Good Evening,

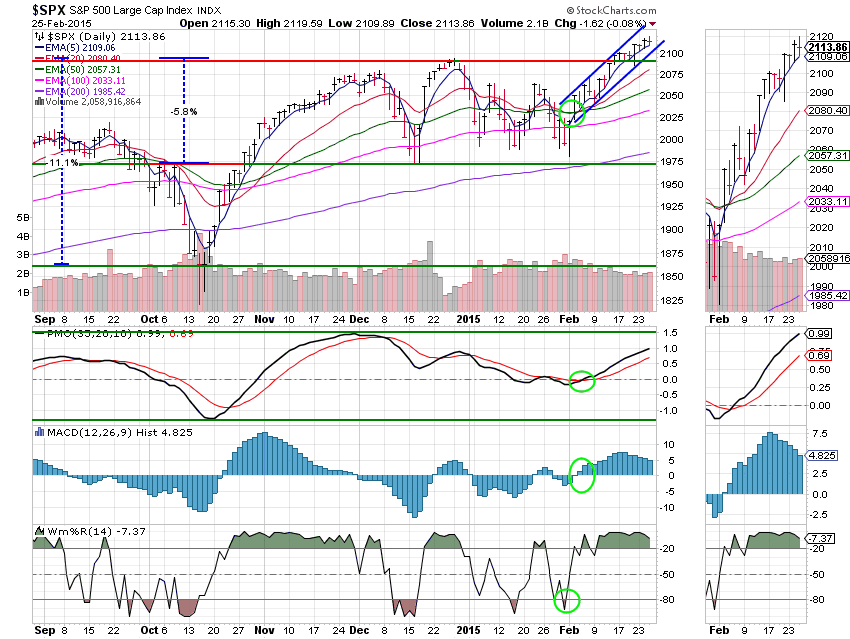

The recent pattern of a dip in the morning followed by a move higher in the afternoon played out again today. However, traders were surprised in the afternoon by a pretty nice sized dip from which the S&P 500 and Nasdaq were unable to recover; but the Dow was able to rise to a new record. That said, while the day had a somewhat negative bias, it remained well within the parameters of recent action as losses were minimal.

The day’s action left us with the following results: Our TSP allotment did manage a gain of +0.08%, but AMP’s streak of consecutive gains came to an end as it slipped back -0.1329%. There’s no complaining here as both allocations are set to book nice gains for the month of February given reasonable action over the next two trading days. For comparison, the Dow gained +0.08%, the Nasdaq also ended its streak at -0.02%, the S&P was -0.08%, AT&T was +0.47%, Alaska Air Group was -1.54%, Facebook gained +1.41% and Apple dropped -2.56%. As you can see, being invested in individual stocks is a little more volatile than indexing…

