Good Evening,

The market decided to mark time today ahead of Janet Yellen’s testimony before congress. Market players weren’t willing to make any big bets ahead of Janet’s semi annual testimony; you’d think that they’d figured out by now that she isn’t going to say anything to upset the apple cart. She has and will continue to be market friendly. Also, you’d think that the bears who are waiting for a sell-the-news reaction would figure out that this market loves the FED. ‘Sell the news’ strategy hasn’t worked in a while.

The day’s trading left us with the following results: Our TSP allotment slipped back -0.146% but AMP added its ninth straight gain of +0.0854%. For comparison, the Dow was -0.13%, the Nasdaq +0.10%, the S&P -0.03%., AT&T was -0.67%, Alaska Air Group +0.00, Facebook -1.32% and Apple was strong again at +2.71%. I praise God for AMP’s ninth straight gain. It would not be possible without Him. There may be those who are thinking, what will he say on a bad day? I’ll praise Him because it wasn’t any worse!

Nasdaq ends up 9th session; S&P 500, Dow dip with energy

The day’s action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Neutral. We are currently invested at 30/C, 40/S, 30/S. Our allocation is now +2.73% on the year, not including the day’s results. Here are the latest posted results:

| 02/20/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6562 | 16.8848 | 27.9333 | 37.9031 | 25.8447 |

| $ Change | 0.0007 | -0.0125 | 0.1735 | 0.2136 | 0.1944 |

| % Change day | +0.00% | -0.07% | +0.63% | +0.57% | +0.76% |

| % Change week | +0.03% | -0.36% | +0.68% | +1.05% | +2.15% |

| % Change month | +0.09% | -1.60% | +6.00% | +6.39% | +5.46% |

| % Change year | +0.27% | +0.49% | +2.83% | +4.43% | +6.72% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.634 | 23.4299 | 25.529 | 27.2528 | 15.5194 |

| $ Change | 0.0227 | 0.0773 | 0.1080 | 0.1322 | 0.0857 |

| % Change day | +0.13% | +0.33% | +0.42% | +0.49% | +0.56% |

| % Change week | +0.22% | +0.59% | +0.76% | +0.87% | +1.01% |

| % Change month | +1.13% | +2.92% | +3.78% | +4.38% | +4.99% |

| % Change year | +1.05% | +2.32% | +2.91% | +3.31% | +3.75% |

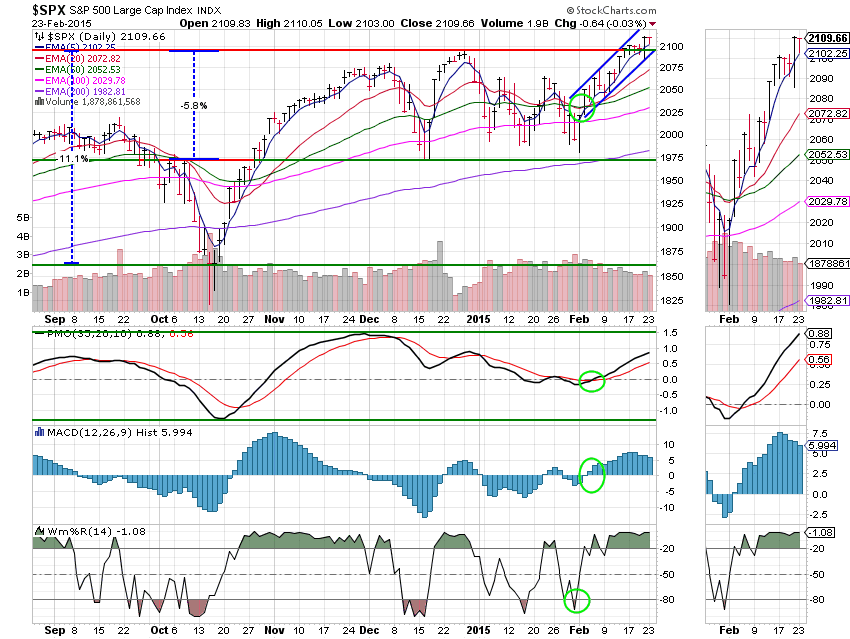

Lets hit the charts:C Fund: Nothing new to add here. Price is consolidating just above support. This chart is still a solid buy signal. I have annotated the signals with green circles.

