Good Morning, How many ways can we say the same thing. The narrative for this market has not changed. It’s all about the Fed’s fight with inflation or more to the point how the market perceives and reacts to the Fed’s fight with inflation. That’s it, plain and simple. No matter how much the noise boys (news media) want to try to put a new spin on it it is what it is…… The market making event this week is Jerome Powell’s testimony to congress on the state of the economy. Fed Chair Powell will address both houses of congress today and Thursday and investors will be listening for clues as to the Federal Reserve’s plan for future rate hikes and how long rates might remain elevated. Expect Powell to repeat what he has said so many times in recent months, that the Fed will be data dependent and that future rate hikes will be tied to the rate of inflation. He will likely say again that inflation remains elevated but that recent reports show that it is starting to respond to the FED’s campaign of rate hikes. Blah, blah, blah…… Chairman Powell will repeat the obvious which makes me wonder if anyone is actually listening at all. I said it at the end of the pandemic. I have continued to repeat it time and time again and like Jerome Powell I wonder if anyone is actually listening. Market conditions have now returned to normal. The days of quick fixes have come to an end. You must have a long term strategy and stick with it. It will take time for the Feds rate increases to work their way through the economy and no amount of wishing will make that process go any faster. There is no more cheap Fed money to fuel the market. Things must now run their course. So…..why be surprised and upset every time the market sells off? The bottom line is that if this volatility bothers you so much that you feel the necessity to pull your money out of the market every time the chicken little media says the sky is falling then you probably shouldn’t be in the market in the first place. Stay in bonds and take what you get….. Our task has not changed! It is to listen to the the current news and to watch our charts to see how the market reacts to it. Notice one thing here and it’s very important. Don’t listen to the media’s predictions. They are worthless!!!!! They will make you panic and move your money into a sell off and that will seldom result in anything good. You must watch your charts and depend on them to tell you what to do and what to do and when to do it. I know I sound like a broken record (at least to those of you who remember vinyl records although I hear their making a comeback) when I say these things, but you would not believe the high volume of questions I get asking about this very issue! So I say again, this market is not going to change back to a pre pandemic state. That was temporary and this is reality. Keep praying and keep a close eye on your charts. Listen to the news to determine when the market might move but resist the temptation to listen to predictions. They are nothing more than glorified guesses. When you do that, you will have success!

The days trading has so far generated the following results: Our TSP allotment is currently off -0.75%. For comparison, The Dow is down -0.81%, the Nasdaq -0.78%, and the S&P 500 -0.99%.

Dow falls 200 points as Powell says rates are headed higher than expected: Live updates

