Good Evening, I’m not going to do the usual spill tonight. If you want to catch up on the financial news I recommend that you visit our Facebook page. I usually post the latest news there even when I don’t do a blog here. Suffice to say, after pausing, the market headed back up again today.

Our system and this blog have always been based on technical analysis. So tonight I’d like to focus on analysis as we are getting very close to putting some money back to work.

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Buy.

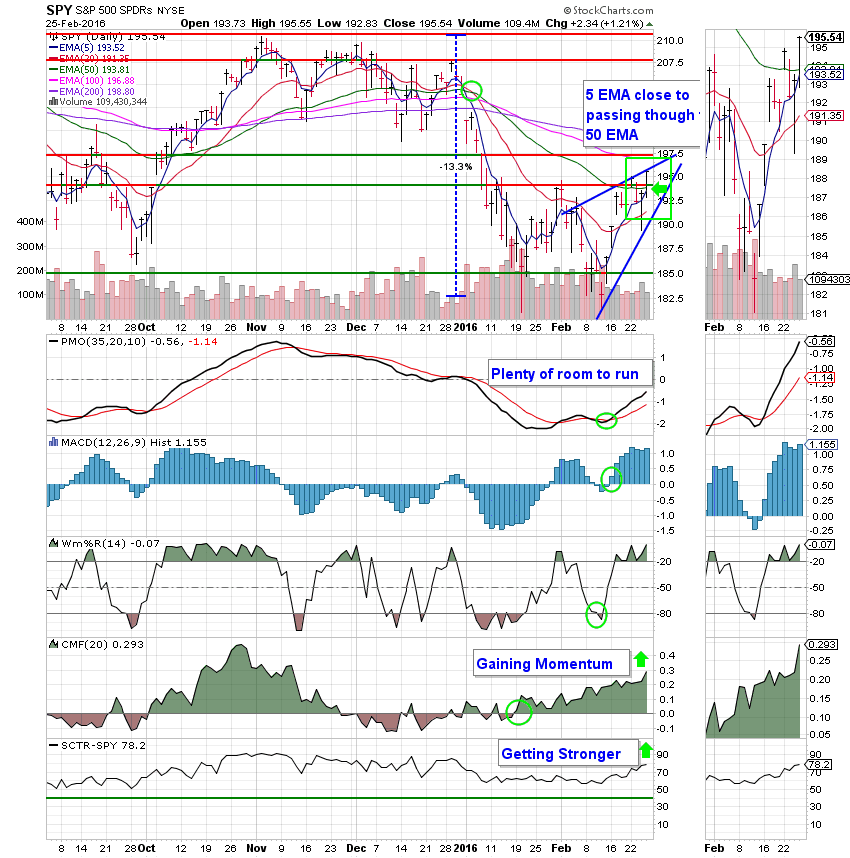

The chart I am focusing on tonight it the C Fund. It is in the best shape of all our equity based charts and will give us the first chance to put some money back to work.

C Fund: The main thing we are waiting on is price. All our other indicators, the PMO, MACD, Williams %R, and CMF are all positive. By the matter of fact the CMF is indicating that money is flowing into the C Fund. In other words, it has the fuel to move it higher. The PMO is also encouraging as it is in a positive configuration (See the green Circle) but is just now entering positive territory ( 0 on the scale). This tells us that it has plenty of room to run before it reaches overbought territory which would be in the +2 range. Another positive indicator is the SCTR. It is slowly rising and has now reached a respectable 78.2. That is a C+ or almost a B if you want to think of it in terms of a grade. Conversely the S Fund is only a 29.9 or an F and the I Fund is even worse at 21.4. This tells us that the C Fund is technically stronger than the S and I Funds. Now back to price. The first technical threshold that I would even consider putting money to work at is when the 5 EMA crosses up through the 50 EMA. As you can see, this is very close to happening. Given another positive day, it could happen tomorrow. It that is the case we will put a quarter or 25% of our funds to work in the C Fund. Why not more? Two reasons. First: The EMA’s are still upside down meaning that the 200 EMA > 100 EMA > 50 EMA > 20 EMA. Until the shorter duration time frames are on top, we are still in a downtrend and as long as we are in a downtrend we incur somewhat greater risk when we invest. Therefore, we do it in stages to help lesson our risk and exposure. Second: We didn’t lose the money that the buy and holders did in the first place so we can afford to be cautious and still have a good return. Remember, It’s not what you make that’s important. It’s what you keep! In the event that the 5 EMA crosses up through the 50 EMA, I will put out an alert to move to 75%/G, 25%/C. Be ready!

That’s all for tonight. Have a nice evening and may God continue to bless you trades!

God bless, Scott ![]()

‘