Good Evening,

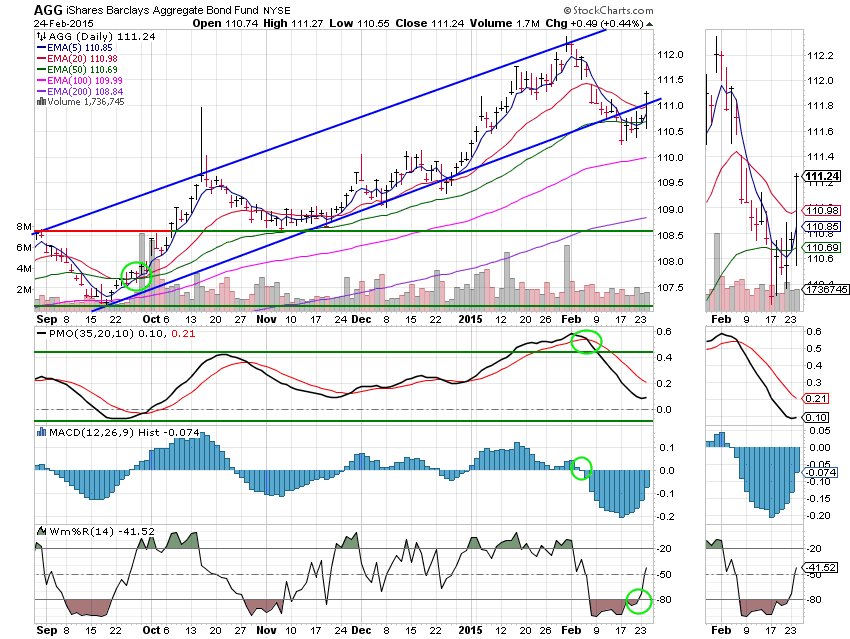

The four month Greek deal was approved and Janet Yellen completed her first day of testimony before congress (She addresses the Senate one day and the House one day every six months). The market seemed to get a small lift from the Greek deal (yeah Greece is saved again, tell the world). But there seemed be an unclear understanding of what Dr. Yellen had to say. Some people felt like it had a hawkish spin. I would disagree. She basically said what the FED minutes said and that is that the decision to raise interest rates will be data driven. She even went as far as to say that there would be no interest rate increase in the next few meetings. Sure can’t argue with that! Nevertheless, many of the market players want an assurance that rates won’t be rise until 2016. Get real, even if rates are raised they will still be at historic lows and if they are raised it will mean that the economy is on solid footing. What part of data dependent don’t these rocket scientists understand? You know what? When the rate increase comes, we’ll watch our charts and deal with the action in front of us. Until then, let’s ride the trend and make some money…..

