Good Evening,

The market followed the same script again today. It was weak in the morning and made a run into the close. Just as yesterday, the Dow and S&P were unable to fully recover, but the Nasdaq moved closer to the coveted (according to the media) 5000 mark and by golly they won’t quit until they get it there! While the market is extended on low volume (which used to mean we were in trouble), I have no problem with the action as it is completely normal for the market to take a rest after a nice run like we just had. It’s true that someday the market will make a turn and sting the bulls. However, trying to guess the top has been an unprofitable play for some time. As we have lamented many times over the past year, the market simply doesn’t play by the same rules that it did before the great recession. Thinking that it will return to the pre-2009 trading rules has been costly as it was for us in 2014. Did I ever tell you how glad I was to see that year end? At any rate, the good traders have adjusted to the ‘new rules’. Not that they like them, but as they say, necessity is the mother of invention…… Rev Shark (James DePorre) at Sharkinvesting.com, who I think is one of the finest traders out there, recently talked about the same thing in one of his commentaries. Here is what he had to say:

“If you focus on the fact that the market has been going straight up with hardly a downtick for two weeks now it is very tough not to be bullish. However if you focus on the fact that we are technically extended on light volume it is easy to think that something negative is about to occur.That is the conundrum that has been at the heart of this market for nearly five years now. We have this consistently streaky action that has very a very questionable technical foundation but the bears and the underinvested bulls never seem to be able to come to grips with the pattern.

What works best is to just ignore the technical and the big picture issues that keep driving the negative views. There simply is no advantage to trying to time a market turn. You navigate this market by staying focused on stock picking or by just embracing the indices and not letting them go until there is some actual change in the price action.

The biggest challenge of dealing with this market is simply having the right mindset. If you keep thinking it is going to trade like it did in the days prior to the Great Recession you will never be in tune with the action. You have to embrace the idea that the market has made a very basic change and the old rules about how things were supposed to act no longer apply.

Many traders that cut their teeth in the 1990’s and up to 2008 are still struggling to understand this market action. Things as basic as volume don’t have the meaning that they used to. Ten years ago there will be very little confidence in a market that has gone straight up on declining volume like we have over the past two weeks. Traders who still think that way are handicapped in dealing with this market while those who have started focusing on the market in the last five years know no other behavior.

If you are one of the traders that have a tough time embracing this market environment the best advice I can give us to try to filter out the big picture views and stay focused on individual stocks. If individual stocks are acting well then stick with them and try not to let the pundits and market timers influence you into feeling that disaster is just around the corner.

The easiest mistake to make in this market is to sell stocks that are acting well just because you are worried that we are going to have a sudden collapse. The folks who tend to underperform are those that don’t stick with the momentum. There are good reasons in their minds for that behavior but the need to recognize that this market operates differently than it used to.”

That’s it in a nutshell. That is what we have learned to deal with. The day’s trading left us with the following results: Our TSP allotment slipped back -0.15% and AMP was off -0.193%. For comparison, the Dow dropped -0.06%, the Nasdaq was +0.42%, the S&P -0.15%, AT&T +0.85%, Alaska Air Group +0.85%, Facebook +1.07% and Apple +1.26%. So you can see, there were some individual stocks working out there today.

Nasdaq resumes climb; S&P 500, Dow fall with energy

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Neutral. We are still invested at 30/C, 40/S, 30/I. Our allocation is now +2.97% on the year not including the day’s results. Here are the latest posted results:

| 02/25/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6594 | 17.0117 | 27.9862 | 37.9693 | 25.9384 |

| $ Change | 0.0006 | 0.0120 | -0.0170 | 0.0842 | 0.0516 |

| % Change day | +0.00% | +0.07% | -0.06% | +0.22% | +0.20% |

| % Change week | +0.02% | +0.75% | +0.19% | +0.17% | +0.36% |

| % Change month | +0.11% | -0.86% | +6.20% | +6.58% | +5.84% |

| % Change year | +0.29% | +1.25% | +3.02% | +4.61% | +7.10% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6529 | 23.4699 | 25.5813 | 27.314 | 15.5562 |

| $ Change | 0.0029 | 0.0088 | 0.0128 | 0.0164 | 0.0107 |

| % Change day | +0.02% | +0.04% | +0.05% | +0.06% | +0.07% |

| % Change week | +0.11% | +0.17% | +0.20% | +0.22% | +0.24% |

| % Change month | +1.24% | +3.09% | +3.99% | +4.61% | +5.24% |

| % Change year | +1.16% | +2.49% | +3.12% | +3.54% | +4.00% |

S Fund: If you’ve seen the chart for the C Fund, you’ve seen the chart for the S Fund….

