | 25.5164 |

| $ Change | 0.0006 | 0.0617 | -0.0073 | 0.1346 | 0.1830 |

| % Change day | +0.00% | +0.37% | -0.03% | +0.36% | +0.72% |

| % Change week | +0.02% | -0.14% | +0.15% | +0.47% | +0.86% |

| % Change month | +0.08% | -1.38% | +5.44% | +5.78% | +4.12% |

| % Change year | +0.26% | +0.72% | +2.28% | +3.82% | +5.36% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6095 | 23.3408 | 25.4046 | 27.101 | 15.4196 |

| $ Change | 0.0121 | 0.0358 | 0.0494 | 0.0601 | 0.0387 |

| % Change day | +0.07% | +0.15% | +0.19% | +0.22% | +0.25% |

| % Change week | +0.08% | +0.21% | +0.27% | +0.31% | +0.36% |

| % Change month | +0.99% | +2.52% | +3.27% | +3.80% | +4.31% |

| % Change year | +0.91% | +1.93% | +2.41% | +2.74% | +3.08% |