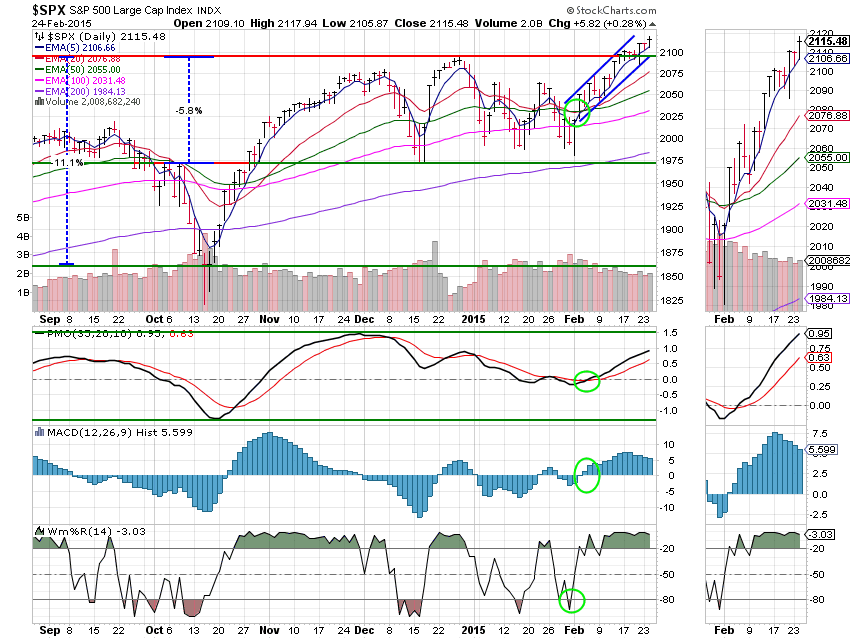

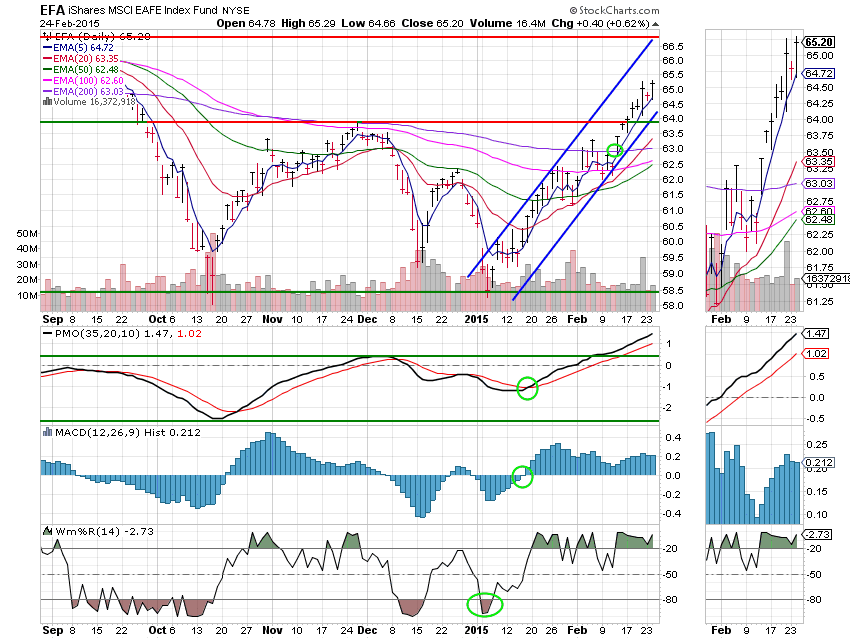

The trading today left us with the following results: Our TSP allotment gained +0.286% and AMP added its tenth straight gain with +0.343%. Before I go on, let me add a bit of trivia for you. I have been trading since the mid 90’s and AMP’s string of gains tied the longest string of consecutive gains that I have ever had in any portfolio that I have put together. If it’s God’s will, we will break that record tomorrow and I couldn’t be more happy for our many wonderful clients! Now let’s see how we compared to the market as a whole today… The Dow gained +0.51%, the Nasdaq +0.14%, the S&P +0.28%, AT&T was +0.59%, Alaska Air Group +0.45%, Facebook was off -0.49% and Apple succumbed to some profit taking at -0.62%. God blessed us again today! Give Him all the praise for He is worthy!

Dow, S&P finish at records after Yellen comments

| 02/23/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6581 | 16.9409 | 27.925 | 37.8747 | 25.7955 |

| $ Change | 0.0019 | 0.0561 | -0.0083 | -0.0284 | -0.0492 |

| % Change day | +0.01% | +0.33% | -0.03% | -0.07% | -0.19% |

| % Change week | +0.01% | +0.33% | -0.03% | -0.07% | -0.19% |

| % Change month | +0.10% | -1.27% | +5.97% | +6.31% | +5.25% |

| % Change year | +0.28% | +0.83% | +2.80% | +4.35% | +6.51% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6365 | 23.4253 | 25.5206 | 27.2413 | 15.5103 |

| $ Change | 0.0025 | -0.0046 | -0.0084 | -0.0115 | -0.0091 |

| % Change day | +0.01% | -0.02% | -0.03% | -0.04% | -0.06% |

| % Change week | +0.01% | -0.02% | -0.03% | -0.04% | -0.06% |

| % Change month | +1.15% | +2.90% | +3.74% | +4.33% | +4.93% |

| % Change year | +1.06% | +2.30% | +2.88% | +3.27% | +3.69% |