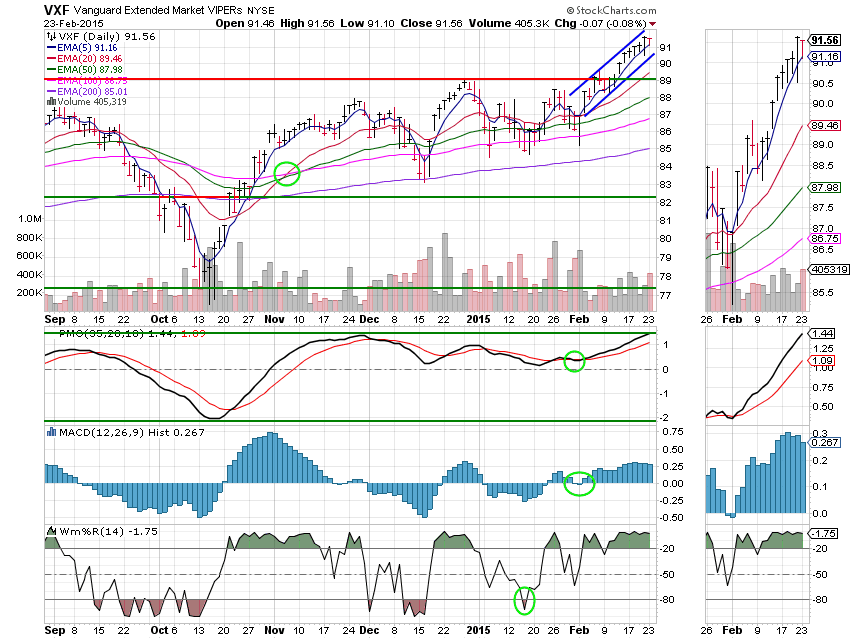

S Fund: Price remains within the ascending channel as this chart is still a solid buy. I have annotated the signals with green circles.

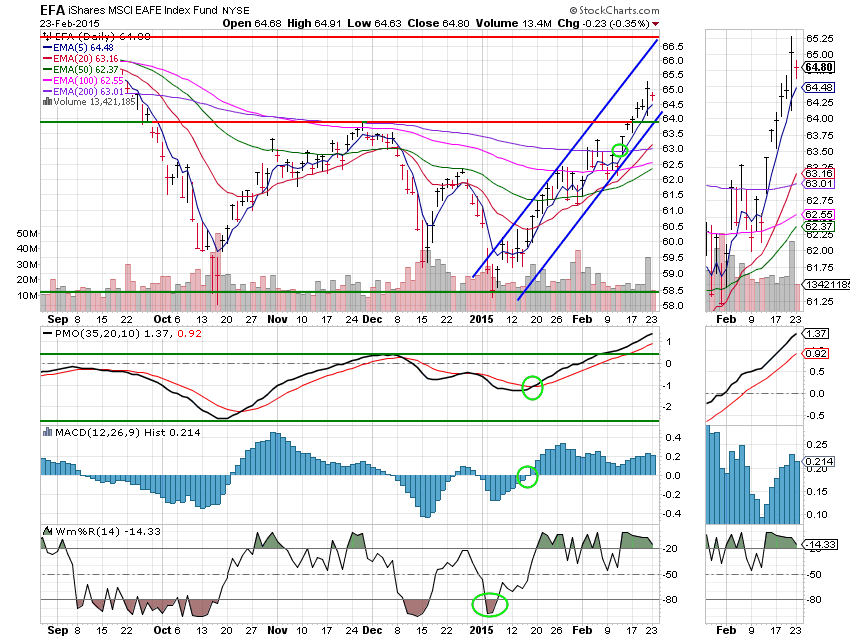

I Fund: The I Fund slipped back a little more than the C and the S but is still in great shape. No damage done as price remains within the ascending channel. My current target for this fund is at resistance around 66.75. I have annotated the signals with green circles.

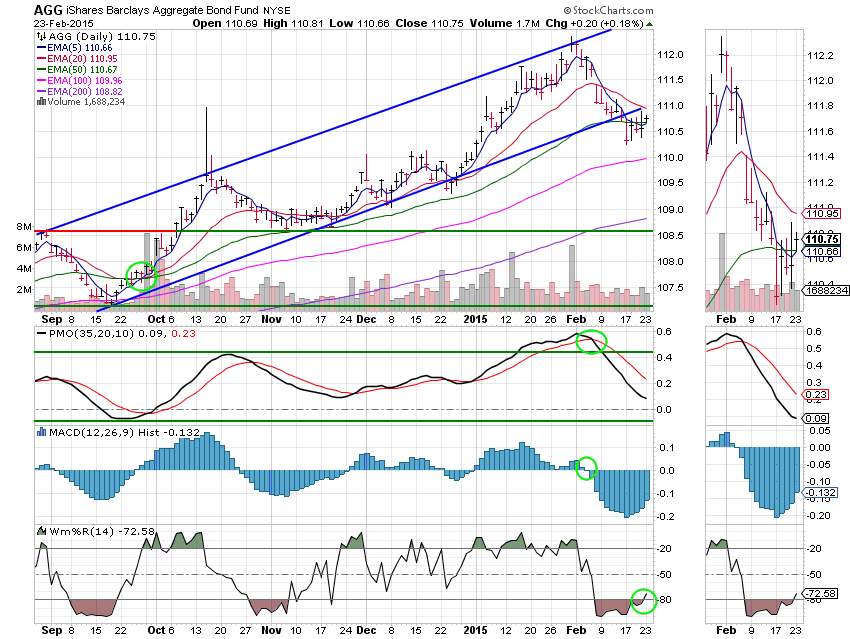

F Fund: The Fund fund had a positive day closing back above its 50 EMA. I would like to see price reenter the ascending channel. Today’s gain was probably more a function of an off day for stocks, rather than the beginning of a new trend. I’m going to have to see a lot of improvement here before I would consider allocating money to this fund. Also of note, the Williams %R entered positive territory, indicating an ultra short-term upper trend in agreement with today’s positive action. I have annotated the signals with green circles.

The market is holding steady as it waits for Janet Yellen’s testimony and a final resolution to the Greek situation. Our job, as usual, is to watch the charts. The market is going to do what it is going to do and when it does, the talking heads will find an excuse for it. That’s all for tonight. Stay warm and we’ll do it again tomorrow.God bless,Scott