Good Evening,

Woo Hoo! Greece is saved, let the world know Greece is saved! That is, at least for four months. The market reacted in the afternoon with a somewhat tepid rally to news that Greece received a four month extension to work out a lasting debt agreement with the EU. That probably means that we’ll have a couple “Greece is lost” sell offs and maybe another “Greece is saved” rally, as market players speculate on the final outcome in four months. You all know what I’d like to see? A Grexit… that is a Greek Exit from the EU.

The day’s action left us with the following results: Our TSP allotment gained +0.675% and AMP continued its strong streak with its eighth straight gain closing up +0.723% on the day. For comparison, the Dow gained +0.86%, the Nasdaq +0.63%, the S&P +0.61%, AT&T -0.03%, Alaska Air +2.23%, Facebook +0.60% and Apple +0.81%. God is truly blessing our group. Give Him all the Praise!

The day’s action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Neutral. We are currently invested at 30/C, 40/S, 30/I. Our allocation is now +2.07% on the year, not including today’s gains. Here are the latest posted results:

| 02/19/15 |

|

|

|

|

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

14.6555 |

16.8973 |

27.7598 |

37.6895 |

25.6503 |

| $ Change |

0.0006 |

-0.0254 |

-0.0249 |

0.0053 |

0.1339 |

| % Change day |

+0.00% |

-0.15% |

-0.09% |

+0.01% |

+0.52% |

| % Change week |

+0.03% |

-0.29% |

+0.06% |

+0.48% |

+1.38% |

| % Change month |

+0.09% |

-1.52% |

+5.34% |

+5.79% |

+4.66% |

| % Change year |

+0.27% |

+0.57% |

+2.19% |

+3.84% |

+5.91% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

17.6113 |

23.3526 |

25.421 |

27.1206 |

15.4337 |

| $ Change |

0.0018 |

0.0118 |

0.0164 |

0.0196 |

0.0141 |

| % Change day |

+0.01% |

+0.05% |

+0.06% |

+0.07% |

+0.09% |

| % Change week |

+0.09% |

+0.26% |

+0.34% |

+0.38% |

+0.45% |

| % Change month |

+1.00% |

+2.58% |

+3.34% |

+3.87% |

+4.41% |

| % Change year |

+0.92% |

+1.98% |

+2.48% |

+2.81% |

+3.18% |

Lets’ hit the charts: (They are my charts. I set them up and annotate them using the Stockcharts website which is the one that I recommend!)

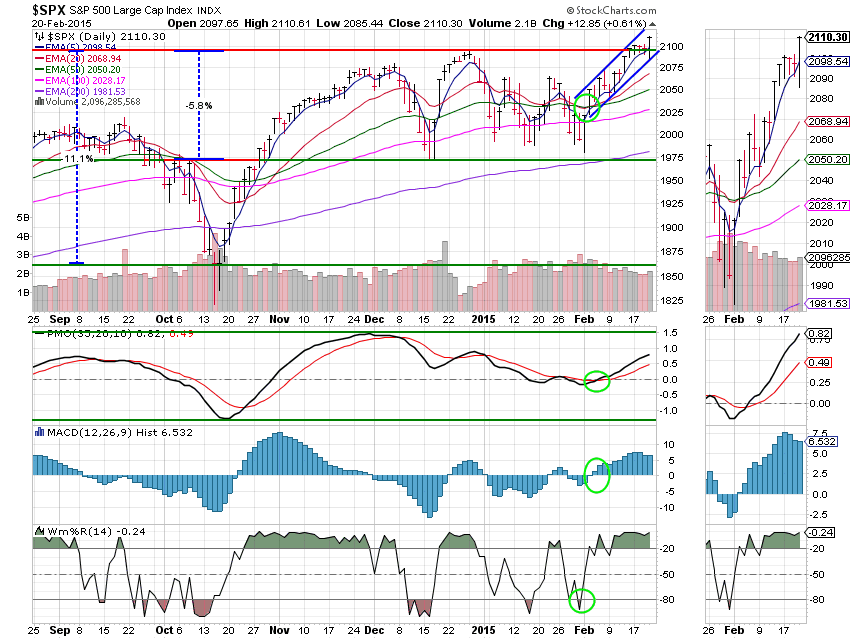

C Fund: The C Fund is in great shape. Price remains in the bullish ascending channel as it continues to move above support at 2095.

