Good Evening, Wow, just like old times. We get a presidential tweet and the market moves. This morning President Trump tweeted that his administration would recommend a fiscal stimulation plan to counteract the effect of the corona virus. Specifically, he mentioned two things. He said they would propose a payroll tax cut to help working class Americans and further tax help for those in the hardest hit industries such as travel. Of course, any stimulus plan must be approved by congress and you certainly have to wonder if they will cooperate on anything, even this…. Yes the market priced in the news with a nice rally. However, that proposal must turn into action for this rally to have legs. As for the corona virus itself, it continues to spread in the United States. The latest news is that a National Guard Unit has been deployed to quarantine a New York city suburb. Folks it has always been my contention that this virus is going to get worse before it gets better, but that it will indeed get better! The issue with the market right now is that there is a battle between the multiple stimulus efforts and the overall economic effect of the Corona Virus. The market moves up and down in a volatile fashion depending on which one has the upper hand. Today it was stimulus as a result of the presidential tweet. I might add that yesterdays sell off was actually caused by an oil price war between Saudi Arabia and Russia which in fact is a result of the Corona Virus. There’s not enough time to delve into that now. As of this morning the market was about one percent from an official bear market. As with most selloffs, the majority of traders are now trying to call the bottom. Eventually someone will get lucky and I emphasize the word LUCKY. Nevertheless, calling the bottom is a dangerous practice which I have personally found to be futile in the past. Our task now is to be patient. Our priority is not to be the first one back into stocks but to get back in safely. The thing that you must keep in mind here is that if we were to enter a bear market that the average length of a bear market is 12 – 24 Months. It takes a lot of patience, a lot. Most inexperienced traders keep trying to jump back in so they can catch the exact bottom when in fact they keep moving deeper and deeper into the hole. The first thing you need do to get out of the hole is to stop digging!!! Today was a good day. There is no argument about that, but what you must remember is that the issue is still in doubt. The bottom line is this. While things have been looking pretty dark lately we have a President (like him or hate him) that understands and supports the market and a Federal Reserve that supports the market. Given those facts you can never totally give up on the possibility that this market can bounce right back. That said, you must let the price action be your guide. Stop trying to call the bottom. Watch your charts and be disciplined. Don’t worry about being the the first one to the party. Just get their safely. It is far more important to keep your account close to it’s high than it is to try to squeeze the market for every dollar that’s available. I’ve been doing this a long time and that’s never going to happen. At least not on a regular basis!

