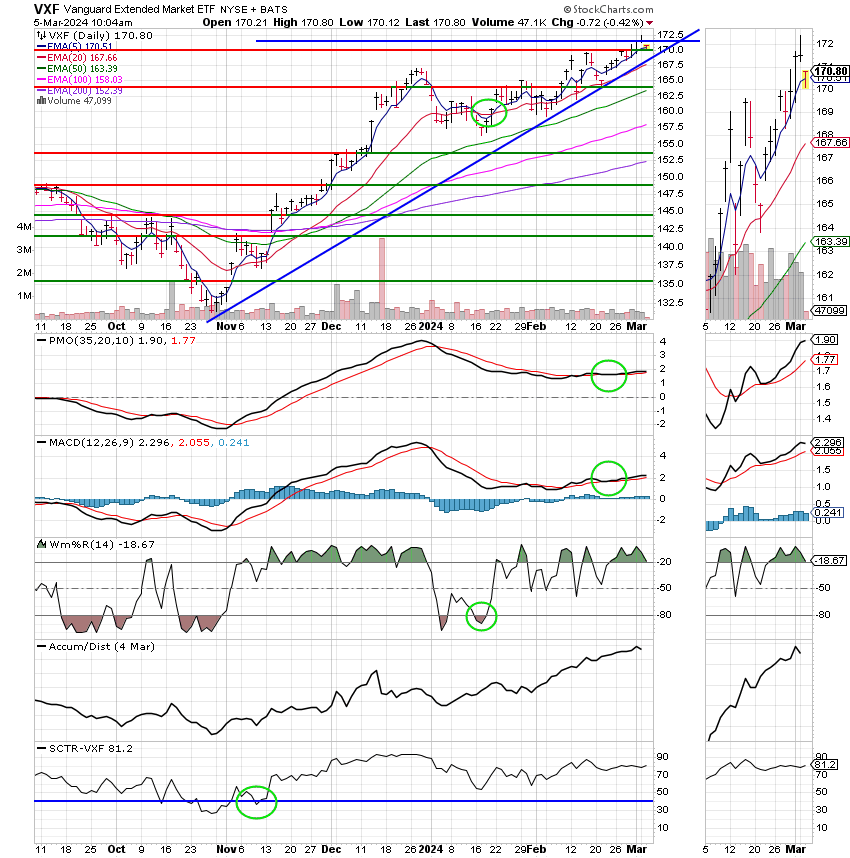

Good Morning, We find the market selling off this morning with the Dow pulling back 100 points. Stocks pulled back yesterday as well although our TSP allocation in the S Fund came out even on the day. If you ask me the market is just consolidating it’s gains after taking a step higher last week while it waits for the next piece of market making news. What specifically is the market waiting for? It’s waiting for Jerome Powell to speak before congress. Chairman Powell will be addressing the House of Representatives on Wednesday and the Senate on Thursday. I probably don’t have to tell you this, but his remarks will be closely scrutinized by market players to determine what the Federal Reserves Policy regarding interest rates will be over the rest of the year. It was originally expected that the Fed would begin cutting rates in March, but it became evident that would not be the case after a handful of reports showed that inflation was still slightly hot. Investors have now reduced their expectations for rate cuts in 2024 with the overall consensus being that they will begin in July. However, the Fed has repeatedly said not so fast! The economy remains resilient with demand for products and services still strong. So what is the Fed really trying to do? Well of course they have a dual mandate to maintain employment and the economy. What they are looking at on the economy is that inflation will remain (as we have said many times) in the 2 percent range. So how do they do that? I can hear you now, “what do you mean how do they do that? they control interest rates dummy!” The real question is why? Why would economists want to control the interest rates? What’s at the core of all this?? It’s really simple. Above we talked about demand still begin strong. You learned in economics 101 about supply and demand. Well supply and demand is the key to everything they do and to effectively invest in stocks you must understand it. It is important that supply and demand be balanced for a healthy economy. When demand is too high inflation rises. So the the Fed increases interest rates to reduce demand. Have you ever really thought about it? What happens when interest rates rise? The housing market slows down, auto sales slow down, purchasing slows down. The average consumer can’t afford to make big purchases as it takes more of their income to pay interest. Never ever forget that the consumer makes up 80% of the economy. What happens when demand drops? The econ0my contracts and you get a recession or in an extreme case a depression. Everything is related to everything else in the economy and that’s what makes it so confusing for the average investor. Take for instance 2023 and for that matter 2024. The Fed was dealing with inflation. Ever wonder why when an employment report surprised to the upside that stocks sold off?? Isn’t it a good thing when employment is good and the economy is strong? In most cases too much of a good thing is actually, well, not a good thing. The Fed pays attention to employment (and wages as well) for two reasons. First they want to maintain them as that is part of their mandate and second, they want make sure demand does not get too strong. Remember, Supply and demand must be balanced for a healthy economy. So….when the Fed is trying to control inflation they actually need for employment and wages to be a little soft. Folks, the bottom line in all this is that you need to understand this stuff in order to know what to expect in the market. That way you will know when you really need to monitor your charts closely! For now we continue to remain invested at 100% S. Our charts show that the S Fund remains strong. The fundamental reason for that is that we are in a falling interest rate environment. It’s not a matter of if rates will fall, but when. So we will be patient with the S Fund knowing our reward will come sometime in the not so distant future.