S&P, edge down with Apple; Dow ends at record high

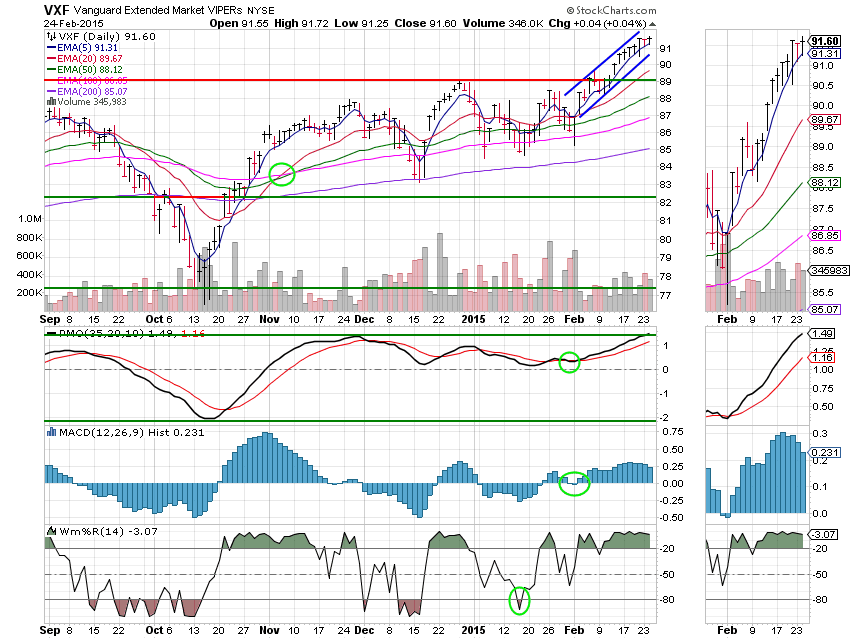

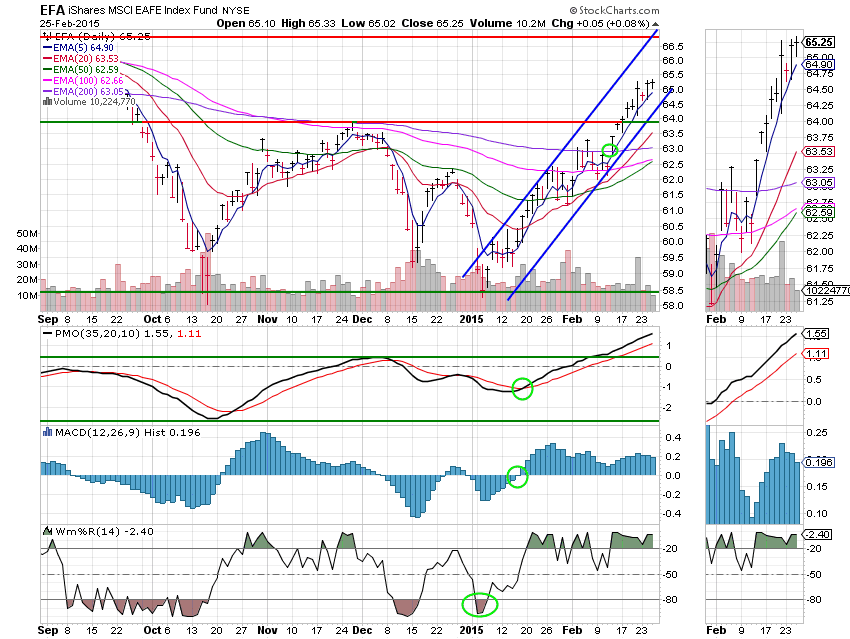

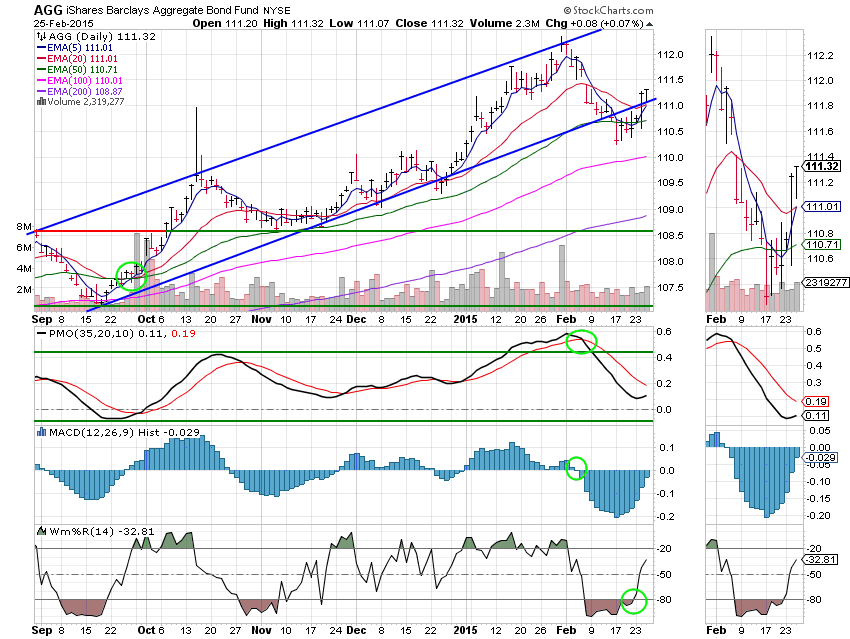

The day’s action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Neutral. We are currently invested at 30/C. 40/S, 30/I. Our allocation is now +2.84% on the year, not including the today’s results. Here are the latest posted results:

| 02/24/15 | |||||

| nd | |||||

| Price | 14.6588 | 16.9997 | 28.0032 | 37.8851 | 25.8868 |

| $ Change | 0.0007 | 0.0588 | 0.0782 | 0.0104 | 0.0913 |

| % Change day | +0.00% | +0.35% | +0.28% | +0.03% | +0.35% |

| % Change week | +0.02% | +0.68% | +0.25% | -0.05% | +0.16% |

| % Change month | +0.11% | -0.93% | +6.27% | +6.34% | +5.63% |

| % Change year | +0.29% | +1.18% | +3.08% | +4.38% | +6.89% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.65 | 23.4611 | 25.5685 | 27.2976 | 15.5455 |

| $ Change | 0.0135 | 0.0358 | 0.0479 | 0.0563 | 0.0352 |

| % Change day | +0.08% | +0.15% | +0.19% | +0.21% | +0.23% |

| % Change week | +0.09% | +0.13% | +0.15% | +0.16% | +0.17% |

| % Change month | +1.23% | +3.05% | +3.94% | +4.55% | +5.17% |

| % Change year | +1.14% | +2.46% | +3.07% | +3.48% | +3.92% |

C Fund: Price dropped a little today, but is still right smack in the middle of the ascending channel. This chart is still a solid buy with all four indicators in a positive configuration.