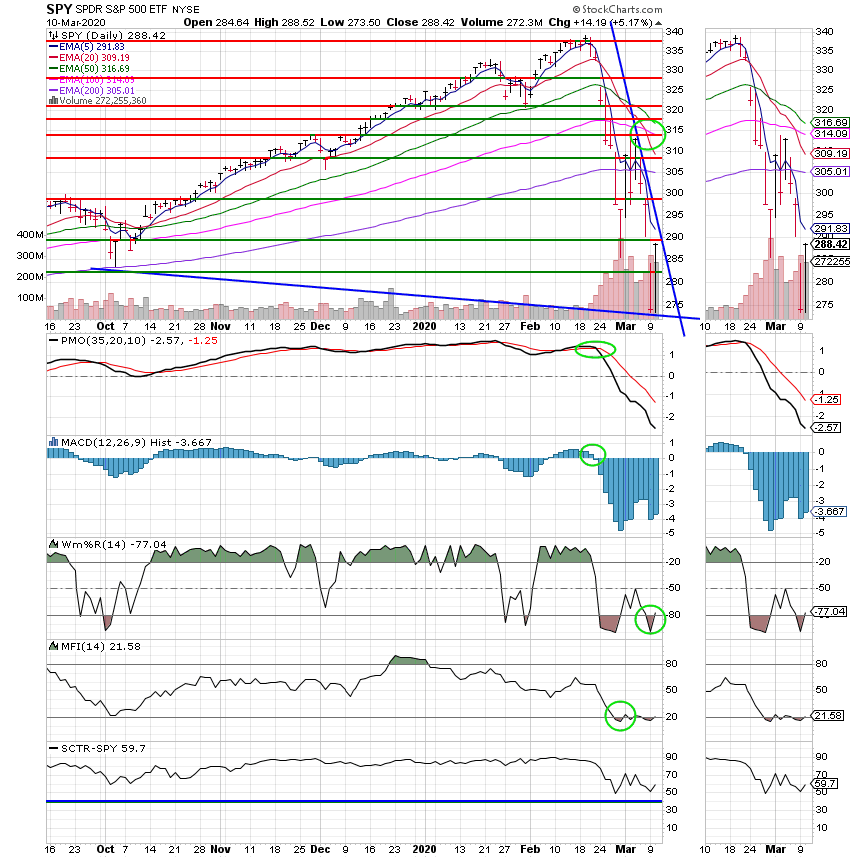

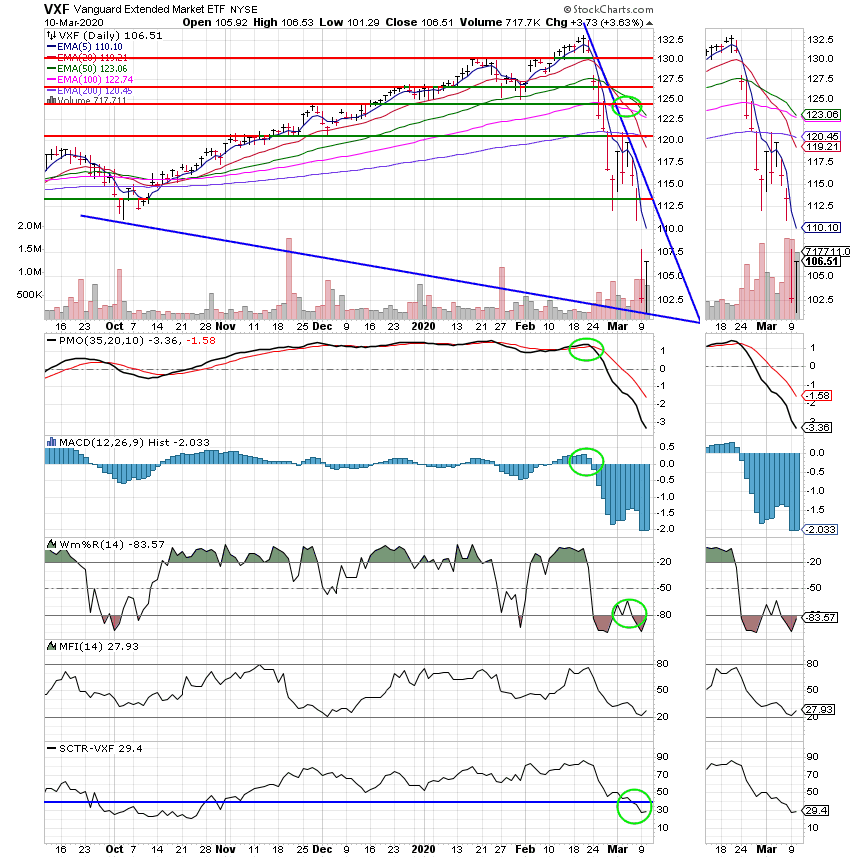

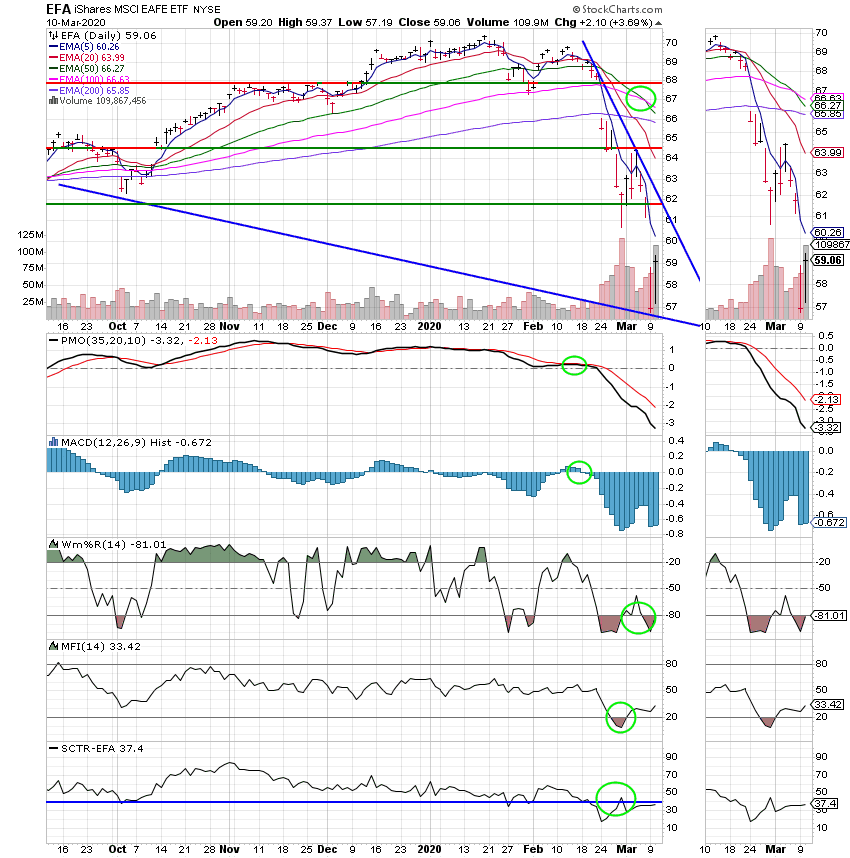

The days trading left us with the following results: Our TSP allotment remains steady in the G Fund. For comparison, the Dow was up +4.98%, the Nasdaq +4.95%, and the S&P 500 +4.94%. It was a nice bounce but can it last? We will see….

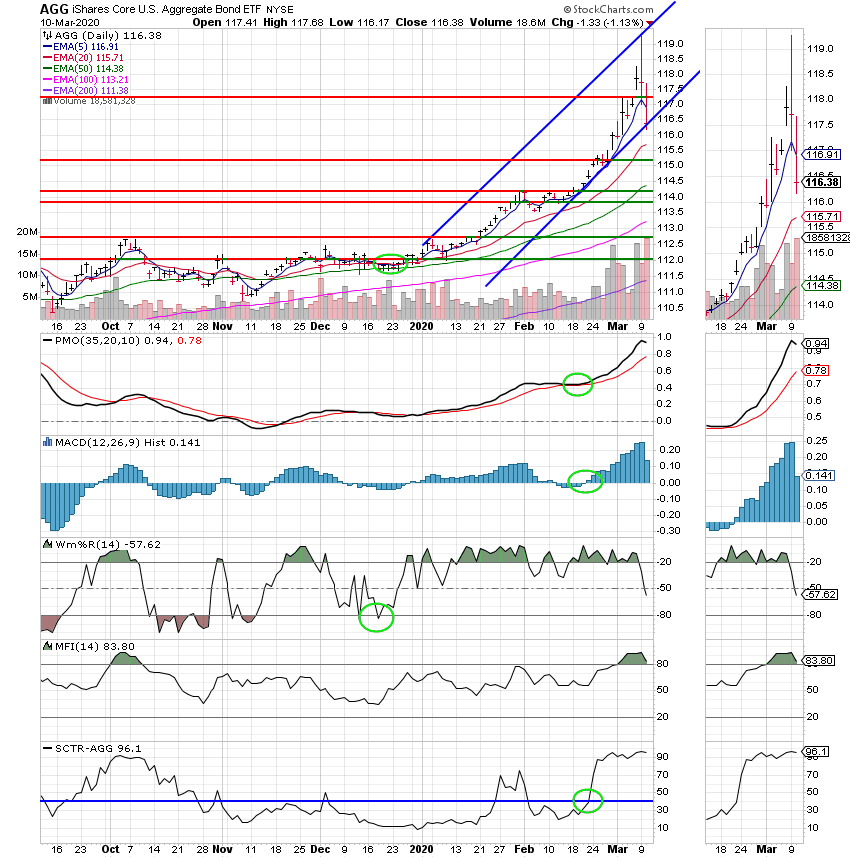

The days action left us with the following signals: C-Sell, S-Sell, I-Sell, F-Buy. We are currently invested at 100/G. Our allocation is now -3.24% on the year not including the days results. Here are the latest posted results:

| 03/09/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.404 | 20.9175 | 40.3189 | 45.8613 | 27.0008 |

| $ Change | 0.0017 | 0.0680 | -3.3088 | -4.7193 | -2.2485 |

| % Change day | +0.01% | +0.33% | -7.58% | -9.33% | -7.69% |

| % Change week | +0.01% | +0.33% | -7.58% | -9.33% | -7.69% |

| % Change month | +0.03% | +2.23% | -6.99% | -10.86% | -8.04% |

| % Change year | +0.33% | +6.09% | -14.69% | -18.51% | -17.47% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 20.548 | 28.2835 | 31.5705 | 34.0847 | 19.5714 |

| $ Change | -0.3422 | -0.5379 | -1.5464 | -2.0204 | -1.3390 |

| % Change day | -1.64% | -1.87% | -4.67% | -5.60% | -6.40% |

| % Change week | -1.64% | -1.87% | -4.67% | -5.60% | -6.40% |

| % Change month | -1.52% | -1.75% | -4.57% | -5.51% | -6.34% |

| % Change year | -3.01% | -3.49% | -9.42% | -11.31% | -12.95% |