Good Evening. The rally resumed today, but are we out of the woods? The answer to that question is a resounding no! I am glad the market is rising. If it keeps going we may have an opportunity to put some of our money to work soon. Today, the price of oil firmed up on comments by Russia that it reached an agreement to cut oil production with OPEC. I sure never though I’d see the day that the market would increase on rumors of higher oil prices. Wonders never cease…….

The days trading left us with the following results: Our TSP allotment was steady in the G Fund while the Dow added +1.40%, the Nasdaq +1.47%, and the S&P 500 +1.45%.

Stocks Out of Correction Territory, but Not Out of the Woods

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Buy. We are currently invested at 100/G. Our allotment is now +0.29% on the year not including the days results. Here are the latest posted results:

| 02/19/16 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9583 | 17.296 | 25.9538 | 31.5006 | 22.06 |

| $ Change | 0.0007 | 0.0060 | 0.0029 | 0.0725 | -0.1660 |

| % Change day | +0.00% | +0.03% | +0.01% | +0.23% | -0.75% |

| % Change week | +0.04% | +0.15% | +2.91% | +4.19% | +3.23% |

| % Change month | +0.10% | +0.52% | -0.93% | -2.06% | -2.99% |

| % Change year | +0.29% | +2.01% | -5.84% | -10.60% | -8.45% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.5744 | 22.4601 | 23.9233 | 25.1442 | 14.0926 |