The days action so far has produced the following results. As of the time of this writing our TSP allotment is off -1.08%. For comparison, the Dow is trading lower at 0.67%, the Nasdaq -1.72%, and the S&P 500 -0.88%. Just keep one thing in mind as we have repeatedly said, this market is not going to go straight up. Those days are gone! That said, the trend is still up. Don’t forget, the trend is your friend!

Dow falls more than 100 points as Wall Street continues to pull back from records, Apple shares slide: Live updates

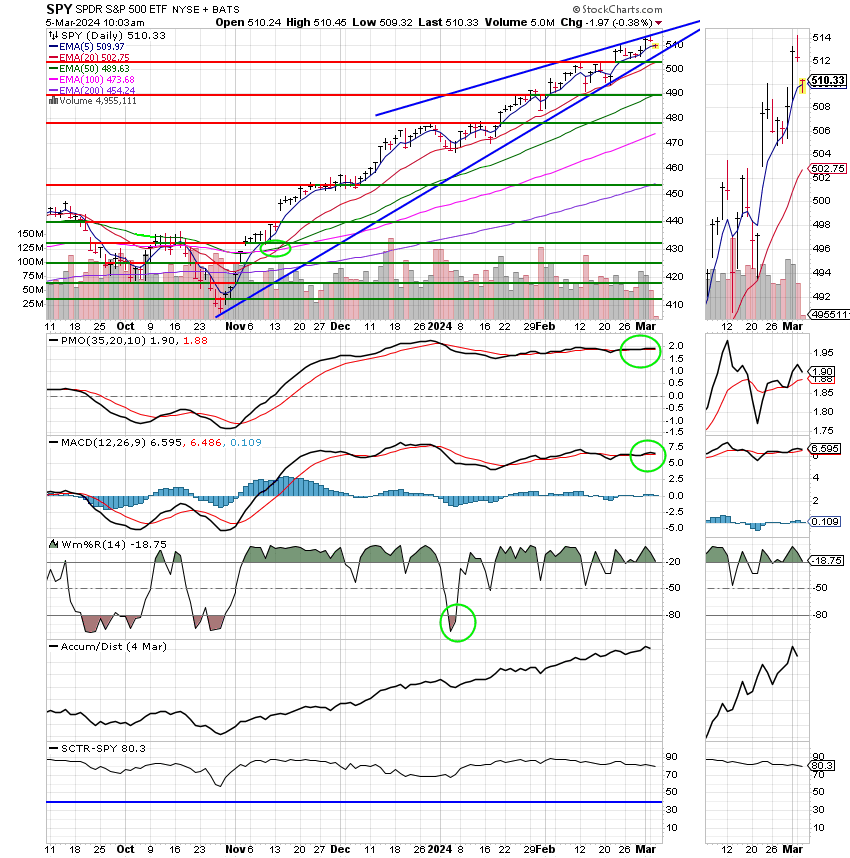

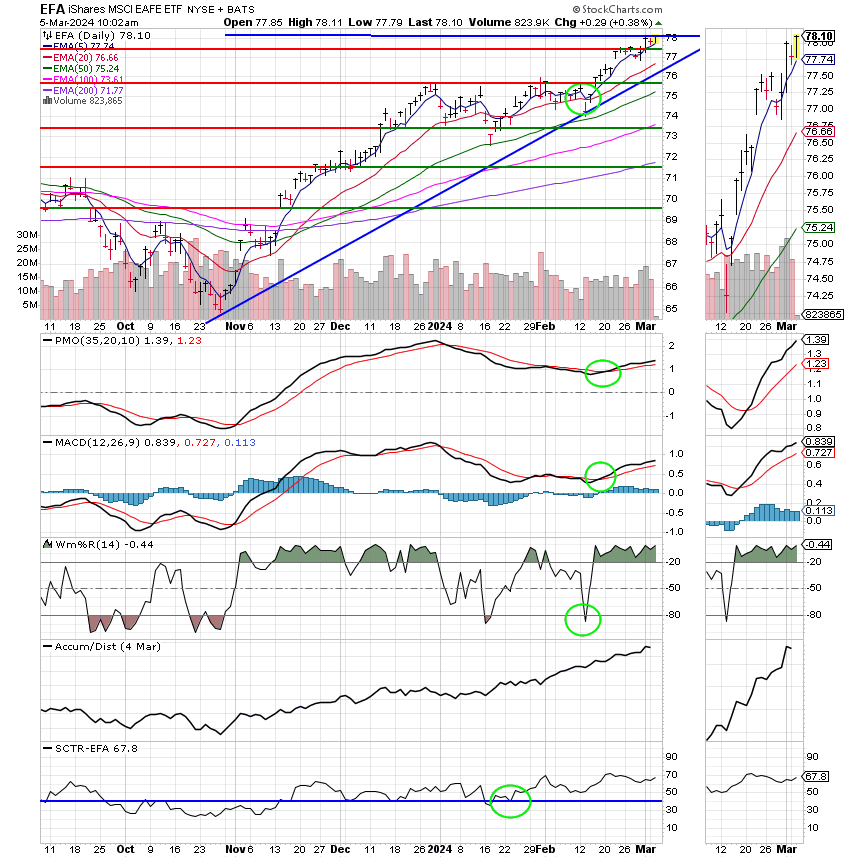

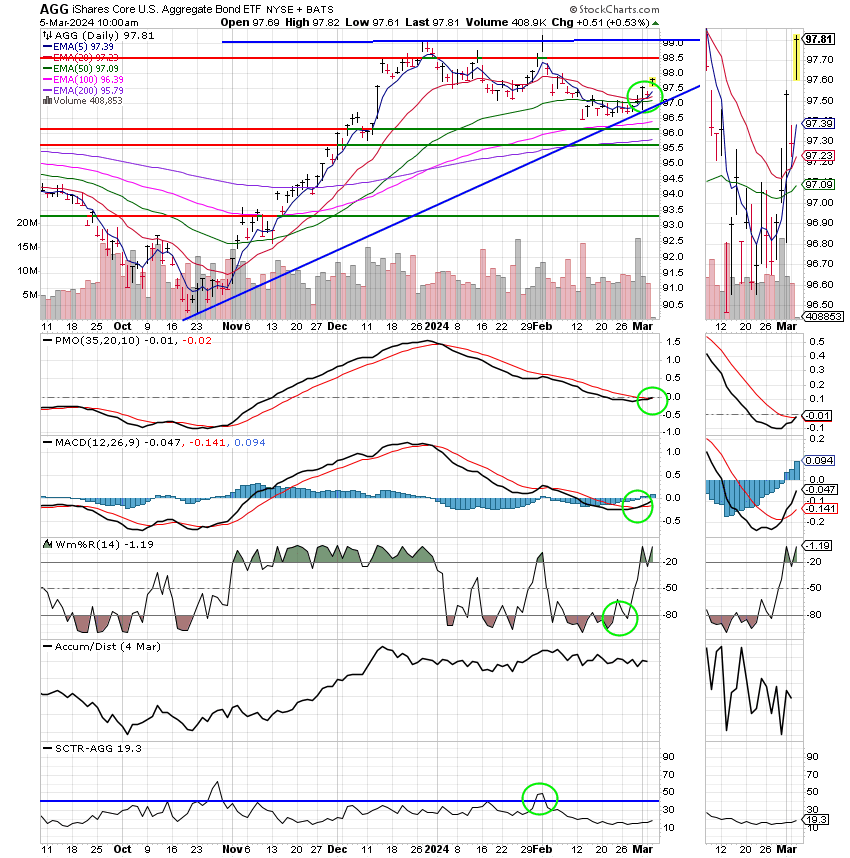

Recent action has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy, We are currently invested at 100/S. Our allocation is now +4.49% for the year not including the days results. Here are the latest posted results:

| 03/04/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.0927 | 18.9611 | 80.1955 | 80.4304 | 41.5555 |

| $ Change | 0.0065 | -0.0284 | -0.0940 | 0.0076 | -0.0536 |

| % Change day | +0.04% | -0.15% | -0.12% | +0.01% | -0.13% |

| % Change week | +0.04% | -0.15% | -0.12% | +0.01% | -0.13% |

| % Change month | +0.05% | +0.24% | +0.69% | +0.82% | +0.89% |

| % Change year | +0.72% | -1.36% | +7.84% | +4.33% | +3.42% |