Good Evening, I am going to keep this real short tonight. I coming d0wn with the flu or covid or something. So I am starting to feel a little rough. The good news is that we’re in the right place. Our move to the G Fund appears that it will be a profitable one in the end. The S&P 500 moved into negative territory today after yet another big sell off. This is a good thing for us because our powder is dry and we will be ready to swoop in and buy at a nice discount when this thing finally bottoms. The catalyst is President Trumps Tariffs. Today president Trump confirmed that the 25% tariffs on Canadian and Mexican imports will still go into effect Tuesday. The stock market appeared to add to its losses following his remarks. “Very importantly, tomorrow, tariffs, 25% on Canada and 25% on Mexico, and that will start,” Trump said during a press conference. “No room left for Mexico or for Canada,” Trump said alongside Commerce Secretary Howard Lutnick from the White House. “Reciprocal tariffs start on April 2 … but very importantly, tomorrow, tariffs, 25% on Canada and 25% on Mexico … will start.” Trump also signed an action to impose an additional 10% duty on China, according to an administration official. So it’s ALL about the Tariffs right now.

Let me tell you where I’m at on this. Let the market drop! The more it drops the more we will make when it comes back. We are safely in the G Fund. So let it drop!! This is good for us! I’m holding 75% cash on the street as well and I’ll go to 100% cash if and when the stocks I still own quit working, That was not the case today as I was able to eek out a small gain. Let it drop!!! We’ll all be fine.

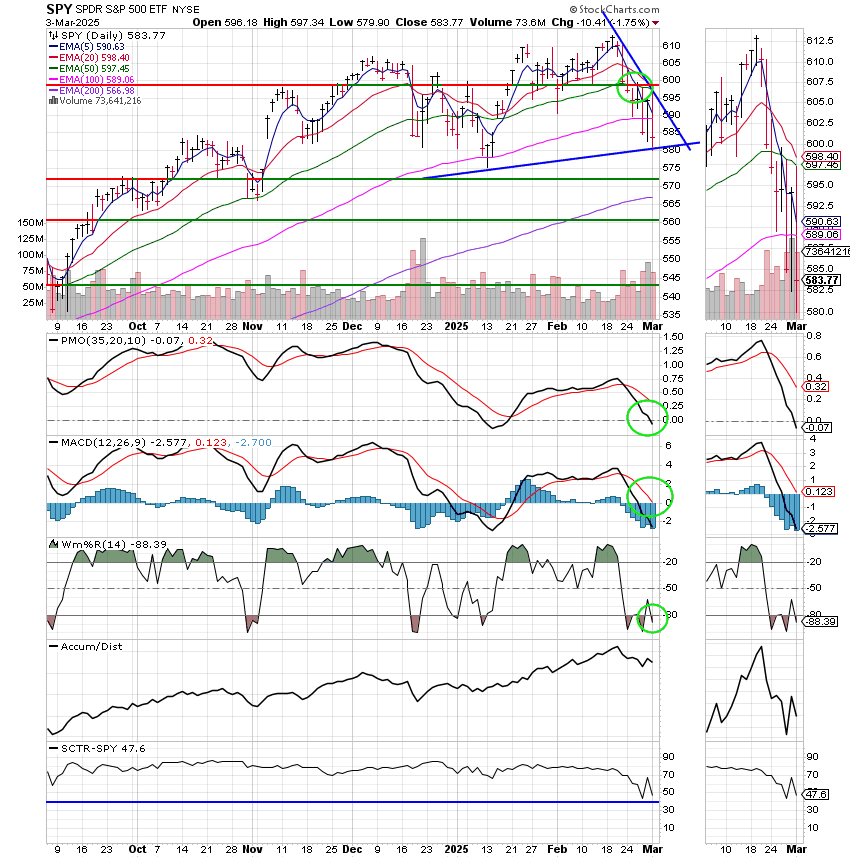

The days trading left us with the following results. Warning! If there are any small children in the room you might want to have them leave because this is bloody! Our TSP allotment was steady in the G Fund. For comparison, the Dow lost -1.43%, the Nasdaq -2.64%, and the S&P 500 -1.75%. Let it drop…..