| $ Change | -0.0055 | -0.0185 | -0.0273 | -0.0332 | -0.0211 |

| % Change day | -0.03% | -0.08% | -0.11% | -0.13% | -0.15% |

| % Change week | +0.68% | +1.54% | +2.09% | +2.42% | +2.74% |

| % Change month | -0.21% | -0.69% | -1.01% | -1.21% | -1.42% |

| % Change year | -1.12% | -3.22% | -4.55% | -5.37% | -6.21% |

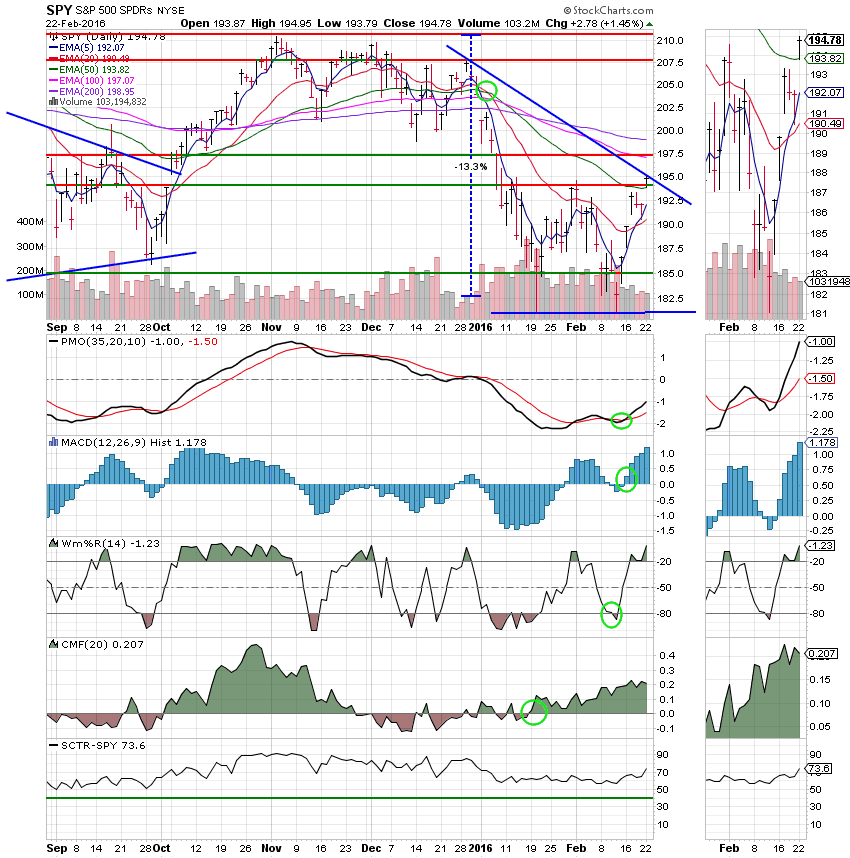

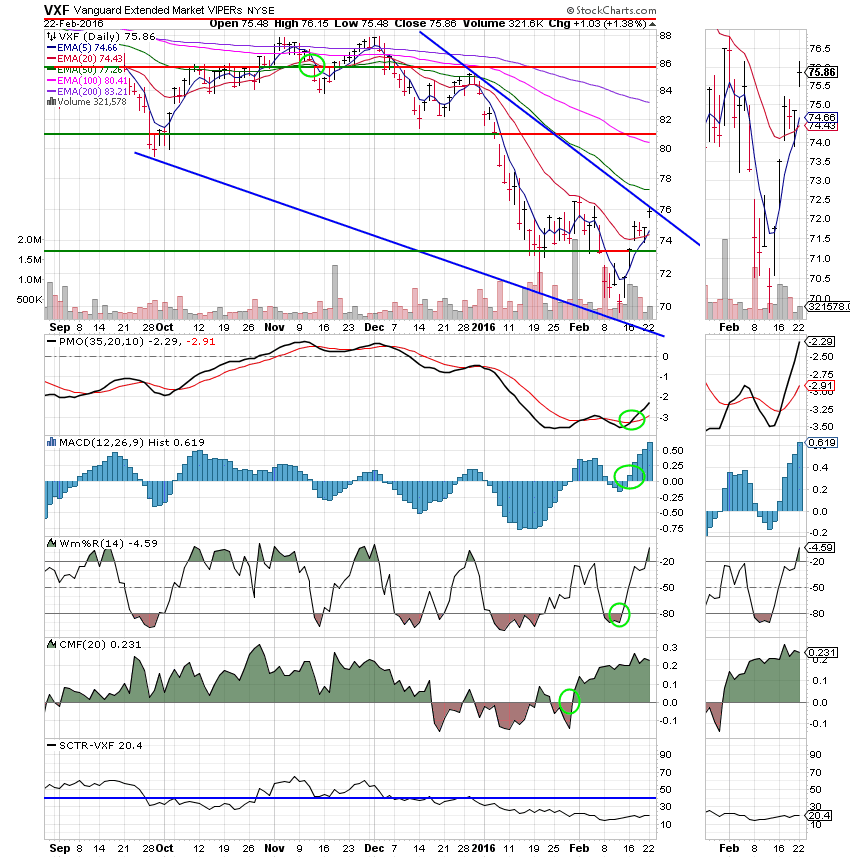

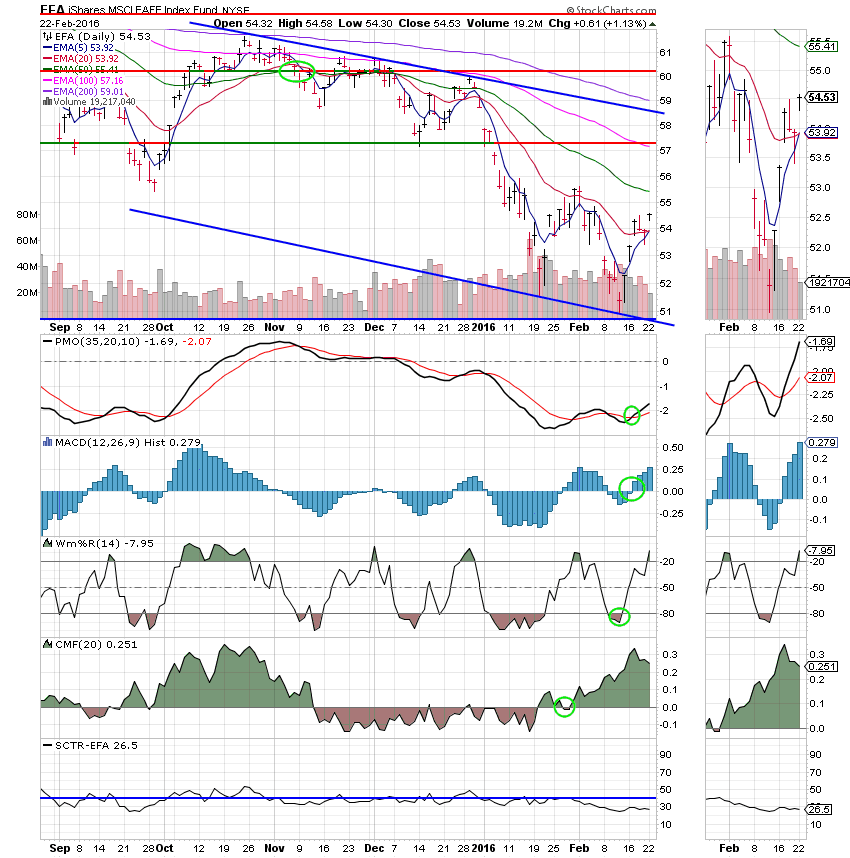

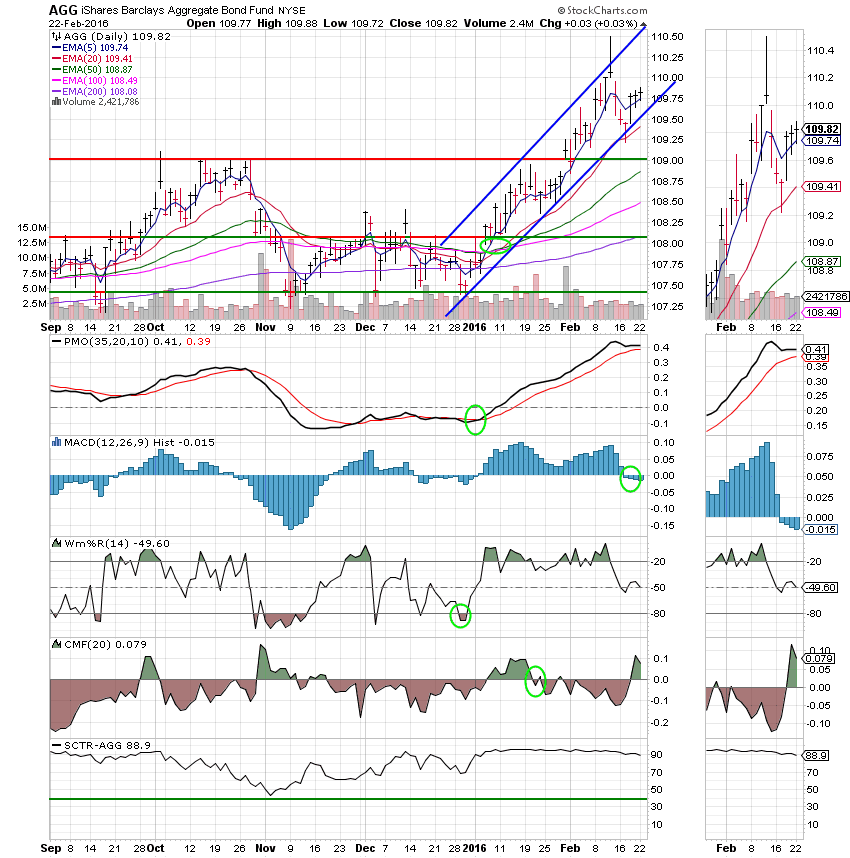

Lets take a look at the charts: (All signals annotated with Green Circles) If you click on the charts they will become larger!

C Fund: Price broke through resistance at 194 today. The 5 EMA has reclaimed the 20 EMA and is moving toward the 50 EMA. This chart is improving and may allow us to put a little money to work soon. However, I would caution everybody that it took a while for all this damage to occur and it will take a while for it to be repaired. Until it is, we are still not out of the woods. ‘What do I need to look for?? It’s going up!’ you say. A chart is not officially in an up trend until the 5 EMA > 20 EMA > 50 EMA > 100 EMA > 200 EMA. Right now it’s pretty much the opposite. We normally refer to that as being upside down. The more that the EMA’s (Exponential Moving Averages) are upside down, the greater risk you are taking by jumping back into equities. You must be very patient and pray that your timing is good. I recommend buying back in in increments of 25% or so. That will protect you if the market goes south while at the same time give you some early exposure to the next up trend. I would advise against committing any capital to the market until at least the 5 EMA passes up through the 50 EMA. Somebody else may get in early and make more than you do, but your long term average will almost always be better than theirs.

S Fund: Same as the C Fund…

I Fund: Same as the C Fund…

F Fund: This ones still working which tells me the down side for equities may not be over. We’ll keep wary eye on bonds as they relate to stocks….

Right now we’re keeping a close eye on the C Fund. Should the 5 EMA pass up thought the 50 EMA, we may consider putting 25% of our capital to work. Based on past experience, we must be very careful not to be overexposed in case a new downtrend develops. That’s all for tonight! Have a great evening and may God continue to bless your trades.