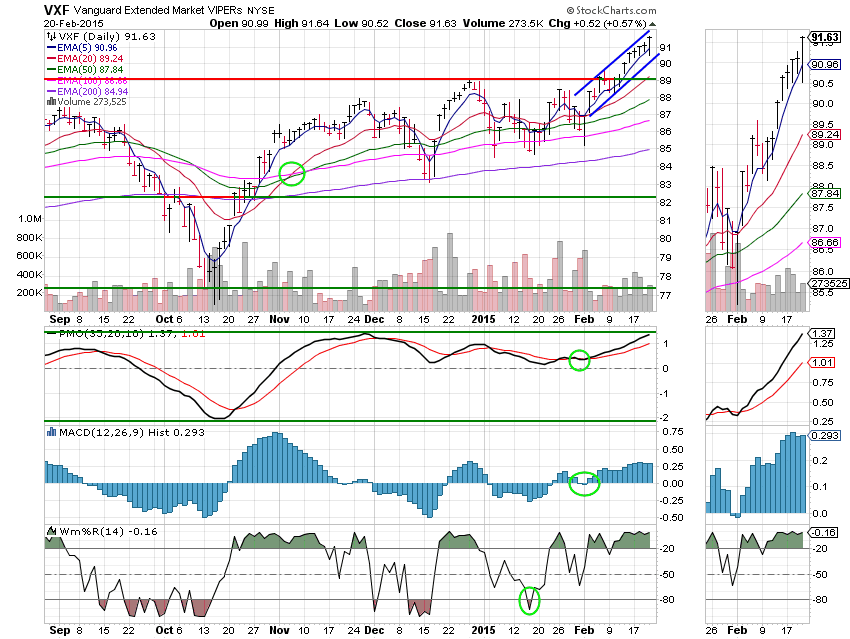

S-Fund: You can pretty much say the same thing about the S Fund as you did for the C Fund. This is a very strong chart. A solid buy!

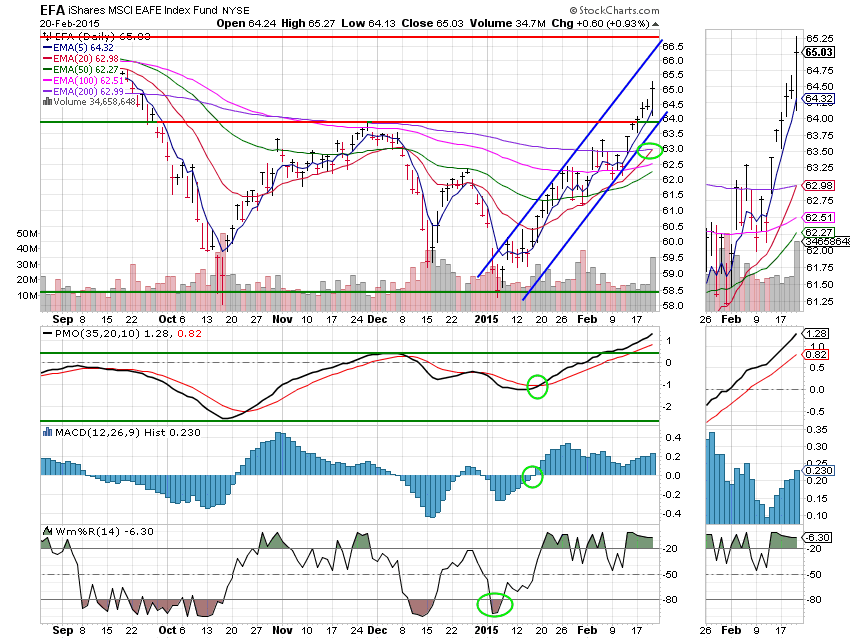

I Fund: Our analysis was rock solid for the this fund. It continues to strengthen with the 20 EMA crossing up through the 200 EMA. This is very bullish! The next resistance is set at around 66.75. If you have not already done it, I strongly recommend increasing your allotment to this Fund!

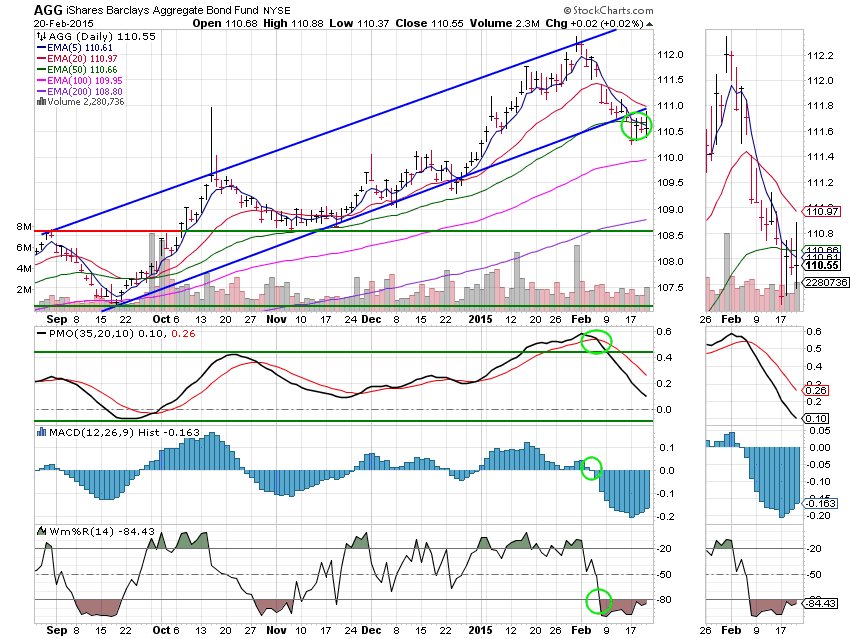

F Fund: The F Fund continues to gradually weaken as price consolidates just below the 50 EMA. This Fund is currently rated Neutral using our system. However, it will eventually move to a sell signal if price remains below the 50 EMA. I do not recommend investing in the F Fund at this time.

God gave us another good day and another good week. Give Him all the Praise for He is worthy! Our system and indicators have finally adapted to this new style of trading so I think I can confidently say that 2014 is in the rear view mirror! It’s pretty cut and dried at this point. We just need to keep monitoring our charts and keep our allocation balanced as we ride this trend, but then again, that’s what we do! Have a great evening and stay safe. Another front of bad weather is due to pass through a lot of the US this weekend! Stay warm and safe and I’ll see you on Monday!

God bless,

Scott