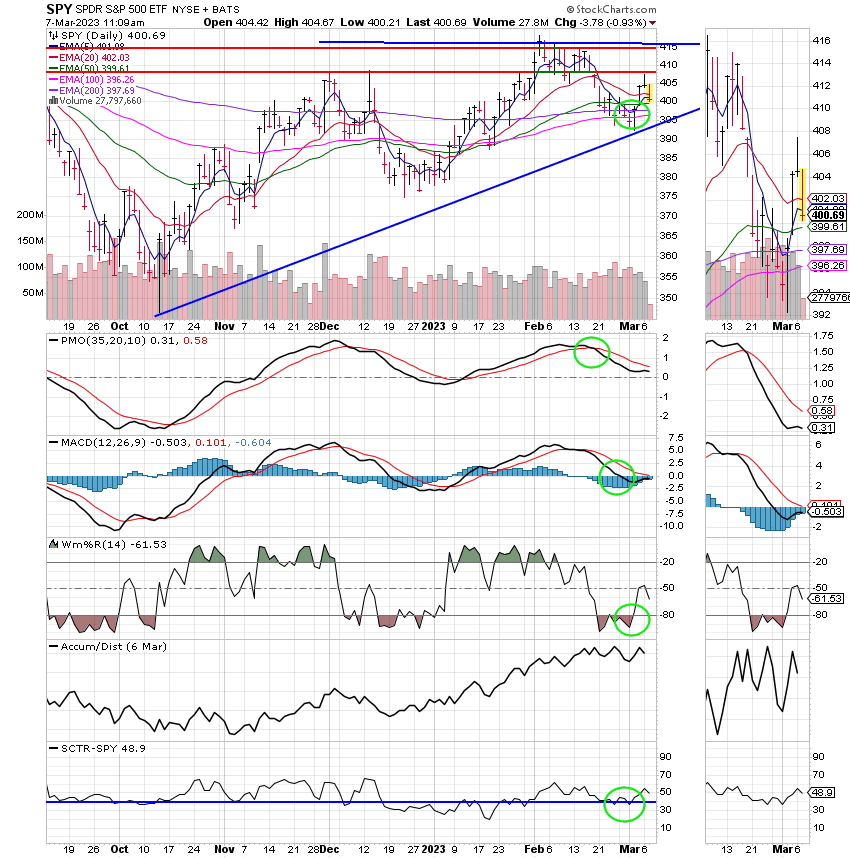

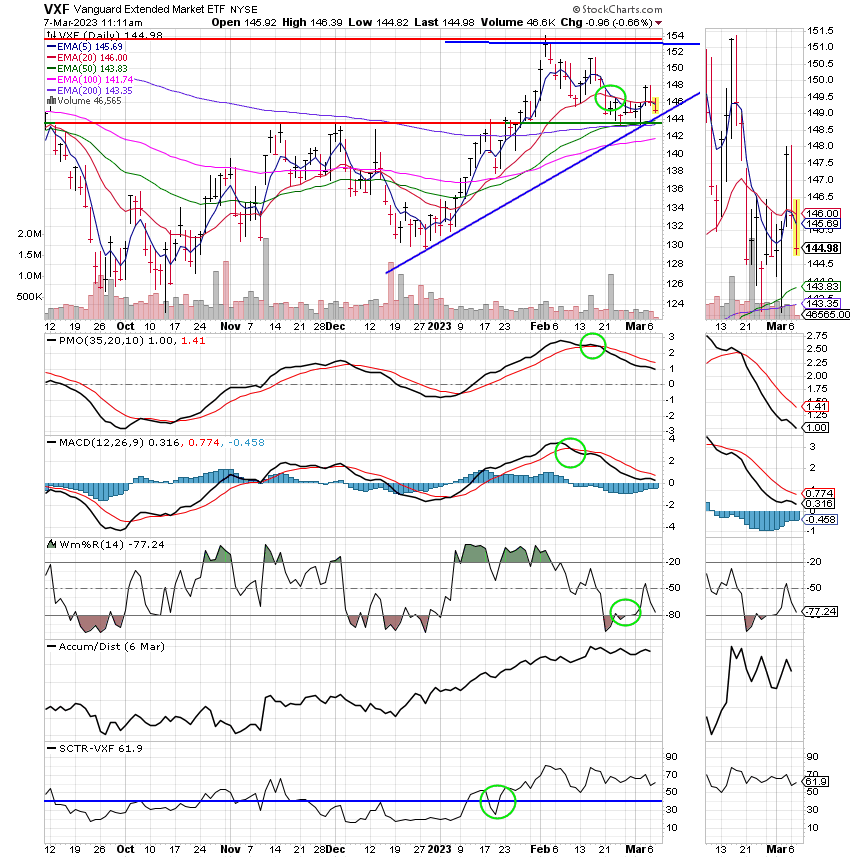

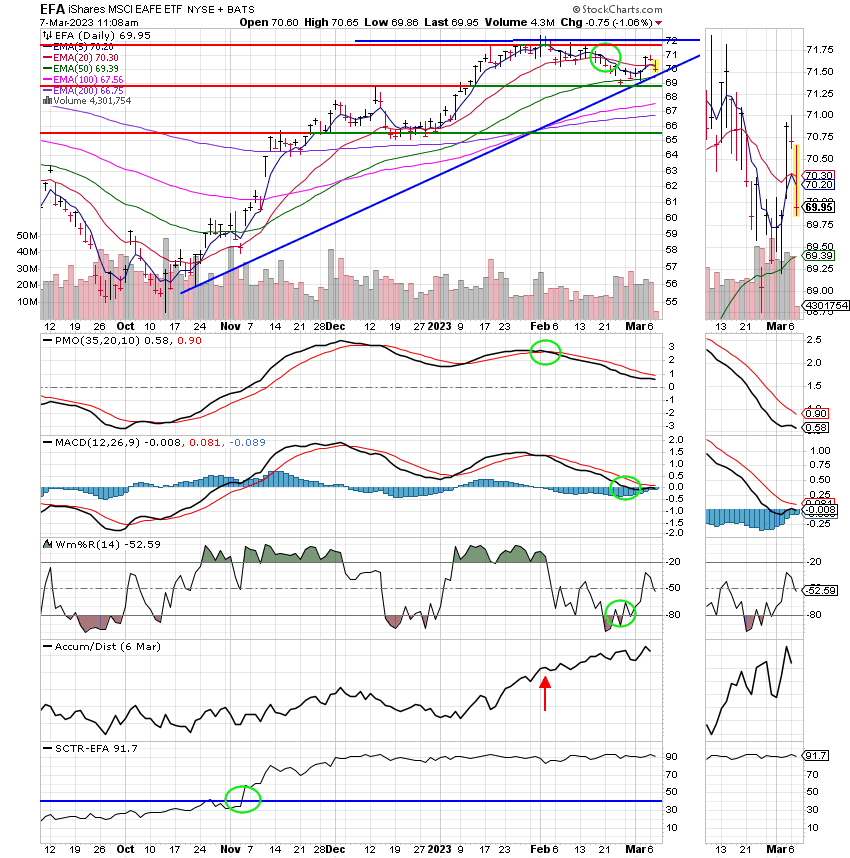

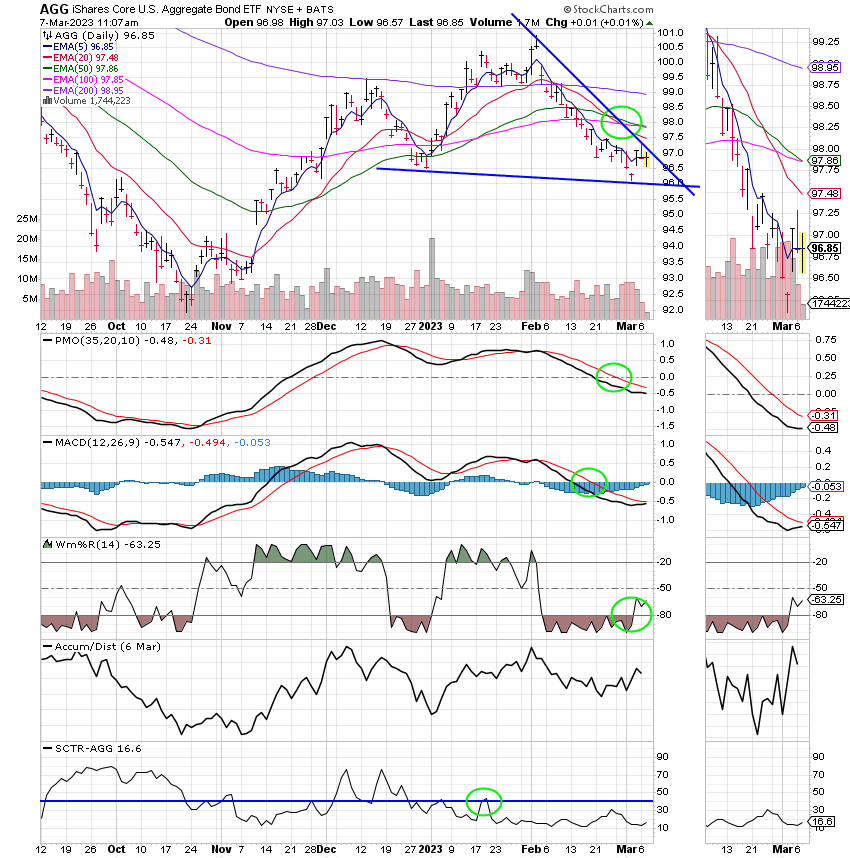

Recent action has left us with the following signals: C-Hold, S-Buy, I-Hold, F-Sell. We are currently invested at 100/S. Our allocation is now +4.38% for the year not including the days results. Here are the latest posted results.

| 03/06/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.3533 | 18.2616 | 62.2999 | 67.5438 | 36.4365 |

| $ Change | 0.0059 | -0.0273 | 0.0452 | -0.8674 | 0.0068 |

| % Change day | +0.03% | -0.15% | +0.07% | -1.27% | +0.02% |

| % Change week | +0.03% | -0.15% | +0.07% | -1.27% | +0.02% |

| % Change month | +0.07% | -0.28% | +2.01% | +0.70% | +1.89% |

| % Change year | +0.69% | +0.30% | +5.76% | +9.77% | +7.35% |

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.