Dow tumbles more than 600 points, S&P 500 posts biggest loss since December as Trump says tariffs will proceed

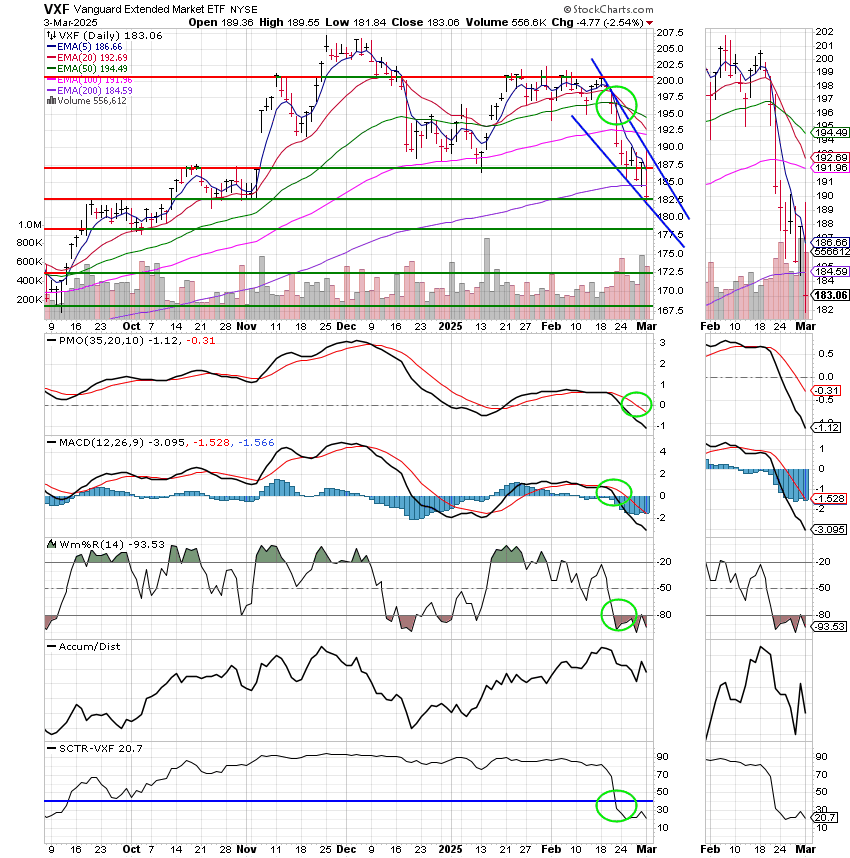

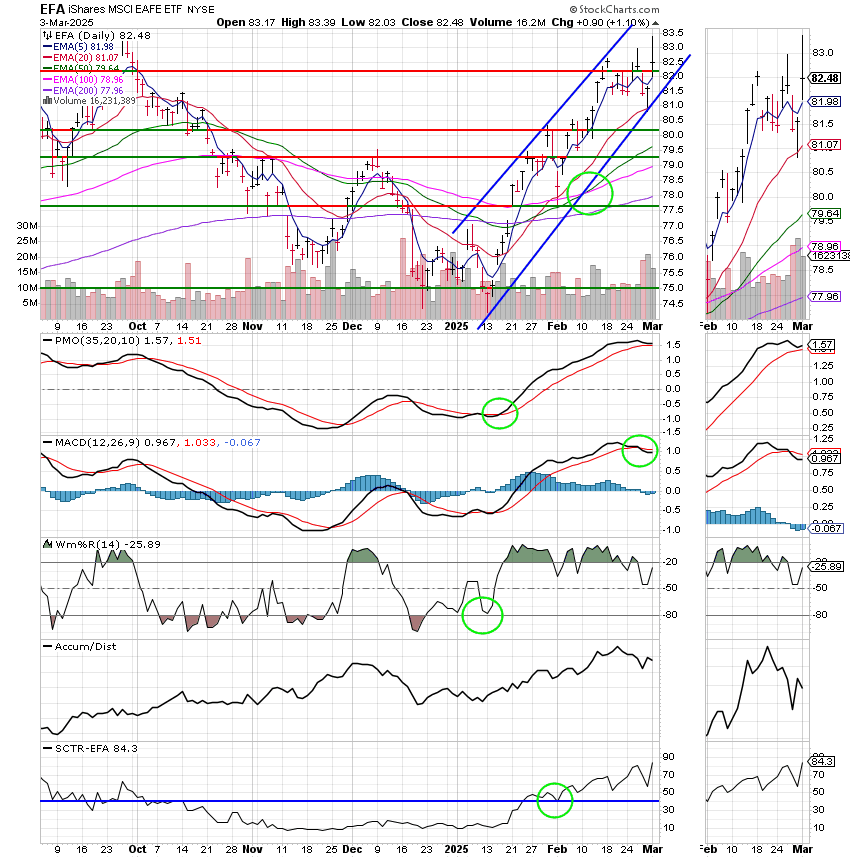

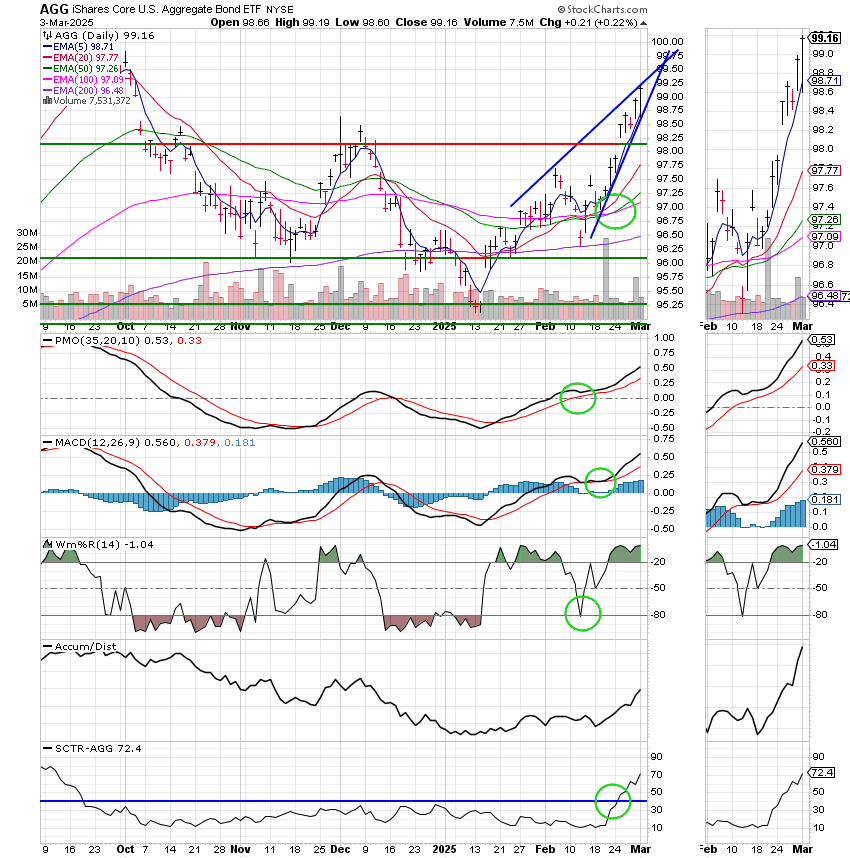

The days action left us with the following signals: C-Sell, S-Sell, I-Hold, F-Buy. We are currently invested at 100/G. Our allocation is now +0.43% for the year not including the days results. Here are the latest posted results:

| 02/28/25 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.8952 | 20.01 | 94.2662 | 89.1575 | 43.8343 |

| $ Change | 0.0024 | 0.0791 | 1.4810 | 1.1815 | 0.0120 |

| % Change day | +0.01% | +0.40% | +1.60% | +1.34% | +0.03% |

| % Change week | +0.09% | +1.26% | -0.96% | -1.44% | -1.00% |

| % Change month | +0.36% | +2.20% | -1.30% | -5.80% | +0.91% |

| % Change year | +0.75% | +2.73% | +1.44% | -1.10% | +4.63% |

S Fund:

I Fund:

F Fund:

The I and the F Funds are still in play, but do we really want to chase? We’ll watch our charts closely and answer that question. However, it appears that the best strategy for us at this time is probably to wait for a fresh buy signal in the C or S funds. Of course we’ll take a close look at the I but there are only so many questions we can answer about it since we no longer have an exact chart for the fund. I am a little apprehensive about invested in a Fund that I don’t really have a chart for…… we will see. That’s all for tonight. Have a nice evening and may God continue to bless your trades!