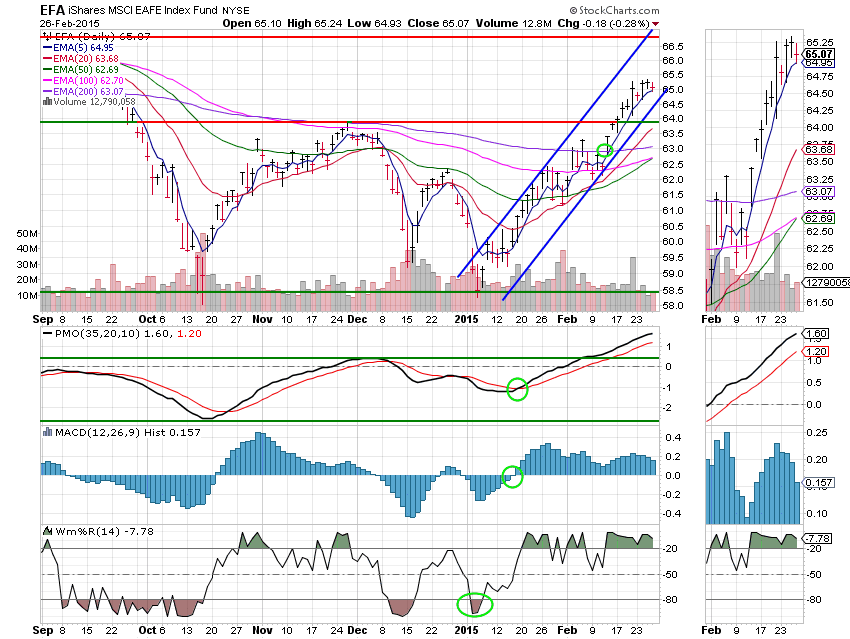

I Fund: Same deal here. Price is consolidating within the ascending channel.

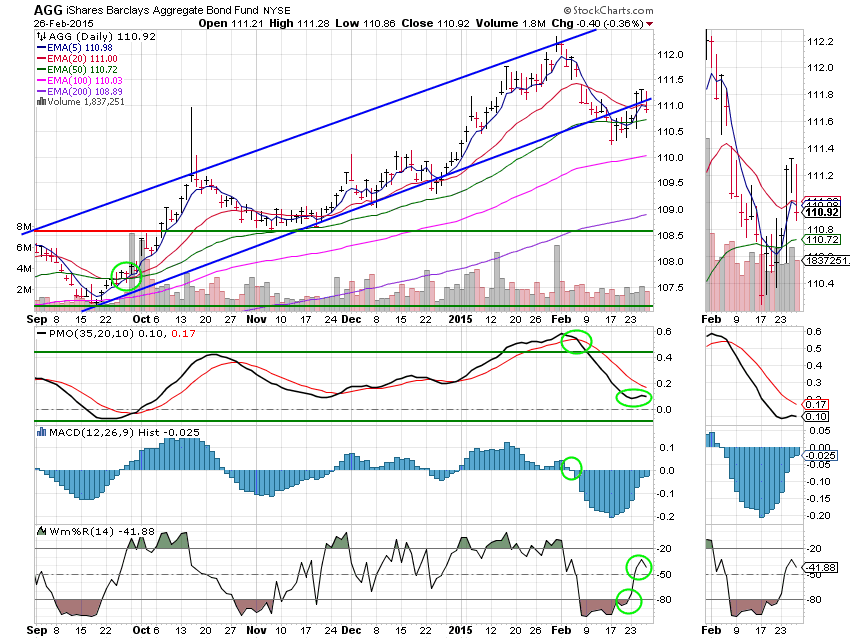

F Fund: I won’t say I told you so, but I told you so….. The F Fund took a big hit today (for Bonds that is). Price moved back out of the ascending wedge and the PMO and Wms% R turned down. This is bearish. There is a reason that we wait for an overall buy signal before we move into a fund and this is it. Conversely, if you are holding this fund, there is a reason not to sell it until you get a sell signal. I would rather be in equities until they go south and who knows… that could be soon. I don’t think so, but it could……